COMMENTS ON THE ART MARKET

The New Year

We, at Rehs Galleries, wish you and your family all the best for the New Year and hope you all have a wonderful and safe celebration.

As you will note, Volume 121 marks the beginning of our 11th year for Comments on the Art Market. Over the past 10 years we have tried to cover every aspect of buying a work of art along with market updates and news from the darker sides of the art world. We really enjoy the comments many of you send to us and are always open to covering topics that may interest our readers … please feel free to send on any suggestions.

____________________

Los Angeles Art Show

A quick reminder that the gallery will be exhibiting at the 16th Annual Los Angeles Art Show which runs from January 19th through the 23rd and takes place at the LA Convention Center, Los Angeles, CA. More than 100 exhibitors will be attending and if you are in the area, please stop by.

____________________

The Stock Market

First, I think I have beaten the addiction … not once, during the month, did I turn on a financial news channel and to be honest, I did not even feel the urge! This could be very good.

Now on to the important things … the DOW (which opened the year at 10,428, hit a low of 9,686 in July and is now hovering around 11,580) and my portfolio – (which, for the year, is up over 12%). WOW!! Not too shabby. In addition, many of my favorite stocks are doing well (but not all): GE is around $18.50 (up 24%); McD was at $77.46 (up 26%); RIMM at $58.27 (down 14% for the year); Citi hit $4.77 (up 44%); CTL was over $46; AT&T is almost $30 (up 10%); Oracle is closing in on $32 (up 29%) and INCYTE (my son’s pick) is $16.91.

I hope that 2011 is another good year for the market.

____________________

And The Sales Keep On Coming

The 2010 New York art auction action finished with the American painting sales and as we have seen with other 19th century sales, the offerings had their high and low points.

Taking top honors here was Edmund Tarbell’s Child with Boat that carried a $2-$3M estimate and sold for $4.2M; coming in second was Winslow Homer’s Peach Blossoms that fell short of its $3-$5M estimate to sell at $2.88M and capturing the third position was Frank Benson’s portrait titled Two Little Girls which made $2.1M (est. $1.5-$2.5M). Rounding out the top 5 were John S. Sargent’s Ricordi di Capri at $1.65M (just squeaking past it low estimate of $1.5M) and Childe Hassam’s Rainy Day, New York, which blew by its high estimate of $700,000 to sell for $1.54M.

In addition there were some additional results I think you will find of interest. A nice, small (12 x 16 inch) Wall Street snow scene by Guy Wiggins made $101,500; Norman Rockwell’s Dreamboats made $1.1M while his study for The Problem We All Live With made an impressive $855K (est. $150-$250K) and Marsden Hartley’s Knotting Rope (est. $150-$250K) made $975K.

On the flip side there were works that could not find buyers. Among the biggest failures were: Marsden Hartley’s Still Life with Flowers (est. $700-$1M); Julius Stewart’s In the Garden ($700-$1M); George Bellows’ Between Rounds ($600-$800K); Sharp’s Fireside ($500-$700K); Moran’s Sunrise Landscape ($400-$600K); Farny’s Something Stirring ($300-$500K); Milton Avery’s Sally at the Writing Table ($250-$350K); as well as works by Wyeth, Bridgman, Hennings, Rockwell, Hassam, Moses, Burchfield…

When the sales ended, the results at Christie’s were a bit short of expectations: they offered 148 works of which 96 sold and 52 were returned to their owners, leaving a sell-through rate of 65% and a total take of $21.2M (with the commissions) – the low end of their estimate (without commissions) was over $23M. And as for their competition, Sotheby’s offered 133 works of which 89 sold and 44 were returned to their owners; leaving them a sell-through rate of 66.9% and a total take of $27M (with commissions) … the low end of their estimate was also just over $23M (without commissions).

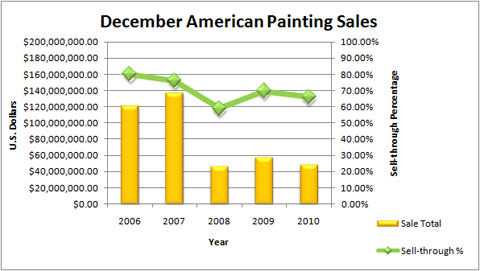

So you may be wondering where this particular market has gone over the past few years, well…

2006: 387 lots offered, 309 sold (79.8%), total take $120.9M, top lot –$26.8M (Hopper)

2007: 414 lots offered, 314 sold (75.8%), total take $136.8M, top lot –$5.9M (Rockwell)

2008: 370 lots offered, 218 sold (59%), total take $46.1M – top lot –$2.66M (Silva)

2009: 239 lots offered, 166 sold (69%), total take $57.4M – top lot –$6.9M (Wyeth)

2010: 281 lots offered, 185 sold (65.8%), total take $48.2M – top lot –$4.2M (Tarbell)

From the numbers above one can see that the American painting market is still in the recovery phase and the auction rooms are having trouble getting the really great works. I continue to recommend that the auction rooms pare down the offerings and present only the best works they can obtain; it would be nice to see an improvement in the sell-through rates.

____________________

Are You Kidding!?

And while I am on the American market, here is a contender for the “Most Ridiculous Price of the Year Award”. In May a nice painting by Nikolai Fechin was offered at Doyle New York and sold for $632,500 (est. $200-$300K) – a pretty good price for this artist whose auction record, at the time, was $1.1M. Well, this December the same Fechin painting was offered in a Russian painting sale in London and when the battle was over, and this was a battle, the painting sold for an astounding $10.85M! Talk about a short term gain. I am still trying to determine whether I feel worse for the people who sold it at the Doyle sale or the buyer at the Russian sale.

____________________

Antiquities

Now I am no expert on this topic and to be honest I wouldn’t know the difference between a piece done c.2500 B.C. and one from the 1st Century A.D., but the results from a New York evening sale were newsworthy.

On the 7th, Sotheby’s offered a group of Antiquities from the collection of the late Clarence Day (an avid collector and philanthropist). The sale included 38 works and the top price was a staggering $23.8M achieved for a Marble Portrait Bust of Antinous, A.D. 130-138 (the piece was estimated to bring $2-$3M); the second place finisher was a Green Porphyry Sphinx of an Egyptian Queen that made $5.2M (est. $800-$1.2m) and coming in third was an Egyptian Polychrome Limestone Ushabti of Djehuty-mose that made $1.3M (est. $200-$300K).

When the sale was done, of the 38 works offered all were sold – a sell-through rate of 100% (a rarity) and the total take was $36.7M – blowing away its presale estimate of $5.7 - $8.6M. This sale goes to show that if you offer the right material the buyers will come and the results can be outstanding.

____________________

Old Master, British and Some (I Stress SOME) 19th Century

By the 8th our attention turned to the London for the Old Master sales (as you know, currently Christie’s includes their 19th century offerings in these sales as well).

First up was Christie’s evening sale whose overall results were disappointing, and that was caused by one painting – the Poussin. Like I always say: what a difference a painting can make. The top sold lot was The Master of the Baroncelli Portraits which made £4.2M ($6.6M) on a £1-£1.5M estimate; second place was achieved by Gerrit Berckheyde’s A View of Haarlem from the northwest corner… at £2.6M ($4.1M) on a £500-£700K est.; and third place was grabbed by Le Lorrain’s Extensive Landscape … at £2.05M ($3.2M) – just above its low estimate of £2M. In addition, the highlight of this sale was Nicolas Poussin’s Ordination; a work I saw in NYC and was far from impressed with it … I actually commented to the person I was with that I could not understand why it was so highly valued (£15-£20M). It was not very impressive (in my humble opinion); but then again I am not an Old Master dealer. Anyway, the Poussin was the last lot in the sale and the catalog entry was 36 pages long … I am sure you can guess what happened … it did not sell – what a waste of paper!

This sale also highlighted the best 19th Century works they could source … but one was hard pressed to find many really great 19th century paintings here. In fact, of the 52 works offered, only 7 fell into the 19th Century arena and of those 5 sold and 2 did not.

When the evening ended, of the 52 lots, 39 sold leaving a sell-through rate of 75% and a total take of £25.3M ($39.9M) – the low end of the presale estimate was £31.1M ($49.1M) – so they fell a bit short. Now if the Poussin was not part of the sale, the low end of the estimate would have been £17.1M and their total would have easily beaten that. And in case you are wondering about the 19th Century works - the 7 pieces had a total presale estimate of £1.16-£1.76M and brought £1.28M (within the estimate, but only after the buyer’s commissions is added).

The following evening Sotheby’s held their Old Master & British Painting sale; and while the overall results were in line with their competition, they did sell their top lot (which came in at number one): George Stubbs’s Brood Mares and Foals, £10.1M ($15.9M -- est. £10-£15M). You should note that it only reached the low end of the estimate with the buyer’s commission added in, but it sold. Taking second place was a Venice scene by Canaletto bringing £2.2M ($3.5M) on a £2-£3M estimate and in third was Luis de Morales’s The Virgin and Child which trounced its £250-£350K estimate to sell for £1.6M ($2.5M).

When this sale ended 32 of the 44 works sold; creating a sell-through rate of 72.7% and a total take of £23.6M ($37M) -- their presale estimate was £20.4-£30M. So they only hit the estimate range after the buyer’s premium is added in … but they made it!

Now both salerooms had corresponding day sales whose results were rather disappointing. Christie’s offered 246 works and sold only 119 for a sell-through rate of 48% and a total take of £5M ($7.9M). The top lot three lots were a Breughel at £241K ($379K – est. £80-£120K); a Circle of van Poelenburgh at £199K ($313K – est. £12-£18K) and a von Stuck at £157K ($247K – est. £20-£30K). It was nice to see that of the top 10 works 6 were from the 19th century. I will add that the one surprise to me was a small (15 x 18 inch) Corot that actually sold since it had a tear that must have been close to 25 inches long; the piece carried a £50-£70K estimate and brought £55K ($87K).

Sotheby’s day sale did a little better, but it was still far from ‘good’. Of the 171 works offered, 100 sold for a sell-through rate of 58.8% and a total take of £4.4M ($7M). On the positive side, the top three lots crushed their presale estimates: Castilian School (est. £40-£60K) sold for £307K ($486K); Tironi’s Venice scene made £229K ($363K – est. £80-£120K) and a portrait by Pickering made £223K ($353K – est. £20-£30K). In fact, all of the top 10 easily beat their estimates.

In addition to these main sales, Christie’s had two lower end sales of Old Master & 19th Century works. The first featured drawing and watercolors – of the 236 items offered and 163 sold for a sell-through rate of 69% and grossed £419K ($664K). The second sale offered paintings and some watercolors – of the 349 works offered 207 sold (60% sell-through rate) and grossed £1.14M ($1.8M).

When this series of sales finished the totals were as follows (APPL = Average Price Per Lot):

Christie’s: 883 offered – 528 sold (59.8%) – total take £31.9M ($50.4M) – APPL £96K ($152K)

Sotheby’s: 215 offered – 132 sold (61.4%) – total take £28M ($44M) – APPL £333K ($527K)

Now if we remove Christie’s ‘lower end sales’ from the results (so we are comparing apples to apples) then their overall totals were: 298 offered – 158 sold – total take £30.4M ($47.8M) – APPL £192K ($303K). This is still well below their competition. Like I have been saying --- Smaller, stronger, sales are the way to go today … and Christie’s: Give Us Back Our 19th Century Sales!!!

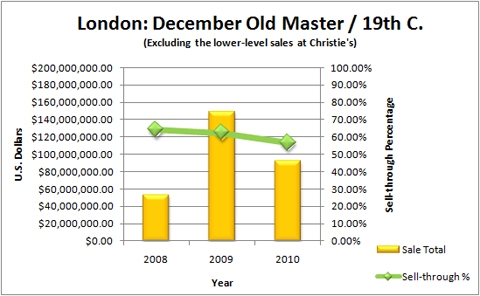

In case you were wondering, here are the results for the past three years (again, so we can compare apples to apples, I did not include the lower-level sales for 2010) … the sell-through rates are not heading in the right direction:

2008 – 447 offered, 286 sold, 64% sell-through rate, total take £35.9M ($53.3M)

2009 – 407 offered, 254 sold, 62.4% sell-through rate, total take £90.7M ($148.7M)

2010 – 513 offered, 290 sold, 56.5% sell-through rate, total take £58.4M ($91.8M)

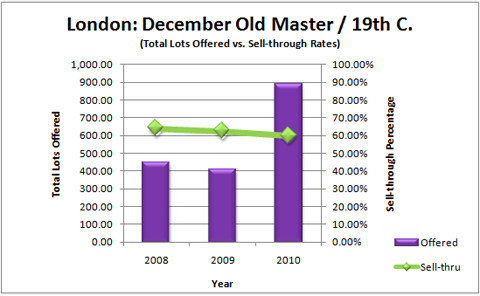

In the next chart I have compared the total sales volume against all the works offered (this included the lower-level sales for 2010) … and as you will see, more works does not equal more money:

.jpg)

And the final chart compares the Total Lots Offered vs. the Sell-through Rates – here again you will see that more product does not mean better sell-through rates.

From the numbers, and charts, I would say that they are having trouble obtaining high quality works with reasonable estimates and the sell-through rates are declining. It is really important to remember that quality is far better than quantity!

____________________

The Victorians

Hyped as a select group of Victorian and Edwardian Masterpieces one would have expected big things from this Sotheby’s sale … but that was not the case; the works (and their estimates) just did not live up to the hype. It was interesting to read their presale press release since they used the off-the-charts price for the Alam-Tadema (sold in NY for $35.9M) as a springboard for this sale, but I think we all know that the Tadema was a one-off event.

The release also stated that the sale would begin with 14 carefully selected works from private collections with a combined estimated value of about £3M. Well, by the time they hit lot 14, only 7 had sold; leaving a combined total of £1.56M ($2.5M) – not a very good start. In addition the most expensive work, a Tissot (£800-£1.2M), found no takers – it was last on the market in 1996 and sold for £440,000; and Godward’s A Tryst failed to meet its reserve – it was last on the market in 1999 when it made £275,000. Both were strong prices when they were originally bought at auction and the owners will have to wait a little longer for the market to reach the levels they now want.

Oh, they did offer an Alma-Tadema which was estimated at £200-£300K and failed to find a buyer; to be honest, the woman featured in the painting was not very attractive. The seller bought the work in 1996 for $195,000, then tried to sell it in 2008 with an estimate of $700-$900K (come on) and now tried it at less than half that range … still no takers. Remember, just because one painting by an artist does exceptionally well does not mean the next one will … it all comes down to what is on the canvas.

Of the 90 lots offered only 44 sold (48.8% sell-through rate) for a grand total of £3.3M ($5.24) – about what the first 14 lots were supposed to bring. Not very good!

____________________

Highlights from Other Sales

During the past few months there were many additional sales of paintings, documents, books, furniture, etc.; far too many to review. However, among them were some pretty interesting items – so here is a quick rundown:

- An 1820-40 glass flask with the bust of General Jackson on one side brought a record breaking $176,670

- In a Maine sale a MiG-21 fighter jet was offered and sold for only $23,000 (the story goes that the owner was contacted by the CIA and informed that since the jet still had the Soviet Union attack radar system if he flew it, they would shoot him down – yikes! So he replaced it with an American system) and in the same sale Theodore Roosevelt’s F grade A.H. Fox shotgun sold for $862,500 … kind of funny that the jet only sold for $23,000 since it has a lot more ‘fire power’ than the shotgun!

- In London a white marble fire surround sold for $893,434; some wooden brackets designed by William Kent sold for $182,164 – amazing!

- A Viktor Schreckengost ‘Jazz’ bowl (est. $20-$30K) sold for $158,600.

- An intense pink diamond weighing 24.78 carats sold in Europe for $46.2M – WOW

- A 1953 Patek Philippe gold two-crown world time wristwatch sold for $2.7M – I always say: time is money!

- Detective Comics #27 (the first appearance of Batman) sold for $493K – what was interesting is that the seller originally bought the comic in 1939 for 10 cents – NICE! Buying for the long run.

- General George Custer’s cavalry guidon (found under the body of a dead trooper at the little Bighorn and the only flag flown that was not captured by the Indians) was sold for $2.2M (est. $2-$5M).

- The original, 1891 hand written rules for Basketball, by James Naismith, found their way to auction and brought $4.3M

- And the biggest surprise of the season was the record breaking Chinese vase. A brother and sister who live in the English countryside were clearing out a house and brought a vase in to a local auction room. Well, by the time the sale took place at least 10 serious buyers were in play and the final price was $83.36M --- yes, more than $83 million for the vase … I am sure that made their holiday season – along with the auction room and “the Tax Man”!!

Howard L. Rehs

© Rehs Galleries, Inc., New York –January 2011

Gallery Updates: As mentioned earlier, we will be exhibiting at the Los Angeles Art Show: January 19 – 23, 2011.

Web Site Updates: Among the artists whose works have come and gone from our web site were: Alonso-Perez, Francesco Bergamini, Edouard Cortès, Antoine Blanchard, Ugo Giannini and Katie Swatland. Works by the following artists have, or will be, added to our web site this month: Henry Woods, Arthur J. Elsley, Evert Pieters, Mary Browning, Edouard Cortès, Joan Miro, Holly Banks and Sally Swatland.

Next Month: More art world coverage.