COMMENTS ON THE ART MARKET

November Hours

The gallery will be open Tuesday through Friday from 10 am – 5 pm. If you would like to stop by, please call to schedule an appointment. All visitors are required to wear a mask, and we will be providing hand sanitizing stations along with gloves and masks should you need them.

____________________

Current & Upcoming Gallery Exhibitions

Taking Flight: ARC Select 2020

A group exhibition benefiting the American Bird Conservancy

Taking Flight, which runs through November 20, features artwork from Jasmine Becket-Griffith, Jon Burns, Natalie Featherston, Lucia Heffernan, Adam Matano, Rob Rey, and Josh Tiessen. Please use the link below to schedule your visit.

Holiday Exhibition

Beginning on November 17, the gallery will be presenting a holiday gift exhibition titled Not A Creature Was Stirring featuring the whimsical works of Stuart Dunkel, Lucia Heffernan, Tony South, Beth Sistrunk, and Kelly Houghton. Prices for the featured works will range from $600 to $2,500. This year, the perfect holiday gift may be one that hangs on the wall.

____________________

Stocks

By: Howard & Lance

Another down month, and with the election only days away, it will be an interesting last quarter. The Dow opened the month at 27,781, got as high as 28,837, but closed at 26,501.60 (a 1,280.10 point drop); so we are now back to the July levels -- not what most of us would like to see. Most of the cryptocurrencies were up - Bitcoin closed at $13,911.15 (up $3,157.45); Litecoin finished at $55.41 (up $9.08); Ripple ended at $0.24 (even); and Ethereum closed at $390.27 (up $30.72).

The Euro and Pound were basically flat against the Dollar - $1.17 (even) and $1.29 (even), respectively. Crude Oil dropped again, closing at 35.72 (down $4.22), and Gold lost $14.50 to close at $1,878.80. And now for my stocks:

JP Morgan ($98.04 – up $1.77), AT&T ($27.02– down $1.49), Verizon ($56.99 – down $2.50), Wal-Mart ($138.75 – down $1.16), Disney ($121.25 – down $2.83), Intel ($44.28 – down $7.50), Apple ($108.86 – down $6.95), Microsoft ($202.47 – down $7.86), Bristol-Myers ($58.45 – down $1.84), Pepsi ($133.29 – down $5.31), Eaton Corp. ($103.79 – up $1.76), Comcast ($42.24 – down $4.02), American Express ($91.24 – down $9.01), Bank of American ($23.79 – down $.30), Twitter ($41.36 – down $3.14), and eBay ($47.63 – down $4.47). 2 up and 14 down …oh well, hopefully brighter skies are on the horizon.

____________________

Tales from the Dark Side

By: Alyssa

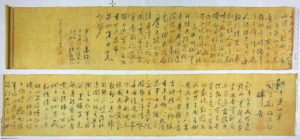

Mao Zedong Scroll Recovered, But Cut In Half

Three people were arrested in connection to a September 10 burglary in Hong Kong that is said to be the most expensive heist in the region to date. According to reports, the apartment of Fu Chunxiao, a well-known collector of stamps and revolutionary art, was broken into while he was quarantined in mainland China. The thieves made off with what is estimated to be HK$4 billion ($645 million) worth of goods. The trove included 10 bronze coins, over 24,000 stamps, and seven calligraphy scrolls written by Mao Zedong, the Chinese Communist revolutionary considered to be the founding father of the People’s Republic of China.

Three people were arrested in connection to a September 10 burglary in Hong Kong that is said to be the most expensive heist in the region to date. According to reports, the apartment of Fu Chunxiao, a well-known collector of stamps and revolutionary art, was broken into while he was quarantined in mainland China. The thieves made off with what is estimated to be HK$4 billion ($645 million) worth of goods. The trove included 10 bronze coins, over 24,000 stamps, and seven calligraphy scrolls written by Mao Zedong, the Chinese Communist revolutionary considered to be the founding father of the People’s Republic of China.

After the heist, the scroll was sold for a mere HK$500 ($65), and the buyer, assuming it was a forgery, cut it in half for “storage” purposes; the actual estimated value is said to be about HK$2.3 billion ($300 million). The buyer surrendered the scroll after seeing a public appeal by the police; however, two of the stolen copper coins were also found in his apartment, and police arrested him on suspicion of handling stolen property. He has since been released on bail.

After some investigation, police raided the apartment of one of the suspected burglars and arrested him, along with a friend (who assisted the burglar by providing a hideout). Authorities are still looking for two additional men in connection with the heist and the remaining stolen items.

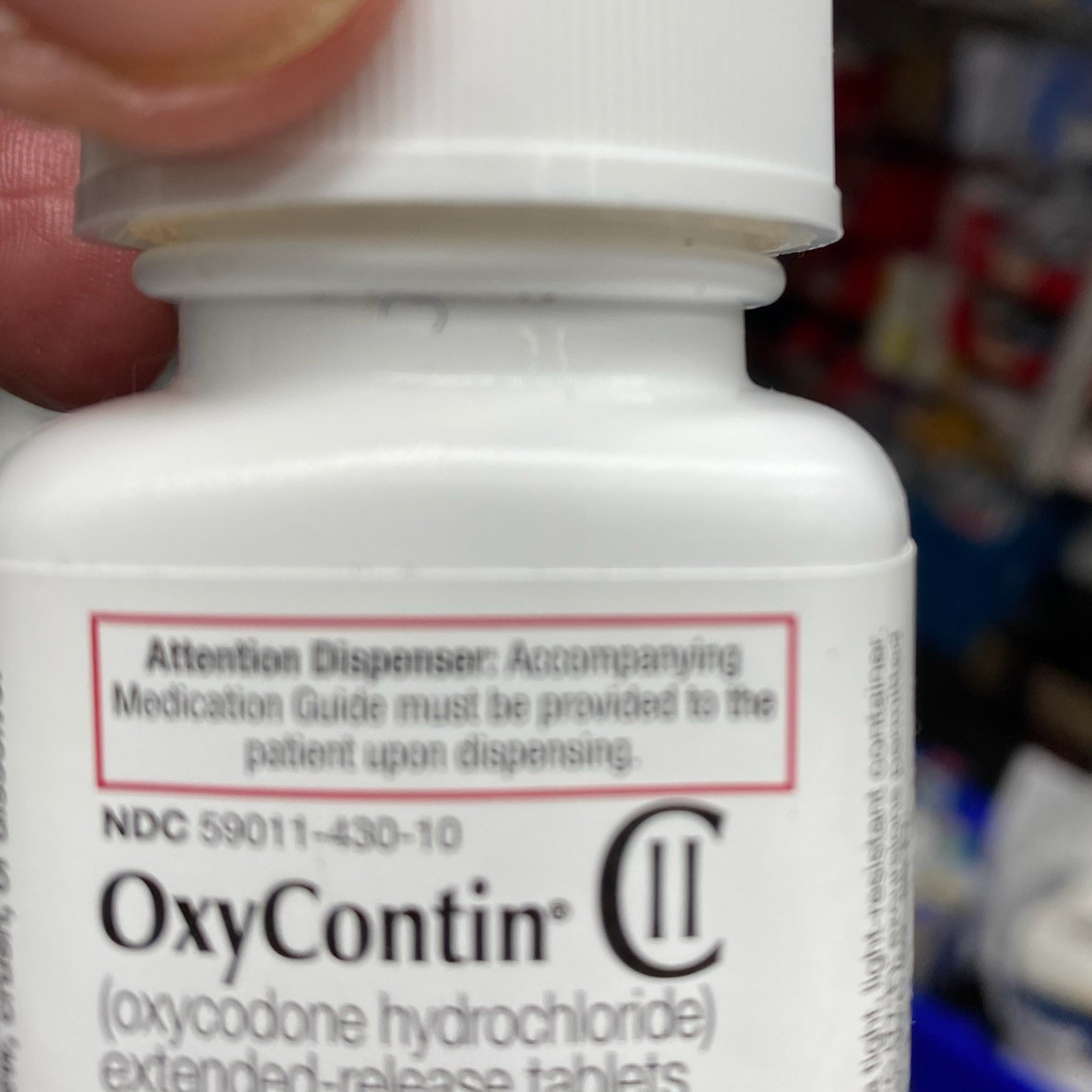

MET Reviewing Sackler Wing’s Name After Purdue Pleads Guilty

Major institutions are showing their support in the fight against the Opioid Crisis after Purdue Pharma pled guilty to criminal charges over their marketing strategy of OxyContin, a highly addictive painkiller, and agreed to a settlement of $8.3 billion, $225 million of which will be paid personally as part of the civil penalties.

In the late 1990s, the pharmaceutical company assured doctors that the drug was not addictive and misled regulators, and because of that, they began prescribing the pain killer at an ever-increasing rate. Unfortunately, the drug was extremely addicting, leading many to misuse the prescription; in some cases, it acted as a gateway to heroin. It was also uncovered that Purdue Pharma was engaging in a practice called kickbacks, where doctors would receive monetary compensation from the company for prescribing their patients. According to the U.S. Department of Health and Human Services, a study done in 2018 found that over 130 people died every day from an opioid-related drug overdose; 10.3 million people misused their prescription opioids that year and 808,000 people used heroin. On a personal note, I have not been immune to the opioid crisis; at just 29 years old, I would need both hands to count the number of friends/acquaintances that I have lost because they overdosed.

In the late 1990s, the pharmaceutical company assured doctors that the drug was not addictive and misled regulators, and because of that, they began prescribing the pain killer at an ever-increasing rate. Unfortunately, the drug was extremely addicting, leading many to misuse the prescription; in some cases, it acted as a gateway to heroin. It was also uncovered that Purdue Pharma was engaging in a practice called kickbacks, where doctors would receive monetary compensation from the company for prescribing their patients. According to the U.S. Department of Health and Human Services, a study done in 2018 found that over 130 people died every day from an opioid-related drug overdose; 10.3 million people misused their prescription opioids that year and 808,000 people used heroin. On a personal note, I have not been immune to the opioid crisis; at just 29 years old, I would need both hands to count the number of friends/acquaintances that I have lost because they overdosed.

The Sackler family, who owns Purdue Pharma, has always been philanthropic towards the arts and sciences. Institutions around the globe bear the Sackler name including, the Sackler Institute of Graduate Biomedical Services at New York University, The Sackler Wing of Oriental Antiquities at the Louvre Museum, and the Sackler Center for Arts Education at the Solomon R. Guggenheim Museum – and these are just a few.

In support of the movement to end the crisis and honor the lives lost, the institutions mentioned above, have begun to remove the Sackler name, paving the way for others to follow. The Metropolitan Museum of Art who has received hefty donations from the family, including funding for the Sackler Wing, home to the Temple of Dendur, pledged to no longer take donations from the family last year. After the guilty plea, the MET confirmed that name of the wing is now “under review.”

____________________

Really?

By: Amy

We are happy as larks to be presenting Taking Flight, an exhibition that benefits the American Bird Conservancy. As such, I thought it would be very apropos to find a recent auction item with a bird theme…I was successful!

We are happy as larks to be presenting Taking Flight, an exhibition that benefits the American Bird Conservancy. As such, I thought it would be very apropos to find a recent auction item with a bird theme…I was successful!

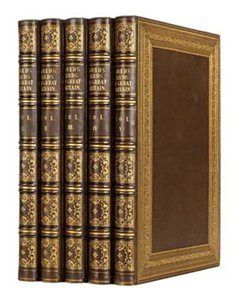

John Gould (1804 – 1881) was an English ornithologist and artist; he illustrated and published monographs on birds, and is considered one of the most significant figures in bird illustrations, second only to Audubon. One of his most sought-after publications is titled Birds of Great Britain, which Gould self-published and produced just 750 copies of. The set contains 25 volumes, completed between 1863-1873, and contains 367 colored lithographs. Although Gould did not do all the illustrations himself, he did supervise their production and took great pride and joy in the images.

A 1st edition, complete set, compiled into a five-volume set, was recently offered and quickly flew past the estimate of £15 -25K ($19.5 – 32.6K) when it sold for £51K ($66.6K)!

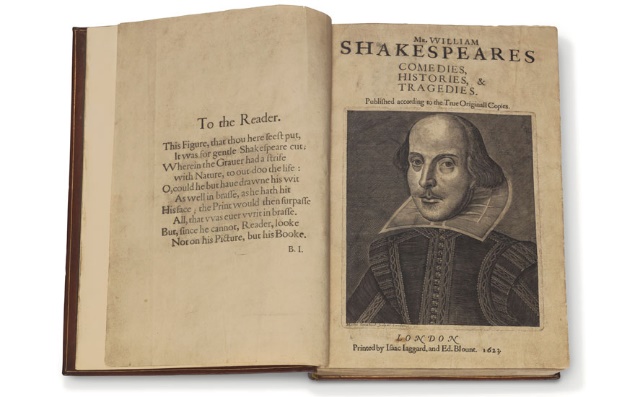

To buy, or not to buy, that was the question: whether or not to part with a few sweet dollars to purchase a rare, complete set of William Shakespeare’s First Folio. The book was published in 1623 by Shakespeare’s friends and fellow actors, John Heminge and Henry Condell, to preserve the playwright’s place in history. The First Folio is a collection of Shakespeare’s Comedies, Histories, and Tragedies and is considered by scholars to be one of the most important and influential books ever published. Among the masterpieces in the book were Macbeth, The Tempest, and Julius Caesar.

There were 750 copies printed, but only 235 copies are known to exist. Of those, just 56 are believed to be complete sets, and just six sets remain in private collections. This copy was consigned on behalf of Mills College in California and was accompanied by a letter from Edmond Malone (an 18th/early 19th-century Shakespearian scholar), who had personally handled and confirmed its authenticity.

The lot was estimated to bring $4-6M, and a 3-way bidding battle erupted on the phone, of course. When the hammer fell, the result was one for the record books! The new owner, Stephan Loewentheil, a book dealer, purchased it for $8.4M ($9.98M w/p)!

____________________

The Art Market

By: Howard, Lance & Amy

Throughout my entire career (which spans about 40 years), I have never seen so much art offered in such a short period of time. The salerooms now have auction upon auction, and at times sales from different rooms overlap one another, not a great idea. On top of that, some online platforms are so difficult to use (hard to believe when this is relatively new technology) that trying to watch and bid online becomes a real PITA (pain in the…). The biggest issue with all the art being dumped onto the market is that many works do not sell; this leaves the owners with what we call a burned painting. Sellers need to remember that there are only a finite number of people interested in any one artist, and putting too much work by that artist on the market at one time will result in many pieces not selling.

It appears that the auction rooms have resorted to an old tactic of throwing everything one can against the wall. If it sticks, great; if not, they move on to the next sale. That is fine for them but bad for the owners of unsold works.

We also see that in certain areas of the market, the salerooms have difficulty sourcing quality material. Many works have condition issues, are not from the right period, or are just poor examples. I can tell you that we recently viewed a collection of works; they were all bought at auction decades ago, and most had real condition issues. Among the works, were three paintings that met our criteria, and we bought them – they sold very quickly. I advised the owners not to sell the remaining works at this time … they did not listen. The paintings (about a dozen) were split between the two major salerooms (from whom they were purchased), and in the end, only 2 sold.

This month we have covered several sales (but it is only a fraction of what appeared), and we apologize for the length of this newsletter. On the bright side, imagine how long it would have been if we covered most of the sales!

Christie’s 20th Century Evening Sale

By: Howard

On October 7, Christie’s presented their sale of 20th-century works of art. The title is a little misleading since the earliest lot was some 67 million years old, and there were 5 works from the 19th Century. As you will soon see, while the sale generated a good deal of money, it was not a real blockbuster.

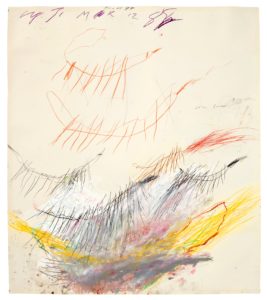

The top lot of the evening was Cy Twombly’s Untitled (Bolsena) that hammered at $35M ($38.685M w/p – est. $35-50M). We know that this painting was guaranteed by a third party and it is obvious that they were the ultimate buyer since the final price with the buyer’s premium is less than it should be … $38.685M vs. $40.7M … that is a nice savings! Taking second at Mark Rothko’s Untitled that hammered at $28M ($31.275M w/p – est. $30-$50M – this was another guaranteed lot that was acquired by the guarantor). The Rothko last appears on the auction block in 1998 where is made $1.2M, and then was acquired around 2002 by Ron Perelman (the seller). And the surprise of the evening, and one of the few lots with serious action, was Stan. Stan is a T-Rex skeleton that was offered at the end of the sale with an estimate of $6-8M, and when the battle ended, the buyer had to cough up $27.5M ($31.848M w/p)

Rounding out the top 5 were a still life by Cézanne that brought $26M ($28.65M w/p – estimate on request – whisper number was $25M), and Picasso’s Femme dans un fauteuil at $25.5M ($29.56M w/p – est. $20-30M).

There were a couple of other lots that seemed to garner a bit of action, Damien Hirst’s bronze titled Mickey at $1.9 hammer ($2.31M w/p – est. $700K-1M), and a small still life by Renoir that made $2.3M ($2.79M w/p – est. $800-1.2M). Then there were several works that found no takers – Warhol’s Statue of Liberty (est. $1.2-1.8M), an early van Gogh still life (est. $1.5-2M), Picasso’s Guitare et compotier sur un guéridon devant la fenètre (est. $7-10M), Koons’s Dolphin (est. $2-3M), and Miro’s Le Cirque (est. $3-5M). And let’s not forget that 4 works were pulled from the sale, including Brice Marden’s The Golden Pelvic (est. $12-18M), and Picasso’s Tête de femme sur fond jaune (est. $8-12M).

By the time the sale began, of the 59 lots originally in the sale, 4 were withdrawn; this left 55 to be sold. Of those, 46 found buyers, and the other 9 were returned to their owners (83.6% sell-through rate), with a total take of about $291M hammer ($340.8M w/p). The presale estimate was $277-$401M, so they just made it … and that is all because of T-Rex!

Looking a bit closer, we find that of the 46 sold lots, 13 were below, 28 within, and 4 above their presale estimate ranges. This gave them an accuracy rate of 60.8% … which is pretty strong. In addition, 14 of the works were guaranteed … and a few of those guarantees came on the day of the sale.

Christie’s Impressionist & Modern Day Sale – Not Enough Meat!

By: Howard

On October 8, Christie’s held their Impressionist & Modern Day Sale, and I am sure they were not very happy with the end result. I have said this before, the auction rooms are flooding the market with material … some good, some bad, and some just downright ugly. There is only so much the market can absorb at any given time, and cramming so many sales together is not going to be a good thing … both for the overall market, and the owners of the works that do not sell.

Coming in first was Henri Matisse’s Jeune fille assise, robe jaune (1). This rather sketchy image of a woman in a chair carried a $700-$1M estimate (one of the highest in the sale) and hammered at $880K ($1.086M w/p). I can think of a lot more attractive works one can buy for far less money these days. Taking second was a very small (12 x 10 inches) Pierre Renoir, Coco au ruban rose, that was estimated at $400-600K and hammered at $700K ($870K w/p). Hopefully, one day, I will understand why people pay so much for so little. Guess it is all about the ‘name’? In third was Maurice de Vlaminck’s Nature morte au compotier that fell short of its $700-$1M estimate when it sold for $550K ($688K w/p).

Coming in first was Henri Matisse’s Jeune fille assise, robe jaune (1). This rather sketchy image of a woman in a chair carried a $700-$1M estimate (one of the highest in the sale) and hammered at $880K ($1.086M w/p). I can think of a lot more attractive works one can buy for far less money these days. Taking second was a very small (12 x 10 inches) Pierre Renoir, Coco au ruban rose, that was estimated at $400-600K and hammered at $700K ($870K w/p). Hopefully, one day, I will understand why people pay so much for so little. Guess it is all about the ‘name’? In third was Maurice de Vlaminck’s Nature morte au compotier that fell short of its $700-$1M estimate when it sold for $550K ($688K w/p).

Rounding out the top five were another Matisse, this time a drawing that was expected to sell in the $150-200K range and hammered at $380K ($475K w/p), and Barbara Hepworth’s small bronze titled Six Forms on a Circle that also beat its estimate of $250-350K when it hammered down at $360K ($450K w/p).

There were some lots that performed rather well, these included Vlaminck’s Pont de Nogent at $200K ($250K w/p – est. $100-150K), and Valtat’s Jardin fleuri à Choisel (circa 1930) at $150K ($188K w/p – est. $40-60K … it is also interesting to note that this same painting failed to sell at Doyle in November 2019 with a $70-100K estimate and dated circa 1918). Guess the change of venue, a lower estimate, and later circa date was the key?

A number of the pricier works that failed to find takers included a bronze by Marino Marini (est. $250-350K), a Chagall gouache (est. $250-350K), a Matisse landscape (est. $300-400K), a Caillebotte ($250-450K), Sisley’s Le chemin montant (est. $600-800K), a bronze by Aristide Maillol (est. $400-600K), and another gouache by Chagall – La chèvre bleue – (est. $400-600K).

By the end of the session, of the 110 works offered, 73 sold (66.4% sell-through rate), and the total take was $7.77M ($9.7M w/p) … well below the $11.16M low end of their estimate range. Basically, 1 out of every 3 lots did not sell, and the total hammer price was 31% below expectations. We also saw 26 lots sell below, 24 within, and 23 above their estimate ranges. This left them with an accuracy rate of 32.9%, which was not too bad.

Have no fear, there are many more sales that we will be covering this month!

Christie’s – Part I – 19th Century

By: Howard

Well, the 19th-century action continues (and there is more coming). Today, Christie’s presented a small, select, group of more expensive works, and the results were ok (for those items that were really nice).

We went to view the sale (yes, in person), and there were a few works that caught my eye. The first, which also ended up being the top lot, was a small piece by the 19th-century German artist Carl Spitzweg titled Der Hexenmeister (The Sorcerer) that was expected to sell in the $300-$500k range and hammered down at $1M ($1.23M w/p – doubling the high end of its estimate, but just shy of the record price). This painting was restituted to the heirs of Leo Bendel in 2019. The second spot was taken by William A. Bouguereau, when his late (1899) work titled Rêverie found a buyer at $750K ($930K w/p – est. $800-$1.2M). In third was Gustave Courbet’s Bords de la Loue avec rochers à gauche that made $640K ($798K w/p – est. $400-600K – it was being deaccessioned by the Brooklyn Museum). Rounding out the top five were Vittorio Corcos’s Alla Fontana, a very nice example, that made $550K ($688K w/p – est. $500-$700K), and Jean Beraud’s L’accident: Porte Saint-Denis at $450K ($563K w/p – est. $400-600K – this one last sold in 2002 for $395K).

Another painting that caught my eye during the preview was Alphonse Mucha’s Girl with a Plate with a Folk Motif. This work carried a $120-180K estimate and sold for $260K ($325K w/p – the painting last sold in 2006 for $90K). Several pricey works did not find takers; among them were a work on paper by Gericault (est. $250-350K), Collier’s The Laboratory (est. $150-250K), and Boldini’s tiny L’Amica del Marchese (est. $200-300K).

The sale originally included 25 works, but by sale time, a Tissot (est. $400-600K) and Waterhouse ($300-500K) were withdrawn, so they only offered 23 works. Of those, 15 found buyers (65.2%), and the total achieved was $5.34M ($6.34M w/p) … their presale estimate range was $5.58-8.51M, so they needed the buyer’s premium to reach it. Going a little deeper, we find that 7 sold below, 5 within, and 3 above their estimate ranges; this left them with an accuracy rate of just 21.7%.

I went back to the comparable sale in October 2019, that one totaled $17.5M, far more than the 2020 edition; however, while that sale included a similar number of works (24), only 9 sold, and most were very expensive paintings: a Waterhouse for $4.7M, Rossetti for $3.5M, and a Bouguereau for $3.6M. This time around, they could not get a group of multimillion-dollar paintings. I guess some people are just not ready to take their chances at auction.

19th Century European – Sotheby’s Mid-Level Sale

By: Howard

When I first saw the Sotheby’s sale (and we did physically view it), I knew they would have a tough go – there were very few outstanding works. A few years ago, they moved their major 19th-century sale from the October/November time slot to January/February. So, these October sales contained mid-level works. I said ‘sales’ because it took place in two parts, two days apart, but I have combined them to give a fair comparison to last year’s sale (they had one auction in 2019).

As we have seen in previous sales, the auction rooms are having difficulty obtaining high-quality material in this genre. There were even several works that we had the opportunity to purchase directly from the owners and decided to take a pass. I will add that they did have a few nice paintings in their collection… we bought those! Anyway, on to the results. (w/p = with the buyer’s premium)

As we have seen in previous sales, the auction rooms are having difficulty obtaining high-quality material in this genre. There were even several works that we had the opportunity to purchase directly from the owners and decided to take a pass. I will add that they did have a few nice paintings in their collection… we bought those! Anyway, on to the results. (w/p = with the buyer’s premium)

Taking the number one spot was a ‘not too great’ looking Sir Alfred Munnings titled Five Racehorses with Jockeys. The painting was estimated to bring $200-300K and hammered down at $140K ($176.4K w/p). In second and third were works by Corot. Collines et pâtures des environs de Saint-Lo was expected to bring between $150-200K and sold for $120K ($151.2K w/p), while Un Torrent des Abruzzes made $110K ($138.6K w/p) on an estimate of $150-200K. As you can see, while the top three lots did find buyers, none of them reached their presale estimate range.

In the fourth, fifth, and sixth places, we had a three-way tie. Courbet’s Paysage Franc-Comtois or Le Vallon Vert (est. $100-150K), Corot’s A Corner of the River with Houses and Poplars (est. $40-60K), and Millet’s Portrait of George Roumy, Uncle of Pauline Ono (est. $15/20K) each hammered at $80K ($100.8K w/p). I was surprised by the prices paid for the Corot and Millet.

Other than Paul Huet’s Salt Marshes Around Saint-Valèry in Sum, Picardie that hammered at $65K ($81.9K – est. $20-30K) and Georges Picard’s Sous l’Arbre Rose that made $32K ($40.3K w/p – est. $6-8K), most of the other works did not fare too well. Several pieces failed to find buyers (and that was no surprise to me as their estimate or condition were a hindrance); among them were Arthur Chaplin’s Floral Still Life ($80-120K), Frederick Bridgman’s Woman of Algiers on a Balcony (est. $60-80K), and Munnings’s Gypsy Caravan (est. $150-250K).

By the end of the first session, of the 67 lots offered, 39 sold (58.2% sell-through rate), the total hammer price was just $1.694M ($2.135M w/p), and the low end of their estimate range was $2.48M … so even with the buyer’s premium added in, they fell short. Of the 39 sold works, 20 were below, 9 within, and 10 above their presale estimates; this left them with an accuracy rate of 13.4%.

The second session added another 84 works. Of those, 54 found buyers (64.3% sell-through rate) and garnered an additional $437K ($547K w/p). The low end of the estimate range was $598K, so this one fell a little short too. Here, 32 went below, 7 within, and 15 above their projected ranges, leaving them with an accuracy rate of 8%.

Combining the two parts resulted in 151 works offered, 93 sold (61.6% sell-through rate), a total of $2.131M ($2.68M w/p), and an accuracy rate of 10.6%. The low end of the presale range was $3.08M … so they were short. To drive home the point that these were nothing more than general 19th-century sales – the top lot was only expected to bring between $200-300K (which it did not), there were 126 works carrying estimates that did not exceed $50K at the top end, and of those, 117 did not exceed the $30K level, and 51 were below $10K.

With everything being offered online (without the expense of hard copy catalogs), it is far easier for the salerooms to offer just about anything they can get their hands on. Like they say — throw it against the wall and see what sticks!

I also looked back at the October 2019 sale that had 162 lots and a total (w/p) of $1.69M … so when compared to last year’s sale, this one did a bit better: $14K per lot sold in 2019 vs. $17.7K per lot sold in 2020 – a 21% improvement. But to really put the offerings into perspective, in their January 2020 sale, the top lot (an Alfred Munnings) brought $3.14M, a million more than all the lots in this sale. In fact, the top three lots in January made almost exactly what the October 2019 and 2020 sales combined made: $4.36M vs. $4.37M. Guess we need to wait for their January 2021 sale to see if they can source any top-end works.

Christie’s –19th Century – Part II

By: Howard

On the 16th, Christie’s presented Part II of their 19th-century works, and it was a continuation of a difficult situation — lack of good quality material.

Taking the top spot was Francois-Joseph Navez’s Two Italians. The painting was estimated to bring $40-60K and sold for $100K ($125K w/p) … this seller was one of the happier ones. Hendrik Reekers’ Still Life with Summer Flowers took second at $70K ($87.5K w/p – estimate $80-120K), and a collaborative work between Corot and Jules-Antoine Demeur, Arleux-du-Nord—le bord des clairs, took third place at $60k ($75k W/P – est. $40-60K). Rounding out the top five were a small, sketchy, Corot – La Rochelle – un coin de la cour de la – that brought $48K ($60K w/p – est. $60-80K), and in fifth, there was a tie between two sculptures: A Batacchi’s Innocence Tormented by Love and Jean-Baptiste Carpeaux’s Aurora were each expected to bring between $30-50K and hammered at $42K (52.5K w/p).

Only three works in this sale achieved prices above their estimate range, the Navez mentioned earlier, as well as a tiny (6.25 x 8.625 inch) Sanchez-Perrier landscape, A Midday’s Rest, at $20K ($25K w/p – est. $8-12K), and Jozef Israels’s Mending the Nets at $30K ($37.5K w/p – est. $15-20K). On the other side of the coin, many works did not find buyers (I know that condition issues and high estimates were the main stumbling blocks). Among them were a small Lhermitte (est. $80-120K), a Paolo Sala (est. $80-120K), an Elsley (est. $100-150K – this one had condition issues), and a de Schryver (est. $120-180K). There was one result that left me wondering… lot 27 was a 30 x 19-inch nude by Julius Leblanc Stewart. The painting was estimated at $80-120K and sold for $11K ($13.8K w/p). So, the question now is: was their estimate way off, or did someone get the bargain of a lifetime? Guess we will find out when it comes up for sale again.

By the time the 62 lot sale was over, just 27 works found buyers (43.5% sell-through rate), and the total take was $659K ($820K w/p) … the low end of their estimate range was $1.89M … so they were WAY short (still an understatement). Of the 27 sold works, 18 were below, 6 within, and 3 above their presale estimate ranges; this left them with an accuracy rate of just 9.7%. Yikes.

Christie’s –Post-War And Contemporary Day Sale

By: Amy

Christie’s Post-War and Contemporary Day Sale was a full-day event for me as I began watching it at 10:00 am, and there were still six lots to go when I left the gallery at 5:35 pm. Unfortunately, there was really nothing exciting about the sale, and when all was said and done, one painting and one shiny sculpture stole the show.

Christie’s Post-War and Contemporary Day Sale was a full-day event for me as I began watching it at 10:00 am, and there were still six lots to go when I left the gallery at 5:35 pm. Unfortunately, there was really nothing exciting about the sale, and when all was said and done, one painting and one shiny sculpture stole the show.

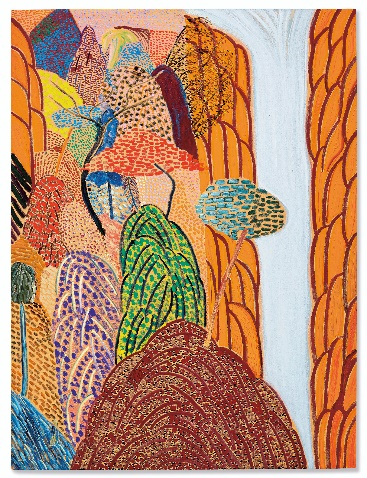

The top lot, and first show stealer, was Matthew Wong’s (1984 – 2019) Shangri-La (2017), which far surpassed the estimate of $500-700K when it hammered down at $3.7M (4.47M w/p) … setting an auction record for the artist. Wong was a Canadian artist dealing with Tourette’s syndrome and depression and took his own life just last year in October 2019. In second place was Ed Ruscha’s (b. 1937) City, With Marbles estimated at $2.5 – 3.5M and hammered a little below, at $2.2M ($2.67M w/p).

Coming in third was that shiny sculpture I mentioned earlier; a sterling silver work by Takashi Murakami (b. 1962) titled Oval Buddha Silver (a cartoonish and new interpretation of the religious leader). The work is number one from an edition of 10 that was executed in 2008; it measures 53 ¾ x 31 ¾ x 30 ¾ inches and lived up to its stature when it sold for $1.5M ($1.83 w/p), well past the estimate of $400-600K.

I do want to mention one piece, mostly because I found it intriguing. The piece was created by the artist Ben Gentilli; however, it was cataloged as ‘by Robert Alice’ (the name of the artistic project Gentilli created to promote visual works based on blockchain).

The series will include 40 hand-painted pieces, 20 of which have already been sold by the artist to private collectors. Gentilli decided that the remaining 20 works would be sold publicly; the first one presented in this sale. This is the first time a work by the artist has been up at auction, and the first time Christie’s has sold a work related to cryptocurrency and blockchain. Titled Block 21 (42.36433 ° E) (From Portraits of a Mind), it was created from 24-carat gold leaf, suspended pigment and acrylic on canvas laid down on a panel, and Non-Fungible Token (NFT). In case you are wondering what an NFT is, here is what I found on Wikipedia – A non-fungible token (NFT) is a special type of cryptographic token which represents something unique; non-fungible tokens are thus not mutually interchangeable. This is in contrast to cryptocurrencies like bitcoin, and many network or utility tokens that are fungible in nature. Understanding this, is way beyond my pay grade!

The artist used special machinery to engrave the 40 paintings, each with over 300,000 digits of the intricate 12.3 million digit code that launched Bitcoin; he then went on to paint each digit by hand. Gentilli explained that by creating each work with just a portion of the code, no one collector will have the entire code. In addition, the work includes an OpenDime hardware key (a device that allows you to store and spend your Bitcoins – if you have any). While I was unable to find any information about what the private collectors paid for their pieces, I am sure they are all thrilled when the piece bolted past the estimate of $12-18K and sold for $105K ($131K w/p).

There were a number of pricier works that could not find a new home; among them were works by Motherwell (Black Open with Ochre – est. $600-800K and Untitled – est. $400-600K), Alex Katz (Kristen – est. $400-600K), Keith Haring (Untitled – est. $350-450K), Damien Hirst (Naja Nivea – est. $350-550K), Franz Kline (Untitled – est. $480-680K), and Gottlieb (Green Halo – est. $250-350K).

When the sale ended, of the 254 works offered (there were 4 withdrawn), 190 sold, leaving them a sell-through rate of 74.8%. The final result of $29.4M hammer was towards the lower end of the estimate range, but when we add in the buyer’s premium, the total came to $36.5M – falling just in the middle of the presale estimate of $28.8M – $42.3M.

Seeking Clarity – Contemporary Curated At Sotheby’s

By: Lance

It is getting to the point where auctions go out of their way to add a layer of opacity to the results, seemingly in an effort to make it more difficult to analyze their sales… I assume the underlying reason is to make poor results less obvious; I mean let’s be real, the good results are all over the place, including various other media outlets trying to get your clicks with flashy headlines… but for the people that simply want to get a clear picture of the market and what is happening, the supposed public pricing of auctions is becoming less visible. Once in a while, you’d come across a mysteriously missing auction record and wonder if it was intentional, but now merely utilizing the ‘big auction house’ websites are more and more difficult – aside from the Contemporary Curated (New York) sale not having a press release, they also did not offer a results sheet/top 10 (which they always used to offer), nor could you even sort the lots in order of price realized on the sale page… the only options are by lot number or by estimate. Even their high-end Contemporary Evening sale in London didn’t get a press release and the unsold lots were completely removed from the web! Auctions have historically helped set market pricing as well as offered a certain level of transparency into the art world… that is becoming less and less the case. Now that I’ve gotten that out of the way, let’s get to the sale at hand…

The Contemporary Curated sale at Sotheby’s earlier this month featured nearly 250 lots of mid-level Contemporary works, with estimates ranging from just $4-6K all the way up to $2.2-2.8M (though only 3 lots actually had estimates above $1M). As expected, the top lot was Kenneth Noland’s Ember which came in with that $2.2-2.8M estimate… with the premium, the work achieved $2.56M – the work had been in a private collection since 1977. After that was a work by Kerry James Marshall that vastly outperformed… The Wonderful One, considered to be a seminal work by the artist, utilizes many of the characteristics that would define the artist’s career. It was only expected to bring between $500-700K, but ultimately found a buyer at $1.77M. Rounding out the top three was another overachiever… Barkley Hendricks’ Latin From Manhattan… The Bronx Actually, was expected to bring $700K-1M, but topped that with $1.47M.

There were a handful of other works that greatly outperformed expectations… the biggest surprise came late in the sale as Shepard Fairey’s Obama Hope achieved $600K on a $50-70K estimate; more than 8x the high end! There was also an Alexander Calder that smashed its $40-60K estimate when a bidder pushed it to $440K; more than 7x the estimate. A slew of other works has nice performances too… a Romare Bearden topped $770K on a $150-200K estimate; an Edward Clark achieved $576K on a $100-150K estimate; Calder’s Spotted Butterfly sold for $151K on just a $30-40K estimate; a work by Damien Hirst sold for $1.2M on a $250-350K estimate; a Marca-Relli sold for $428K on an $80-120K estimate; and a work by Cecily Brown found a buyer at $441K on a $90-120K estimate. In fact, 111 total works of the 249 topped their estimate (4 works were withdrawn, so there were really only 245 “available” lots).

There were quite a few unsold lots as well… the most significant was Robert Indiana’s Iconic LOVE, which was expected to bring $1-1.5M. There were also no takers on works by Ruth Asawa ($300-400K), De Kooning ($300-400K), Sam Francis ($180-250K), Botero ($200-300K), Haring ($500-700K) and Christopher Wool ($700K-1M). In all, there were 60 works left unsold giving them a 75.5% sell-through rate.

The sale as a whole totaled $30.6M, which is towards the top end of the $22.9-32.5M range… remember, the sale total includes premiums added on to each sold lot, so those premiums (fees/commissions) really padded the number to make up for all the unsold work. At the end of the day, what is more useful information to gauge the market – seeing a sale total near the top end of the estimate range, or knowing that 25% of the material did not sell? These two accuracies tell very different stories on the success of the sale. It is no wonder they are being careful what information they present to their viewers these days.

Sotheby’s Impressionist & Modern

By: Howard

On October 28, Sotheby’s presented two sales, a Contemporary one followed by the Impressionist & Modern (which we will cover here). By the time the sale began, four works had disappeared, so the featured 36 lots. This review will also illustrate how inaccurate some of these online art valuation companies can be. Giacometti took the lead here when his Femme Leoni (est. $20-30M) hammered at $22.6M ($25.92M w/p – the piece also had an irrevocable bid, so it was guaranteed to sell). Van Gogh’s Fleurs dan un Verre squeezed into second when it hammered down at $13.9M ($16.24M w/p – est. $14-18M … this painting last sold in 2000 for $4.63M, and in 1998 it made $4.07M … so a nice return for the seller, but just below the estimate range). In a close third was de Chirico’s Il Pomeriggio de Arianna at $13.6M ($15.9M w/p – est. $10-15M). Rounding out the top five were Magritte’s L’Ovation at $12M ($14.05M w/p – est. $12-18M), and Man Ray’s Black Widow that brought $4.8M ($5.78M w/p – est. $5-7M).

Giacometti took the lead here when his Femme Leoni (est. $20-30M) hammered at $22.6M ($25.92M w/p – the piece also had an irrevocable bid, so it was guaranteed to sell). Van Gogh’s Fleurs dan un Verre squeezed into second when it hammered down at $13.9M ($16.24M w/p – est. $14-18M … this painting last sold in 2000 for $4.63M, and in 1998 it made $4.07M … so a nice return for the seller, but just below the estimate range). In a close third was de Chirico’s Il Pomeriggio de Arianna at $13.6M ($15.9M w/p – est. $10-15M). Rounding out the top five were Magritte’s L’Ovation at $12M ($14.05M w/p – est. $12-18M), and Man Ray’s Black Widow that brought $4.8M ($5.78M w/p – est. $5-7M).

The day before the sale, we received an email from one of these all-knowing art valuation companies discussing the Man Ray work and what they believed was the accurate valuation … and I quote: Given this work’s uniquely desirable characteristics and the ARTBnk Values of the works from this series, the ARTBnk Value for Black Widow (Nativity) is in the range of $12m. If we feel that the pandemic has reduced the overall Man Ray market and we use the ARTBnk Values produced from the median of the bottom 80% of returns we get an ARTBnk Value of $10.3m. Considering the work only sold for $5.78M, I would have to say that they were way off!… or as ArtBnk goes on to say A result below $10.3m, which appears to be the expectation from Sotheby’s, would indicate either a significant drop in the market value of the entire series of paintings or an ineffective sales strategy on the part of the auction house… I guess Sotheby’s needs to step their game up.

Unlike many other sales, this one had no unsold lots (they called it a white glove sale). When you consider the following, you will see why they (on the surface) had a 100% sell-through rate. First, three lots were withdrawn from the sale before it started (preventing them from going unsold). Then, of the 36 lots offered, 21 sold below their estimate range; some were way below, like a Botero for $900K (est. $1.5-2M), a Miro from the Brooklyn Museum at $950K (est. $1.2-1.8M), and a Braque at $420K (est. $800K-1.2M). And finally, seventeen of the pieces had guarantees on them – so there was no chance they would not sell.

By the end of the session (which took a pretty long time as the bidding on some of the top works went in $100K increments and bidders took a long time to place their bids), of the 36 sold works, 21 went below, 9 within, and 6 above their expected ranges. The sale’s total was $119.1M hammer ($141.1M w/p), and the low end of their range was $111M … so they did make it.

Opacity In The Auction Market Gets Greater And Greater

By: Howard

The first part of the October 28th evening sales at Sotheby’s featured their Contemporary offerings, plus a piece of furniture and three Alfa Romeos! Now you, like me, might think this makes no sense, but for the auction rooms, it gives them a way to generate better results for these higher-end sales. As we all know, a year from now, most people will never remember that the millions generated from a particular sale included items that were not classic works of art – you know, cars, tables, dinosaur bones, etc. And when the press raves about the final results, most people do not realize that ‘other’ things were among the works being sold.

I started watching this sale at lot 29 (a Tansey that went unsold). So for all of the later lots, I had the hammer prices; but for the early ones, it is tough to figure out what the works hammered for (you know, before the buyer’s premium). First, there are the various rates charged at different price levels (25%, 20%, 13.9%), plus the additional 1% B.S. charge (wonder when the buying public will say ENOUGH?). Then, any works purchased by guarantors (who get a piece of the action, so they receive a discounted price if they buy a work), it takes a math wiz to figure it out … way too much time for me. So, we will be using hammer and/or selling price with the buyer’s premium (w/p) for this review.

Driving slowly, but taking the checkered flag, were the set of three Alfa Romeo’s B.A.T. 5, 7, and 9d, which date from the early 1950s (so, if they were not going to offer them in an automobile sale, the least they could have done was sell them in the Modern section). The lot carried a $14-20M estimate (the second highest in the sale) and sold for a hammer price of $13.25M ($14.84M w/p). It was interesting to note that the buyer’s premium for automobiles is just 12%. Why do they only charge a 12% commission for cars and more complex/ higher premiums for other items? They did not even charge the additional 1% on this lot. Coming in a distant second was Calder’s mobile Sumac 17 at $8.3M w/p (est. $6-8M), this same work last sold in 2016 for $5.77M, so I am guessing that the seller was happy. In a close third was Basquiat’s Black at $8.1M w/p (est. $4-6M). Rounding out the top 5 were Frank Stella’s Untitled (I always love these creative titles) that was supposed to bring $5-7M and sold for $8.08M w/p, and Basquiat’s Jazz at $6.93 w/p (est. $4-6M).

Coming in a distant second was Calder’s mobile Sumac 17 at $8.3M w/p (est. $6-8M), this same work last sold in 2016 for $5.77M, so I am guessing that the seller was happy. In a close third was Basquiat’s Black at $8.1M w/p (est. $4-6M). Rounding out the top 5 were Frank Stella’s Untitled (I always love these creative titles) that was supposed to bring $5-7M and sold for $8.08M w/p, and Basquiat’s Jazz at $6.93 w/p (est. $4-6M).

There were a couple of failures in the sale, lot 29 (which I mentioned above), and the ‘star’ lot of the sale, Mark Rothko’s Untitled (Black on Maroon). This painting carried a $25-35M estimate and failed to garner a single bid. The work last sold in 2013 for $27M, and it appeared (from the triangular-shaped symbol next to the description) that Sotheby’s now owns this lot … so that seller was not happy!

Along with the unsold lots, the Baltimore Museum, at the last minute, decided to pull two of the lots they were going to offer – a Brice Marden ($10-15M) and Clifford Still ($12-18M). It was reported that along with the general outcry from the public, two former members of the museum’s board were very upset and rescinded their planned gifts to the museum – the stated value was $50M! Guess the money talked! There was also a large Warhol (Last Supper) from the museum being offered privately … that was put on hold.

By the end of the 41-lot sale (which took a couple of hours to complete), 39 lots found buyers, for a total take of $119.7M hammer ($142.9M w/p). The presale estimate range was $128.2-142.8M, so they fell short until you add in the buyer’s premium.

The Rehs Family

© Rehs Galleries, Inc., New York – November 2020