COMMENTS ON THE ART MARKET

We wish all of our friends and readers a very happy holiday celebration and a healthy and prosperous New Year!

___________________

The Stock Market – Still On a Roll

While there were some wild days this month, overall the stock market seems to be holding its own … hovering in the 11,000 range, far better than the 9,600 range back in July! Who knows where we will go from here, but I am really hoping that those bottles of Dramamine will stay in the medicine chest!

As for my favorite stocks, on the day I went to press GE was around $16; MCD in the $80 range; RIM was closing in on $60; Oracle was over $28; Citi was in the $4.2 range; CTL was hovering in the $42.5 range; BofA was getting hammered -- $11.3 and here are couple of new ones INCYTE - $15.27 and SMTC $3.86.

And my personal portfolio was up 9.73%.

_____________________

The Art Market

Well, there were plenty of fireworks in New York this month … so much so that one might have thought we were celebrating July 4th! Since there was so much action in New York I am going to limit myself to those sales.

Impressionist & Modern

First up were the Impressionist and Modern works and the results were pretty good. Now I know the newspapers were abuzz with the top lots from these sales, which were outstanding; however, the general merchandise was just that, general, and the overall results were ok.

Both salerooms had their respective evening sales and extremely strong prices were seen for the really good works …. even some of the mediocre pieces commanded hefty prices. The top five for these sales were: Modigliani’s Nu Assis Sur un Divan (expected to make in excess of $40M) which brought $68.96M; Matisse’s sculpture Nude dos, 4 etat (est. $25-$35M) at $48.8M – what was interesting here is that the piece was cast in 1978 (24 years after the artist died … there is just something wrong with that!); Juan Gris’s Violon et guitar at $28.6M (est. $18-$25M); Monet’s Le Bassin aux Nymphéas at $24.7M (est. $20-$30M) and another Matisse – Danseuse dans le Fauteuil, Sol en Damier – at $20.8M (est. $12-$18M).

Like all sales, there were a number of items that left me a bit cold; some because of their quality and others because of their estimates – among them were: Boudin’s La Jetée du Havre whose $700-$1M estimate seemed very steep, but it sold for $1.1M … shows you what I know; Monet’s Etude de Joncs (very boring) carried a $1.2-$1.8M estimate and made $2.1M … another example of what I don’t know; and Munch’s Ragnhild and Dagny Juel (est. $2.5 - $3.5M) which did not sell … finally got one right! Or maybe I got them all right and the buyers got them wrong?

The breakdowns for the individual evening sales were as follows: Sotheby’s offered 61 works, of which 46 sold and 15 were bought-in for a sell-through rate of 75.4% and a total take of $227.5M (they expected between $195-$266M). Now the press release for the sale stated that it fell comfortably in that range, and that is true, but only when you add in the buyer’s commissions, otherwise it was more towards the low end of the estimate.

The Christie’s sale saw 84 lots offered with 67 sold and 17 bought-in for a sell-through rate of 80% and a total take of $231.5M (they predicted a range of $199-$287M) – so they were in the same range as Sotheby’s – at the low end of the estimate before the commissions.

Now for the fun facts --- what some of the works sold for in the past and what they made today (this is only a sampling):

The Good (price appreciation):

Modigliani’s Nu Assis sur un Divan: 1999 - $16.7M; 2010 - $68.9M – Average Annual Return 13.75%

Giacometti’s Nature Morte dans l’Atelier: 1999 - $417K; 2010 - $3.33M – Average Annual Return 20.79%

Sisley’s Le Pont de Moret: 1999 - $1.6M; 2004 - $1.75M; 2010 - $2.9M – Average Annual Return 5.56%

Monet’s Nymphéas: 1998 - $9.9M; 2010 - $24.7M – Average Annual Return 7.92%

Modigliani’s Jeanne Hebuterne: 1996 - $3.5M; 2010 - $19.1M – Average Annual Return 12.89%

Schiele’s Mann und Frau: 2001 - $2.57M; 2010 - $7.36M – Average Annual Return 12.4%

Leger’s Femme sur fond rouge…: 1993 - $437K; 2010 - $6.35M – Average Annual Return 17.05%

To put these in perspective, the Average Annual Return for the DJIA from 1995-2010 was 5.34%

The Bad (losses or unsold):

Pissarro’s La Recolte des Foins, Eragny: bought in 1994 for $1.6M and unsold this time.

Matisse’s Deux Négresses: 2001 - $7.6M; 2010 - $8.5M (a loss for the owner)

Matisse’s Danseuse dans le Fauteuil: 2000 - $7.45M; 2007 - $21.7M; 2010 - 20.8M (a loss)

The Ugly (I just did not like these works)

Van Gogh’s Une liseuse de romans: 2003 - $5.6M; 2005 - $4.3M; 2010 - $3.1M ... moving in the right direction!

Renoir’s Maternité: 1988 - $8.8M; 2010 – Unsold (est. $5-$7M)

Renoir’s La couseus: 1995: $2.8M; 2010 – Unsold (est. $5-$7M)

Matisse’s Femme assise dans un Fauteuil: 1987: $396K; 2010 – Unsold (est. $2-$3M)

The Day Sales tacked on even more money with Sotheby’s adding $36.1M (227 lots offered, 166 sold, 61 bought-in, for a sell-through rate of 73.1%) and Christie’s adding $39.6M (289 offerings of which 246 sold and 43 were bought-in for a sell-through rate of 85%).

When all totaled, the two sales grossed $534.7M from 661 works offered and 525 finding new homes, creating a sell-through rate of about 79%.

And here is a recap of the November auction sales, in New York, for the past 5 years

2010 – 661 lots offered, 525 sold, sell-through rate of 79% and a grand total of $534.7M

2009 – 557 lots offered, 425 sold, sell-through rate of 76% and a grand total of $301.1M

2008 – 941 lots offered, 506 sold, sell-through rate of 54% and a grand total of $417.6M

2007 – 750 lots offered, 565 sold, sell-through rate of 75% and a grand total of $804M

2006 – 901 lots offered, 708 sold, sell-through rate of 78% and a grand total of $847M

Here are the artists whose work took the number one spot & that work’s percentage of the sale:

2010 – Modigliani - $68.96M (12.9% of combined total)

2009 – Giacometti - $19.35M (6.4% of combined total)

2008 – Malevich - $60M (14.4% of combined total)

2007 – Gauguin - $39.2M (4.8% of combined total)

2006 – Klimt – $87.9M (10.4% of combined total)

I am not really sure what all the numbers and results say – other than there is a lot of money chasing good art and that some of the buyers are not paying attention to my advice: buy the best you can within any artist’s work and if you cannot afford the best, either choose another artist or do not buy!

The 19th Century – What a Difference a Painting or Two Can Make!

Now Sotheby’s decided to sandwich our good old 19th century sale in-between the Impressionist sales that took place during the first week of November. And while the overall results were the best we have seen, I still believe they need to give the 19th century its own week. The great results were completely overshadowed by the big Impressionist sales … and as you will see, that was a shame.

As I mentioned in last month’s newsletter it was nice to see that the auction room decided to scale back the number of offerings and just concentrate on the better works (something I have been screaming about for years). I was sure that this would create a far better return for them – which it did.

The 19th Century European Painting sales hardly ever see any serious fireworks … those are usually left for the big Impressionist, Contemporary and Old Master sales … but this sale provided some of the best displays ever (one the Grucci family would have been proud of); and while there were a number of low points the results for the right works were SMOKING HOT!

The sale started off pretty strong with a very nice work by Louis de Schryver that carried an estimate of $150-$200K (one we were prepared to go to $310,000 for); however it sold for a hammer price of $320K ($386K with commissions) – “missed it by that much”! Lot 11 was Gérôme’s After the Bath, a nice example that last sold in 1999 for $1.04M; this time around it brought $1.48M – not a big increase, but an increase. Lot 20 was Breton’s Summer (a work I was not very impressed with), but it did garner some action and finally sold for $554,500 (est. $300-$400K) – it was also sold in 2002 for $240K and again in 2005 for $352K – so it has seen a steady price increase. Lot 21 was another Breton (a fairly late piece that left me wondering: what would happen if you actually cleaned it? It was a very thin painting) titled Les Sarcleuses de Lin which made $374,500 – a pretty strong price for that work, in my humble opinion!

Lot 23, a large Bouguereau, was the first of two paintings Demi Moore was selling. Ms. Moore acquired the work in 1995 for $178,500 and this time around it made $1.08M (on a $1-$1.5M estimate) … the hammer price was $900,000 so it actually fell a little short of the estimate. The second work was Alfred Stevens’ Mere et ses Enfants – three lovely figures in a rather dark, ominous, landscape – which found a buyer at $182,500; Ms. Moore acquired the work in 1995 for $200,500 – so she took a bit of a loss on this one. But overall her return was pretty good if you figure that she paid $379,000 for the two in 1995 and sold them for $1.262M in 2010.

A very nice Emile Munier, titled Her Best Friend, appeared as lot 26. This painting last sold in 2001 for $159,750 and now carried an estimate of $150-$200K. We thought a bid of $170-$180K would have been enough, but we were a bit short here as well … sold for $220K ($266,500 with the commission).

It was interesting to see the resurfacing of many recently sold works (and I am talking about very recently). Lot 35 was a rather stiff, but colorful, Parisian street scene by Bakalowicz. I saw this painting at a Sotheby’s sale in Paris this June where it made $65K and paid very little attention to it; the work sold for $65K. Well, only a few months later it was here in NY with a $100-$150K and sold for $422,500 – WOW! Lot 40 was another Parisian street scene, this time by Victor Gilbert. This was a nice piece and one that carried and estimate of $50-$70K … and sold for $104,500 – a very strong price; what was really interesting is that this painting was sold in September , 2010 (yes, two months earlier) in a Texas sale for $25,000 --- now that is another nice short term gain. I am sure the seller was very happy, but what about the people who sold it at the Texas sale?

As the sale progressed through lot 55 we were on track for a fairly strong, but typical, 19th century sale. Then lot 56 appeared and the fun began. The painting, Alma-Tadema’s The Finding of Moses, had an extensive provenance and exhibition history. The painting was originally sold in 1904 for £5,250 (then making it one of the most expensive British paintings ever sold); when it appeared on the market in the 1960s it was reported to have sold for just £900- the buyer bought it for the frame and left the painting! Then in 1995 it came back on the market and sold for $2.75M (the auction record for a work by the artist). Well, when the bidding war was over – and this was a war since the painting carried a realistic estimate of $3-$5M – the new owner paid $35.9M … and that is not a typo. Now I did hear, from a reliable source, that before the sale the ultimate buyer was asking whether or not he could hang this painting in his yacht … what a “boat” that must be!!

There was one final Big Burst at lot 75 – Boldini’s sexy portrait of 10 year old Giovinetta Errazuriz. This large work carried a $1-$1.5M estimate and finally traded hands at $6.6M … another sky high price for a work which last sold in 2004 for $1.35M (as you will note from the estimate, the owner was prepared to take a loss).

It is important to remember that there has never been a true 19th century painting (one that normally sells in the 19th century European Painting sales) that has gone past the $8M market – the record, until November, was, if memory serves me right, Alfred Munnings’s The Red Prince Mare at $7.8M. And even with Tadema’s off-the-charts price, there was little to no press reaction; almost all the major news organizations covered the highs and lows of the Impressionist and Moderns --- nothing, or very little, about the 19th century. What a shame! Come on, this painting sold for more than most of the paintings offered in the other major sales.

Anyway, by the time the sale was over, the presale estimate range of $20-$29.5M was left in the dust. Of the 82 lots offered, 60 found new homes and 22 were unsold, leaving a sell-through rate of 73.2% and a total take of $61.5M!

To put this sale in perspective, the 2009 sale offered 139 works, sold 73 (54% sell-through rate) and grossed $9.83M. I went back to 2008 (when both Sotheby’s and Christie’s had sales, remember in 2009 Christie’s merged the 19th century & Old Master departments) and found that combined the two rooms offered 467 works, sold 215 (a 47% sell-through rate) and totaled $24.48M (remember, this was at the worst point in the market). And why not throw in 2007 results – 555 works offered, 346 sold (63% sell-through rate) and a total take of $39M … even at the market’s height the results didn’t come close.

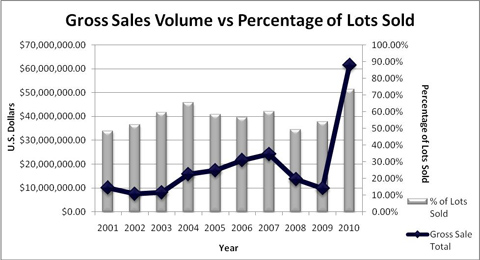

The graph above illustrates the last 10 years of the sales from the fall 19th Century sales at Sotheby’s New York. The blue line represents the total U.S. Dollar Gross Sales Volume while the grey bars illustrate the Percentage of Lots Sold; the latter of which runs between 50% and 70%; the highest being 2010 when they seriously scaled back the number of lots offered and mainly concentrated on the quality works.

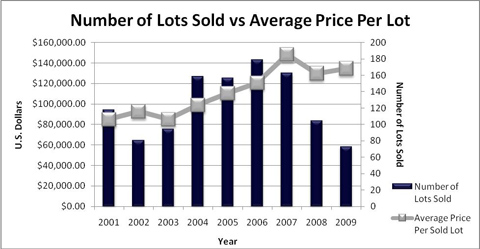

The graph above illustrates the Number of Lots Sold and the Average Price Per Lot. You will note that 2010’s results are not included since it made the 10 year span difficult to read. What this chart beautifully illustrates is that as the market cooled off in 2008 & 2009, and only the better lots were selling, the Average Price Per lot still remained very high (evidence that buying the best is the way to go). In addition, the 9 year trend was a positive one - increasing from about $85,000 to $135,000 per lot sold.

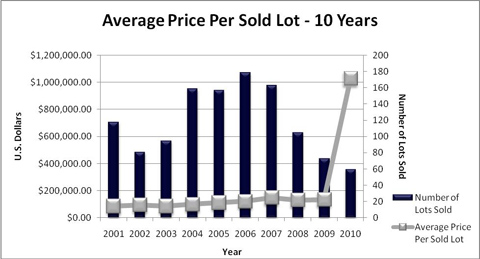

I am sure you are wondering what the previous graph would look like if we added in the 2010 results … so here it is! The scaling makes it very difficult to see the trend for the Average Price Per Sold Lot.

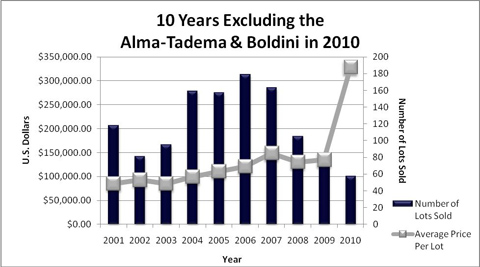

Now here is another interesting fact. If we remove the Alma-Tadema and Boldini from the equation (assuming those were just one-off results) the price per lot sold drops to $327,586; however this is still an amazing increase for the period, and the resulting chart (below) looks pretty similar to the last one.

So what does all of this say to me --- better quality + less product = far better results. It will also be interesting to see how many Alma-Tadema and Boldini paintings show up on the market --- but to all you potential sellers please remember …too much of a good thing is BAD!

The Contemporary – More HOT Results

The action did not stop; the following week found us in the middle of the Contemporary Art auctions … and fireworks lit up the sky.

As I always admit, I really cannot tell you if the quality of one work was superior to another for many of these artists; let’s face it, do I know if a pile of candy on the floor is better than a pile of cookies? Nope. And more importantly, do I care? Nope! I will also add that while walking through the exhibitions I did shake my head, in disbelief, more than once. So, I will leave quality out of this discussion and concentrate on the results.

Unlike the previous week, the Contemporary sales have three main players in the auction world: Sotheby’s, Christie’s and Phillips. Top honors for this week went to Andy Warhol whose works captured three of the top five results. Number one was Warhol’s Men in Her Life (offered at Phillips) – bringing in $63.3M (that amount would have bought the entire 19th century sale and more!); Lichtenstein’s Ohhh…Alright…., being sold by Steve Wynn, brought $42.6M from a single bidder (it was reported that the auction room had a bidder who contractually agreed to bid up to a certain amount --- poor person; in addition rumor has it that Wynn paid $50M for the work – if so, I do not get it: why sell at that price?); Warhol’s Coca-Cola (4), being sold by Elizabeth Rea, made $35.3M (to Steve Cohen) on a $20-$30M estimate – Ms. Rea paid $143,000 for the work in 1983; while his Campbell’s Soup Can with Can Opener (Vegetable) fell way short of its estimate, $30-$50M, to sell for ‘only’ $23.8M … now do not cry for the seller because this was last on the open market in 1986 and made $264,000; and coming in fifth was Rothko’s Untitled, 1955 which sold to a lone bidder for $22.48M – in other words, he bid against the seller’s secret reserve.

And while I am at it, I will give you a few more notable results: Lichtenstein’s Ice Cream Soda (1962) brought $14M (est. $12M-$18M); Koons’ Balloon Flower made $16.8M (est. $12M-$16M) and Gonzalez-Torres’ Untitled (Portrait of Marcel Brient) – a pile of candy with a fancy title – made $4.5M --- come on! What happens if someone eats a piece?

Each of the evening sales did extremely well. Phillip’s offered 59 lots and had a sell-through rate of 88% and a total take of $137M (the biggest return for any sale the firm has had). Sotheby’s offered 54 works for a 90.7% sell-through rate and a total take of $222.5M and Christie’s offered 75 works with a sell-through rate of 93% and a total take of $272.8M. Together, the three evening sales offered 188 works, sold 171 (a sell-through rate of 91%) and had a total take of $632.4M … that works out to an average of $3.7M per lot.

The Day Sales had a bit more trouble, but they still added tens of millions of dollars to the totals. Phillips tacked on another $6M from 224 sold works (a sell-through rate of just 63.8%); Sotheby’s sale garnered another $48.8M from 275 sold works (79.9% sell-through rate); and Christie’s added $67.7M from 392 sold works.

Now for the week’s total --- $755M! Not bad. And for information’s sake, in 2009 the total take was $296.46M; in 2008 it was $312.97M and in 2007 it was $890M … so they are almost back to the nose-bleed levels.

I am sure many of you are wondering where all of this money is coming from … well, most of us are wondering that as well. I would like to say that a majority of it is foreign, but many of the after-sale reports noted that a large percentage of the buyers were from the United States. It will be interesting to see where we go from here … in other words, how high is up!? Right now it is over $1.3 Billion for the two weeks and climbing.

Howard L. Rehs

© Rehs Galleries, Inc., New York –December 2010

Gallery Updates: As you may have noticed this month we added some very nice graphs to our newsletter. These came courtesy of my son, who graduated from college with a degree in finance. Right now his is working in the gallery … until he finds his calling (or goes back to school)!

Web Site Updates: Works by the following artists have, or will be, added to our web site this month: Martin Rico y Ortega, Jan Monchablon, Thomas Luny, Louis Aston Knight, Edouard Cortès and Antoine Blanchard.

Next Month: More art market coverage.