COMMENTS ON THE ART MARKET

Happy Holidays

We wish everyone celebrating this weekend a Happy Hanukkah, and for those celebrating Christmas and Kwanzaa later this month, a festive holiday. And let’s not forget all those small national holidays in between: National Bartender Day, National Cookie Day, National Monkey Day, and National Call a Friend Day!

____________________

Gallery News

New Landing Page

Some of you may have noticed a recent change to our website - an updated landing page --- it has been a long time coming. The new page offers easy access to both the historical and contemporary sides of our site, blog posts, information on the catalogue raisonnés, our Bookstore, and all current contact information.

December Hours

For the month of December, the gallery will be open Tuesday – Friday from 10 am – 5:30 pm, and all other times by appointment. Please note that the gallery will be closed on December 24th & 31st. And do not forget, we are always available by email and telephone ... so feel free to contact us if you have any questions.

Emilio Sánchez Perrier – L’Epte à Gisors

By: Howard

Rehs Galleries is pleased to have had the opportunity to acquire L’Epte à Gisors, an outstanding painting by one of the finest 19th-century Spanish landscape artists, Emilio Sánchez Perrier .

Rehs Galleries is pleased to have had the opportunity to acquire L’Epte à Gisors, an outstanding painting by one of the finest 19th-century Spanish landscape artists, Emilio Sánchez Perrier .

Emilio Sánchez Perrier was born in Seville, Spain, on October 15, 1855. His family realized his artistic talent at a young age, and by 1868, he was attending the Real Academia de Bellas Artes de Santa Isabel de Hungría. He then continued his training at the Real Academia de Bellas Artes in Madrid, where he studied with Carlos de Haes, a Spanish-Belgian landscape artist. Haes introduced Sánchez Perrier to contemporary plein air landscape painting and afforded him the opportunity to visit various European art centers.

Sánchez Perrier began his career in 1877 when he submitted work to the regional art exhibitions in Seville and Cadiz. The following year, he made his debut at the national exhibition in Madrid with six paintings. Then in 1879, he won a gold medal at the Cadiz regional exhibition.

Seeing local success, he moved to Paris and began working in the studio of the Barbizon painter Auguste Boulard (1825-1897). Sánchez Perrier also studied with Jean-Léon Gérôme (1824-1904) and Félix Ziem (1821-1911); two painters with very different styles. The former known for French academic tradition and the latter for his naturalist/impressionist approach. It was in 1880 that Sánchez Perrier made his debut at the Paris Salon with three works.

By the mid-1880s, with a well-established reputation, Sánchez Perrier’s works were being sold by Chaine & Simonson, Goupil, and Knoedler. L’Epte à Gisors, one of the artist’s more complex works, was initially sold by Knoedler in 1895 to a collector named Jackson. The painting appears to have remained in private hands for most of its life, finally reappearing on the market in 2021.

____________________

In The News

Eleinne Basa’s Solo Exhibit ‘LuminoCity’ Now On View!

Known for her intimate cityscapes, artist Eleinne Basa seeks to explore her environment through an investigation of light. While each piece featured in ‘LuminoCity’ is set within a city (most in New York City), the subjects are not simply buildings and streets… more so, it seems the subjects are brake lights and street lamps; radiating light.

Known for her intimate cityscapes, artist Eleinne Basa seeks to explore her environment through an investigation of light. While each piece featured in ‘LuminoCity’ is set within a city (most in New York City), the subjects are not simply buildings and streets… more so, it seems the subjects are brake lights and street lamps; radiating light.

In this Forbes feature by Natasha Gural, several of the paintings in ‘LuminoCity’ are examined and analyzed. In addition, it provides insight into Basa’s painting process as well as inspiration for creating the work she does.

____________________

Stocks & Crypto

By: Lance

As we move into the final month of the year - a strong month for the stock market, historically – one must wonder if it’ll be just your average December. Typically, November and December provide some of the greatest returns… but this year, the Dow Jones dropped precipitously through November. We saw an all-time high on the 8th at 36,565.73, before it retreated more than 2,000 points to close out the month at 34,430.53; that’s nearly a 4% drop from last month’s close and almost 6% off the high mark –more volatility than we’d like to see for this time of year. That said, the NASDAQ Composite and the S&P 500 were far less dramatic… the NASDAQ climbed a bit, up about 0.25% for the month, while the S&P dropped 0.8%. So, what is going on?? Well, things were going pretty well until the final week of the month… that’s when news broke of the newly discovered Omicron variant of Covid. A moderate sell-off is expected with this kind of negative news, but to make matters worse, the Fed announced they would slow their purchasing of government bonds sooner than expected - that move further exacerbated a steep sell-off at the end of the month.

Looking at currencies… the Pound and Euro continued the trend of weakening relative to the dollar, now sitting at $1.33 and $1.129, respectively. Gold saw a nice bump through the middle of the month, climbing more than 5%, but pulled back as November came to a close – it effectively settled where the month started, down 1%. But the real mover was crude… the negative news hit while it was sitting at lofty levels, and it dropped sharply – when the market opened after Thanksgiving weekend, crude had fallen more than 16% in just a few days, resulting in a 21% decline for the month.

In the crypto arena, it is getting all too common to see huge swings in values – the past month is a prime example. Bitcoin started off just north of $60K… 10 days later, it was pressing $70K… then two weeks later, it was down to $53K – I honestly can’t keep up. Ethereum followed in suit but experienced a miraculous recovery, whereas Bitcoin is down for the month… Ethereum is back to pushing record highs after briefly dipping below $4K – it now sits at $4.5K. Litecoin performed similarly to Bitcoin, jumping 50% and topping $300 before falling off a cliff… it dipped under $200 after Thanksgiving and is now trading at $207.

And as always, some personal favorites courtesy of my blindfold and dartboard… Airbnb (ABNB – month +1%); American Well Corporation (AMWL – month -28%); Aurora Cannabis Inc. (ACB – month -3%); Beyond Meat, Inc. (BYND – month -29%); Blink Charging Co. (BLNK – month +21%); Churchill Capital Corp IV (CCIV is now trading as Lucid Group LCID +43%); Canopy Growth Corp. (CGC – month -15%); Cronos Group Inc. (CRON – month -13%); FuelCell (FCEL – month +9%); Fisker Inc. (FSR – month +33%); Microvision (MVIS – month -7%); Nikola Corp (NKLA – month -13%); QuantumScape Corp (QS – month -0.3%); Under Armor, Inc. (UAA – month 7%); and Zomedica Corp. (ZOM –month -22%). More losers than winners… need to work on my aim

____________________

The Dark Side

By: Alyssa & Lance

Update: Inigo Philbrick And His Day In Court

Since 2019 we have covered the unraveling fraud scheme of disgraced art dealer Inigo Philbrick. Philbrick, who has defrauded art collectors, investors, and institutions of $86M, pleaded guilty in Manhattan court on one count of wire fraud. During the hearing, he admitted knowing what he was doing was “wrong and illegal,” but greed got the best of him when trying to finance his business. The judge has ordered Inigo Philbrick to restitute over $86M and give up his stake in 2 undisclosed paintings by Christopher Wool and Wade Guyton. The sentencing will take place in March; he could be facing up to 20 years in prison. We will update you in a few months with the verdict.

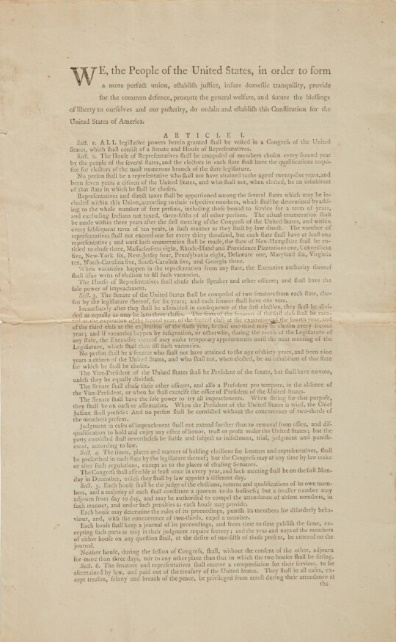

The Crypto-Constitution-Catastrophe

Crypto-mania is still going strong and the jealousy-inducing headlines keep coming… but as evidence that many of us still have no idea how it all works, I present the following mess (I’ll preface this with – there are a lot of strange terms, so I hope I don’t lose you):

Crypto-mania is still going strong and the jealousy-inducing headlines keep coming… but as evidence that many of us still have no idea how it all works, I present the following mess (I’ll preface this with – there are a lot of strange terms, so I hope I don’t lose you):

Last week, a group of “investors” pooled their resources… I used quotes as the term investor is being used loosely in this case. In the crypto world, there is something called a DAO or Decentralized Autonomous Organization – essentially they are like social clubs online, and in some cases each member contributes money to make a purchase collectively.

In this instance, the ConstitutionDAO (I haven’t been able to find how many members there are) set out to raise money to buy a copy of the Constitution that was up for sale at Sotheby’s. In a shockingly short amount of time, the ConstitutionDAO had 11,000 Eth contributed towards the effort – approximately $45 million!

From the beginning, it was made clear that those who contributed would not earn a fractional ownership, but would be given tokens which allowed the group to vote on what would happen with the copy of the Constitution after it was purchased – the tokens were called $PEOPLE, and each Eth donated would be compensated with 1 million $PEOPLE (Trust me, I know it’s getting weird and it gets worse).

Now fast forward to the auction… $45 million should have been enough to secure the auction win, until it wasn’t. That’s when the madness began to unfold… one issue which was seemingly not considered: is in the event they were unsuccessful, how would funds be returned? Well, a real world crypto lesson is that there are something called “gas fees” and when you interact with the blockchain, you are charged those fees… and if you made a small donation, the fees to return the money may be more than the original donation. Simply put, it was more expensive to get your money back than to take the loss… remember, we’re talking a collective $45 million.

To make matters worse, the group never formally structured the voting system for the $PEOPLE tokens they distributed, and after they lost the auction it was announced that the group leaders were developing a new token. So, each person who contributed was left with some amount of a worthless digital currency. As you could imagine, a lot of people were angry… and in response, the group scrapped the new token and reverted back to the original plan of returning funds. So to be clear, the $PEOPLE token went from a volatile speculation, to totally worthless, then back to possibly valuable within 24-hours.

The part that makes it all the more ridiculous is a DAO is supposed to be completely democratic and transparent, but without a voting system in place it continues to be governed by a small anonymous group… which brings me back to my original question of – does anyone know how any of this works?

In case you are wondering, the winning bidder was Citadel’s Kenneth Griffin. He will be loaning it to Crystal Bridges Museum of American Art in Bentonville, Ark.

____________________

Really?

By: Amy

Al Capone’s Prized Possessions At Auction

Alfonse (Al) Capone was one of the most notorious American gangsters of the 20th century. Also known as Scarface, Capone was the inspiration for many books and movies based on his time with The Chicago Outfit, an organized crime syndicate in Chicago… Capone was the boss from 1925-1931. Many of his prized possessions just crossed the auction block.

Alfonse (Al) Capone was one of the most notorious American gangsters of the 20th century. Also known as Scarface, Capone was the inspiration for many books and movies based on his time with The Chicago Outfit, an organized crime syndicate in Chicago… Capone was the boss from 1925-1931. Many of his prized possessions just crossed the auction block.

While the government was unable to prosecute him for most of his crimes, Al Capone was finally indicted and convicted for tax evasion in 1931 – he was sentenced to 11 years in prison. While in prison he was diagnosed with syphilis, which had gone untreated for years. By 1939, Capone’s medical condition had significantly deteriorated, and he was given an early release from prison for medical treatment.

Eventually, Capone and his wife, Mae, retired to Florida where he lived out his remaining years. Many of his most prized belongings were passed down to their son, Sonny, who in turn left them to his four daughters.

As Capone’s granddaughters are advancing in age (and one has passed), they decided it was time to auction off some of the heirlooms so they could share their stories of their grandfather. In total, 174 lots were offered, including personal photographs, letters, firearms, jewelry, and furniture. Among the collection were 16 guns, two of which blew away their estimates and had the highest prices in the sale.

Capone’s Colt Model 1911 semi-automatic pistol took the top spot… estimated to make $100-150K, it sold for $860K ($1.04 million w/p); this is believed to be the highest auction price paid for a 20th century handgun. His Colt Model 1908, a hammerless semi-automatic pistol, was estimated at $30-40K; it hammered down at $200K ($242K w/p). Rounding out the top three lots was Capone’s platinum and diamond Patek Philippe pocket watch. It was not working, missing parts, and rusting in areas, but it still had a solid estimate of $25-50K… when it was time for the watch to hit the block, it struck a final price of $190K ($229.9K w/p).

With over one thousand registered bidders for this sale, it is not surprising how well it did. When the sale as a whole was tallied, buyers spent just over $3.1M; not bad for some old family treasures of America’s Public Enemy No. 1!

Marie Antoinette’s Diamond Bracelets

Marie Antoinette (1755 – 1793) was the last Queen of France and became famous for her lavish lifestyle and eventual beheading. Born in Austria, Marie was the 15th child of the Holy Roman Emperor Francis I and Empress Marie Thérèse. At 14, Marie married the future King of France, Louis XVI; the union secured diplomatic relations between Austria and France. The couple had four children, only one, Marie Thérèse, would survive to adulthood.

Marie Antoinette (1755 – 1793) was the last Queen of France and became famous for her lavish lifestyle and eventual beheading. Born in Austria, Marie was the 15th child of the Holy Roman Emperor Francis I and Empress Marie Thérèse. At 14, Marie married the future King of France, Louis XVI; the union secured diplomatic relations between Austria and France. The couple had four children, only one, Marie Thérèse, would survive to adulthood.

Marie was very popular in France, but rumors spread of her extravagance and the public became disenchanted with her. The French Revolution broke out in October 1789 and soon after, the family was placed under house arrest.

In 1791, Marie Antoinette, fearful that her finest jewels would be taken from her, packed them in a wooden chest to be sent out of France. She gave the chest to Count Mercy-Argenteau, the former Ambassador to Austria. He had a friend store them in Brussels, hopeful that Marie would retrieve her possessions one day.

On January 21, 1793, Louis XVI was executed for high treason. Marie’s trial began on October 14, and two days later, she was found guilty of numerous crimes and publicly guillotined; she was just 37.

Several months after her death, the Holy Roman Emperor Francis II ordered the chest opened and found it filled with Marie Antoinette’s valuable processions. All the contents were sent to Austria and held for Marie’s only heir, Marie Thérèse. Two of her diamond bracelets were among the contents, each containing three strands of diamonds with an approximate weight of 140 – 150 carats.

For over 200 years, the bracelets remained in Marie Thérèse family’s possession. According to historians, she spent 250,000 livres on the bracelets, which would be close to $4.6M today. The bracelets were just auctioned in Switzerland and received what I thought was a modest estimate of $2-4M. The hammer came down at $6.8M ($8.2M w/p). It’s a solid price, but I think Marie would lose her head over their modest appreciation during the past two centuries!

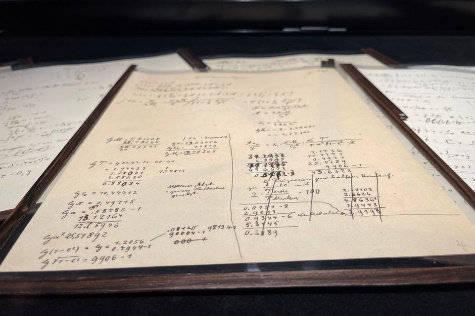

The Papers That Led To The Theory Of Relativity

A few weeks ago, while at Christie’s, I was fortunate to see a bunch of old, yellowed, and worn papers. They were lying in a glass case with a ton of scribbled mathematical formulas on them when. It turns out they were the early calculations done by Albert Einstein and Michele Besso that led to the theory of relativity. All I could say to myself was, “how do any of these equations mean anything, and who could understand them?”

A few weeks ago, while at Christie’s, I was fortunate to see a bunch of old, yellowed, and worn papers. They were lying in a glass case with a ton of scribbled mathematical formulas on them when. It turns out they were the early calculations done by Albert Einstein and Michele Besso that led to the theory of relativity. All I could say to myself was, “how do any of these equations mean anything, and who could understand them?”

Both scientists contributed to writing out the formulas. Twenty-six pages are in Einstein’s handwriting, twenty-four in Besso’s, and three collaborated. Besso wisely and carefully preserved the papers until he died in 1955. According to the provenance, they were offered at Christie’s twice before. In 1996 they sold for $398,500 (est. $250-350K) and again in 2002 for $560K

.

It appears that the current owner decided this was the right time to put the theory of relativity papers back on the market. Hey, with the prices people are paying for things today, why not. Christie’s, Paris, estimated them at $2.4 -3.5M, which would have been a nice profit. But at least two people thought that the most important scientific documents of the 20th century were worth a lot more. This time around, they sold for $13.17M to Hong Kong’s property tycoon, Li Ka-shing! Guess Christie’s calculations were a little off.

____________________

The Art Market

By: Howard & Lance

November came and went, but in the art market it was a very long month. Sale after sale took place, some happening on top of one another. In fact, there were so many sales that we could not keep up with all of them. Reports surfaced that more than $2 billion worth of art sold just in the New York sale – amazing! This month, we chose 4 of them to dive into.

Sotheby’s Sale Of Mid-Level European Paintings

By: Howard

Towards the end of October, Sotheby’s offered their selection of lower to mid-level 19th and 20th century European paintings. As with the competition, the pickings were rather slim.

The top seller here was a fresh-to-the-market Jean Beraud titled Le Buggy. The painting was purchased from a gallery in 1966 and has since remained in the same family’s collection. I felt the estimate ($80-120K) was a little robust for this particular subject, and I guess the market agreed as it hammered at $70K ($88.2K w/p). Then  there was a tie for second place; Petrus van Schendel’s Fish Market at the Sint-Jacobskerk (est. $30-50K) and Montage Dawson’s Wings of Evening (est. 50-70K), each made $55K ($69.3K w/p). Rounding out the top five were Alexandre Cabanel’s Portrait des deux soeurs at $40K ($50.4K w/p – est. $50-70K) and Philip Alexius de László’s Mrs. William Burden, A. M. (née Margaret Livingston Partridge), which made $38K ($47.88K w/p – est. $40-60K).

there was a tie for second place; Petrus van Schendel’s Fish Market at the Sint-Jacobskerk (est. $30-50K) and Montage Dawson’s Wings of Evening (est. 50-70K), each made $55K ($69.3K w/p). Rounding out the top five were Alexandre Cabanel’s Portrait des deux soeurs at $40K ($50.4K w/p – est. $50-70K) and Philip Alexius de László’s Mrs. William Burden, A. M. (née Margaret Livingston Partridge), which made $38K ($47.88K w/p – est. $40-60K).

There were several paintings that performed well; these included Cesar Pattein’s The Young Artists at $26K ($32.8K w/p – est. $10-15K), Antonio Casanova y Estorach’s Amusing Gossip that made $10K ($12.6K w/p – est. $3-5K), and Antoine-Louis Barye’s Eagle which brought $5K ($6.3K w/p – est. $1-1.5K). On the other side, many did not perform well (and I am not just talking about the unsold works). Two of several works that sold well below their estimate were Diaz de la Pena’s The Fortune Teller, which made just $600 ($756 – est. $3-5K); and Ottenfeld’s Desert Rider and his Faithful Companion, that brought $1.2K ($1.5K w/p – est. $6-8K). Then we had plenty that BI’ed (short for ‘bought in’, or unsold), including paintings by Grolleron (est. $25-35K), Meissonier ($25-35K), Carlsen ($30-40K), and Beda ($30-50K).

When the sale ended, of the 126 lots offered, 82 sold (65.08%), and the total take was $951K ($1.2M w/p). Their presale estimate range was $1.58 – $2.48M, so they fell well short, even when the buyer’s premium is added in. Of the 82 sold lots, 44 were below, 25 within, and 13 above their estimate ranges, leaving them with an accuracy rate of 19.8%.

Again, this was not their main 19th-century sale; those normally happen in January. However, it does show how difficult it is for the main room in New York to source quality material in the 19th-century European painting arena.

The Macklowe Collection’s Results

By: Howard

The buying frenzy keeps going and going. On November 15, Sotheby’s presented The Macklowe Collection, a sale of 35 Modern and Contemporary works of art. Before we get started, please note that all the lots in this sale were guaranteed, and 22 had irrevocable bids. In other words, its success was a fait accompli

The buying frenzy keeps going and going. On November 15, Sotheby’s presented The Macklowe Collection, a sale of 35 Modern and Contemporary works of art. Before we get started, please note that all the lots in this sale were guaranteed, and 22 had irrevocable bids. In other words, its success was a fait accompli

The top seller was Mark Rothko’s No. 7 at $77.5M. The lot took about 8 minutes to sell, and once the hammer fell, the auctioneer announced that it was a new auction record for the artist. With the premium, the price was to be $89.3M… but when their website displayed a final price moments later, it was almost $7M less – $82.47M. Now you may wonder how that could happen? Maybe a computer glitch? Well, that lower price would indicate that the buyer was the guarantor. If the guarantor does not buy the work, they receive a percentage of the selling price above their guarantee. However, they receive a credit/discount if they continue bidding and ultimately purchase the piece. To me, this seems a bit unfair to the other bidders. Long story short – it was no longer an auction record with the reduced commission.

Albert Giacometti’s bronze, steel, and iron sculpture Le Nez came in second. The work was estimated to bring $70-90M and hammered at ‘just’ $68M ($78.4M w/p), so there wasn’t much serious action. The buyer was Justin Sun, the 31-year-old founder of the cryptocurrency platform TRON. In case you did not know, a few months ago, Sun was the underbidder on the Beeple NFT that made $69M. Guess those early crypto investors need to convert some of it into hard assets.

Jackson Pollock’s Number 17, 1951, took third when it sold for an impressive $53M ($61.2M w/p) after an almost 10-minute bidding battle — its estimate was $25-35M. While this is an auction record for the artist, over the years, reports have emerged of other works by the artist selling over $150M privately.

Rounding out the top five from the Macklowe Collection were Cy Twombly’s Untitled (a very large work consisting of 6 parts, measuring 217 inches in length). The painting carried a $40-60M estimate and sold for $51M (58.9M w/p). And then there was Andy Warhol’s Nine Marilyns… when the work appeared on the block (lot 19), it brought just $42M ($48.5M w/p – est. $40-60M). Well, when they got to lot 30, the auctioneer announced that the Warhol would be reoffered. This time it sold for $41M ($47.4M), and it took a mere 30 seconds to close. Of course, they did not explain the reason for the reoffering, but while I was watching the actual sale, I kept up with the Twitter posts people were making. One art critic in the room Tweeted that the agent who originally bought the painting for $42M was now sitting on her hands, so one of two things happened. Either she mistakenly bid on the work… or the individual she was bidding for was also on the phone with one of the auction representatives. If it were the latter, the two were bidding against each other while representing the same buyer. Either scenario is not a good one. When this crap happens, it should be mandatory for the auction room to explain the situation.

Several additional lots performed well. These included Agnes Martin’s Untitled #44 ($15.2M/$17.7M w/p – est. $6-8M), Philip Guston’s Strong Light ($21M/$24.9M w/p – est. $8-12M), and Warhol’s Sixteen Jackies ($29.3M/$33.9M w/p – est. $15-20M).

While a few other lots did not hit their target, in the end, everything sold… but remember, everything was guaranteed, so we expected this result. The presale estimate was $440-619M, and the total achieved was $588M ($676M w/p). Of the 35 works, 4 sold below, 14 within, and 17 above their estimate ranges, giving them an accuracy rate of 40%, one of the highest we have seen. I am sure that the Macklowes, now divorced and in attendance for the sale, were pleased with the results.

If you are interested in reading a bit more about the Macklowe mess, check out this article in Curbed – Everything We Know About the Immense, Messy Macklowe Art Auction.

Weekend At Christie’s = The Edwin Cox Collection

By: Nathan

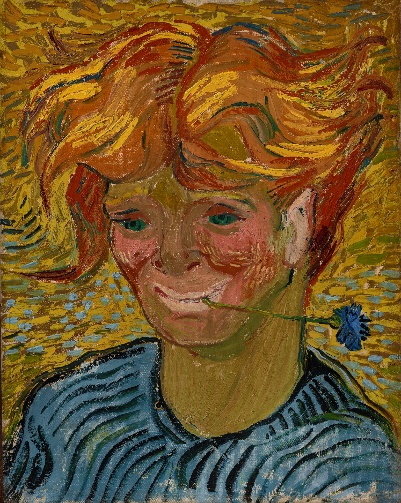

Witnessing the events of Thursday November 11th at Christie’s New York was electrifying, to put it lightly. The 23-painting collection of the late Texas oil baron Edwin Cox, which included works by Van Gogh, Monet & Caillebotte, brought in $286 million ($332 million w/p), surpassing Christie’s presale estimate range of $178.6 to $267.6 million. Interestingly enough, the Edwin Cox collection is the most recent example of artists’ name recognition alone attracting big spenders to the auction houses.

Van Gogh’s Jeune homme au bleuet, or Young Man with a Cornflower, or, as I like to call it, Young Man in the Style of a Raggedy Anne Doll, is so jarring and unusual that it must’ve been Van Gogh’s name alone that caused it to sell for $40.5 million ($46.7 million w/p, est. $5 to $7 million). Of course, the fact that it was one of Van Gogh’s last works before his suicide in 1890 might add something to its value, but not exactly in the tens of millions. Frankly, Young Man with a Cornflower reaching such a ludicrous price is rather insulting to Van Gogh, whose catalogue raisonné is stocked with beautiful examples of portraiture, like those of the Roulin family, of Dr. Paul Gachet, or even his innumerable self-portraits executed throughout his life.

Van Gogh’s Jeune homme au bleuet, or Young Man with a Cornflower, or, as I like to call it, Young Man in the Style of a Raggedy Anne Doll, is so jarring and unusual that it must’ve been Van Gogh’s name alone that caused it to sell for $40.5 million ($46.7 million w/p, est. $5 to $7 million). Of course, the fact that it was one of Van Gogh’s last works before his suicide in 1890 might add something to its value, but not exactly in the tens of millions. Frankly, Young Man with a Cornflower reaching such a ludicrous price is rather insulting to Van Gogh, whose catalogue raisonné is stocked with beautiful examples of portraiture, like those of the Roulin family, of Dr. Paul Gachet, or even his innumerable self-portraits executed throughout his life.

But while the offputting nature of the Van Gogh is detectable even through a computer screen, one of the other main attractions of sale had a secret that was a little more difficult to detect. Practically the centerpiece of the entire auction was Gustave Caillebotte’s Jeune homme à sa fenêtre, or Young Man at His Window. It is a striking and beautiful example of French realism, like many of Caillebotte’s works. Fortunately, Christie’s allows the public to view works about to go to auction, letting potential buyers examine the works up close. It’s good that auction houses like Christie’s keep this policy, since it would’ve allowed any interested parties the opportunity to spot the one major problem with the Caillebotte. Blacklight and extensive tests were not necessary; just the lights Christie’s set up in the galleries. If you got within ten feet of the Caillebotte, it became apparent that the work had been damaged. It appeared that the canvas had been slashed horizontally several times, then subsequently repaired and in-painted. And yet, despite the sloppy repair job, the painting was bought by the Getty Museum in Los Angeles for $46 million ($53 million w/p – est. in the region of $50 million).

There was also Claude Monet’s Nymphéas (fragment) which was a gift to Edwin Cox from Daniel Wildenstein in 1982 … I guess he spent enough money to warrant that! This rather unimpressive work with a stamped signature was expected to make anywhere between $700,000 and $1 million, yet sold for $5.2 million ($6.2 million w/p).

But the sale of the Edwin Cox collection wasn’t all about mistakes. It was a very good day for Gustave Loiseau, one of Impressionism’s most underrated stars. The two Loiseau paintings offered were definitely undervalued, with the $150,000 to $200,000 range being more appropriate than the under $50,000 range that Christie’s specialists had put down. However, I don’t think anyone expected them to exceed their estimates as exponentially as they did. Rocher la Teignouse, Cap Fréhel made $520,000 ($650,000 w/p – est. $30,000 to $50,000) and L’hôtel de Mademoiselle Ernestine, Saint-Jouin (Finistère) reached $620,000 ($774,000 w/p – est. $20,000 to $30,000).

It was a long sale, well over an hour for the 23 lots, all of which sold. While that’s certainly a good thing, it was also an expected result since Christie’s had a financial interest in all the works, and many were guaranteed by a third party. Can you really call that an auction when works are basically presold?

The Impressionist and Modern Art Day Sale, taking place on the Saturday after the Cox sale, also saw Loiseau’s continuing popularity. One of the two works tripled its $50,000 high estimate. The rest of the sale was nearly just as exciting, with a Renoir flower vase still life reaching nearly double the high estimate of $800,000, with a hammer price of $1.5 million ($1.83 million w/p). The Renoir was topped only by Joan Miró, whose Le serpent glisse vers l’azur parsemé de flèches brought in $2.3 million ($2.79 million w/p – est. $1 to $1.5 million). Many other works went far beyond their estimates, sometimes inexplicably. A painting of a goat by Henri Martin went for nearly six times its estimate; a Henri Lebasque landscape also hit a triple; and a Suzanne Valadon nude got $380,000 ($475,000 w/p), more than five times what experts predicted.

Other than the multimillion-dollar price tags, an unexpected highlight for anyone watching was a series of bidding wars in the middle of the sale. Two bidders, one on the phone, the other online, viciously fought over the three Max Ernst sculptures available. All were estimated to sell in the area of $30,000, so it came as a surprise when one bid after another drove the price for Masque aux yeux ronds up to $160,000 ($200,000 w/p). The fact that there were two parties with a particular interest in the Ernst sculptures only became apparent when La femme demi-tête, Ernst’s collaboration with Leonora Carrington, very quickly shot up to $90,000 ($112,500 w/p). Therefore, a bidding war over Ernst’s Sirène ailée was sort of expected, with presumably the same two bidders going back and forth until one of them eventually snagged it for $150,000 ($187,500 w/p), over four times what was predicted.

The day sale was a pretty nice follow-up to the Cox collection, bringing in nearly $30 million and some interesting stories to go along with it.

Christie’s American Art Sale

By: Amy

As Christie’s New York auction extravaganza comes to a close, the last to cross the auction block was their 20th Century American Art sale, and I would say it went out in style.

As Christie’s New York auction extravaganza comes to a close, the last to cross the auction block was their 20th Century American Art sale, and I would say it went out in style.

Taking the top spot in the American Art sale was Sunset by Arthur Dove (considered the first American abstract artist); it sold for more than double the high estimate when it hammered down at $6.5M ($7.8M w/p – est. $2 -3M). In second place was Thomas Hart Benton’s Keith Farm, Chilmark that made $4M ($4.83Mamerican w/p), doubling the low estimate of $2-3M. And rounding out the top three was a work by Paul Cadmus titled Lloyd and Barbara Wescott; the estimate of $300- 500K was left in the dust as the painting fetched $2M ($2.43M w/p)!

A few additional lots performed well… George Copeland Ault’s The Plough and the Moon, which was estimated to make $120 -180K and sold for $550K ($688K w/p). Jacob Lawrence had a strong result for his Builders – 19 Men; estimated to make $100 -150K, it hammered down at $520K ($650K w/p). And two paintings by Wolf Kahn far exceeded their estimates; each was expected to bring $25-35K. Atlantic Highlands sold for $170K ($212K w/p) and Looking Up-River garnered $150K ($187.5K w/p).

There were 78 works offered in the American Art sale, of which 66 sold and 12 were bought-in, for a sell-through rate of 84.6%. The accuracy rate of the estimates was a dismal 16.6%; of the works that sold, 20 fell below, 13 were within, and 33 pieces sold for more than the estimate. In the end, the results were strong as the pre-sale estimate range was $17.2 – 25.8M, and when the final hammer fell, the sale generated $23.6M ($28.9M w/p); a successful sale!

____________________

Deeper Thoughts

By: Nathan

Art Crime In A Time Of Covid

By: Nathan

The pandemic has been an interesting period to study. With nearly everyone abiding by the prescribed public health measures for nearly two years, not only have our lives clearly changed, but the processes that govern our lives have changed as well; the way we work, the way we shop, the way we educate our children, even the way we commit crimes. While crime as a whole has decreased, an Interpol report from last month revealed that many forms of crime related to art and cultural property have skyrocketed. Across 72 countries in 2020 alone, the amount of contraband art seized by law enforcement nearly doubled in the Americas and increased by about 23% in Europe. Though the increase in Europe was nowhere near as large as in the Americas, about two-thirds of the over 800,000 objects seized from traffickers and smugglers were confiscated in Europe, which only goes to show how much stolen art is sent to Europe in a relatively normal year.

Looting and illegal excavations have also increased. While digs in Africa increased by 32% last year, similar digs in the Americas rose by 187%. But that is nothing compared to the increase in looting in Asia and the Pacific, which increased thirty-eight times from the previous year. Since nearly all museums were closed for much of 2020, it is not surprising that museum crimes have plummeted. The only notable exceptions to this overall trend were the theft of a Van Gogh painting from a museum in the Dutch town of Laren, and the theft of three pieces from a gallery in Oxford, UK, both in March of last year. But just because crime in museums was down doesn’t mean all went well for those institutions. Because of the closures, nonprofit arts organizations have seen 40% decreases in overall income, or about $5 billion in losses.

Looting and illegal excavations have also increased. While digs in Africa increased by 32% last year, similar digs in the Americas rose by 187%. But that is nothing compared to the increase in looting in Asia and the Pacific, which increased thirty-eight times from the previous year. Since nearly all museums were closed for much of 2020, it is not surprising that museum crimes have plummeted. The only notable exceptions to this overall trend were the theft of a Van Gogh painting from a museum in the Dutch town of Laren, and the theft of three pieces from a gallery in Oxford, UK, both in March of last year. But just because crime in museums was down doesn’t mean all went well for those institutions. Because of the closures, nonprofit arts organizations have seen 40% decreases in overall income, or about $5 billion in losses.

It seems that international law enforcement has banded together to adapt to the changing trends in art-related crimes. For example, the European Union Agency for Law Enforcement Cooperation (Europol) and the World Customs Organization carried out joint operations that targeted cartels of art traffickers operating in 103 countries. So far, these collaborative undertakings have recovered over 19,000 objects. But nowadays, some forgers and smugglers operate in a strangely open and public way to the point that it becomes indistinguishable from a comedy sketch. Over the past year or two, the Antiquities Trafficking and Heritage Anthropology Research Project (ATHAR) has reported that one of the main ways groups engaged in looting and smuggling keep in contact is through, of all things, Facebook groups. ATHAR’s Twitter account has posted screenshots of particular Facebook groups, with members numbering in the hundreds of thousands, where smugglers and looters share pictures and videos of looted items. It’s absolutely inconceivable that some smuggling operations are difficult to prevent when the masterminds behind them use the same communications techniques as suburban housewives involved in MLMs.

The pandemic has also seen its fair share of forgery stories. Over the summer, Angel Pereda was arrested for wire fraud relating to several forged works that he claimed were by Jean-Michel Basquiat and Keith Haring. He now faces up to twenty years in prison for trying to sell these forged works at auction houses in New York. The Haring fakes, one painting, and one vase, were uncovered thanks to evaluations done by the Keith Haring Foundation. Regarding the fake Basquiat painting, experts were tipped off about the dubious origins of the work because of questionable provenance documents. If the Basquiat were authentic, it would hypothetically be worth around $6 million.

Francis Bacon has also been getting some attention, with accusations of forgery aimed at multiple, unconnected people. This year, Bacon’s estate published a book of his studies, in which his friend Barry Joule is accused of passing off his own sketches as those of Bacon. Because of this claim, the works Joule provided to the Tate in London have been taken down, much to Joule’s chagrin. At the same time, in an unconnected incident, nearly 500 Francis Bacon forgeries were confiscated by Italian authorities in September. Had the works been genuine, this collection would have been worth €3 million. An investigation uncovered a conspiracy consisting of five people who intended to provide false authentications for the works and then sell them. The apparent mastermind behind the scheme, a man from Bologna, had previously been investigated for trying to sell forged Picasso works. Other 20th century artists, including Raymond Pettibon, Richard Hambleton, and Barkley Henricks, had their works forged and sold during the pandemic. Even Old Masters like Francisco de Goya and El Greco were not spared. However, we are not sure if instances of art forgery have legitimately increased, or if their coverage has simply become a more frequent subject for news sites.

This pandemic is one of those once-in-a-lifetime periods that radically changed certain aspects of our lives, much in the same way that Watergate or the First World War served as similar junctures. Law enforcement and the scholarly community may have to seriously reconsider how smuggling and forging are prevented and detected due to the new realities of the pandemic that we’ve all grown accustomed to.

The Other Boleyn Bird

Sometimes you don’t need a stained parchment map with a big, red X to find some treasure. Some treasures can be found in the most unexpected places, including when we’re unknowingly staring right at them. For example, just a few weeks ago, a British family discovered that their sphinx-style lawn statues are actual Egyptian artifacts. Earlier this week, a British antiques dealer made a similar find. In 2019, Paul Fitzsimmons of Marhamchurch Antiques bought a gilded wooden falcon for £75 ($101) at an auction. It was described in the catalogue as an “antique carved wooden bird,” and, though it was all in one piece, it was tarnished and almost completely black, likely caked with soot after being hung on a wall near a fireplace. Marhamchurch specializes in 15th to 17th century furniture and wood artifacts, so it seemed right up their alley.

Even at the time of the auction, there was something about this particular wooden bird that led Fitzsimmons to believe that there was more to it. Fitzsimmons had a hunch that the carved bird had some sort of royal connection because of the design: it is a falcon, with a crown and scepter, perched near a bed of red and white roses. Interestingly enough, this description matches that of the personal sigil used by Anne Boleyn, Queen of England and the second of Henry VIII’s six wives. Sure enough, after a good amount of research, Fitzsimmons can confidently say that this small, gilded bird carving belonged to the famous queen.

Even at the time of the auction, there was something about this particular wooden bird that led Fitzsimmons to believe that there was more to it. Fitzsimmons had a hunch that the carved bird had some sort of royal connection because of the design: it is a falcon, with a crown and scepter, perched near a bed of red and white roses. Interestingly enough, this description matches that of the personal sigil used by Anne Boleyn, Queen of England and the second of Henry VIII’s six wives. Sure enough, after a good amount of research, Fitzsimmons can confidently say that this small, gilded bird carving belonged to the famous queen.

Though purchased for only £75, Fitzsimmons estimates that the artifact is worth, conservatively, about £200,000. That estimate is on the conservative end because it does not take into consideration the fact that Anne Boleyn is the most well-known of Henry VIII’s wives. She has been one of the most visible figures from the Tudor era in terms of pop culture representation. She has been portrayed by the likes of Natalie Dormer, Vanessa Redgrave, Natalie Portman, Merle Oberon, and Claire Foy. More recently, though, Anne Boleyn can be seen on Broadway and the West End in the Tudor-themed rock musical Six.

Anne Boleyn’s presence in popular culture comes with a fair bit of irony, mainly because of the iconoclasm following her execution. Art relating to Anne Boleyn is very rare in Britain today because, according to Fitzsimmons, “Henry VIII did his utmost best to completely obliterate every trace of her. All her emblems were removed from the palace, and nothing survived.” Therefore the excellent condition of the piece only adds to its value, both historical and material.

Fitzsimmons has expressed his intent to loan the piece to Hampton Court Palace, which was one of Henry VIII’s residences. Historians like Tracy Borman, chief curator of Historic Royal Palaces, speculate that the carving was once kept in Anne Boleyn’s private chambers, making the piece’s return to one of her former residences all the more appropriate.

How Paintings Influence Movies

By: Nathan

Because of their seemingly serious subject matter, movies about art and artists can serve as a quick way for a director, an actor, or a screenwriter to garner some attention and a bit of critical acclaim. While they’re rarely ever nominated for best picture at the Academy Awards, artist biopics are often the sole sources of information about an artist that are accessible to many people. Films like Frida, Pollock, and Big Eyes cover modern and contemporary icons like Frida Kahlo, Jackson Pollock, and Margaret Keane, respectively. Some of the older masters have also gotten their time in the cinematic spotlight, from Michelangelo in The Agony and the Ecstasy, to J.M.W. Turner in Mr. Turner, to the medieval Russian icon painter Andrei Rublev in the monumental 1966 Soviet film that bears his name. Van Gogh has gotten particular attention recently, with two incredible movies, Loving Vincent and At Eternity’s Gate, released within a little over a year of each other. These films have had a remarkable effect on how society views these artists and their work.

Because of their seemingly serious subject matter, movies about art and artists can serve as a quick way for a director, an actor, or a screenwriter to garner some attention and a bit of critical acclaim. While they’re rarely ever nominated for best picture at the Academy Awards, artist biopics are often the sole sources of information about an artist that are accessible to many people. Films like Frida, Pollock, and Big Eyes cover modern and contemporary icons like Frida Kahlo, Jackson Pollock, and Margaret Keane, respectively. Some of the older masters have also gotten their time in the cinematic spotlight, from Michelangelo in The Agony and the Ecstasy, to J.M.W. Turner in Mr. Turner, to the medieval Russian icon painter Andrei Rublev in the monumental 1966 Soviet film that bears his name. Van Gogh has gotten particular attention recently, with two incredible movies, Loving Vincent and At Eternity’s Gate, released within a little over a year of each other. These films have had a remarkable effect on how society views these artists and their work.

But the life of an individual artist is not the only thing one can see on the screen. Often an artist can go unnamed, yet their work can shape the feel, cinematography, and even the entire design of a film. One of the most cited examples of this influence comes from a Stanley Kubrick cinematic masterpiece. In creating his 1975 film Barry Lyndon, chronicling the life of an Irish adventurer and his aristocratic aspirations, Kubrick used the catalogues raisonnés of many great eighteenth-century British artists to encapsulate the feel of the period. The design team used portraiture by Joshua Reynolds and Thomas Gainsborough to create period-appropriate costumes. When filming outdoors, Kubrick framed his shots in a manner reminiscent of John Constable’s landscapes. Furthermore, all the interior shots exclusively used natural light from windows and candles, giving many scenes a tenebrism similar to Joseph Wright of Derby’s paintings. But the single painter who had the most significant influence on the production was William Hogarth. Not only was Hogarth a respected painter, but he became one of Britain’s most prominent social critics through his art. He was mainly known for his series of paintings about moral decline. His series Marriage A-la-Mode shows an ill-fated marriage between a wealthy merchant’s daughter and an aristocrat’s son. The most recognizable installment in the series is the second painting entitled The Tête à Tête, popularly known as the Breakfast Scene. The wealthy newlyweds sit at their breakfast table, with the wife stretching and yawning, while the husband sits slouching in his chair with his legs lazily spread out in front of him. The various items strewn across the floor, plus a guest in the act of waking himself in the background, are indicative of the previous night’s revelry. The husband also has a noticeable blotch on his neck, likely from some venereal disease, while a sniffing dog draws attention to another woman’s knickers stuffed into his jacket pocket. Not only do the clothing and interior decoration appear to influence Barry Lyndon’s design, but the layout of the figures and the themes of financial irresponsibility and moral degradation are also apparent.

Barry Lyndon is far from the only film influenced in this way. It may be surprising to learn that nearly all the great movies set in the ancient world have been shaped by the work of a single nineteenth-century artist. The Dutch-born British painter Lawrence Alma-Tadema is known for his academic paintings showing life in ancient Egypt and Rome. He was a perfectionist, ensuring accuracy up to the most minor details. For his 1888 work The Roses of Heliogabalus, Alma-Tadema shows an actual banquet held by the Roman emperor Elagabalus in the third century CE. As a practical joke, the teenage emperor installed a false ceiling in his dining room, filling the space above it with literal tons of flowers. When the ceiling was removed, these flowers fell in such great heaps that some guests were smothered to death. Alma-Tadema not only tried to replicate the clothing and architecture typical of third-century Rome, but he scheduled regular deliveries of French roses over four months to have the right visual aides to complete the piece.

Barry Lyndon is far from the only film influenced in this way. It may be surprising to learn that nearly all the great movies set in the ancient world have been shaped by the work of a single nineteenth-century artist. The Dutch-born British painter Lawrence Alma-Tadema is known for his academic paintings showing life in ancient Egypt and Rome. He was a perfectionist, ensuring accuracy up to the most minor details. For his 1888 work The Roses of Heliogabalus, Alma-Tadema shows an actual banquet held by the Roman emperor Elagabalus in the third century CE. As a practical joke, the teenage emperor installed a false ceiling in his dining room, filling the space above it with literal tons of flowers. When the ceiling was removed, these flowers fell in such great heaps that some guests were smothered to death. Alma-Tadema not only tried to replicate the clothing and architecture typical of third-century Rome, but he scheduled regular deliveries of French roses over four months to have the right visual aides to complete the piece.

Alma-Tadema’s Egyptian works were also immensely popular, with The Finding of Moses being one of his most influential works. In the production of The Ten Commandments, Cecil B. DeMille told his set designers to study Alma-Tadema’s Egyptian works, particularly The Finding of Moses. Through works like A Pyrrhic Dance and Caracalla and Geta, Alma-Tadema was also extensively studied in the design of Ben Hur and Gladiator, both of which won the Academy Award for Best Picture. Consequently, many of the great movies set in the ancient world have been influenced in one way or another by Alma-Tadema’s work: from Oscar-nominated greats like Cleopatra and Spartacus, all the way to Monty Python’s Life of Brian.

But some paintings can be seen in relation to movies even before you walk into the theater. Movie posters have almost become artworks in their own right, and certain similarities can be observed across multiple posters and identified as clichés. One such poster cliché is the main character with their back turned looking out into empty space; from Star Trek Into Darkness to Captain America: Winter Soldier, and from Inception to Despicable Me 2. But this layout is nothing more than a repeated copy of Caspar David Friedrich’s romantic icon Wanderer Above the Sea of Fog. But whether it’s something as little as the poster hanging in a theater lobby, or something as all-encompassing as the film’s design, art has continually shaped the way our movies are made. So, who knows? Be prepared to see shots from an upcoming film resembling a David Hockney, or a new Disney protagonist that looks like a Takashi Murakami figure — just warning you.

The Rehs Family

© Rehs Galleries, Inc., New York – December 2021