COMMENTS ON THE ART MARKET

August Hours

As of now, our August hours will be Tuesday through Thursday from 10 am – 5 pm. If you do want to visit the gallery, please call to make an appointment since you never know if things will change. We are being very flexible these days.

We truly appreciate all the support and positive comments we have received and are looking forward to a time when things are back to normal. Until then, our website is open 24/7/365, and we are always available to answer any questions you may have … be safe and enjoy the rest of the summer.

____________________

Stocks

By: Howard & Lance

Another month under our belts, and the market seems to be traveling in its own dimension. I was very pleased to learn that Apple announced a 4 for 1 stock split. Reminds me of the days when GE would hit the $100 mark and then split (now, who knows if that stock will ever get out of the toilet). I, for one, have never understood the reason for a stock to go to $300, $500, $1000, or $3000 a share. I would believe that those numbers turn a lot of investors off ... especially those with small accounts. Hopefully, some of the other highflyers will rethink their strategy. And while I am at it, what about Kodak? In the span of four days, it went from about $2 to $60, and now it is at $22. Something smells a little fishy. Sadly, I did not see that one coming, so I missed out. Hopefully one or two of you got in at a low point, and out near the high.

You may remember that last month was a downer; well, this month, things seem to have reversed course. The DOW opened the month at 25,879 and closed at 26,428 – a 550-point gain. The cryptocurrencies were on fire - Bitcoin closed at $11,358.47 (up $1892.62); Litecoin finished at $58.16 (up $11.95); Ripple ended at $0.2547 (up $0.0578); and Ethereum closed at $344.63 (up $110.68). Nice!

The Euro and Pound gained against the Dollar - $1.177 (up $.067) and $1.3076 (up $0.0735) respectively. Crude Oil is continuing its uphill climb, closing at 40.37 (up $5.05), and Gold gained $246.70 to close at $1,989.70. And now for my stocks:

JP Morgan ($96.60 – up $2.60), AT&T ($29.59 – down $0.60), Verizon ($57.48 – up $2.41), Wal-Mart ($129.40 – up $9.71), Disney ($116.98 – up $5.52), Intel ($47.73 – down $12.10), Apple ($425.04 – up $60.24 - wow), Microsoft ($205.01 – up $1.50), Bristol-Myers ($58.66 – down $0.13), Emerson (SOLD), Pepsi ($137.66 – up $5.40), Eaton Corp. ($93.13 – up $5.57), Comcast ($42.80 – up $3.82), and American Express ($93.32 – down $1.92). Since I sold Emerson and like round numbers, I have added my Bank of America stock to the report. Last month it closed at $23.75, and this month it was at $24.89 – up $1.14. Of the 14 stocks I listed, 10 were up, and 4 were down.

____________________

Tales from the Dark Side

By: Alyssa

Nahmad vs. Phillips – More Legal Matters

The Nahmad family is back in the news, this time, with the youngest of the art dealing clan, Joseph Nahmad. According to a complaint filed on June 9th in New York, Joseph Nahmad is suing Phillips auction house after a "guaranteed" deal involving a Rudolf Stingel and Jean Michel Basquiat went south. Nahmad claims that he placed an irrevocable bid for £3 million on the Basquiat and, in return, would receive a guarantee of $5 million on his Rudolf Stingel, which was to be offered in their upcoming May auction.

When the world took a turn for the worst, and the COVID-19 pandemic took its toll on the market, Phillips removed the guarantee from the Stingel; however, Nahmad stayed true to his previous irrevocable bid (though he did not end up buying the work which sold for £3.8M) . Nahmad is seeking at least $7 million for the reneged deal; claiming that the auction house is using the pandemic as a cover for their true reason of the breach — the fact that Stingel's market crashed after a bunch of speculative deals — one of which included disgraced art dealer Inigo Philbrick.

Phillips has not commented on the suit, but in WhatsApp messages between Phillip's CEO, Leonid Friedland, and Nahmad, he stated that the guarantee could be canceled, in the case of "natural disaster, fire, flood, general strike, war, terrorist attack… or chemical contamination…" and offered to include the work in their July Sale with a "stripped down" agreement that eliminated the guarantee.

One more little interesting tidbit … it appears that Leonid Friedland was the owner/seller of the Basquiat.

Bouvier – Roybolovlev Continued…

Over the years, we have written more than a dozen posts about the Bouvier – Rybolovlev conflict. In a quick summary, Russian billionaire Dmitry Rybolovlev claims to have been defrauded of over $1 billion for 38 works of art by Swiss art dealer Yves Bouvier.

In December, an appellate court judge in Monaco dismissed the case, which began in 2015, stating that "all investigations were conducted in a biased and unfair way without the defendant being in a position to retrospectively redress these serious anomalies that permanently compromised the balance of rights of the parties." Of course, his attorney appealed the decision.

In the most recent news, the Monaco Court of Revisions "…upheld the decision of a lower court to dismiss charges of fraud and money laundering against Bouvier. The decision effectively ends the country's criminal investigation into the dealer…"

I guess this mess will continue since Bouvier had filed charges of corruption against Rybolovlev, claiming he bribed law enforcement involved in the case, which has sparked an investigation. This win for Bouvier does not mean he's out of hot water since there are additional open cases against him, including those in Geneva, France, and Switzerland.

An alleged forgery ring is unraveling after authorities garnered enough evidence to obtain a search warrant for artist Donald "D.B" Henkel's property in Traverse City, Michigan. According to reports, the FBI began investigating the artist after learning he was involved in the sale of fake works said to be by notable 20th Century American artist to U.S. galleries, collectors, and museums. Conservators confirmed that materials used in these "rediscovered" works did not exist during the period in which they were supposedly created.

These forgers did not only use their talents in the art world but ventured in the world of sports memorabilia. According to one article:

Since 2015, two accused co-conspirators have sold a purported Babe Ruth bat for $60,000 and a Lou Gehrig bat for $120,000, according to the FBI agent. Most of the money was sent to Henkel and another person.

The FBI affidavit does not say the bat was counterfeit.

The timing of the Gehrig bat auction and price tag appears to match one sold by Hunt Auctions of Pennsylvania. According to the listing, the Gehrig bat belonged to a descendant of a bat boy who had met the New York Yankees legend.

With that, 30 FBI agents raided the home, seizing a number of undisclosed items. No arrests have been made… yet.

____________________

Really?

By: Amy

Winning Result for Pokémon

A rare Pokémon card was recognized as a true champion when it sold for more than a few PokéCoins (the game's currency) at a recent auction featuring Comics and Comic Art. One of the most sought after and rarest cards produced for the Pokémon Trading Card game is a 1999 Super Secret Battle No. 1 Trainer Card. There are only seven known cards, each of which were given to the first-place winners of regional Pokémon tournaments. The cards informed the winners of the location and gave them preferential entry to the final Secret Super Battle, which took place on August 22, 1999. This card is graded a perfect GEM Mint 10… so it doesn't get any better. As the battle for the card came to a close, the victor paid $90K…not a record-breaker for Pokémon (a 1998 Pikachu card sold in 2019 for $224K), but still a winning result!

A rare Pokémon card was recognized as a true champion when it sold for more than a few PokéCoins (the game's currency) at a recent auction featuring Comics and Comic Art. One of the most sought after and rarest cards produced for the Pokémon Trading Card game is a 1999 Super Secret Battle No. 1 Trainer Card. There are only seven known cards, each of which were given to the first-place winners of regional Pokémon tournaments. The cards informed the winners of the location and gave them preferential entry to the final Secret Super Battle, which took place on August 22, 1999. This card is graded a perfect GEM Mint 10… so it doesn't get any better. As the battle for the card came to a close, the victor paid $90K…not a record-breaker for Pokémon (a 1998 Pikachu card sold in 2019 for $224K), but still a winning result!

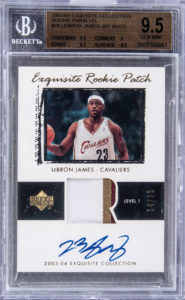

Lebron James Breaks Another Record

It did not take long to break the auction record for a modern-day trading card… I am referring to a card that was produced after 1980. In June, I wrote about a Mike Trout rookie card that made $922K… well, a LeBron James trading card from his rookie season with the Cleveland Cavaliers just shattered that record!

It did not take long to break the auction record for a modern-day trading card… I am referring to a card that was produced after 1980. In June, I wrote about a Mike Trout rookie card that made $922K… well, a LeBron James trading card from his rookie season with the Cleveland Cavaliers just shattered that record!

Why would a card that was produced just 17 years ago be so valuable? Limited production! The 2003-04 Upper Deck set of Basketball cards titled the Exquisite Collection is one of the most sought after sets of cards by collectors. The base set included 78 cards of which 36 were rookie players from the 2003 – 04 basketball season, and LeBron James, Dwyane Wade, Carmelo Anthony, and Chris Bosh were among the rookies.

The card that was just auctioned is from a parallel collection called the Rookie Patch Autograph collection, meaning it had a slight variation to the base card and each rookie card included the players' autograph and a patch from their jersey. Upper Deck only produced as many cards as the number on that player's jersey, as a result, there were only 23 cards made for LeBron James; this card is numbered 14/23.

Currently, there are only 2 known examples of the LeBron James Rookie Autograph Patch card that are graded 9.5 mint gem by Beckett grading services; the card that just sold is one of them. As 34 bidders battled to take possession of the prized card, an auction record was achieved when it finally sold to Leore Avidar, the CEO of Lob.com, for $1.5M ($1.845M w/p)! By the way, when the cards were released, only one Rookie Patch Autograph card was included in each pack of cards, which cost $500! That was considered a really ridiculous price – obviously today it would be a real steal!

And if any of you are interested in bidding on another Mike Trout rookie card, one is coming up at auction soon…starting bid is $1M!! I will let you know how that goes!

____________________

The Art Market

By: Howard, Lance & Amy

There was a great deal of action in the public arena during July ... here are reviews of just a few of the sales.

The New Auction Normal – Sotheby's Online Evening Pt. 1

Being back at the gallery has really cut into all this free time I've gotten used to… going to play a little catch-up on some sales from a few weeks back. At the end of June, Sotheby's hosted a trio of evening sales in succession… online evening sales. These were the big spring sales that were pushed off from May, and by this point, they were far slimmer than anticipated. Each individual sale was relatively small, with roughly 20-30 works… and while I expected it to go relatively quickly, it dragged on until nearly midnight (more than 5 hours for less than 100 lots!)

Being back at the gallery has really cut into all this free time I've gotten used to… going to play a little catch-up on some sales from a few weeks back. At the end of June, Sotheby's hosted a trio of evening sales in succession… online evening sales. These were the big spring sales that were pushed off from May, and by this point, they were far slimmer than anticipated. Each individual sale was relatively small, with roughly 20-30 works… and while I expected it to go relatively quickly, it dragged on until nearly midnight (more than 5 hours for less than 100 lots!)

Things got started with The Ginny Williams Collection – just 18 works were offered… that said, all of them sold. The top lot was Lee Krasner's Re-Echo , which topped it's $4-6M estimate as it hammered for $7.7M ($9.03M w/p); it was seemingly guaranteed at $3.9M from what I gleaned from few choice words by the auctioneer. Just behind was a work by Joan Mitchell, which also surpassed expectations, as it hammered for $7.5M ($8.8M) on a $5-7M estimate. There was a tie for the third highest price at $6.7M… another work by Mitchell – Garden Party estimated to bring between $4-6M – and the biggest surprise of the bunch being a work by Helen Frankenthaler which was only expected to sell between $2-3M… with the premium, those lots work out to $7.9M.

Things got started with The Ginny Williams Collection – just 18 works were offered… that said, all of them sold. The top lot was Lee Krasner's Re-Echo , which topped it's $4-6M estimate as it hammered for $7.7M ($9.03M w/p); it was seemingly guaranteed at $3.9M from what I gleaned from few choice words by the auctioneer. Just behind was a work by Joan Mitchell, which also surpassed expectations, as it hammered for $7.5M ($8.8M) on a $5-7M estimate. There was a tie for the third highest price at $6.7M… another work by Mitchell – Garden Party estimated to bring between $4-6M – and the biggest surprise of the bunch being a work by Helen Frankenthaler which was only expected to sell between $2-3M… with the premium, those lots work out to $7.9M.

In total, 8 lots topped their estimate, 8 sold within their range… leaving just two works selling below their estimate. That said, they did achieve an impressive 100% sell-through rate… we won't mention the fact that all 18 lots were guaranteed prior to the sale… oh, oops.

In total, 8 lots topped their estimate, 8 sold within their range… leaving just two works selling below their estimate. That said, they did achieve an impressive 100% sell-through rate… we won't mention the fact that all 18 lots were guaranteed prior to the sale… oh, oops.

Collectively, the lots were expected to bring between $35.9- 51.7M, so they well outpaced the projection even with a couple of poor performance, as the sale totaled $55M ($65.4M w/p). Not a bad way to get the evening started.

Sotheby's Contemporary Evening – Online Pt 2

Immediately following the Ginny Williams collection, Sotheby's offered up 30 lots of Contemporary work, though it was a far cry from the usual slate of works featured in an evening sale… the high end of the sale estimate was $239M – just for a frame of reference, last year Sotheby's Contemporary Evening sale totaled $341M, and Christie's totaled more than half a billion.

Immediately following the Ginny Williams collection, Sotheby's offered up 30 lots of Contemporary work, though it was a far cry from the usual slate of works featured in an evening sale… the high end of the sale estimate was $239M – just for a frame of reference, last year Sotheby's Contemporary Evening sale totaled $341M, and Christie's totaled more than half a billion.

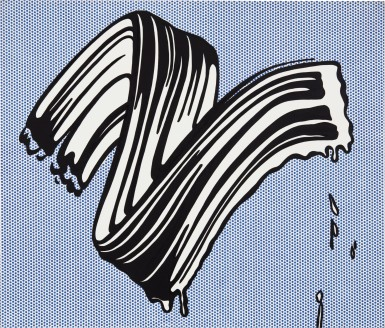

The top lot of the session was none other than Francis Bacon, who has become a staple in evening sales… no other lot came close. Expected to sell for $60-80M, the sizable triptych, which has been privately held for more than 30 years, found a buyer at $74M ($84.5M w/p). A work by Clyfford Still titled PH-144(1947-Y-NO.1) took second at the low end of its range… $25M on a $25-35M estimate ($28.7M w/p). Rounding out the top three was Roy Lichtenstein's White Brushstroke 1, which was guaranteed going into the sale… it found a buyer at $23.5M ($25.4M w/p) on a $20-30M estimate. Surprisingly, this work last sold at Christie's in 1993 and went below estimate (even with the premium). At that time, the estimate was only $750-950K! This time around, the seller was certainly happy with the results given they acquired the work for just $728K – a roughly 3,100% return.

The top lot of the session was none other than Francis Bacon, who has become a staple in evening sales… no other lot came close. Expected to sell for $60-80M, the sizable triptych, which has been privately held for more than 30 years, found a buyer at $74M ($84.5M w/p). A work by Clyfford Still titled PH-144(1947-Y-NO.1) took second at the low end of its range… $25M on a $25-35M estimate ($28.7M w/p). Rounding out the top three was Roy Lichtenstein's White Brushstroke 1, which was guaranteed going into the sale… it found a buyer at $23.5M ($25.4M w/p) on a $20-30M estimate. Surprisingly, this work last sold at Christie's in 1993 and went below estimate (even with the premium). At that time, the estimate was only $750-950K! This time around, the seller was certainly happy with the results given they acquired the work for just $728K – a roughly 3,100% return.

Only one lot provided a truly surprising result… the first lot up – Matthew Wong's The Realm of Appearances saw some spirited bidding as it climbed to $1.5M ($1.8M w/p) though it was estimated at just $60-80K… if anyone can explain that, I'm all ears.

Only one lot provided a truly surprising result… the first lot up – Matthew Wong's The Realm of Appearances saw some spirited bidding as it climbed to $1.5M ($1.8M w/p) though it was estimated at just $60-80K… if anyone can explain that, I'm all ears.

There were five work that sold below estimate, along with one failure… the most significant were works by Diebenkorn ($7.7M on $9-12M est.) and Henry Moore ($2.95M on $4-6M est.), as well as the Basquiat, which sputtered out at $1.3M on a $1.5-2M estimate, leaving it unsold.

Half of the lots (15 of 30) were sold within their estimate range, along with another 9 that topped their estimate, so 80% saw good results… and with just one unsold, that works out to 97% sold – a solid showing given the circumstances. The 29 sold lots totaled $203M ($234.9M w/p), and they were expecting between $171-239; not too far off the high end, but well off last year's levels.

Sotheby's Impressionist & Modern Evening – Online Pt 3

Wrapping up the three-part evening, Sotheby's offered up a modest selection of Impressionist & Modern works; we were expecting 32 lots to be offered, but only 26 materialized, as 6 lots were withdrawn – that's nearly 20% of the sale!

That said, things got off to a hot start with 8 of the first 10 lots topping the high end of their estimate. After that, things took a turn for the worse with most of the sold lots selling below their estimate range (not to mention all the BIs or withdrawals). The high for the evening came at lot 14, but it was guaranteed with an irrevocable bid prior to the sale – Picasso's Tête de Femme Endormie. The work, which has been in private hands since 1962, hammered inside its expected range at $9.6M ($11.2 w/p) on a $9-12M estimate. Taking second was Wifredo Lam's Omi Obini (lot 8) which was expected to bring between $8-12M and just made the mark as it hammered at $8.2M ($9.6M w/p). Rounding out the top lots we had a work by Remedios Varo (lot 4), which impressively topped its estimate of $2-3M, when it hammered at $5.2M ($6.1M w/p)… that work last sold in 1988 through Christie's in New York – there was no estimate provided but made an impressive  $385K (I cannot be certain, but that appears to have been an auction record for the artist at that time)… this time around, it was definitely an auction record for the artist.

$385K (I cannot be certain, but that appears to have been an auction record for the artist at that time)… this time around, it was definitely an auction record for the artist.

There were not many overly impressive results… just one lot really. A work by Frida Kahlo, estimated at just $400-600K, sparked a bit of a bidding war that saw the work climb to a $2.2M hammer ($2.6M w/p). The  handful of unsold lots included works by Tamayo ($1.2-1.8M), Chagall ($3-4M), Giacometti ($2.8-3.5M), and Buffet ($800K-1.2M)… accounting for 15% of the sale (4 of 26 works).

handful of unsold lots included works by Tamayo ($1.2-1.8M), Chagall ($3-4M), Giacometti ($2.8-3.5M), and Buffet ($800K-1.2M)… accounting for 15% of the sale (4 of 26 works).

The 22 sold lots (85%) totaled $53.6M before you add in the premiums… the sale estimate was $55.8-77.6, so they were a bit short – add in the premiums, and that bumps it to $62.7M, so that feels a bit better but not what you'd expect for an evening sale… Between the three sales, the evening saw a grand total of $363M, including the premiums, and they were expecting between $262.7-368.3M, so really not too bad when all was said and done, especially given the current situation.

Rembrandt to Richter – 500 Centuries of Art

The onslaught continues, and this week, Sotheby's presented their Rembrandt to Richter sale … a mash-up of pricier works from Old Master to Contemporary. I, for one, have never been a fan of this type of sale, especially when you go to the viewing and see a Picasso sitting next to a Rubens. Yes, both were exceptional artists, but their styles are so different that, at times, it hurts the eye. I will say that since there are no physical viewings right now, the juxtaposition of these very different works is less troubling. (w/p = with the buyer's premium)

The onslaught continues, and this week, Sotheby's presented their Rembrandt to Richter sale … a mash-up of pricier works from Old Master to Contemporary. I, for one, have never been a fan of this type of sale, especially when you go to the viewing and see a Picasso sitting next to a Rubens. Yes, both were exceptional artists, but their styles are so different that, at times, it hurts the eye. I will say that since there are no physical viewings right now, the juxtaposition of these very different works is less troubling. (w/p = with the buyer's premium)

Taking the number one spot was Joan Miro's Peinture (Femme au Chapeau Rouge) that carried a £20-30M estimate and sold for £19,406,620/$25.03M (£22,302,140/$28.8M w/p) – I assume these wacky numbers are because the guarantor purchased the work (so they were afforded a bit of a discount). Oh, in case you are wondering, the seller was billionaire Ronald Perelman. In second, and at the other end of the art history spectrum, was Rembrandt's Self-Portrait of the Artist… which made £12.6M/$16.3M (£14.55M/$18.77M w/p – est. £12-16M). I was told that the painting had some condition issues, but I guess the fact that this was only one of three self-portraits still in private hands, overshadowed that. The third spot was taken by Fernand Leger's Nature Morte at £10.5M/$13.55M (£12.16M/$15.7M w/p) falling comfortably inside its £8-12M estimate. Rounding out the top five were Giacometti's Femme Debout at £9.2M/$11.9M (£10.68M/$13.8M – est. £4-6M), and Gerhard Richter's Clouds (Window) at £9M/$11.6M (£10.5M /$13.5M w/p – est. £9-12M).

Taking the number one spot was Joan Miro's Peinture (Femme au Chapeau Rouge) that carried a £20-30M estimate and sold for £19,406,620/$25.03M (£22,302,140/$28.8M w/p) – I assume these wacky numbers are because the guarantor purchased the work (so they were afforded a bit of a discount). Oh, in case you are wondering, the seller was billionaire Ronald Perelman. In second, and at the other end of the art history spectrum, was Rembrandt's Self-Portrait of the Artist… which made £12.6M/$16.3M (£14.55M/$18.77M w/p – est. £12-16M). I was told that the painting had some condition issues, but I guess the fact that this was only one of three self-portraits still in private hands, overshadowed that. The third spot was taken by Fernand Leger's Nature Morte at £10.5M/$13.55M (£12.16M/$15.7M w/p) falling comfortably inside its £8-12M estimate. Rounding out the top five were Giacometti's Femme Debout at £9.2M/$11.9M (£10.68M/$13.8M – est. £4-6M), and Gerhard Richter's Clouds (Window) at £9M/$11.6M (£10.5M /$13.5M w/p – est. £9-12M).

The most interesting thing about these online sales is the ability to withdraw lots just before, or even during, a sale. In all, six works were pulled, including Francis Bacon's Study for a Portrait of John Edwards, which was expected to bring in excess of £12M, and Gustave Bauernfeind's Jerusalem, From the Mount of Olives at Sunrise that was estimated at £3-4M. I guess that helps make the sell-through rate a lot stronger!

The most interesting thing about these online sales is the ability to withdraw lots just before, or even during, a sale. In all, six works were pulled, including Francis Bacon's Study for a Portrait of John Edwards, which was expected to bring in excess of £12M, and Gustave Bauernfeind's Jerusalem, From the Mount of Olives at Sunrise that was estimated at £3-4M. I guess that helps make the sell-through rate a lot stronger!

By the end of the show (and it was a show), of the 65 works offered, just three failed to find buyers (Sigmar Polke's After Dali, Giacometti's Figurine, and Louise Bourgeois Arched Figure). This gave them a sell-through rate of 95%, and the total take was £126.34M/$163M (£149.7M/$193M – w/p) against a presale estimate range of £111-159M. Of the 62 sold works, 2 were below, 25 within, and 26 above their estimate ranges, leaving them with an overall accuracy rate of 40.3% … somewhat respectable. I am sure that the seller's whose works eclipsed their ranges were pretty happy.

British & European Art – Christie's, London

Christie's just completed another online auction, this one featured British and European Art, and once again, there were not a lot of great works presented. Christie's promoted the featured works from this sale on their site, amounting to 11 of the 117 lots offered, and unfortunately, almost half of the featured lots did not sell, almost mimicking the overall sale results. (w/p = with the buyer's premium)

Taking the top slot was one of the featured works, John Atkinson Grimshaw's Stapleton Park, Near Pontefract, which carried an estimate of £60-80K and sold for £65K/$84.5K (£81.3/$105.7K – w/p). In second place was a colorful and nice work by Arnoldus Bloemers titled Still life with roses, peonies, tulips, narcissi, convulvulus and others in a vase on a marble ledge, estimated at £20-30K, which more than doubled the estimate, once the commission was added in; it sold for £50K/$65K (£62.5K/$81.3K -w/p). Coming in a close third was a painting by Josef Israels titled Kinderen der zee; children playing in the surf. , which was estimated to bring £8-12K; well it blew that estimate out of the water when it hammered for £48K/$62.4K (£60K/$78K – w/p).

Now onto some of those featured works that just did not make it to the finish line. A painting by Frederic Lord Leighton titled Head of a Girl in a White Dress did not sell with an estimate of £60-80k. Another disappointment were two works by Cornelis Springer — The Town Hall of Bolsward and The Vegetable Market (each estimated at £50-70K). A work by Hippolyte Camille Delpy did not attract interest with a slightly aggressive estimate of £40-60K. And the two works with the highest estimates in the sale (£100-150K) also failed to attract a buyer – the 'cover' piece by Sir George Clausen titled A Midsummer Day and a sculpture by Alfred Boucher titled Volubilis (Morning Glory).

Now onto some of those featured works that just did not make it to the finish line. A painting by Frederic Lord Leighton titled Head of a Girl in a White Dress did not sell with an estimate of £60-80k. Another disappointment were two works by Cornelis Springer — The Town Hall of Bolsward and The Vegetable Market (each estimated at £50-70K). A work by Hippolyte Camille Delpy did not attract interest with a slightly aggressive estimate of £40-60K. And the two works with the highest estimates in the sale (£100-150K) also failed to attract a buyer – the 'cover' piece by Sir George Clausen titled A Midsummer Day and a sculpture by Alfred Boucher titled Volubilis (Morning Glory).

When the sale was over, of the 117 works offered, 67 sold (57.3%) and the total take was just £1.45M ($1.89M), far below the presale low estimate of £2.368M ($3.08M). Even adding in the buyer's premium couldn't get this sale up to speed. Was it the lackluster appeal of the works offered, their quality, or do people just need a break from the massive amount of online sales?

The Rehs Family

© Rehs Galleries, Inc., New York – August 2020