COMMENTS ON THE ART MARKET

April Showers Might Bring More May Hours

Finally, Spring is here! The birds are chirping, the flowers are blooming, and the rain is falling … all good signs. Now, all we need is for the thermometer to stay in the 70-degree range! On top of all that, news that many people are finally vaccinated adds to the excitement. While there is a lot of positive news, we have decided to continue with our current gallery hours: Tuesday – Friday from 10 am – 5 pm for April. As always, we are happy to come in on Saturday, Sunday, or Monday if that is more convenient for you.

____________________

Upcoming Online Exhibitions

Bite Size - our small works exhibit will begin this Thursday, April 1st, featuring a wide variety of paintings that all measure 12 x 12 inches or less. Among the included artists will be Stuart Dunkel, Lucia Heffernan, David Palumbo, Tony South, Todd M. Casey, and many others – 20 artists in all, with more than 70 available pieces. With such a diverse mix of artists, there is sure to be a little something for everyone. These small, affordable works are a great way to continue building your art collection or get started altogether! And there should be no excuses from those seasoned collectors who are running out of wall space… this is the perfect event to fill in those nooks and crannies with little gems to cherish for years to come.

____________________

Stocks

By: Lance

For some strange reason, it seems like some of the craziness surrounding the stock market settled down; but in reality, we continue pushing record highs and see intense volatility in the tech sector. A fresh record for the Dow was achieved this past Monday (the 29th) as it hit 33,259 before retreating just a bit to close the month at 32,983.99. We usually don’t touch on the other major indices, but the S&P 500 also hit a record high of 3,3994.41 on the final day of the month, though it ultimately closed at 3,973.15. And the Nasdaq, which is known to be tech-heavy, experienced a rather choppy month but ended up closing things out at 13,246.87 (about 1,000 points off the high seen in mid-February), which was not far from where it started – 13,454.55.

The Euro and Pound weakened relative to the dollar, now sitting at $1.17 and $1.38, respectively. Crude hovered in the $60 range, opening at $62.43 and closing out at $59.32. Gold futures remained relatively stable through the month, finishing off at $1,708.60, though that is still a long way from where we started the year – in fact, it was the biggest quarterly decline in over 4 years.

Perhaps the only reason it seemed like things settled down was because everyone was busy trying to figure out what the heck an NFT, or Non-Fungible Token, is… we will get to that later. As far as the good ol’ fungible tokens – Bitcoin continued its anxiety-inducing ascension to glory as it topped $60,000 for the first time; starting the month around $45,000 and quickly climbing to a high point of $61,788.45 on March 13th, then abruptly dropping to the $50,000 range and bouncing back to close the month at $58,917.23. If you’ve been sad theme parks are closed due to the pandemic, perhaps you should buy some bitcoin and enjoy the ride! Ethereum followed suit, though it did not top the high of $2,041.42 seen in February; it is currently rallying in the right direction as it sits at $1,932.13. Of the big 3, Litecoin is furthest off its high, currently at $196.10. Last month I included a few lesser-known cryptocurrencies, so to keep things consistent – in March, Bitcoin Cash gained 10.6%, Stellar Lumens lost 2.25%, and Civic saw a gain of 52%! Ah, yes, and Dogecoin, the runt of the Crypto world… a paltry 10.7% gain for the month – I guess I won’t be retiring from the gallery as soon as I thought.

And now for my stocks… again, I am not endorsing an investment in any of the following, and with these kind of numbers I’m not sure anyone would follow me anyway if I was endorsing them (sad times)… Airbnb (ABNB – month -4); American Well Corporation (AMWL – monthly return -33%); Aurora Cannabis Inc. (ACB – month -16%); Beyond Meat, Inc. (BYND – month -14%); Blink Charging Co. (BLNK – month +3%); Churchill Capital Corp IV (CCIV – month -26%); Canopy Growth Corp. (CGC – month -7%); Cronos Group Inc. (CRON – month +13%); FuelCell (FCEL – month -19%); Fisker Inc. (FSR – month -35%); Nikola Corp (NKLA – month -25%); QuantumScape Corp (QS – month -23%); Under Armor, Inc. (UAA – month -4%); and Zomedica Corp. (ZOM –month -23%). Mostly losers, better luck next time.

__________________

Tales from the Dark Side

By: Alyssa

The Serial Swindler

The Inigo Philbrick art scandal (here are a couple of our earlier posts on the matter: Inigo Philbrick - More Art World Greed, Kenny Schachter Duped by Inigo Philbrick) is getting more complex. It now seems that Peter Klimt, a British entrepreneur who created the now defunct Dawnay Day, is claiming that he owns 50% of a Rudolf Stingel painting that many other investors are claiming ownership of. In fact, there are numerous works that Philbrick sold multiple times, including paintings by Basquiat, Wool, and Picasso... in all, it seems he generated over $20 million.

What I am most interested in, is how our legal system will handle this mess. Philbrick needs to face some serious jail time, and not just a year or two... decades!

Really, Another Person Leaves Works In A Parked Car?

Charges of fraud have been brought against Ioan Bolborea, a 65-year-old sculptor from Romania nearly ten years after his work was unveiled; and this is not the first time the work has made the news. Bolborea was commissioned to complete a series of sculptures from 2005-2016, and back in 2012, the Bucharest municipality installed one of them in front of their National History Museum – the work was publicly ridiculed, with even the museum’s curator stating it was of “doubtful artistic quality.”

Now to make matters worse, in 2017, the sculpture suffered damage, at which point it was determined that the materials used were brass, not bronze, as agreed. As a result, the artist has been charged with defrauding the Bucharest municipality of €3.7M ($4.5M).

Interestingly, the artist is defending himself by stating that “brass gives a beautiful patina… the costs are the same, sometimes brass is even more expensive [than bronze].” He goes on to claim that the Romanian authorities are “trying to pin all sorts of crap on me” due to legal disputes…

I wonder what his defense is for the poorly executed statue at the center of the controversy?

Since the discovery, three additional monuments by the artist are being investigated by authorities.

____________________

Really?

By: Amy

Yard Sale Treasure

With a bounty of treasures, galleries and auction houses presented works of art and collectibles during Asia Week New York, which took place from March 10th -20th. One of the treasures offered was a rare Yongle period blue and white "floral' bowl that someone with an astute eye purchased at a Connecticut yard sale for just $35.

With a bounty of treasures, galleries and auction houses presented works of art and collectibles during Asia Week New York, which took place from March 10th -20th. One of the treasures offered was a rare Yongle period blue and white "floral' bowl that someone with an astute eye purchased at a Connecticut yard sale for just $35.

Experts believe this small, 6-inch bowl was created during the Yongle Emperor's reign (1403-1424), the third ruler of the Ming Dynasty. It was a period noted for its distinctive porcelain techniques. The bowl was made in a lotus shape and decorated with intricate patterns of lotus, peony, chrysanthemum, and pomegranate flowers. It is one of only seven known similar bowls to exist. The other six are in museums, such as the National Palace Museum of Taipei, the British Museum and the Victoria & Albert Museum in London, and the National Museum of Iran in Tehran.

The small bowl had a sizeable estimate of $300 – 500K, which did not deter four bidders from fighting it out; the hammer fell at $580K ($721K w/p). Wow, more than a sixteen-thousand times return on investment...someone had a great day! So now that spring is here, and many are doing their spring cleanup, this may inspire you to really hunt for that rare find!

Sacha Jafri Creates a Painiting as Big as His Heart

When it too big, too much - apparently not when your heart is in the right place. According to Guinness World Records, a recently created painting that just sold is the world's largest and one of the most expensive sold by a living artist. The work was auctioned off in Dubai last month.

Sacha Jafri, a British artist, created the work over seven months during the Covid-19 pandemic; he completed it last September. Jafri incorporated the artwork of children from over 140 countries to make the giant painting, which ended up being seventy individual sections.

Sacha Jafri, a British artist, created the work over seven months during the Covid-19 pandemic; he completed it last September. Jafri incorporated the artwork of children from over 140 countries to make the giant painting, which ended up being seventy individual sections.

He titled the painting The Journey of Humanity which measured over 17,000 square feet. Jafri intended the artwork to be sold in segments.

He hoped all the segments would raise $30M, which would be donated to different children's charities, helping those affected by covid-19 and supporting children's health, sanitation, education, and digital connectivity in areas it is most needed. Charities that will receive some much-needed funds are UNICEF, UNESCO, the Global Gift Foundation, and Dubai Cares.

The piece(s) surpassed his expectation when they sold to one collector for $62M. The Journey of Humanity is now the fourth most expensive work by a living artist. Artists who have garnered more at auction are Jeff Koons' Rabbit - $91.1M, David Hockney's Portrait of an Artist (Pool with Two Figures) - $90M and the most recent sale of Beeple's Everydays: The First 5000 Days, as you all must know by now, it's the NFT that sold for $69.3M.

The new owner of The Journey of Humanity is Andre Abdoune, a French national currently living in Dubai and runs a cryptocurrency business, no surprise here. Abdoune is now part of an elite group of collectors of Jafri's work; they include Barack Obama, Sir Richard Branson, Paul McCartney, Leonardo DiCaprio, Bill Gates, Madonna, David Beckham, George Clooney, and Eva Longoria.

____________________

The Art Market

By: Howard, Lance & Amy

Well, the auction action ramped up in March; so, this month, we have picked several (ok, many) sales from different periods to review. Also, there is a new player in the market – NFTs. Many people are having difficulty understanding what they are, how they work, etc. So, Lance has been doing some research and will create a few posts, over the next few weeks, about them. His first is included below. Will these works stand the test of time, only time will tell.

Understanding the NFT Market

By: Lance

By now, I am sure many of you have gotten wind of the new "fad" sweeping the crypto community - NFT's. And for those who have not heard of NFT's, do not fret… it seems most people still do not understand them, so you are not too far behind.

Well, what is an NFT? NFT stands for Non-fungible token. And to be sure I am not losing anyone – fungible, or fungibility, refers to a good or asset's ability to be interchange with another good or asset of the same kind. The easiest way to think about it is money – my dollar can be exchanged for your dollar, or my five single dollars can be exchanged for your five-dollar bill. It does not matter if the corners are creased, if there is a slight tear, or if one is 25 years older. A dollar is a dollar unless we are talking about bills that have been deemed collectibles (but let's not convolute this too much yet). Compare that to two of the same baseball cards – one may have creased corners or a tear… in this case, two of the same item are not interchangeable as they hold different values.

Building on that, a baseball card is a great way to understand NFT's… minus the whole "physical card" part, but hey, this is 2021! We're practically living in the future; who needs physical cards anymore?! So, an NFT is essentially a digital collectible; that is the easiest way to think about it. The neat thing about it being digital is that we are not restricted to simply using an image. Here is a great example - NBA TopShot offers collectors the ability to buy digital cards NFT’s that feature video highlight clips of their favorite players in specific memorable moments of their career.

That brings us to the inevitable question of… umm, can't I just go on YouTube and watch the same highlight? Well, yes, yes you can, but just the same, you can go online and look up a picture of a Michael Jordan rookie card. The desirability is two-fold – for the sake of collecting and owning the desired item and in the hopes that the asset appreciates over time (becomes more desirable).

Great, so why does the art world care about any of this? Excellent question, Lance! Well, as you may already know, many artists work in digital mediums. NFT's provide an incredible infrastructure for buying and selling digital artwork, but most importantly, the system is built on the Ethereum Blockchain. By creating an NFT on the Ethereum Blockchain, the underlying code serves as an authenticator and tracks the change of ownership – think of it like provenance. The code will point to various details such as when the work was created or published, who the creator (artist) is, and who the current owner is, which gives credibility and confidence to buyers and sellers.

While there is much promise surrounding NFT’s as they relate to the art world, and more broadly the collectables world, there also appears to be some concern and hesitancy as with any new technology… that said, I do not want to overwhelm you or convolute this difficult-to-digest subject, so I will leave it at that for this month. But I plan to follow up in the next newsletter with more information and updates on this new, booming market.

Christie's White Glove Works On Paper Sale In New York

By: Howard

The month's first sale took place on the 1st, and I was a little surprised by the number of lots offered – just eight. Guess that is what you might call a curated sale; actually, the works all come from one collection! (unless otherwise noted, prices are hammer; w/p = with the Buyer's Premium)

As expected, taking the top honors was van Gogh's La Mousmé which carried a $7-10M estimate and hammered for $8.8M ($10.436M - w/p). George Seurat's little drawing, La voile blanche, hammered at $3.8M ($4.59M - w/p – est. $2.5-3.5M). Third place was nabbed by Magritte when his Journal intime brought $3.1M ($3.75M - w/p – est. $2.5-3.5M … this same work was sold for $356K in 2002 – nice return).

As expected, taking the top honors was van Gogh's La Mousmé which carried a $7-10M estimate and hammered for $8.8M ($10.436M - w/p). George Seurat's little drawing, La voile blanche, hammered at $3.8M ($4.59M - w/p – est. $2.5-3.5M). Third place was nabbed by Magritte when his Journal intime brought $3.1M ($3.75M - w/p – est. $2.5-3.5M … this same work was sold for $356K in 2002 – nice return).

There were a few additional works that performed well, among them were Neapolitan School (17th C.) Venus at the Forge of Vulcan that hammered at $37.5K ($47.3K w/p – est. $5-8K), Martin-Ferrières’ Place du Tertre sous la neige at $18K ($22.7K w/p – est. $4-6K), and Valentin de Boulogne’s Étude pour Le Martyre de Saint Procès et Saint Martinien at $62.5K ($78.8K w/p – est. $20-30K).

Typically, we would round out just the top five, but we will give you all the results since there were only eight works in the sale. Henry Moore's Two Sleepers in the Underground sold for $2.6M ($3.15M - w/p – est. $1.5-2.5M), while Lucien Freud's Self-portrait made $1.8M ($2.19M - w/p – est. $1.8-2.5M). Then there was Matisse's Nu couché (the largest work in the sale – 15 x 20 inches) which made $470K ($588K - w/p – est. $300-500K), August John's Head of a Girl - $390K ($488K - w/p – est. $200-300K … it last sold in 1997 for $168K), and bringing up the rear was Jean-Louis Forian's Au café at $72K ($90K - w/p – est. $50-70K … this work brought $64K in 2006).

By the end of the short session, of the eight works offered, all sold (100% sell-through rate), and the total take was $21.032M ($25.3M w/p). The presale estimate range was $15.85 - $22.87M; so, they almost reached the upper end, and with the buyer's premium, they beat it. Four of the works sold within and four above their estimate ranges, leaving them with an accuracy rate of 50%! So this was quite a successful sale.

Man Ray, Christie's, And Due Diligence

By: Howard

This week, Christie's (Paris) offered an extensive collection of works (188 lots) by Man Ray that were in the possession of Lucien Treillard – an assistant of Man Ray. Before the sale started, the Man Ray Trust released a statement asking that the sale be halted and raised concerns about ownership. The Trust is calling into question 148 of the 188 lots, and they believe that Treillard "stole a substantial number of Man Ray's works and possessions immediately following his death."

According to The Art Newspaper article, the Trust also claims that "at least 36 photographs bear a fraudulent stamp" allegedly fabricated by Treillard. "Having not been consulted by Christie's," the Trust was "alarmed by the sheer scope and size of this sale, which offers not only fine art photographs by Man Ray, but also unique contact prints, personal correspondence and artworks by Marcel Duchamp and Max Ernst."

Christie's stated that "nothing has been provided that would give grounds to challenge the legality of the sale," and they would not "offer any work on sale if it had any reason to think that there any issues for the works."

And now for the actual sale (all prices include the buyer's premium)

The overall results were pretty impressive, and taking the top spot was a set of 9 gelatin silver contact prints titled Erotique voilée from 1933. The group was estimated to bring €50-60K and made €312.5K ($377K). Coming in second was a Dark green imitation leather covered wooden and cardboard box containing 68 miniature replicas and reproductions of works by Marcel Duchamp, from an edition of 30, that carried a €200-300K estimate and sold for €275K ($331K). The third spot was held by Les doigts d'amour de Main Ray, la ligne, la couleur, la forme, l'espace, l'air, 1951, a rayograph, enhanced with ink, that was expected to bring between €50-70K and made €187.5K ($226K). Rounding out the top five were Les Trois pêchés, a painted wooden box, synthetic peaches, and cotton, at €175K ($211K - est. €20-30K), and À quoi rêvent les jeunes..., adhesive strips on four glass plates mounted in a wooden stand, brought €150K ($181K - est. €50-70K). To some, myself included, it might seem a little funny that four pieces of glass with some black tape on them could even sell, let alone bring more than $180K; but think of all the people spending millions on baseball and basketball cards. Those are just small cardboard pieces with a printed image on them, and many are not unique.

Most sales have a flip side, the works that fail to find a buyer; however, this was a White Glove sale -- that means of the 186 lots offered, all sold. Obviously, that gave them a sell-through rate of 100%; it cannot get better than that. The low end of the presale estimate range was €1.79M, and the sale generated €5.93M ($7.15M), more than three times what was expected.

Of course, the wild card here is the Trust. Will they take legal action? If so, it will be a real mess. We will keep you updated as more information becomes available.

Winston Churchill Made All The Difference

By: Howard

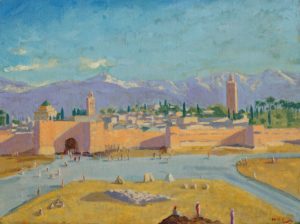

On the evening of March 1, Christie’s presented a small sale of Modern British art which included works by Lavery, Moore, Hepworth, and Sir Winston Churchill.

Taking the top spot was Sir Winston Churchill’s Tower of the Koutoubia Mosque that Angelina Jolie was selling. The painting was only 18 x 24 inches, but had excellent provenance (initially, Churchill gave the painting to President Franklin Roosevelt) and carried an estimate of £1.5-2.5M. When the bidding battle ended, the new owner paid £7M/$9.73M (£8.29M/$11.5M w/p) – an auction record for the artist. Henry Moore’s Maquette for King and Queen (a 10 ½ inch high bronze) took second place when it sold for £2.5M/$3.5M (£3.02/$4.2M w/p). Third place saw a larger (24 x 36 inches) Churchill work – Scene at Marrakech – that hammered at £1.55M/$2.15M (£1.88M/$2.6M – est. £300-500K); Churchill gave this painting to Field Marshal Bernard Law Montgomery (man, I wish my grandfather was a friend of Churchill). Rounding out the top five were Churchill’s St. Paul’s Churchyard, which did nothing for me, but I guess the buyer of the other two needed this one as well and ended up paying £880K/$1.22M (£1.08M/$1.5M – est. £200-300K); and Barbara Hepworth’s Square Forms made £750K/$1.04M (£923K/$1.3M – w/p).

Taking the top spot was Sir Winston Churchill’s Tower of the Koutoubia Mosque that Angelina Jolie was selling. The painting was only 18 x 24 inches, but had excellent provenance (initially, Churchill gave the painting to President Franklin Roosevelt) and carried an estimate of £1.5-2.5M. When the bidding battle ended, the new owner paid £7M/$9.73M (£8.29M/$11.5M w/p) – an auction record for the artist. Henry Moore’s Maquette for King and Queen (a 10 ½ inch high bronze) took second place when it sold for £2.5M/$3.5M (£3.02/$4.2M w/p). Third place saw a larger (24 x 36 inches) Churchill work – Scene at Marrakech – that hammered at £1.55M/$2.15M (£1.88M/$2.6M – est. £300-500K); Churchill gave this painting to Field Marshal Bernard Law Montgomery (man, I wish my grandfather was a friend of Churchill). Rounding out the top five were Churchill’s St. Paul’s Churchyard, which did nothing for me, but I guess the buyer of the other two needed this one as well and ended up paying £880K/$1.22M (£1.08M/$1.5M – est. £200-300K); and Barbara Hepworth’s Square Forms made £750K/$1.04M (£923K/$1.3M – w/p).

There were a few other good results; among them were Sir John Lavery’s The Viscountess Castlerosse, Palm Springs that was expected to bring £400-600K and hammered at £700K/$937K (£863K/$1.2M – w/p)... this painting last sold at auction in 1997 for $63K, so that was a happy seller! Sir Michael Craig-Martin’s With Red Shoes was expected to sell between £60-80K and brought £260K/$361K (£325K/$451K – w/p), and Hepworth’s Three Round Forms made £480K/$$667K (£599K/$832K – w/p) – this same bronze last sold in 1988 for $77K … another happy seller.

By the end of the sale, of the 34 works offered, 33 sold (an impressive 97% sell-through rate), and the total take was £21M/$29.3M (£25.6/$35.6M). The presale estimate range was £9.06-14.28M, so they easily beat that. Of the 33 sold works, 7 were below, 11 within, and 15 above their estimate range, leaving them with an accuracy rate of 32.4% -- which is not terrible.

As we have seen with many other sales, all it takes is one or two bidding battles to make any sale a real success … at least if you are just looking at the overall numbers. In this case, three paintings by Churchill made all the difference.

Beeple Hits The Jackpot!

By: Howard

On March 11, Christie’s sale of Beeple’s (Mike Winkelmann) Everydays: The First 5,000 Days (2021) NFT ended at a record-shattering and mind-boggling price of $69,346,250! According to the ARTnews article, Christie’s reported that among the bidders, 55 percent were based in the U.S., 27 percent in Europe and 18 percent in Asia, with 64 percent of those participants in the Millennial and Gen Z age group (under 40 years old). Someone needs to explain to me how that is possible? It seems there is way too much money out there.

On March 11, Christie’s sale of Beeple’s (Mike Winkelmann) Everydays: The First 5,000 Days (2021) NFT ended at a record-shattering and mind-boggling price of $69,346,250! According to the ARTnews article, Christie’s reported that among the bidders, 55 percent were based in the U.S., 27 percent in Europe and 18 percent in Asia, with 64 percent of those participants in the Millennial and Gen Z age group (under 40 years old). Someone needs to explain to me how that is possible? It seems there is way too much money out there.

Is Beeple the equivalent of van Gogh, Rembrandt, Picasso, Cezanne, and da Vinci? Guess time will tell if this is real or just a flash in the pan!

Impressionist and Modern Art - Sotheby's, New York

By: Howard

On March 11, Sotheby’s New York presented their first Impressionist and Modern Art sale for 2021; it was an online-only event, and bidding was open from March 1 through the 11th -- at 2pm on the 11th, lots began to close in one-minute increments. The works offered were quite a mixed bag of ‘goodies’ as estimates ranged from just $300 to $120,000; included were, as Sotheby’s stated, “accessible works on paper offered without reserve by artists of the twentieth and twenty-first centuries as well as excellent examples of the School of Paris.” (w/p = with the buyer's premium)

The top lot in the sale was a work by Tsugharu Foujita (1886 – 1968) titled Les Roses (1951). It was a rather small painting, just 9 ½ x 7 ½ inches, that carried an estimate of $60-80K and sold for $160K ($201.6 – w/p). Taking second place was a relatively recently created work by Jean-Pierre Cassigneul (b. 1935) titled Le Compotier (2014), which was estimated at $80-120K and sold above the high estimate at $140K ($176.4 w/p). Third place honors went to a giant crustation by Bernard Buffet (1928 – 1999) titled Le Homard (1958) with an estimate of $80-120K; it hammered down right in the middle at $100K ($126K w/p). Three lots tied to round out the top five (ok, six), these included Louis Valtat's Femme cousant Dans le Jardin (est. $60-80K), Jean Dufy's La Seine au pant du Carrousel (est. $30-50K), and Camille Bombois' Après-midi au parc (est. $10-15K). All three sold for $70K ($88.2K w/p).

The top lot in the sale was a work by Tsugharu Foujita (1886 – 1968) titled Les Roses (1951). It was a rather small painting, just 9 ½ x 7 ½ inches, that carried an estimate of $60-80K and sold for $160K ($201.6 – w/p). Taking second place was a relatively recently created work by Jean-Pierre Cassigneul (b. 1935) titled Le Compotier (2014), which was estimated at $80-120K and sold above the high estimate at $140K ($176.4 w/p). Third place honors went to a giant crustation by Bernard Buffet (1928 – 1999) titled Le Homard (1958) with an estimate of $80-120K; it hammered down right in the middle at $100K ($126K w/p). Three lots tied to round out the top five (ok, six), these included Louis Valtat's Femme cousant Dans le Jardin (est. $60-80K), Jean Dufy's La Seine au pant du Carrousel (est. $30-50K), and Camille Bombois' Après-midi au parc (est. $10-15K). All three sold for $70K ($88.2K w/p).

I will add that I was happily surprised to see a work by Hugues Claude Pissarro garner so much interest. The painting was estimated to bring $7-9K and hammered down at $25K ($31.5K w/p). And while it was a bright and colorful work, it did not have the complexity of many of his other works - case in point, the one we are currently offering in the gallery... and no, I am not sorry for the blatantly apparent sales pitch ;-)

https://rehs.com/Hugues_Claude_Pissarro_Bateau_mouche_sur_la_Seine.html

We often talk about how the condition of a work impacts its value; however, sometimes poorly conditioned items somehow find buyers at auction (I guess people just do not read the condition reports or simply do not care). Lot 74 was a small painting (15 x 18 inches) by Maurice de Vlaminck titled Coin de village. The condition report read as follows:

The canvas is not lined. There is scattered craquelure to the center of the sky at the upper edge, including lifting, flaking, and losses to the pigment which requires consolidation by a restorer. There are two areas of pigment loss to the center left of the composition and some minor losses to the extreme edges, caused by frame abrasion. Under UV light: a thick varnish makes the surface difficult to read. There is extensive re-touching to the upper right quadrant and throughout the sky of the composition, notably to the left of the house with corresponding paint loss. The painting is in fair condition.

We would never purchase a painting like this as it has flaking, losses, extensive re-touching throughout the sky, etc... mind you, they conclude that the painting is in "fair condition" (read as "we cannot in good faith say this is in good condition, what else can we say that doesn't sound awful"). The work was estimated to bring $35-45K, and while it did not reach that range, it did sell for $25,200. Why would anyone buy this? It seems like a total waste of $25K, plus it will cost thousands of dollars to restore it... oh well.

In the end, the sale did very well - the initial overall estimate was $1.525 – 2.184M, and it came very close to the high end before the premiums were added in --- $2M ($2.521M w/p). With just 4 out of 96 not selling, it had a 96% sell-through; one of the best I have seen in a while.

A Colorful Day For The The Scottish Colourists

By: Howard

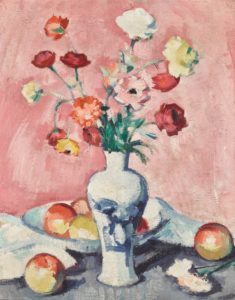

On the 17th of March, Sotheby's presented a group of works by the Scottish Colourists from the Harrison collection – all of the paintings were acquired by Major Ion Harrison almost 100 years ago.

Some of you might be wondering, who were the Scottish Colourists? Simply put, they were four artists - Francis Cadell, John Duncan Fergusson, Leslie Hunter, and Samuel Peploe. Their Post-Impressionist style of the 1920s and 30s would have a significant influence on future Scottish artists. (unless otherwise noted, all sold prices include the buyer's premium)

Taking the top spot was lovely still life by Peploe titled Carnations and Ranunculus. This 20 x 16-inch work was estimated at £250-350K and sold for £560K ($780K). Francis Cadell's Carnations (12 x 9 inches) made £499K ($695K) on a £120-180K estimate, and Peploe's Street in Cassis brought £353K ($491K) on a £100-150K estimate. Rounding out the top five were Cadell's Tree and Houses on the French Riviera at £202K ($281K – est. £60-80K) and George Leslie Hunter's The Harbour, Villefranche at £164K ($228K – est. £60-80K).

Taking the top spot was lovely still life by Peploe titled Carnations and Ranunculus. This 20 x 16-inch work was estimated at £250-350K and sold for £560K ($780K). Francis Cadell's Carnations (12 x 9 inches) made £499K ($695K) on a £120-180K estimate, and Peploe's Street in Cassis brought £353K ($491K) on a £100-150K estimate. Rounding out the top five were Cadell's Tree and Houses on the French Riviera at £202K ($281K – est. £60-80K) and George Leslie Hunter's The Harbour, Villefranche at £164K ($228K – est. £60-80K).

A few lots did not find buyers, but those works were not among the best -- at least from my online observations. Maybe it was just a matter of the best items sold, and the others will find takers another day … when they are not competing against better examples.

The session was a short one as the sale included just 24 works. Of those, 19 sold, giving them a sell-through rate of 79% (not bad). The presale estimate range was £1.39 – £1.98M, and the total take was £2.67M ($3.7M). Of the 19 sold works, 5 were below, 5 within, and 9 above their presale estimates. When we factor in the unsold lots, this left them with an accuracy rate of 20.8%. Happily, for the sellers, about 38% of the sale sold above their range.

As some might know, the presale estimate range does not include the buyer's premium. Since almost none* of the estimates in this sale exceeded £300K (that is when the 26% premium drops to 20%), it was easy to add that into the numbers. So, with the buyer's premium, the presale range was £1.75-2.5M (*one lot had a high estimate of £350K, which means that upper end range has an extra £3,000 due to my basic math*). That means that their total take of £2.67M beat the estimate.

To give you a little more insight into the market for these artists, the current auction record for a Peploe is £903K/$1.53M (that happened in 2014, and the piece was estimated to bring £300-500K). Cadell reached £874K/$1.17M (est. £400-600K) in 2018. George Hunter's Still Life with Tulips and Oranges made £433K/$634K in 2009, and Fergusson's Poise brought £639K/$1M in 2014 – that one carried an £80-120K estimate.

I think this sale is an excellent example of a few things we often talk about. First, the material should be fresh to the market. Since all of these works have been in the same family's collection for close to a century, we can call them fresh! Second, the estimate must be realistic. Third, the painting's condition is a significant factor – and most of these lots were in excellent condition. And finally, too much of the same material will impact the overall results – the fact that there were 24 paintings from the same school of art created an issue for the less than stellar examples.

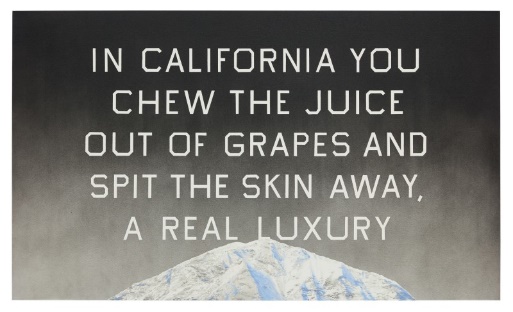

Sotheby’s Curated Contemporary Sale

By: Amy

On March 12th, Sotheby’s New York presented their Curated Contemporary Sale, which featured a diverse group of artists whose work spans the last 70 years. The selection includes artists that exemplify the postwar period to cutting-edge artists of today.

For Sotheby’s Contemporary Curated sales, they invite a guest curator for each sale. Cynthia Erivo, an award-winning actor, singer, songwriter, and author, was the guest curator this time around and she selected 16 of the 135 works initially offered in the sale. Erivo will portray Aretha Franklin in a production which will air on National Geographic titled Genius: Aretha. One of the highlights of the curated sale is a piece by Andy Warhol of Aretha Franklin. So, let’s see how the sale and Aretha did.

Taking top honors was a painting by Ed Ruscha titled California Grape Skins (2009); it was estimated to make $2.2 – 2.8M and came in close to the low estimate, hammering down at $2.35 ($2.87M w/p). In second place was Wayne Thiebaud’s Dark Heart Cake from 2014; it was estimated at $1.8 – 2.5M and again just sold slightly north of the low estimate at $2M ($2.44M w/p). Taking third place was the Aretha Franklin image by Andy Warhol. It was estimated to make $900 – 1.2M but fell short when it sold for $850K (1.05M w/p); it last sold in 2014 for $305K. Alexander Calder’s White Fields (which was a guaranteed lot) took fourth place at $700K ($857K w/p – smack in the middle of its $600-800K estimate); the work last sold in 2018 for $1.095M. I am sure the consignor was not happy with the loss they took. And rounding out the top six were two works that tied – each bringing $600K ($746K w/p). Ed Clark’s Made in Manhattan had an outstanding performance based on the estimate of $80- 120K, and a small work by Marlene Dumas, titled Handy, fell right at the low end of the $600-800K estimate; the piece last sold in 2005 for $443.6K.

In total, there were 126 lots in the sale (9 were withdrawn before the sales started), and it just managed to eclipse the overall estimates of $17.3 – 23.8M as the final total was $19.5M ($25.1M w/p). It had a healthy sell-through rate of 86.5%, and the estimates were on target about 33% of the time – 42% of the works made more than the high estimate, and 30% fell below the low end of the estimate. The next Contemporary Curated sale opens in London in April…too much too soon?

American Art at Sotheby’s

By: Howard

Earlier this month, Sotheby’s offered up a group of American paintings ranging from Hudson River School, to Western, to Impressionist, to Modernist, to Contemporary.

Earlier this month, Sotheby’s offered up a group of American paintings ranging from Hudson River School, to Western, to Impressionist, to Modernist, to Contemporary.

Taking the number one spot, and a surprise to many, was a small (20 x 16 inches) Floral Still Life by Nicolai Fechin that was estimated to bring $100-150K and hammered at $350K ($441 w/p) – I am sure the sellers were delighted. In second was Sanford R. Gifford’s Leander’s Towner on the Bosphorus. This well done 8.5 x 16.5-inch canvas carried a $60-80K estimate and brought $240K ($302.4K w/p) – another happy seller! There was a tie for third place when two bronzes by Remington, The Rattlesnake (est. $80-120K) and The Mountain Man (est. $60-80K), each made $150K ($189K w/p). Rounding out the top five were Andrew Wyeth’s Wash Bucket - $95K ($120K w/p - est. $60-80K), and Milton Avery’s Girl in Stocking Hat - $90K ($113.4K w/p – est. $100-150K).

Several works did better than expected; these included Nicolino Calyo’s American Landscape with Indians ($70K – est. $15-25K), E.M. Hennings’ Sunlit Aspen Grove ($60K – est. $20-30K), Jessie A. Botke’s Pair of Egrets ($48K – est. $10-15K), Emil Bistrram’s Sound Dynamics ($24K – est. $12-28K), and John Whorf’s Brooklyn Navy Yard ($11K – est. $3-5K). And then there were those that found no takers. Among them were works by Wolf Kahn, Everett Shinn, Milton Avery, Emil Carlsen, Alter L. Palmer, and George H. Durrie.

One painting of special interest to us was lot 77 – Guy Wiggins’ St. Patrick’s, Winter (16 x 12 inches). From the photo, it did not appear to be one of his finest works. The lot was estimated at $25-35K and hammered at $50K ($63K w/p) - a pretty nice result! Currently, we have a work by the artist featuring a view of Wall Street; one of Wiggins' most sought-after scenes... not to mention it's already clean and retains its original period frame – have a look: Wall Street Winter. You may note that while both works are the same size, the Wall Street Winter scene offers far greater detail and quality - both important factors when evaluating works of art.

One painting of special interest to us was lot 77 – Guy Wiggins’ St. Patrick’s, Winter (16 x 12 inches). From the photo, it did not appear to be one of his finest works. The lot was estimated at $25-35K and hammered at $50K ($63K w/p) - a pretty nice result! Currently, we have a work by the artist featuring a view of Wall Street; one of Wiggins' most sought-after scenes... not to mention it's already clean and retains its original period frame – have a look: Wall Street Winter. You may note that while both works are the same size, the Wall Street Winter scene offers far greater detail and quality - both important factors when evaluating works of art.

By the sale’s end, of the 105 lots offered, 87 sold, giving them a sell-through rate of 82.8% - not bad. The total take was $2.6M ($3.28M w/p), falling into its presale estimate range of $1.97-2.94M. When looking a bit closer, we discover that 26 lots sold below, 20 within, and 41 above their presale estimate ranges. Also, 18 went unsold, leaving them with an accuracy rate of just 19%.

More Auction Action – Impressionist & Modern, Paris

By: Howard

On the 25th, Sotheby's, Paris, presented a curated group of Impressionist and Modern works of art and the results were pretty good. (all final prices, unless otherwise noted, include the buyer's premium; estimates do not)

For the past month, the art world was bombarded with news about a fresh-to-the-market van Gogh that was coming up for sale. Scène de rue à Montmartre (18 x 24 inches) was created in 1887 and featured one of the three mills in Montmartre – the Pepper Mill. The painting carried a €5-8M estimate and became the top lot in the sale when it sold for €13.1M ($15.4M). But there is more to the story. During the sale, the auctioneer initially sold the work for €13.05M (hammer price) to a telephone bidder but quickly retracted and stated that it sold for €14M to an online bidder. A short while later, they offered the work again, and this time it hammered for €11.25M to the telephone bidder. You may be wondering why? Well, according to an article in The Art Newspaper:

For the past month, the art world was bombarded with news about a fresh-to-the-market van Gogh that was coming up for sale. Scène de rue à Montmartre (18 x 24 inches) was created in 1887 and featured one of the three mills in Montmartre – the Pepper Mill. The painting carried a €5-8M estimate and became the top lot in the sale when it sold for €13.1M ($15.4M). But there is more to the story. During the sale, the auctioneer initially sold the work for €13.05M (hammer price) to a telephone bidder but quickly retracted and stated that it sold for €14M to an online bidder. A short while later, they offered the work again, and this time it hammered for €11.25M to the telephone bidder. You may be wondering why? Well, according to an article in The Art Newspaper:

Sotheby's… contacted the second successful online bidder, "who denied having placed a bid and obviously did not have the financial capacity to bear the price of [of the amount they had bid]", although he or she had been given a paddle prior to the event. "Sotheby's then decided to apply a provision that allows the sale's director, when the sale is not concluded, to cancel it and put the lot back on auction". The auction house says that it had informed all previous bidders and that the final price was "well above the estimate".

According to an anonymous source close to the sale, on the Sotheby's website the online bidder had to increase their bids by almost €1m, while Valette [who was handling the telephone bidder] had been allowed to bid several times in increments of only €50,000.

Since French law is strict on issues like this – when the hammer falls, all sales are final - it will be interesting to see if Sotheby's (or the initial online buyer) will be held responsible for the €2.75M price difference. You can read the full story here: Selling, selling, sold...and sold again. The truth about the bungled sale of a Van Gogh at Sotheby's

Now let us get back to the results. In a distant second was a recently restituted gouache by Camille Pissarro - La Récolte des pois - which was expected to bring €1.2-1.8M and made €3.38M ($3.97M). And in a close third was Picabia's La corrida (Le Matador dans l'arène) – another fresh to the market work – that carried a €1.7-2.5M estimate and sold for €3.15M ($3.7M). Rounding out the top five were a work on paper by Degas - Danseuse au tutu vert – that brought €2.67M ($3.14M - est. €2-3M), and another Picabia - Adam et Ève – that made €1.95M ($2.3M - est. €1.5-2M).

Several works performed well – Raffaelli's Les courses à Jersey made €302K ($355K - est. €50-80K), Le Sidaner's Trianon-sous-bois made €351K ($413K - est. €120-180K), and Degas' Mademoiselle Salle achieved €545K ($641K - est. €250-350K). Then there were works by Moreau (€400-600K), Matisse (€400-600K), Pissarro (€150-200K), and Arp (€80-120K) that did not sell.

By the time the small evening sale ended, of the 33 lots offered, 29 sold, giving them a sell-through rate of 87.8% (nice). The sale was estimated to bring between €19.16-29.9M and brought in €36.54M ($42.9M), so I am sure they were pleased, along with many of the sellers. Of the works offered, 2 sold below, 13 within, 14 above their estimate ranges. When we consider the 4 unsold works, this left them with an accuracy rate of 39.4% -- a pretty solid number.

The Rehs Family

© Rehs Galleries, Inc., New York – April 2021