COMMENTS ON THE ART MARKET

Celebrating Our 24th Year!

On January 1, 2001, we released our first edition of Comments on the Art Market. That one was a whole 7 paragraphs long (492 words), less than one of the many articles included in our current editions. For the first 12 years, Howard penned all the articles and by the beginning of 2013, Amy, Lance, and Alyssa started adding their own thoughts and comments, allowing us to broaden the topics we cover. Then, in September of 2021, things started to get more interesting when Nathan Scheer (our nephew) came aboard. Nathan loves writing and researching, and over the last couple of years, has taken over. Today, most of the articles are written by him.

Many people have complimented him on the level of research he does … both through emails and in person. In fact, we have had several notable people in the art world thank him for the content and accuracy of his articles.

As we move forward, it is our hope that everyone will continue to not only enjoy our monthly updates but will learn a thing or two about the art market. Our family wishes all our fans and readers a happy, successful, and peaceful New Year.

______________________

Update Your Preferences

Thank you for your continued support! Your passion for the artists and art we offer has truly enriched our gallery's journey, and we are excited to share even more with you.

Comments on the Art Market (Monthly Edition):

Educating our readers about the intricacies of the art world. We love delving into the latest trends, market shifts, crime, punishment, and noteworthy developments.

Weekly Art Update (Every Saturday):

For those of you who eagerly anticipate our weekly updates, we sincerely appreciate your enthusiasm! Our Saturday emails bring you firsthand updates with new acquisitions, upcoming exhibitions, exclusive events, and the latest from our blog. It's a weekly rendezvous we look forward to sharing with you.

Missing Out on Weekly Updates?

If you find that you haven't been receiving our weekly updates and would like to stay seamlessly connected with all things art-related, we've got you covered! Simply let us know by sending an email to info@rehs.com, and we'll ensure you're added to our additional mailing list.

______________________

Upcoming Art Fair

We are pleased to announce that Rehs Contemporary Galleries will be exhibiting at the second edition of Art Palm Beach which will run from Janaury 24 – 28, 2024. The gallery will showcase works by many of its contemporary artists including Ben Bauer, Julie Bell, Stefano Bolcato, Jon Burns, Todd Casey, Gail Descoeurs, Stuart Dunkel, Hammond, Lucia Heffernan, James Hollingsworth, Timothy Jahn, Alexandra Klimas, Shana Levenson, David Palumbo, Tony South, June Stratton, Mitsuru Watanabe, Anne-Marie Zanetti, and more.

If you are interested in attending, please let us know as soon as possible since we only receive a limited number of complimentary tickets. Be sure to note your preference - Opening Night or General Admission. Ticket availability is on a first come first served basis. Send an email to info@rehscgi.com

____________________

Stocks & Crypto

With 2023 [nearly] in the rearview, it’s time to take a look at how the stock market performed over the past 12 months. It was a pretty wild year, to say the least… seriously, in retrospect, I think the most accurate word would be “shitshow.” It’s probably hard to remember everything, but just to recap: This year the world experienced some of the most devastating natural disasters, including the deadliest earthquake in more than a century. Silicon Valley Bank collapsed, nearly setting off a chain reaction of bank failures across the US. There were more than 400 workers’ strikes nationally, with more than half a million workers participating – that’s up nearly 3 fold from last year and included major groups like Hollywood’s actors and writers (SAG-AFTRA) and The United Auto Workers. July set a new high for the hottest average global temperature on record, just as Hawaii dealt with the most catastrophic wildfire it has ever seen. The Middle East spiraled to the brink of WWIII, and Artificial Intelligence is getting ready to upend nearly every aspect of our lives… and that’s not even mentioning the oddities of a Chinese Spy Balloon or the Titanic Submersible. Oh, and inflation, duh. Seriously, 2023 was an unusual one.

With that in mind, it's rather surprising that all three major US indexes brushed off the madness to close out the year with strong gains… in fact, over the past two months, we’ve seen an incredible rally to test record-high numbers. Back at the end of 2021, the NASDAQ breached the $16K mark; however, by the start of 2023, it had given up more than 30% of its value. With that, the NASDAQ currently sits just above $15K – so while not a fresh high, that is still good for a mind-blowing 44% gain on the year! The S&P is on the brink… it is just a few points shy of the record set in January of 2022, but it will likely surpass that in the coming days; either way, it achieved a gain of roughly 24%. The Dow kept punching through the roof… this December, the index logged five consecutive days of new highs, and closed out the year at that level; it yielded the lowest return of the bunch with a modest 14% gain. When you take a deeper look, it becomes apparent that US Stocks were heavily buoyed by a small group of tech stocks that performed insanely well – they’ve become known as the Magnificent Seven, which includes Apple, Alphabet (Google), Amazon, Meta (Facebook), Microsoft, Nvidia, and Tesla. That group alone accounted for 60% of the S&P’s gain this year!

When it comes to currencies and commodities, it was a mixed bag. Both the Pound and Euro strengthened relative to the Dollar, roughly 5% each – the Pound is currently trading around $1.27, while the Euro is in the $1.10 ballpark. Gold futures notched a new high a few weeks ago and are still hovering in that $2,100 neighborhood. Conversely, crude started the year off with a nice rally but fizzled quickly and faded… as of the end of the year, oil futures were trading nearly 30% lower than where they started.

And last but not least, the crypto kids are here to make you cry a little… even with all the uncertainty and volatility, Bitcoin turned in a staggering 152% gain for 2023 – hope you were all HODL! Ethereum was up there too… it nearly doubled, notching a gain of more than 90%. Litecoin was the odd man out with a paltry 11% return for the year.

In the end, all my whining about inflation concerns was for nothing… everyone who behaved rationally and took a conservative approach in a tumultuous year came out a loser. Truly hoping you didn’t listen to me and play it safe; and if you did, I have to ask… why the heck are you taking my financial advice? I work at an art gallery.

Wishing everyone a happy and successful 2024!

____________________

Really!?

Beatles Painting Heads To Auction

Images of a Woman by The Beatles

A painting created and signed by all four members of the Beatles will be up for sale at Christie’s this February. In 1966, Beatlemania was at its height. The group had been touring nonstop for several years, traversing the globe from Britain to the United States to Japan. During their stay in Tokyo, they spent much of their time in the presidential suite at the Tokyo Hilton. Police advised that the Beatles stay at their hotel as much as possible since there were serious safety concerns due to some Japanese people’s response to the band playing shows in the country. Between June 30th and July 2nd, the Beatles were scheduled to play five shows at Tokyo’s famous Nippon Budokan stadium. Some were unhappy since the venue was exclusively used for martial arts events. Japanese nationalists, as well as supporters and practitioners of judo, kendo, karate, and other traditional Japanese martial arts, felt that having a Western musical group play a concert there would be disrespectful. Nonetheless, the Beatles played their shows, paving the way for other artists to perform at the venue, most notably Cheap Trick in 1978 and ABBA in 1980.

While locked in their suite, the Beatles found ways to pass the time. After a fan gifted them some art supplies, they created the painting, which was later called Images of a Woman. John Lennon was the only member of the group with any formal arts training, having attended classes at the Liverpool College of Art before pursuing music professionally. However, all four members of the band created the painting in their hotel room by placing a lamp in the center of the paper and then each man focusing on their respective corners. The photographer Robert Whitaker, who was accompanying the band, said, “I never saw them calmer or more contented than at this time”. The bandmates would look forward to completing the painting after ending each Budokan show. Whitaker’s photograph showing the painting’s creation can attest to this. The blank circle near the center is where the lamp was placed, with all four Beatles placing their signatures there corresponding to their corner of the work. Only a couple of months after their Japanese tour dates, the group would quit touring and focus mainly on working in the studio.

The band donated the painting to a charity auction, where Tetsusaburo Shimoyama bought it. Shimoyama was a Japanese entertainment executive and the Tokyo Beatles fan club president. It last sold in 2012 at Philip Weiss Auctions, a small auction house on Long Island, for $155,250 w/p. The painting will now be featured during the Exceptional Sale, an auction at Christie’s New York consisting of various items, including decorative arts, antiquities, furniture, and memorabilia. Images of a Woman is predicted to be one of the sale’s top lots, along with a gold medal from the 1968 Mexico City Olympics, a collection of porcelain, and an example of the gemstone rubellite tourmaline. Christie predicts Images of a Woman will sell for anywhere between $400K and $600K. The painting is not the only music-related item in the sale. A Gretsch guitar believed to have been owned by Elvis Presley will be crossing the block that day as well, along with a gold crocheted vest worn by Janis Joplin, most famously at a photo shoot in 1970.

Sneaker Surprise At Shelter

In Portland, Oregon, a local shelter experienced an unexpected windfall earlier this year: a pair of striking gold Nike sneakers surfaced in their donation pile. These weren’t just any sneakers but the Air Jordan 3s, size 12 1/2, custom-made for the renowned filmmaker Spike Lee.

An anonymous donor left these remarkable kicks at the Portland Rescue Mission in the spring. While sorting through donations, a sharp-eyed individual in the Mission’s long-term program discovered the rare gems and promptly informed the shelter staff.

Designed by Nike’s Tinker Hatfield in 2019 for Spike Lee, these sneakers weren’t from Lee’s personal collection but were part of a limited batch intended for him to share with close friends. After confirming their authenticity, Hatfield visited the shelter, signed a replacement box, and generously included Nike goodies.

The story took an exciting turn when Sotheby’s auctioned off the gold Air Jordan 3s, anticipating between $15-$20,000 in proceeds for the benefit of the Portland Rescue Mission. In a surprising move, the auction house waived its fee, ensuring that every penny raised would directly support the shelter’s crucial mission of aiding those grappling with homelessness, hunger, and addiction.

As the bidding unfolded, sneaker enthusiasts and Spike Lee fans eagerly participated, driving the auction price to an impressive $50,800. The shoes’ authenticity and connection to the acclaimed filmmaker turned them into highly sought-after collector’s items.

While the individual’s identity behind the generous donation remains unknown, their act of kindness has left a lasting impact on the Portland Rescue Mission and the individuals it serves.

____________________

The Dark Side

Bouvier Affair At An End (Maybe)

The Bouvier affair has been one of the most prolific feuds the art world has experienced in the past ten years. We’ve been covering it since it first started in 2015. And now it seems like it’s finally coming to an end… sort of.

To sum up, the Russian oligarch Dimitri Rybolovlev, who made his fortune primarily in the fertilizer business, amassed one of the finest art collections in the world with the help of a Swiss businessman named Yves Bouvier. Between 2003 and 2014, Bouvier purchased paintings on the Russian billionaire’s behalf, buying thirty-eight paintings for about $2 billion. The crown jewel in Rybolovlev’s collection was Leonardo da Vinci’s Salvator Mundi, which he later sold at Christie’s for around $400 million ($450.3 million w/p), making it the most valuable painting ever sold at auction. Rybolovlev has accused Bouvier of scamming him out of $1.1 billion. According to the numerous criminal complaints filed over the past nine years, Bouvier acted as Rybolovlev’s agent and was supposed to charge a 2% fee. However, Bouvier asserts that he was not acting as an agent but an independent dealer and, therefore, could determine his profit margins however he pleased. For example, Bouvier purchased Salvator Mundi at Sotheby’s for $75 million. He then turned around and sold it to Rybolovlev for $127.5 million. He, therefore, raised the final price by 41%. While several courts have dismissed Rybolovlev’s suits against Bouvier, the Russian billionaire still went ahead and sued Sotheby’s for allegedly collaborating with Bouvier to defraud him.

This dispute has seen the insides of courtrooms throughout the world, with proceedings taking place in Monaco, Geneva, Singapore, Hong Kong, and New York. For years, sometimes it seemed like it was all winding down, and then someone would file another motion or submit another criminal complaint in a different court. However, I think this is finally the end. Swiss prosecutor Yves Bertossa announced that the parties had entered into mediation after being informed they had no grounds for a criminal case against Bouvier. Then, on Thursday, December 7th, they agreed to settle out of court. The parties have not disclosed the settlement’s details, but Bouvier and his legal team quickly declared victory. However, Rybolovlev’s lawsuit against Sotheby’s is still making its way through the courts in New York. It is set to go to trial in January 2024. But for the first time in nine years, Rybolovlev and Bouvier are no longer at each other’s throats.

Lyft-ed Murillo: Old Master Lost In Miami

A portrait of Bartolomé

Esteban Murillo

I’ve left stuff in taxis before. So have a lot of people I know, from wallets to umbrellas to phones. But I think if I were in a cab with a million-dollar painting, I wouldn’t let it out of my sight. But one Miami rideshare driver has recently returned one such painting after driving off with it still in their trunk.

On December 3rd, Rodrigo Salomon curated a booth at Art Miami for Dmitri Shchukin, managing director of Gallery Shchukin. Among the works they were handling was a relatively small Madonna & Child painting that they claim is by the Spanish Baroque master Bartolomé Esteban Murillo. A contemporary of Diego Velázquez, Murillo is mainly known for his religious paintings, which have sold for millions at auction. This Madonna is allegedly worth $500K to $1 million if it is, in fact, by Murillo. Salomon and his wife were taking a Lyft to the Westover Arms Hotel in Miami Beach, where Salomon would hand it over to its buyer, who was also there to discuss other matters regarding the painting. Salomon put the painting in the trunk of the car. Distracted by a phone call, Salomon got out of the vehicle, and the driver left. After failing to retrieve the painting from the driver, Salomon and Shchukin have since filed a police report, contacted the FBI, and had their lawyer contact a private detective. They also plan on taking legal action against the driver and the company Lyft, even going so far as to call for a boycott of the ridesharing service.

I’m not sure if the alleged negligence of a single driver (or possibly the patron) is enough to justify a total boycott. There seem to be insufficient details to get the full story, though. The information we do have, and the information we don’t, raise some significant red flags. I’m not doubting Salomon, but the more information, the better. The first red flag is how the driver sped off the moment Salomon left the car. I’ve taken my fair share of taxis and Ubers and Lyfts. None of them immediately sped off when I closed the door. If it’s a driver for a ridesharing app, they get on their phone and look for a new fare. The second red flag is why was the Murillo in the trunk of all places? It’s not your suitcase full of laundry. It’s a small painting, so even when wrapped, it could easily fit on someone’s lap, especially when it’s allegedly worth at least half a million dollars.

The third red flag is the discussion topics between Salomon and the buyer, one of which was the details of the work’s authentication. The buyer had reportedly contacted an expert from Spain to do this. This might just be the buyer taking extra precautions, but it somewhat implies that the work had not been authenticated yet. Why would you sell or buy a work that has not been properly authenticated? Why would you positively attribute it to a Spanish Baroque master like Murillo without consulting the specialists familiar with his work? I understand that not everyone who buys or sells art is a connoisseur, but these are the bare basics you must do before doing anything with a painting. It’s just basic due diligence, not only to protect the buyer should they spend enormous amounts of money on something that might be incorrectly attributed, but it also protects the seller in case any future buyer brings legal action against them.

The fourth and final red flag is this: even if it’s a genuine Murillo, an estimate range of $500K to $1 million seems rather steep. The painting is relatively small, measuring only 17 by 14 inches. Murillo works of greater size and greater aesthetic quality have sold for far less at auction. In fact, only around twenty paintings by Murillo have sold for as much as Salomon and Shchukin’s valuation. The peak of Murillo’s popularity among collectors seems to have been between the late 1980s and early 2000s. Those pieces were almost all large canvases, meant as altarpieces or full-sized portraits of saints. Unless the Madonna’s material quality is immaculate (pun intended) or there’s some famous name in the provenance, who knows if that price is entirely justified?

The alleged Murillo has since been returned after tracking down the Lyft driver. It is completely unharmed, with its packaging undisturbed. Salomon implied without any evidence that the driver wanted to keep the painting and was trying to wait out Lyft’s 30-day lost-and-found policy. Despite the painting being returned, Salomon is still talking about a possible lawsuit against Lyft for not being of any help. “A class action suit would be adequate.”

Update Up North: The Morrisseau Forgery Trial

A forgery attributed to Norval

Morrisseau (photo courtesy of

the Ontario Provincial Police)

A Canadian court has sentenced the main perpetrator of one of the largest art fraud conspiracies. Back in March, I wrote about how police in Ontario had arrested a group of people for creating and selling thousands of artworks being passed off as originals by the Canadian indigenous artist Norval Morrisseau. Morrisseau is recognized today as one of Canada’s greatest artists, putting indigenous art on the map. Even before he died in 2007, he was concerned about forgeries of his work on the market. This led him to create the Norval Morrisseau Heritage Society (NMHS) to manage his estate and provide authentication services.

Beginning between 1996 and 2002, Gary Lamont served as the leader of a forgery ring operating out of Thunder Bay, Ontario. Lamont ran a sort of forgery assembly line, hiring indigenous artists to create new works in Morrisseau’s style, often paying them with alcohol and drugs. One of the ring’s members was Benjamin Paul Morrisseau, the artist’s nephew. Lamont himself would often apply Morrisseau’s signature using the Cree syllabics the artist typically used to sign his name. Lamot’s forgery ring sold each work through intermediaries for anywhere between $2,000 and $10,000. Many of these forgeries have reached Canadian galleries and private collections worldwide. Some have insinuated that the Smithsonian collection contains Morrisseau forgeries and that there are probably many more forgeries on the market than originals. It has been estimated that Lamont’s crew caused the market for Morrisseau works to reduce in value by $100 million. Several people, who bought the fake works, submitted statements to the court, attesting that some of Lamont’s victims were not wealthy collectors but regular people, thinking it would have been a good investment for themselves and their children. The judge overseeing the case, Justice Bonnie Warkentin, said that the actions of Lamot and his conspirators constitute more than just fraud. “It is the appropriation of a cultural and spiritual identity of one of Canada’s most profound artists.”

In early December, Lamont pled guilty to forgery, making false statements, and defrauding the public. He also took full responsibility and expressed remorse. Art lawyer Jonathan Sommer has called Lamont’s guilty plea “a huge step forward” as a guilty plea would save everyone both time and resources. The investigation into Lamont’s activities took over two years, and over a thousand forgeries were confiscated in the process. 190 works were submitted as evidence in the court proceedings as confirmed Lamont forgeries. However, the NMHS’s current director, Cory Dingle, has claimed that there are likely thousands more still circulating out in the marketplace. Because the artist’s estate will be completely overwhelmed in sorting out the forgeries from the authentic works, Dingle has called for the creation of a national art fraud investigation service in Canada. The government is not seeking any restitution in this case. Rather, they recommend that any of the conspiracy’s victims seek damages through a civil suit.

____________________

The Art Market

Bonhams Paris Impressionist & Modern Sale

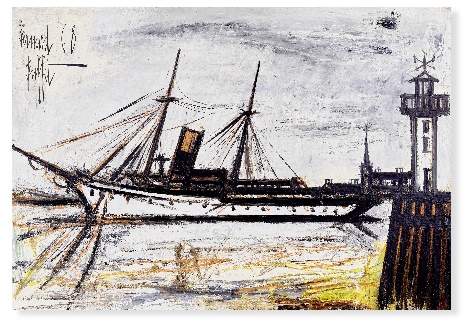

Yacht et phare by Bernard Buffet

Thursday, December 7th, saw a wave of action across the London and Paris auction houses. Christie’s, Sotheby’s, and Bonhams all hosted sales ranging from antiquities to Old Masters to early twentieth-century work. It also marked the last day at the podium for Christie’s global president and auctioneer, Jussi Pylkkänen, who presided over the London old masters sale. However, the dark spot on Thursday occurred at the Bonhams location in Paris, where the Impressionist & Modern sale occurred. A relatively small sale of fifty-one lots is often nothing to write home about. Bonhams’ impressionist and modern sales often do relatively well. However, they made a slight error that doomed the sale. The average minimum estimate for this sale was around €30K. Thirty of the fifty-one available lots had minimum estimates at €10K or below. While the number of unsold lots was a little high but nothing drastic, two in particular were expected to sell for hundreds of thousands of euros, yet were bought in and tanked the sale. The first of these two was a self-portrait by the Japanese-French painter Léonard Tsuguharu Foujita. Bonhams expected the 1928 oil-on-canvas painting of the artist and his cat to sell for at least €350K. Secondly, there was Le lézard aux plumes d’or by Joan Miró. Made from gouache, ink, and pencil on paper created on June 2, 1969, the work is very typical of the Catalan artist’s use of bold lines and colors. It was expected to sell for at least €280K but also went unsold.

Trouville, le lougre échoué

by Eugène Boudin

These two works being bought in allowed the ships to shine. All three top lots were nautical paintings by very different artists a century apart. Bernard Buffet’s 1968 oil painting Yacht et phare is the neo-expressionist artist’s take on a large ship moored in a harbor beside a thin lighthouse. Expected to sell for between €70K and €90K, the Buffet felt nicely in between at €80K / $86.3K (or €102K / $110.1K w/p). Following the Buffet, the remaining top lots were paintings by the nineteenth-century French marine painter Eugène Boudin. Though created over twenty years apart, both were scenes from the same location. Trouville-sur-Mer is a small town on the coast in Normandy, at the mouth of the river Touques, with Deauville lying on the opposite bank. Boudin often returned to the Deauville-Trouville area as a vacation destination and a subject for his canvases. He ended up building a house there in 1884, known now as the Villa Breloque, where he died in 1898. Boudin painted Trouville, le lougre échoué in 1897 when the area was already a popular resort town with lavish hotels and casinos. It shows a small sailing ship in the harbor at low tide, with the twin lighthouses at its mouth in the background. The other painting, Bateaux de pêche devant Trouville, is from earlier in Boudin’s career, dating to the mid-1870s. Both canvases were estimated to sell for €45K to €65K and sold within estimate; the first at €50K / $53.9K (or €63.9K / $68.9K w/p), the second at €45K / $48.6K (or €57.5K / $62.1K w/p).

Though the sale was a little disappointing overall, that doesn’t mean it wasn’t without its surprises. Particularly, a pair of sketches by Hans Bellmer probably woke some people up halfway through the sale. Both are untitled, and dedicated to the artist’s acquaintances. Bonhams specialists predicted the first to sell for at least €5K and the second for €6K. The drawings eventually sold for €16K and €20K, respectively.

Of the fifty-one available lots, twenty-five sold within estimate, giving the specialists at Bonham’s a 49% accuracy rate. Only one lot (2%) sold below, and five (10%) sold above. While this can often signify a rather successful sale, twenty lots (39%) went unsold. Because the Foujita and the Miró are included among the lots bought in, they absolutely wrecked the sale’s final dollar amount… or rather, euro amount. The specialists expected the fifty-one lots to bring in at least €1.39 million. Ultimately, they just barely hit €445.1K / $480.4K.

Christie's London Josefowitz Rembrandt Collection

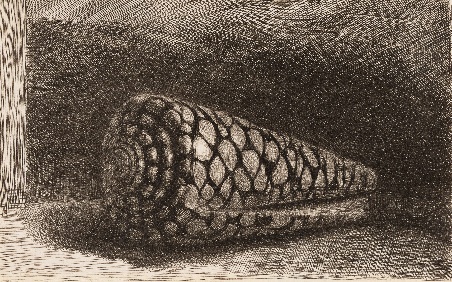

Saint Jerome reading in an

Italian landscape

by Rembrandt van Rijn

At the end of the auction marathon on Thursday, December 7th, was another installment from the Sam Josefowitz Collection. The sale in London consisted of sixty-nine lots, all “graphic masterpieces” by the Dutch Golden Age artist Rembrandt van Rijn. Every lot was an etching, engraving, or drypoint. The previous Christie’s sales of the Sam Josefowitz collection, the first of which was on October 13th, did phenomenally well. And the Rembrandt prints certainly followed that trend. Saint Jerome reading in an Italian landscape was predicted to be the sale’s top lot. However, very few people would’ve expected how well it did. Rembrandt created the work around 1653 using etching and drypoint. Like many of the prints, this one is from the very rare first state of the work. The print was last sold at Christie’s New York in 1983 for $165K hammer after previously belonging to the Grolier Club, the prestigious Manhattan bibliophile society. Estimated to sell for between £500K and £700K, Saint Jerome continued to climb up and up until it finally settled at £1.25 million / $1.57 million (or £1.55 million / $1.95 million w/p).

The very last lot in the sale was the 1650 print simply called The Shell. Made from etching, engraving, and drypoint, it is the only still-life etching Rembrandt ever created, making it one of the rarest works by the Dutch master. This particular shell is a conus marmoreus, or a marbled cone, only found in the Indian Ocean and parts of the Pacific. Shells like these were incredibly rare and typically kept in private collections belonging to wealthy individuals or nobility. Christie’s predicted it would sell for no more than £120K. However, bid after bid prolonged the end of the sale, driving the price all the way up to nearly five times that amount at £580K / $730.1K (or £730.8K / $919.9K w/p). Shortly before The Shell came across the block, there was the print Woman Sitting Half Dressed Beside a Stove. Made in 1658 from etching, engraving, and drypoint, it is one of the four nudes and erotic scenes featured in the sale. It was last sold at auction at Christie’s London in 1992 for £55K hammer. It is fascinating because it’s less of a nude and more of a combination of styles. Yes, there is nudity, but the subject is not fully undressed. There are also elements of a simple interior or a genre painting. It is the largest nude print Rembrandt created in his series between 1658 and 1661. Woman Sitting Half Dressed Beside a Stove was only expected to sell for between £120K and £180K. It achieved more than double that at £400K / $503.5K (or £504K / $634.4K w/p).

The Sam Josefowitz collection of Rembrandt’s graphic works is one of the most memorable sales from the past few months. While normally there might be a small handful of surprises throughout a sale, the lots that hit at least double their high estimates comprised almost a quarter of the works that crossed the block on Thursday, or sixteen of the sixty-nine lots. The most astounding surprises that day, however, included a shocking etching Rembrandt created in 1631, when he was just 25 years old, titled A Woman Making Water. I don’t know if showing a woman crouched in the middle of urination has artistic merit or if this was just the last pang of his juvenile immaturity manifesting itself in his work. Expected to sell for no more than £8K, A Woman Making Water achieved over five times that, bringing in £42K / $52.9K (or £52.9K / 66.6K w/p). Then, for a drastic change of subject, there’s the etching and drypoint Death appearing to a Wedded Couple from an Open Grave. The print, created in 1639, is clearly an example of memento mori or danse macabre, particularly lighthearted reminders of death common in areas affected by plagues and other pandemics. Around this time, northern Italy had just recovered from several years of plague, so it was likely fresh on everyone’s mind. Also assigned an £8K high estimate by Christie’s, Death appearing to a Wedded Couple sold for £35K / $44.1K (or £44.1K / $55.5K w/p), or almost four-and-a-half times as much.

Ultimately, the Josefowitz collection of Rembrandt graphic works was an incredible sale. Fifty-one of the sixty-nine available lots exceeded their estimates, about 74%. Another ten lots (14%) sold within their estimates, while eight (12%) sold below. No lots went unsold. Subsequently, the sale also exceeded the presale total estimates. Christie’s predicted the sale would bring in anywhere between £3.14 million and £4.68 million. With so many lots sold over estimate, it ultimately made £6.3 million / $7.9 million.

Bonhams New York Hartman Collection

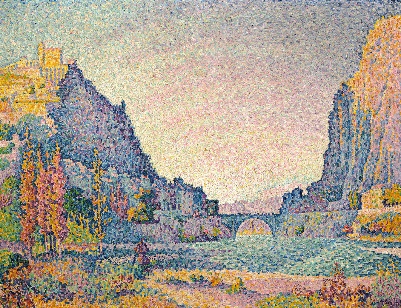

Sisteron by Paul Signac

Alan Hartman owned Hartman Rare Art on New York’s Madison Avenue for decades until his passing earlier this year. He was considered an expert in Chinese jade carvings, East Asian antiquities, and English silver. When his widow Simone consigned their collection to Bonhams, many expected such work to feature heavily in the sale. In some ways, they were right, but in other ways, the couple’s modern and impressionist paintings dominated the December 14th evening sale. Of the one hundred eleven available lots, only twenty-two were paintings, or about 20% of the collection. There were also three sculptures; the remaining eighty-six were decorative pieces, porcelain, jade carvings, and antiquities. However, despite constituting only a small portion of the collection, the paintings comprised the vast majority of the money from the sale.

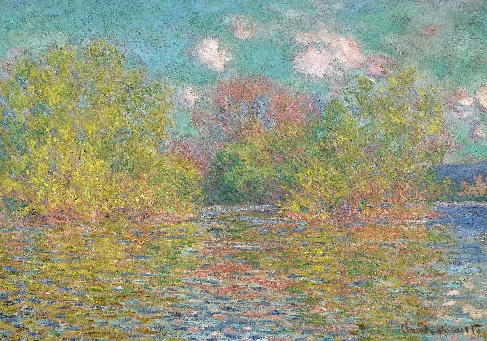

La Seine près de Giverny

by Claude Monet

The top three lots were all late nineteenth- and early twentieth-century French impressionist paintings, which came across the block within the first twenty lots. The expected first-place lot was Paul Signac’s Sisteron, showing the small town of the same name in southeastern France. The town straddles the Durance River, with two steep rocky hills rising above. The town is often called the Gateway to Provence because of this feature. The painting last sold at auction when Hartman purchased it at Sotheby’s New York in 1981 for $310K hammer. The Signac exceeded Bonhams’ $6 million maximum prediction, achieving $7.1 million (or $8.58 million w/p). Seven lots later, there was a bright and colorful Monet, La Seine près de Giverny. Executed in 1888, Monet had only been living in Giverny, a small town outside of Paris, for five years when he created this placid, pink and green view of the River Seine. This painting is known as a creative breakthrough for the artist, resulting from months of artistic struggle following a trip to the French Riviera and disagreements with his dealers in Paris. Hartman bought this painting in 1978, again at Sotheby’s New York, for the bargain price of $290K hammer. Bonhams gave it the same estimate as the Signac, but it did not exceed this prediction. It fell nicely in the middle, with the hammer coming down at $5.2 million (or $6.35 million w/p). The third-place lot was also a painting of the Seine, this time done by Alfred Sisley in 1879. While the Monet focuses entirely on the beauty of nature, the Sisley shows the river with a human presence. Sisley gives us the Seine at Suresnes, a small town on the immediate outskirts of the west of Paris; we see a riverboat chugging along while people and horse-drawn carts occupy the space between the riverbank and the town’s buildings. In 1879, Sisley had been living in a Parisian suburb similar to Suresnes for several years, and he would soon move away to a small village to the southwest. Bonhams gave La Seine à Suresnes a slightly more modest estimate range than the Monet and the Signac, predicting it would sell for between $1 million and $1.5 million. Sisley’s suburban scene hit the low estimate exactly ($1.27 million w/p).

By the time the Sisley sold, the Hartman Collection had already met its $15 million total minimum estimate. Of the one hundred eleven available lots, only twenty-two were paintings, making up about 20% of the sale. However, these paintings constituted 87.5% of the collection’s total dollar amount. The top three lots alone brought in 73.8% of the sale’s total. The rest of the sale included sculptures, decorative art, and antiquities. However, that doesn’t mean that these pieces were not noteworthy. Many of them sold far beyond their initial estimates. Twenty lots made more than double their high estimate, or about 18% of the sale — a small handful even made over eight times their estimates. Lot 61 was a candle holder dating to the Tang dynasty, between the seventh and tenth centuries. It incorporates elements of a lotus flower held up by a dragon coiled below. Estimated to sell for no more than $5K, the antique Chinese candle holder eventually sold for $48K (or $61.4K w/p), over nine-and-a-half times the initial estimate. Earlier in the sale, however, was a large, glazed earthenware statue, measuring slightly over 32 inches tall, showing a Ming dynasty official in vibrant yellow and green robes. It sold for $130K (or $165.6K w/p) against an initial high estimate of $12K. And finally, the biggest surprise of the sale, or any sale in the past few months, came in the form of a small ancient sculpture in the shape of a tiger. Made from bronze and measuring just under 7 inches long, this crouching tiger was likely made between the fifth and third centuries BCE, during the Eastern Zhou dynasty. Regardless of whether it was its age or its subject that drew people to it, several bidders just wouldn’t let it go. Expected to sell for between $10K and $15K, the small bronze tiger eventually sold for an astounding $340K (or $432.3K w/p), more than twenty-two times the estimate.

By the end, thirty-eight of the one hundred eleven lots sold within their estimates, giving Bonhams’ specialists a 34% accuracy rate. That number is impressive by itself, even more so when accompanied by an additional forty-eight lots (43%) sold above estimate. Only fifteen lots (14%) sold below, while ten lots (9%) were bought-in. The entire sale made $18 million against a total presale estimate range of $15.2 million and $22.47 million.

Art Market 2023: The Year In Review

Femmee à la montre

(Woman with a Watch)

Pablo Picasso

2023 was another incredible year for the art market. In an interesting turn, Sotheby’s took the top spot this year with $8 billion in sales, around the same as 2022. Christie’s, however, saw a slight decrease, down from last year’s $8.4 billion to about $6.2 billion. Also, Bonhams saw a record year with $1.4 billion, an approximate 14% increase from 2023 and a high in the company’s history.

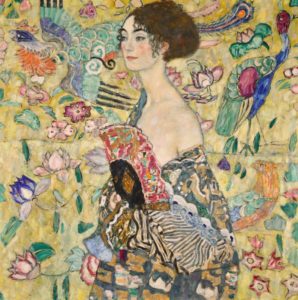

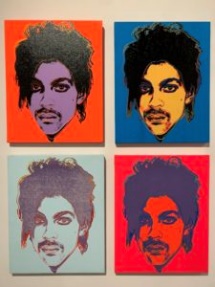

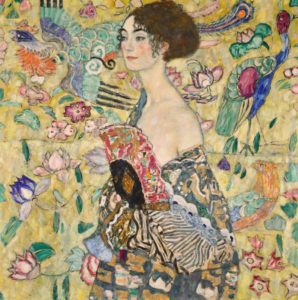

Last year, Christie’s hosted some of the largest sales featuring the vast majority of the most valuable lots. However, this year those sales and lots were a little more evenly spread out between both Christie’s and Sotheby’s. Sotheby’s ended up with the top two lots of the year, one selling at their New York location and the other at their London saleroom. Femme à la montre (Woman with a Watch) by Pablo Picasso sold as part of the Emily Fisher Landau collection on November 8th at Sotheby’s; it brought $121 million hammer, making it the second most valuable Picasso painting of all time. Then, at the June 27th Modern & Contemporary sale in London, there was Gustav Klimt’s Dame mit Fächer (Woman with a Fan). The painting is one of the last complete works created by Klimt, having been found on his easel when he passed away in 1918. It eventually sold for £74 million (or $94.36M), becoming the most valuable painting ever sold in Europe. Christie’s 20th Century Evening sale on November 9th contributed several works to the list, including Le bassin aux nymphéas, one of Monet’s Water Lily paintings that sold for $64 million. At the number four spot, the most recent work in this year’s top lot list, Jean-Michel Basquiat’s gargantuan painting El Gran Espectaculo sold at the 21st Century Evening sale on May 15th for $58 million. Then, number five was another work by Klimt. Insel im Attersee sold on May 16th at the Modern Evening sale at Sotheby’s New York — the impressionist-inspired view of an Austrian lake sold for $46 million.

Christie’s 20th Century Evening sale on November 9th not only included the Monet but also Francis Bacon’s Figure in Movement in the number six spot of the year, Richard Diebenkorn’s Recollections of a Visit to Leningrad in the number seven spot, Mark Rothko’s Untitled (Yellow, Orange, Yellow, Light Orange) in the number eight spot, and Pablo Picasso’s Femme endormie in the number ten spot (for those wondering about the number nine spot, that went to Wassily Kandinsky's Murnau mit Kirche II, which sold at Sotheby's London at their March 1st Modern & Contemporary Sale for £33 million, or about $39.6 million). The Christie's sale made $554.58 million, making it the biggest sale of the year. This was around half the amount made by last year‘s Paul Allen collection, which also sold at Christie’s New York. Regardless, the 20th Century Evening sale came out well above the rest. The Emily Fisher Landau Collection at Sotheby’s New York was a little further behind, bringing in $351.6 million. The Landau collection featured the Picasso portrait mentioned above, Femme à la montre, making up slightly over a third of the sale’s total. Some of the collection’s other stars included multimillion-dollar works by twentieth-century masters like Ed Ruscha and Jasper Johns. In this year’s third place spot, another one of Christie’s 20th Century Evening sales on May 11th made $276.1 million with works by Picasso and Rousseau (even if I preferred the O’Keeffe and the Chagall). And finally, in the fourth and fifth place positions were a pair of Sotheby’s sales, with one in New York on May 16th and the other in London on June 27th. In New York, the Modern Evening sale featured Klimt’s Insel im Attersee, an oddly placed Rubens portrait, and a bronze sculpture by Alberto Giacometti. In the end, the sale brought in $256.3 million. The other auction, a Modern & Contemporary sale in London, made headlines with the other Klimt painting, Dame mit Fächer, which accounted for 46.2% of the sale’s total. The other works didn’t even come close to the Klimt, including an untitled work by Cy Twombly and a relatively small painting by Lucian Freud. The London sale eventually made £160.2 million (or $204.3 million).

Dame mit Fächer

But, of course, 2023 wasn’t without its surprises. In terms of actual paintings, the most surprising lot crossed the block in May, during the Master Paintings sale at Sotheby’s New York. Of course, I’m talking about Portrait of a Small Poodle by Jacques Barthélemy Delamarre. I originally described it as “a rather unimpressive painting of a small dog.” What probably got some people's attention is that Sotheby’s specialists alleged that the painting was likely a portrait of Pompon, the pet poodle of Queen Marie Antoinette. Everyone here at the gallery became increasingly baffled the longer it went on, focusing on something else for five minutes and then returning to see that a few more bids had come in. In my assessment of the sale, I wrote, “When the $50K bid came in, I was surprised. When it reached $100K, I was astounded. And when it got its final bid of $220K (or $279.4K w/p), I was almost upset.” The pup’s portrait sold for around 44 times its high estimate. Other shocking results from this year included Hermann Lismann’s Selbsporträt, which sold at the Bonhams’ New Bond Street October 19th Expressionism sale for 28 times its £1.5K high estimate at £42K, as well as Mujeres en el baño: sorpresa by Antonio Ruíz, which sold at Sotheby’s New York’s Modern Day sale on May 17th for $420K, or 21 times its $20K high estimate. But those were only paintings. Probably the biggest surprise of the year at any major auction house was not a painting or a print but a note written on a scrap of paper. Written and torn from his sketchbook when he was 23, Modigliani provided some insight into his creative process. He wrote, “What I am searching for is not the real nor the unreal, but the unconscious, the mystery of the instinctiveness of the race.” The note was auctioned at Sotheby’s Paris on October 23rd as part of an Impressionist & Modern Art sale alongside another twenty-one sketches by the artist. Estimated to sell for no more than €500, the bit of writing sold for an astounding €120K, or 240 times its original estimate.

But of course, with all the successes and surprises, this year wasn’t without its disappointments. Many sales didn’t do that well this year, with five in particular having more than half of their lots bought in. Two of these sales share the top spot at 59% unsold: the March 10th Modern Art Online sale at Bonhams New York, where 16 of the 27 lots went unsold; then, later at the 19th Century & Old Master Sale at Sotheby's London July 6th, 71 of the 121 lots were bought in. Then there were the year’s most disappointing lots, those highly valued works that wound up getting bought in. Interestingly, the top three came from the same sale; the 20th Century Evening sale at Christie’s New York on May 11th, the number three sale of the year. They were Pull by Philip Guston (est $6 million to $8 million), The Moon and the Loop by Alexander Calder (est. $8 million to $12 million), and Femme assise au chapeau de paille by Pablo Picasso (est. $20 million to $30 million).

2023 was an interesting year for the market. The selling prices of this year’s top lots and the totals for this year’s biggest sales were well below those of 2022. Some saw last year’s astronomical prices as an omen that the market would retract this year. This seems to have resulted from Covid continuing to wreak havoc on the economy, the EU increasing sales taxes, and inflation increases. With Christie’s in particular, their reputation seems to have suffered slightly with them pulling out of their previous forays into AI- and blockchain-based art. Furthermore, the market in 2022 may have set expectations a little too high for 2023. Therefore, it's likely that galleries and auction houses may be a little more cautious in the upcoming year.

___________________

The Year’s Top Instagram Reels

Today, it is all about social media, and like any other business, we post on many platforms. Our largest follower base is on Instagram, so we thought you might enjoy seeing 2023's top three posts for our historical and contemporary accounts (the contemporary's #3 is our favorite).

Rehs Galleries, Inc.

#1 - Cortes's - Champs-Élysées, Arc de Triomphe (over 6,600 likes and 163,300 views)

#2 - Boudin's - Voiliers dans le port (about 3,200 likes and over 46,100 views)

#3 - Ridgway Knight's - Contemplation (over 2,200 likes and 36,600 views)

Rehs Contemporary Galleries

#1 - Alyssa framing Mark Lague's paintings (over 800 likes and 26,000 views)

#2 - Lance unpacking works by Stuart Dunkel (250 likes and almost 19,000 views)

3 - Thea & Lance packing (over 410 likes and 17,400 views) - the cutest video!

____________________

Deeper Thoughts

Second Mona Lisa? Or Just A Copy?

The Mona Lisa is one of the world’s most iconic and enigmatic paintings. Art historians and amateur detectives have combed over the work, looking for answers to everything, from da Vinci’s technique to the possible real location of the fantasy backdrop to the sitter’s identity (which has since been confirmed). It’s been the property of the French state for centuries, so the possibility of it being offered on the market is practically zero. But who knows its value now that a second Mona Lisa might be out and about?

The Isleworth Mona Lisa

The painting that some specialists call the Isleworth Mona Lisa has divided experts for a little over a century. The painting was reportedly brought from Italy to Britain in the 1780s. In 1913, the English art collector Hugh Blaker purchased the work, becoming the first prominent figure in the art world to promote the painting as a genuine Leonardo. Blaker kept the portrait in his studio in the West London neighborhood of Isleworth, where the painting gained its nickname. The one organization that seems to assert its authenticity is the Mona Lisa Foundation, a nonprofit founded in Zürich in 2011 to study the Isleworth Mona Lisa to see if it qualifies as a genuine painting by Leonardo da Vinci. However, the Mona Lisa Foundation was founded by the painting’s current owners and openly acts on their behalf. To say that they might be slightly biased in favor of the Isleworth Mona Lisa being an original Leonardo would not be a difficult conclusion. The group claims it is the first of two versions of the portrait, the second being the version we all know and love hanging in the Louvre. The portrait’s subject, Lisa del Giocondo, appears slightly younger, with a slimmer face, hence why some specialists believe that the work precedes the Mona Lisa. According to the Foundation, “We have proven beyond reasonable doubt that Leonardo painted two Mona Lisas and this is the only candidate to be the second.” I’m not entirely sure how I feel about art historians using the language of lawyers in a statement of attribution. Speaking with that level of certainty regarding something so old can often be a little suspicious.

Some prominent art historians, however, are unconvinced by the data, with many claiming that the work is likely nothing more than a copy of Leonardo‘s original. Some have noted that the Isleworth Mona Lisa is a painting on canvas, while practically every painting by Leonardo da Vinci, including the Mona Lisa, is on panel. Furthermore, while the painting attempts to blend colors and create a softness using Leonardo’s sfumato technique, some da Vinci experts claim that the work does not contain sfumato to the extent that Leonardo would have used it. Martin Kemp, professor emeritus of art history at Oxford, stated that claims of long-lost masterworks are often typical for those attempting to increase the value of a painting with contested authorship. When asked who he thought created the work, Kemp said it can be difficult to successfully identify a creator, especially when the creator is trying to copy another artist’s technique.

Though I’m not entirely sure where I fall on the issue, I must admit that Kemp makes an incredibly valid point. It isn’t easy to attribute a work to a specific artist when the goal of the work is to try to copy the style and technique of another. Much of the evidence favoring a positive Leonardo attribution comes from style, brushstroke patterns, and composition. So I think we can find a lot of similarities between the debate surrounding the Isleworth Mona Lisa’s authenticity and that of the de Brécy Tondo, a Madonna & Child sometimes attributed to Raphael. Some will highlight the similarities between the de Brécy Tondo and Raphael’s Sistine Madonna as evidence that the same Renaissance master created both paintings, as opposed to the skeptics who claim the Tondo is just a later copy. People will bring up everything from brushstroke patterns to facial recognition software to make their point. However, so much of that can be dismissed simply by pointing out that it wouldn’t be much of a copy if it didn’t look almost the same as the original. It would be incredible to have a second version of the Mona Lisa out there in the world, but sometimes you can’t know for sure. It could be a Leonardo or a copy by one of his students or followers. The whole point of making a copy is that the author tries to match the original.

But of course, much of the coverage surrounding the Isleworth Mona Lisa consists of how much it might be worth. Given it is in private hands, the current owner may sell it if they choose. Some publications have even compared it to Salvator Mundi, the world‘s most valuable painting ever sold at auction, whose attribution to Leonardo has also been contested. The Isleworth Mona Lisa is currently being exhibited at the Promotrice delle Belle Arti Gallery in Turin until May 26, 2024.

Lost Botticelli Rediscovered

Often, when I write about a rediscovered long-lost masterwork, the person who had it often had no idea that they owned such a rare, valuable work by a great master. However, when Italian authorities seized a painting from a southern Italian family last week, the owners seemed to know exactly what it was: a €100 million Botticelli painting.

Madonna & Child (also called

the Madonna delle Grazie)

by Sandro Botticelli

Sandro Botticelli’s Madonna & Child is a tempera on panel painting, also sometimes called the Madonna delle Grazie, named after the church of Santa Maria delle Grazie where it was originally kept. Some specialists speculate that the Virgin Mary’s likeness is that of one of Botticelli’s favorite models, the Italian noblewoman Simonetta Cattaneo Vespucci, who also appears as the titular goddess in Botticelli’s magnum opus, The Birth of Venus. There are two popular theories about how the Madonna ended up in a small provincial church outside Naples. The first proposed provenance is that of the art historian Ronald Lightbown, whose biography and catalogue of Botticelli’s life and work is still one of the defining monographs of the artist. According to Lightbown, Botticelli originally gifted the work to Pope Sixtus IV around 1470. However, it soon found its way to Santa Maria delle Grazie, in Santa Maria la Carità, just outside Naples. Lightbown posits the pope did this because the Medici family owned the church and other properties in the area. Therefore, the painting was likely gifted to this small church so the pope, strapped for cash, could strengthen ties with the powerful Florentine banking family. At the time, Sixtus IV was trying to raise funds to build a papal chapel at the Vatican. Though initially called the Great Chapel, later generations called it the Sistine Chapel, named after the pope who had built it. The second theory on the painting’s origins is that of Raffaello Causa, who positively attributed the work to Botticelli in the 1960s while serving as superintendent of the Gallerie della Campania. According to Causa, the Madonna was likely commissioned not by the papacy but by the King of Naples, Ferdinand I. It then found its way to a church in the countryside since much of the land surrounding Naples belonged to the king’s friends and advisors.

In 1982, Santa Maria delle Grazie sustained damage in an earthquake. The church moved some of its treasures out, entrusting them to local families. The Somma family received the Madonna delle Grazie. However, while the church was undergoing repairs, people seemed to have forgotten all about the Botticelli. However, some interest in the painting got kicked up again because the Carabinier renewed its efforts to retrieve it earlier this year. The painting’s transfer was peaceful, with Gragnano’s mayor acting as an intermediary to ensure that the Somma family handed over the work. The Carabinieri, the force that amounts to Italy’s cultural police, took possession of the painting, citing the requirement to guarantee the work’s safety.

Indeed, the painting is not in the best condition. Some of the paint has flaked off, while what remains is very faded. Some of the paint, both original as well as touch-ups, has also oxidized over the centuries. If specialists could effectively restore the painting, reversing hundreds of years of past deterioration and repairs, it is unknown to whom the painting would be returned. Technically, the family was looking after the painting on behalf of the church, given a certificate of transfer that gave them rights as the painting’s custodians. However, while the church would normally have the right to reclaim the work, the damage Santa Maria delle Grazie suffered during the earthquake was enough to close it. Therefore, the Carabinieri’s Massimiliano Croce stated that the Botticelli’s ownership might revert to the Italian state should the Somma family fail to provide proof of legitimate ownership. Restoration is expected to take about one year, after which it will be exhibited at a museum in Naples.

Diego Rivera And How Art Can Create Change

Many famous figures have their own quotes about the power of art and its ability to change people’s minds and the world. However, there are few people whose lives have embodied those kinds of sayings than Diego Rivera. Some people know him as a great Mexican artist, while others simply know him as Frida Kahlo’s husband. But it’s important to understand why and how his work changed people’s lives.

Born in Guanajuato in 1886, Rivera showed artistic talent from a young age. Rather prophetically, he started drawing on the walls of his family home. Instead of scolding him, Rivera’s parents covered parts of the walls with canvases and chalkboards to see what he would create. When he was 24 years old, Mexico was plunged into political turmoil and civil war after the overthrow of the dictator Porfirio Díaz. The Mexican Revolution, as this chaotic time came to be known, raged for ten years, killing one in every eight Mexican men in the process. It continued peacefully (relatively) through new governments that implemented reforms hoping to modernize Mexico, from land redistribution to educational secularization.

However, these governments also sought to redefine Mexican identity. They understood that many Mexicans, especially those living in the countryside, felt little connection with people in the cities or other parts of the country. To them, there was no such thing as Mexican national identity. So, the government decided to help create one. The new government, particularly the new education minister José Vasconcelos, made a new Mexico, one that was mixed in its race and heritage; the blending of white European and indigenous American (and to an extent black African) for what became known as “the cosmic race” in Mexico. To express this new identity and promote the changes and new ideas the revolutionary government heralded, they began to commission painters to create public art. This art would serve several purposes, including highlighting the pride in being mestizo, educating the public about Mexico’s long and complicated history, and promoting the new reforms the government wished to implement. This marked the birth of the Mexican muralist movement. The three great figures who emerged from this movement were José Clemente Orozco, David Alfaro Siqueiros, and Diego Rivera.

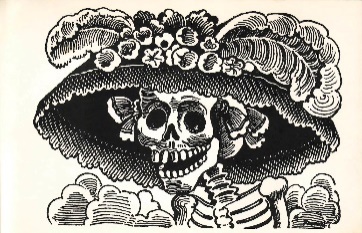

La Calavera Catrina by José

Guadalupe Posada

Rivera was in Paris for much of the Revolution, honing his artistic talents. When the new revolutionary government started planning its mural campaigns, the Mexican ambassador to France reached out to Rivera and urged him to return home. Muralist painters like Rivera took inspiration from various sources to create their new work. They drew from centuries of indigenous wall paintings, the techniques of Renaissance frescos learned in Europe, and political caricatures from pre-revolutionary newspapers like those of José Guadalupe Posada. The old murals found at Mayan and Aztec archaeological sites were of particular influence to Rivera, borrowing their simplified figures and bold colors to express new ideas about nationalism and progress.

Some of Rivera’s most iconic works, and indeed some of the greatest examples of modern Mexican art, were created throughout the 1920s as part of the government’s mural campaigns. These works included decorating the interior walls of the Palacio Nacional, the president’s official residence in Mexico City. One of the building’s main stairwells is now colored floor-to-ceiling with figures from Mexico’s history. From the early conquistadors and Aztec warriors, the Inquisition, the war with the United States, the presidency of Benito Juarez, the French invasion, Porfirio Díaz, and even the great revolutionary leaders like Emiliano Zapata. On the south wall, Rivera even snuck in an image of his wife, Frida Kahlo, in a section often called Mexico Today and Tomorrow.

Rivera wanted his work to show all of Mexico, which meant it would depict its great leaders and its common people, workers, and peasants. He imbued his work with messages of social progress and the great challenges that will accompany it in the future. In doing so, he spoke not only to Mexico but to all people. This enabled him to travel abroad and create murals in New York and Detroit. Rivera is even credited with inspiring Franklin Roosevelt and his administration to found the New Deal’s Federal Art Project. By observing Rivera, the American government understood how art could affect a distressed population and allocated funds to invest in artists like Ilya Botolowsky, Willem de Kooning, Joseph Stella, Mark Rothko, Jackson Pollock, and Lee Krasner. Without Rivera’s influence, many of the great American painters of the twentieth century, the abstract expressionists in particular, would not have gotten the leg up necessary to launch their careers.

While Rivera wasn’t the only person responsible for remaking Mexico in a new, revolutionary image, he was undoubtedly one of the most prolific. And he reshaped not only the way Mexico sees itself but also how the entire world sees the country. Just he and Frida Kahlo alone drew an incredible amount of attention to Mexican art, its themes, its symbolism, and its color. He also drew attention to social issues, advanced the interests of the poor, elevated working people through his paintings, and directly or indirectly inspired artists across the globe. Though not a perfect man by any means, art and culture throughout the world, both in its appearance and its purpose, would be unrecognizable today had it not been for a man from Mexico who drew on the walls as a child and just never stopped.

.

Paris Prepares For Olympics

Paris will host the Olympic games next summer, and the city’s top spots, particularly its cultural institutions, are battening down the hatches. The city already announced that the famous riverside booksellers, the bouquinistes, will be relocated for the opening ceremonies. And now, within a few days of each other, both the Louvre and Notre Dame made some big announcements.

For a bit of optimism, the efforts to rebuild and renovate Notre Dame Cathedral only have a year left. When the cathedral’s roof and iconic spire went up in flames in April 2019, it felt almost unreal. Since then, the world has been closely following the reconstruction, from designs for a new spire to lost treasures rediscovered under the floor. Following the devastating fire, French President Emmanuel Macron promised the cathedral would reopen within five years. Even without COVID delays and safety hazards from the old roof’s lead lining, many thought the president’s expectations were unrealistic and overly optimistic. However, it seems like that promise is being kept. The world-famous Paris church is set to reopen its doors on December 8, 2024. Though it won’t be entirely ready in time for all the summer tourists and Olympic visitors, it will be a momentous affair regardless. Macron recently visited the worksite to view the newly built spire, where he thanked the construction workers and everyone else working on the structure. The scaffolding is now being removed from the interior while crews carefully clean the stone of any remaining dirt and soot. However, the work on the exterior will continue for several more years. Though the spire is nearly completed, the roof will require more time. Though initially Macron suggested the new spire should be of a more contemporary design, those ideas were later scrapped, with the new spire being a recreation of the one that burned down. However, there will be a few modern touches to the refurbished church. Macron previously announced that there will be a competition to choose the design for a series of new stained glass windows. One of the most interesting details is that the construction has used little public money. Rather, most of the €784 million spent on the project thus far is from donations. About half of the €1 billion raised after the fire came from three incredibly affluent French families: the Arnault, Bettencourt, and Pinault.

Visitors to Paris next year will be able to see Notre Dame complete with its new spire, but the Louvre announced some rather disappointing news. The Paris museum will raise ticket prices for the first time in seven years, going from €17 to €22 starting in January 2024, a nearly a 30% increase. This price hike is part of recent policy changes over the past several years, including a daily visitor cap and a two-year renovation plan. The Louvre is not the only organization raising prices in preparation for the Olympics. The Paris Metro, which now costs €2.10 per ride, will soon increase to €4. However, this only applies to single tickets rather than the Navigo metro cards locals tend to use. Laurence des Cars, president of the Louvre, says that the ticket price increase is meant to attract visitors. Specifically, the increase in price plus the visitor’s cap might dissuade tourists from visiting, prompting more local Parisians to visit. The Louvre is free for all children and EU residents aged 26 and under. The new ticket price will also enable the museum to better handle its energy costs.

British Museum Ends The Year On A Low Note

The British Museum has not had the best year. The end of 2023 cannot come fast enough for the museum administration and its supporters. 2023 saw the museum plagued by scandals, the most devastating of which involved a senior staff member accused of stealing thousands of antiquities from museum storerooms. Calls for the restitution of important cultural artifacts to their countries of origin have not only increased but, as a result of the theft, have gained more traction. And now, as if the year couldn’t get any worse, this week, the scandal hit the museum again with a one-two punch: the museum’s deputy director has stepped down, and now an independent review conducted in the wake of the theft has proven to be damning for the museum.

The British Museum has not had the best year. The end of 2023 cannot come fast enough for the museum administration and its supporters. 2023 saw the museum plagued by scandals, the most devastating of which involved a senior staff member accused of stealing thousands of antiquities from museum storerooms. Calls for the restitution of important cultural artifacts to their countries of origin have not only increased but, as a result of the theft, have gained more traction. And now, as if the year couldn’t get any worse, this week, the scandal hit the museum again with a one-two punch: the museum’s deputy director has stepped down, and now an independent review conducted in the wake of the theft has proven to be damning for the museum.

British Museum director Hartwig Fischer stepped down from his post shortly after the initial story broke about the thefts allegedly committed by former curator Peter John Higgs. On December 13th, the museum announced that its deputy director, Jonathan Williams, will also leave. Williams had taken a step back from his official duties after Fischer’s resignation, but now he is leaving the museum entirely. At this point, it is unclear whether he has been fired or if he resigned. His departure was mainly because of his lack of action when Gradel brought the missing artifacts to his attention in 2021. Higgs’s attempts to sell certain items on eBay drew the attention of Danish art dealer Ittai Gradel, who collected evidence on these items and the account selling them between 2016 and 2021. Most damning was a PayPal receipt with Higgs’s name and address. Despite this evidence, Williams dismissed these accusations, prompting Gradel to go to the museum chairman, George Osborne, who referred the matter to the police. Also, thanks to Gradel’s efforts, the museum conducted internal audits of the Greece & Rome department in April 2022 to see if items were missing. The fact that Williams was simply allowed to step back but keep his position immediately after this information became known had some people outraged. Gradel, in particular, had some fiery words for the outgoing deputy director. He said Williams “displayed incompetence to a degree which should have resulted in immediate resignation or failing that immediate dismissal.”

Williams’s departure came the day after the independent review, conducted by a panel comprised of corporate lawyer and former British Museum trustee Sir Nigel Boardman, chief constable Lucy D’Orsi, and deputy high court judge Ian Karet. The panel submitted suggestions and recommendations regarding policy, security, and risk assessment. They suggested, for example, that the museum should make an effort to register or catalogue all the items in its collection and establish set procedures for registering items. It also recommended finding ways to “improve its policy for reporting unlocated objects”. Furthermore, the panel suggested that the museum’s current methods of calculating risk “should be replaced with one that draws on best practice in peer institutions.” In making this recommendation, they cited the manual put out by the British Treasury, often known as the Orange Book, which covers risk management. Of the roughly 1,500 items stolen from museum archives and storerooms, only 351 have been returned, all but one of which were due to Gradel’s efforts. Another 350 or so have been identified but have not yet been returned. However, it has been incredibly difficult for Gradel and museum staff to locate and identify the stolen pieces. Because Higgs tended to steal small artifacts that staff had not properly catalogued, we cannot be certain that these pieces were once in the British Museum’s collection. Another 350 items are still at the museum but have been damaged or destroyed by having their gold mounts and precious stones removed. These missing parts have likely been sold for scrap.

According to the administration, the museum is already in the process of enacting around a third of the policy recommendations the panel suggested in its review. The full report cannot be released because of the ongoing police investigation. However, the investigation has become increasingly difficult because Higgs, the main suspect, has proven uncooperative.

The Higgs theft has weakened public trust in the museum and its leadership. It has also blown an enormous hole in the remaining argument about keeping foreign cultural artifacts in London. Politicians, activists, and large swaths of the general public have called for the repatriation of treasures like the Parthenon Marbles of Greece, the Benin Bronzes of Nigeria, and the Maqdala Collection of Ethiopia. And now, just this week, Lord Frost, a former diplomat and Conservative member of the House of Lords, has called for the Parthenon Marbles’ return to Athens. When the former chief Brexit negotiator, a figure closely linked to Boris Johnson’s government, calls for this kind of action to strengthen Anglo-Greek relations, you know things have gone wrong for your cause.

British Museum & BP Back In Business

Just when I thought I was out, they pulled me back in. As if the British Museum’s reputation couldn’t get any worse, its leadership made an incredibly controversial decision that led to at least one of its trustees resigning. Earlier in the year, people everywhere, and climate activists in particular, celebrated the news that it seemed like the partnership between the British Museum and the oil and gas giant British Petroleum would be ending. The museum was one of the few remaining British cultural institutions to maintain ties with BP, with nearly every other major museum and theater announcing that it would no longer accept their money or sponsorships. However, the British museum administration seems hell-bent on remaining the cartoon villains of the museum world by announcing that BP would provide £50 million towards some much-needed refurbishments.

In what the museum calls a “masterplan”, the new refurbishment will cost nearly £1 billion and take almost a decade to complete. It will include renovating the older parts of the museum and helping with a nearly complete redisplay of its collections. BP’s donation will specifically go towards renovating the galleries on the museum’s west side, which contain the Greco-Roman and Egyptian collections. These galleries contain the Rosetta Stone and the Parthenon Marbles.

It’s safe to say that many people, climate activists in particular, are completely outraged. Chris Garrard, the co-director of the non-profit organization Culture Unstained, referred to this new arrangement as “astonishingly out of touch” and “completely indefensible”. To their credit, activists make rather good arguments when noting how major museums like the British Museum claim they are trying to become more sustainable, yet are doing so by accepting money and sponsorships from the corporations responsible for the climate crisis. I suppose getting a petroleum company to help pay for your efforts to wean yourself off of fossil fuels is a little ironic, and if that’s something that BP wants to spend its money on, then I say go for it. However, knowing that one of the world’s largest, most prestigious museums is only open thanks to the contributions of one of the planet’s biggest polluters will definitely weigh on people before they decide to visit.

Doug Parr, policy director for Greenpeace UK, called the deal “one of the biggest, most brazen greenwashing sponsorship deals the sector has ever seen. No cultural establishment that has a responsibility to educate and inform should be allowing fossil fuel companies to pay them to clean their image, not least the British Museum who have been here before. Did they learn nothing?” Of course, BP has allies in its efforts to clean up its image. Ed Vaizey, Britain’s cultural minister during David Cameron’s premiership and now a member of the House of Lords, has served as a BP apologist, stating in a recent interview, “We tend to treat BP as a pariah – BP has put a huge amount into the arts and has been treated very badly by some of the beneficiaries of that funding.” The decision to accept the donation from BP prompted one of the museum trustees, Muriel Gray, to resign in late November. In the minutes published from a meeting of the trustees, they recognized Gray’s departure and discussed increased security risks due to likely protests staged at the museum. So it’s not like the trustees and the rest of the museum leadership are completely oblivious to the backlash; it’s just that they think the damage to the museum’s reputation will be worth the £50 million donation.

The British Museum’s reputation is already completely trashed for several reasons. One is because of their across-the-board denial to heed calls for the return of cultural artifacts to their countries of origin. But there are also the leadership’s failures that came to light with the Higgs theft scandal that broke in August. Many commentators and analysts have pointed out that the Higgs theft was only made possible because of a toxic, secretive institutional culture the British Museum has developed to better defend itself from restitution claims. This culture is rearing its head once again. The news that the museum had no plans to extend its partnership with BP came in early June. However, these refurbishment plans have been in the works for years. Furthermore, it’s said that the museum chairman, George Osborne, signed off on BP‘s donation not even three weeks after this news story started circulating. So again, lack of transparency has led to a greater decrease in trust and further diminishment of its reputation. They got everyone’s hopes up yet were fully aware that they would dash them against the rocks sooner rather than later. Protests and demonstrations have disrupted museum operations over the British Museum’s ties to BP for years. Furthermore, last year, hundreds of employees across Britain’s museums signed a letter calling for the museum to cut off BP as a sponsor. But it seems the trustees have chosen to disregard all of this.

In the spring of 2024, the museum will sponsor an architectural competition to choose designs for the new galleries.

Top Art World Moments Of 2023

With so much that has happened in 2023, it was difficult to pick just ten of the most interesting, most impactful art world moments of the year. But here are my favorites. From big sales and monumental exhibitions to theft and lawsuits…

#1 - February 10, 2023: The Rijksmuseum opens its monumental Vermeer exhibition

From February 10th to June 4th, Amsterdam’s Rijksmuseum hosted the largest-ever exhibition of the works of Johannes Vermeer. Of the thirty-four verified Vermeer paintings, the exhibition contained twenty-eight of them, or about three-quarters of his total existing work. These include some of his most iconic works like Girl with a Pearl Earring, View of Delft, and The Geographer. Nick Glass of CNN called the exhibition “the art world’s coup of the year”. Ticket sales exceeded 200,000 before it even opened. The show was made possible by collaboration between the Rijksmuseum and other major institutions like Washington’s National Gallery and New York’s Metropolitan Museum of Art.

From February 10th to June 4th, Amsterdam’s Rijksmuseum hosted the largest-ever exhibition of the works of Johannes Vermeer. Of the thirty-four verified Vermeer paintings, the exhibition contained twenty-eight of them, or about three-quarters of his total existing work. These include some of his most iconic works like Girl with a Pearl Earring, View of Delft, and The Geographer. Nick Glass of CNN called the exhibition “the art world’s coup of the year”. Ticket sales exceeded 200,000 before it even opened. The show was made possible by collaboration between the Rijksmuseum and other major institutions like Washington’s National Gallery and New York’s Metropolitan Museum of Art.

#2 - February 21, 2023: Joan Mitchell vs. Louis Vuitton

The Joan Mitchell Foundation (JMF) sent a cease-and-desist letter to the offices of Louis Vuitton in Paris. This came after the fashion house featured some of Mitchell’s work as a backdrop for their new series of advertisements. The ads featured French actress Léa Seydoux posing with a Louis Vuitton Capucine handbag in front of Mitchell’s La Grande Vallée VII. Louis Vuitton had been hosting an exhibition with Mitchell’s work at the Fondation Louis Vuitton. The JMF has only ever licensed the use of Mitchell’s work for educational purposes like gallery exhibitions, making an effort to keep the artist’s work from being used in commercial settings. According to both the JMF and a Louis Vuitton employee, the fashion house had requested that they use some of Mitchell’s work in the advertising campaign, and, keeping with past precedent, the JMF declined. But Louis Vuitton went on with their plans anyway.

#3 - April 25, 2023: Portrait of Omai by Joshua Reynolds jointly bought by the National Portrait Gallery and Getty Museum

After the British government extended its export bar several times, Sir Joshua Reynolds’s famous Portrait of Omai will remain in Britain (sort of). Initially, museums and collectors across Britain squabbled to come up with the £50 million the government claimed the portrait was worth. London’s National Portrait Gallery came the closest, gathering nearly £25 million by December 2022. But the J. Paul Getty Museum of Los Angeles swooped in and saved the day, offering to match the National Portrait Gallery’s £25 million and buy the painting jointly. The plan is to send the portrait back and forth between the two institutions for six months at a time. But while some are applauding the NPG and the Getty for their new approach to collaboration, some in Britain are upset that Omai will have to spend half the year in an American museum instead of remaining in Britain year-round.