COMMENTS ON THE ART MARKET

This will be a busy summer for us; the gallery will be participating in 2 shows.

The first is a new one (for us) – The Newport Antiques Show - and takes place in Newport, Rhode Island, from July 25 – 28. As we get closer to the show, I will send on more information.

Then we will be back at the Baltimore Summer Antiques Show from August 22 – 25 … complimentary tickets will be sent as soon as they are available.

The Stock Market

Well, who can complain? Not me! Things are moving along at a very nice pace … yeah, I know, it will all come to an abrupt end at some point and I will probably wish I had sold out weeks earlier. However, right now I am going to get out the longboard and ride this bomb until the wipeout ... because we all know that will happen at some point!!

I will start off by telling you that I sold off Apple. Bad news for me, since I took a loss, but good news for all of you since once I sell, the stock usually goes up! As for my other favorites: Altria ($36.44 Down), JP Morgan ($54.67 Up), Emerson ($57.27 Up), Chevron ($125.49 Up), Exxon ($92.08 Up), GE ($23.64 Up), Berkshire B ($113.03 Up & Bought more), AT&T ($35.91 Down), VOD ($29.33 Down), Verizon ($49.57 Down), Wal-Mart ($76.23 Down) and Coke ($41.40 Down), MCD (Sold it) and DuPont ($56.02 Up). Right now I do not even have a least favorite stock since all of them are in the black.

My Take on the Contemporary Market

Alyssa Rehs

I think the best way to describe the contemporary art market now, was best said by the infamous, quirky, and unpredictable painter, Pablo Picasso:

"The world today doesn't make sense, so why should I paint pictures that do?”

That’s exactly how I felt after spending hours touring the auction houses earlier last month. I could not believe my eyes. Not only did the art not make sense, but the prices were incomprehensible. Two black rectangles painted over a red canvas estimated to fetch $15,000,000-$20,000,000 and chewed bubble-gum and candy wrappers set to fetch $600,000 - $800,000 -- BOGGLES MY MIND!

The last thing I want to do is insult anyone, so forgive me in advance if you happen to be the one of the individuals who bought those pieces, but how does someone find it suitable to put their money in such art? Can chewed bubble-gum even be considered art? Or has the meaning of art changed so drastically in the past few decades that there is no true definition of it now? Art that reaches such drastic prices like these six, seven, and eight figured pieces need to have some background and depth, right? I guess it would be pretty awesome to say, “Oh yes, this is Timothy Jahn’s paintbrush stuck to canvas with his chewed hubba-bubba gum, it’s $10,000,000. Oh you’ll take it? Wonderful! SOLD!” HA! And trust me, I am not trying to toot-my-own-horn, but the detail and technique I see every day walking into my gallery is light-years ahead of what was sold at the contemporary auctions, and that’s putting it nicely.

I do enjoy abstract art, and we even sell it at the gallery, but there is a limit how far you can push the boundaries of the art world until there is no coming back, and the auction houses were prime examples of that burst. Artists should aspire to be remembered in the way Michelangelo, da Vinci, Caravaggio, and Gentileschi will always be remembered and admired…not by how many colorful dots they fit on a canvas.

Till next month!

Art Basel Hong Kong

Lance Rehs

The last weekend in May saw the inaugural Art Basel Hong Kong (ABHK) fair and it is important to take a look at not only the results, but the overall turnout and response. As Asian communities continue to develop we can clearly see a strong art market emerging and Art Basel Hong Kong gives us a glimpse into that world.

Let me start off with some of the bigger names (and bigger sales) from ABHK. Galerie Gmurzynska sold a number of works by Fernando Botero totaling $3.5 million with the most expensive being Quarteto which fetched $1.3 million from a Malaysian collector. Victoria Miro (UK) and Ota Fine Arts (Singapore) presented Yayoi Kusama’s work and sold 18 pieces – prices for some of the individual works reached $2 million. Tina Keng Gallery sold Wang Huaiqing’s Chinese Emperor for $2.6 million. I could go on about the “big” sales that were made at ABHK but I am sure it will seem unimpressive after reading about this month’s contemporary auctions.

Long story short, Art Basel Hong Kong 2013 was quite successful, drawing as many as 60,000 visitors over the weekend to view works from 245 galleries (35 countries) representing over 3,000 artists. Director Magnus Renfrew, who was the director of ART HK (the fair that ABHK took over), promised that half of the exhibiting galleries would be from east of Istanbul and he delivered, sort of. While there were certainly a large number of Asia-based galleries, several publications commented that there were relatively few galleries that had a presence in Hong Kong itself; in fact there were only 26 and many of them were new to the scene. While there was a clear effort to include Asian galleries, ABHK had to choose the “right ones,” leaving many to believe it will be up to the galleries to raise their standards so they can better compete with Western galleries for space. Even collectors noted that there was an abundance of Western art and it seems to be a common thought that Western art already has it’s platforms around the world, therefore places like Hong Kong and Singapore should be the platform to promote Asian art. At the same time, several media outlets commended ABHK for its incredible management and spacious displays as compared to its predecessor, ART HK. It was described as less crazy than sister fair Art Basel Miami Beach and significantly less stuffy than Art Basel Switzerland; but it had a clear and expected Asian twist. This is the first time many of the participating galleries have exhibited in Hong Kong, or possibly Asia altogether, so several made an attempt to “establish their brand” by showing a familiar mix of their most representative artists to their new Asian clients.

The Art Basel brand will do a great deal for Hong Kong as it rises to be Asia’s official art hub and positions the city to be a mandatory destination for collectors, curators and critics in the art world.

Go Yanks! (Knicks L)

Really?

Amy Rehs

I hope everyone had a very happy Memorial Day Weekend and may the summer ahead of us be warm and sunny J!

There were some wonderful antiquities that recently made their way through the auctions and I was astounded at the prices they made, well above their estimates. To begin, there was an Achaemenid glass phiale, circa 5th – early 4th century B.C., a beautiful pale greenish colored bowl with a flared rim and decorated with twelve tear shaped lobes. The bowl, a mere 7 7/8 inch diameter, dates back to the ancient Persian Empire (over 2500 years ago) made £481,250 ($727,797)…the estimate was £30,000 - £50,000.

A prominent London dealer is now the proud new owner of an Egyptian granodiorite falcon from the late Ptolemaic period, circa 4th century B.C. Standing on a rectangular base, the 17 inch long falcon was finely modeled and executed, with prominent eyes and clearly defined facial markings, a characteristically short, sharp beak, and long talons. The polished granite statue sold for £1,125,875 ($1,749,610) soaring high above the £100,000 - £150,000 estimate ... really!

And, a Sri Lanka Temple Moonstone dating from the late Anuradhapura Period, 10th-early 11th century, was discovered being used as a step in a Devon garden in the UK. Originally the stone was brought to the UK by a Scottish engineer that worked in Sri Lanka from 1915-37 (that was some size souvenir to bring home, LOL!) The stone is 8’9” wide and weighs about 1500 pounds. It is a semi-circular form, depicting a series of carved bands containing from the outer edge, a band of forked tongues representing fire, a band of animals representing the four corners of the earth - the elephant, the horse, the lion and the bull, a band containing a raised and delicately carved wavy vine on a dense bed of curling leafs, a band of swans plucking vegetation, a band of water lily petals with their ends curled upwards and in the center, a half lotus flower. It was an intense bidding war, as eleven people were involved in trying to purchase the stone. When the hammer fell, the lucky new owner paid £553,250 ($836,185) on an estimate of £20,000-£30,000; guess that consignor was really happy!

The Art Market

As we rolled into May, the press was abuzz with the idea that by the end of the month some $1.3B worth of art was going to be sold … the real question was: would the salerooms be able to pull it off? Boy would they!

The month’s action started off with the Impressionist and Modern sales (which gave the $1.3B goal a nice jump start), while the 19th century took a few blows to the jaw and got themselves out of the ring by the skin of their teeth.

On the evening of May 7 the auction action began at Sotheby’s and it was hot and heavy. Taking the top position was Cezanne’s Les Pommes at $41.6M ($25-$35M). Now this was a nice painting, but when I first saw it I was not bowled over and I think Souren Melikian’s comments sum it all up … There are far greater still lifes that include apples in the French Impressionist’s oeuvre. … It rose to $41.6M, a staggering figure for a picture which, attractive as it is, does not really belong in the league of superlative museum acquisitions. Coming in second was Modigliani’s L’Amazone from 1909 … not done in the classic Modigliani style, but it still reached a great price of $25.9M (est. $20-$30M) and in third was a Fauvist landscape by Braque that made $15.8M (est. $10-$15M – this same painting last sold in 2000 for $3.085M, not a bad return).

When the evening ended, of the 71 works offered, 60 sold (84.5%) and the total take was $230M (the upper level of their presale estimate was $235.1M) and the combined total for the top ten works was $150.2M which is about 65% of the sale’s total (please remember that the estimates do not include the buyer’s premium while the individual results and overall sale totals do).

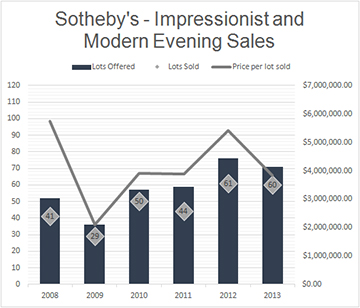

The chart below displays the evening results from Sotheby’s for the past 6 years – Lots offered vs. sold and the Price per lot sold:

The following morning they presented their Day Sale and here again the results were pretty good. Taking top position here was a rather sketchy (ok … Impressionistic) landscape by Renoir that sold for $1.93M (est. $1 - $1.5M). In second we saw a Pissarro at $1.8M (est. $700-$900K) and in third was a Manet watercolor that brought $1.27M (est. $150-$250K). In fact, all of the top ten works either met or beat their presale estimates.

At the end of this long session 360 works were offered and 288 (80%) found new homes for a total take of $58.3M. When we combine the two sessions, we find that of the 431 works offered, 348 sold (80.7%) and the total reached $288.3M. This sale alone gave a great jumpstart to the $1.3B goal.

That same evening Christie’s offered their selection of Impressionist and Modern works and the mood was a little different … while watching the sale I commented that it was a rather lackluster event. Now do not get me wrong, they did well (for what was offered) but the frenzy of the night before was missing.

Taking the top slot here was Chaime Soutine’s La petite patissier which sold for $18M (est. $16-$22M). In second we saw Marc Chagall’s Les trios acrobats reach $13M (est. $6-$9M) and in third was an Egon Schiele that made $11.3M (est. $5-$7M). Rounding out the top 5 were Miro’s Peinture which brought $10.99M (est. $10-$15M … this one last sold in 1996 for $1.32M … a 43.09% annual return) and a Picasso at $9.2M (est. $8-$12M).

When the evening was over, 47 works were offered and 44 sold (93.62% -- real nice) for a total of $158.5M; not as high as the competition, but they offered far less material. Now when you figure out the average price per lot sold, Sotheby’s was $3.8M versus Christie’s $3.6M … so they were close. Just for fun, here are a couple of additional resale results that we found interesting (courtesy of my son … the finance major). Picasso’s Femme assise en costume rouge sur fond bleu made $8.5M (est. $7-$10M, it last sold in 1995 for $662,500 ... giving it an annual return of 65.92%); Picasso’s Homme et femme brought $6.06M and last sold in 2010 for $5.35M (a 5.84% annual return) and Monet’s Chemin brought $5.16M (est. $2-$3M), in 1991 it sold for $770K (a 25.94% annual return).

The chart below displays the evening results from Christie’s for the past 6 years – Lots offered vs. sold and the Price per lot sold.

![]()

.jpg)

The next day Christie’s offered their lower level works – HA HA … lower level. Taking the top two positions here were works by Renoir: Femme lisant dans une clairiere made $1.68M (est. $400-$600K) and Baigneuses brought $904K (est. $400-$600K). Taking the third spot was a Henri Manguin at $868K (est. $400-$600K). At the end, 264 works were offered and 208 sold (79%) for a total take of $31.77M.

When we combine Christie’s evening and day sales the totals were 311 lots presented with 251 finding new homes (80.7%) and a total of $190.27M. Now for the week’s total and comparisons to previous years:

2013 - 742 works offered, 599 sold (80.8%) for a total take of $479M

2012 - 658 works offered, 519 sold (78.9%) for a total take of $514M.

2011 - 653 works offered, 502 sold (76.9%) for a total take of $399M

2010 - 651 works offered. 527 sold (80.9%) for a total take of $593M.

2009 - 425 works offered, 85% sell-through rate, total take of $208M

2008 - 687 works offered, 75% sell-through rate, total take of $598M

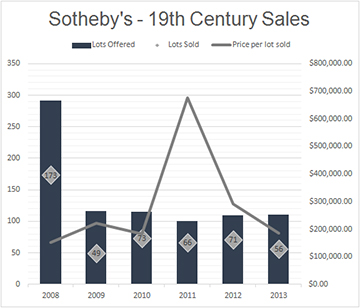

During the Impressionist week Sotheby’s presented their 19th century European painting sale and as I have been saying for a long, long, time … we need a 19th century week. I know they keep saying there is plenty of cross-over, but after more than 30 years in the business I know there is very little. People who collect Bouguereau, Vibert, Dupre, Knight, etc. are rarely the same people who collect the Impressionists (ok … there are some, but not many).

I do have to point out that both salerooms have been doing a great job of cutting down the size of their sales; and I would like to think that it was because of all my complaining. However, what is adding to their smaller sales is the fact that very few really good works from the period are coming to the auction block … at least not enough for all the sales they currently produce (remember, not only are there 19th century sales in the US, but they have plenty in the UK and other countries). With the lack of quality material surfacing and the market being very particular when it comes to quality, condition, period, etc. these sales are not doing very well … at least in terms of what they were expecting.

We saw the poor results at Christie’s last month (not enough good material and some serious overestimating) and a similar fate befell this sale … though it did do a little better.

Taking the top position here was Jean Beraud’s Leaving Montmartre Cemetery (not the best subject in my opinion … but it was an early piece and very well done) which brought $953K (est $600-$800K – this same work sold back in 1999 for $498K). In second was Bouguereau’s Moissonneuse at $797K (est. $600-$800K – this one last sold in 1989 for $120K) and in third was Courbet’s Nu Couché at $725K (est. $600-$800K). There were a few additional works that looked real nice and did rather well … Del Campo’s Gondoliers on the Grand Canal brought $377K (est. $100-$150K), Grimshaw’s The Tryst reached $677K (est. $250-$350K) and Vibert’s The Committee on Moral Books made $167K (est. $60-$80K). From those results all seems well and good, but …

On the flip side there were quite a few paintings that just did not pass muster and were left in the unsold section (which was rather deep). These included works by Troyon, von Blaas, Bouguereau, Stevens, Cucuel, Boldini, Conder, Ernst, Gerome, Bridgman, Poynter, Moreau, Alma-Tadema and Courbet, to name a few.

At the end of the day 111 works were offered and 56 sold (about 50%) and the total take was $10.4M (presale estimate was $12.9 - $18.5M) … not a very good sell-through rate or grand total. It is becoming more and more obvious that you just cannot throw anything you want at the 19th century market. This is not the Contemporary market where you can literally toss crap or bubble gum at a canvas and it will sell. Buyers are looking for great quality works that are in great condition and priced right. Offer ‘stuff’ and you are going to be left with the ‘stuff’ and a heavy buy-in rate … it is as simple as that.

The chart below displays the evening results from Sotheby’s for the past 6 years – Lots offered vs. sold and the Price per lot sold. It shows an amazing decline in the size of their sales since the heyday of 2008:

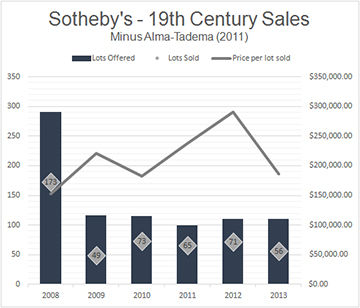

We should also add that the 2011 sale included Alma-Tadema's The Meeting of Antony and Cleopatra which made $29.2M. If we remove this one-hit-wonder the chart would look like this:

And now on to the HEAT … sorry, FIRE!!

I really do not know how to explain the action in the Contemporary market this past month … it was nothing less than surreal. The amount of money spent for some of the really important works was astronomical (and maybe, just maybe, a few were worth it); however, there were large sums spent on other pieces that made me ask – are people crazy? Do they really understand the word ‘art’? How can something like that be worth anything? And it is really important to remember that I have a pretty opened mind when it comes to what is and is not art.

First and foremost keep the following in mind: while things go up, they also come down. Absent from all of the evening sales were works by Damien Hirst. Just a few short years ago he was all the rage; regularly filling up the evening sales and bringing prices in the single and double digit millions ... in fact, in September 2008 there was an entire sale devoted to his work at Sotheby’s in London (and it made a record price … wonder what some of those pieces would bring today?). This time around, the only works seen (4) were in a Day Sale … you know, the lower priced pieces (and in the contemporary market that is a real laugh -- lower priced works!) and they sold between $28K and $965K (the highest being one of his ‘butterfly’ works … just a few short years ago they were selling in the $1.5-$2.5M range). I am sure the question on every Hirst owner’s mind is – will his market ever come back to those levels? Your guess is as good as mine.

Anyway, back to the sales at hand and I will start with the preview at Christie’s. I walked into the room with my daughter and we were hit by this large elephant lying on the ground. As we walked around the piece we saw a white barricade (you know, a piece of wood supported by plastic A frames – the kind you police use to block off the road). My daughter asked if they put that there to stop people from getting close to the elephant; and I chimed in that she should read the card on the wall. It was a work of art (ok, they called it art) and we both walked away laughing and wondering if anyone would actually buy that for the $60-$80K estimate – stupid us (or them), of course they would … it made $68,750. Then we entered the main room and quickly noticed a well-dressed ‘private’ buyer being led around by their ‘art consultant’. What made this so amusing is that the ‘buyer’ seemed to have no idea or understanding of the works they were seeing – they walked around with a questionable look in their eyes; occasionally taking a second look and then reading the descriptions. On the flip side, the art consultant just babbled on and on about the artists and how amazing the works on view were. Give me a break. Look, if you do not understand why you are buying a canvas with bubble gum stuck to it, then you probably shouldn’t be buying it – and on a serious note, I have no idea why I would buy a canvas with bubble gum on it … so I do not buy them!! Now, on with the craziness.

The action started on Monday evening with a charity auction which Leonardo de Caprio hosted to raise money for environmental issues. The sale was expected to bring in about $18M and ended up grossing $38.8M. Works by 33 artists were included in the sale and many were created specifically for the sale … top price was Mark Grotjahn’s Untitled which made $6.5M and Zeng Fanzhi’s The Tiger brought $5M. Now we all need to remember that this was a charity event and there were tax deductions for part of the sale prices … so we cannot use these numbers for real comparisons to the work’s true value.

Tuesday evening, at Sotheby’s, saw the beginning of the battle between the two main rooms … the question on everyone’s mind was: who would be victorious (ok, who would really bring home the big bucks)? Well, taking the top position here was Barnett Newman’s Onement VI at $43.8M (est. $30-$40M). In second we saw and early Richter – Domplatz, Mailand – hit a record $37.1M (est. $30-$40M) and in third was an Yves Klein sculpture that reached $22M (est. upon request --- guess they just were not sure).

Now not everyone was happy that evening … especially the sellers of two works by Koons – his Hoover sculpture (which consisted of 4 different Hoover vaccums in an acrylic case) which carried a $10-$15M est. failed to sell; as did his Wall Relief with Bird ($6-$8M). In addition, a collaborative work by Warhol and Basquiat failed to find a taker (est. $2-$3M).

By the end of the evening, 53 of the 64 works offered sold (82.8%) and the total take was $293.6M – WOW! To put that into a little perspective, the week before, all the sold works (348) at Sotheby’s Impressionist and Modern sales only reached a measly $288M – and that was a pretty strong total!

On Wednesday the Day Sale took place and there were some pretty good results as well … top prices included Ellsworth Kelly’s Red Over Yellow at $3.97M (est. $1.5-$2M), Robert Ryman’s Versions VI at $3.1M (est. $600-$800K) and Calder’s Untitled at $2.63M (est. $800-$1.2M). By the end of the session, 340 of the 455 works offered sold (74.7% -- not great), but the total take was $83.8M … which was one of the highest totals they have achieved for a Contemporary day sale.

When combined, the totals for Sotheby’s were 519 offered and 393 sold (75.7%) and a total of $377M … another big boost to the $1.3B goal … we are now just $405M away --- a big number considering none of the individual sale hit that number … but something HUGE was on the horizon.

Wednesday evening Christie’s presented their Contemporary works and the results were scorching … and I do mean scorching. Taking the number one spot was Pollock’s Number 19, 1948 at $58M (est. $25-$35M - It should be noted that back in 2007 a Pollock was sold privately for a reported $140M, so $58M is not an over-the-top price for one of his works), in second, Lichtenstein’s Woman with Flowered Hat brought $56M (est. refer to dept.) and third place was taken by Basquiat’s Dustheads at $48.8M (est. $25-$35M) … all three of which were auction records.

By the end of the session … which was amazing to watch … of the 77 works offered, 66 sold (94.3% - nice) and the total take was $495M – Holy Moly! Guess the $1.3B goal was now in the rearview mirror and fading fast. I need to add that the top 10 lots (7 of which sold for more than $20M) garnered $304.9M … the competition’s entire Evening sale generated $288M. I guess we know who the winner of this match was … and they still had the Day Sale!

The following day the festivities continued with prices for the right works hitting the ceiling. Wayne Thiebaud’s Reflected Landscape made $2.8M (est. $700-$1M), Noland’s Untitled (1958/9) made $1.97M (est. $400-$600K), Bourgeois’s sculpture Pillar made $1.68M (est. $1.2-$1.8M), another Thiebaud, this one titled Sandwich, brought $1.56M (est. $900-$1.2M) and Sam Francis’s White brought $1.45M (est. $700-$1M). When the two sessions were done … and it was a long day … of the 491 works offered, 380 sold (77.4%) and the total hit $104.8M.

As you can tell, the Christie’s sessions were just mindboggling. In all, they racked up $638.6M in sales and brought the two week total to about $1.5B.

Now for the combined Contemporary sale numbers and comparisons

2013’s combined total was $1.02B – (we have now eclipsed the 2008 numbers)

2012’s combined total was $882M

Where the market goes from here is anyone’s guess!!!

Final Thoughts

The sales discussed above are just some of those which took place this past month … there were many others all over the world and I am sure if we added all of them together, we would be well past the $2B mark. I also typically include the American results, but this volume is already way too long so we will post that review on our blog early next week … I will let you know that the results were mighty impressive.

I really wish I could tell you what all this means; other than people are really into buying art in a big way. The overall numbers amaze everyone I speak with and that includes other dealers. Prices being paid for certain works at the auction end of the market are nothing short of amazing; but it is really important to remember that not everything is doing well (some works are not selling) and certain artists are no longer in the limelight (Damien Hirst is a great example of a fall from grace). Buyers need to be very careful while traveling the art market jungle, there are many traps and pitfalls along the way, and let’s not forget the Kings of the jungle who are just waiting to pounce on the unsuspecting. I have said this before; you need to find the right guide. Enjoy the journey, but watch your step.

Howard L. Rehs

© Rehs Galleries, Inc., New York - June 2013

Gallery Updates: Pleased to say that we are now on our summer schedule. For the month of June the gallery will be open Monday – Thursday … we really need a little time off!

Web Site Updates: More art has made its way to new homes this past month; among them were paintings by Ridgway Knight, Lesur (2), Cortes, Jahn (2), Wood (2), Harris (3), Combes, Hollingsworth, Bauer, Koeppel, Suys, Rogers, Rodriguez, and Garlick.

Next Month: Hopefully a much shorter newsletter!!!