COMMENTS ON THE ART MARKET

September Hours

As of now, our September hours will be Tuesday through Thursday from 10 am – 5 pm. If you do want to visit the gallery, please call to make an appointment. All visitors are required to wear a mask, and we are providing hand sanitizing stations along with extra gloves and masks for your convenience.

We truly appreciate all the support and positive comments we have received and are looking forward to a time when things are back to normal. Until then, our website is open 24/7/365, and we are always available to answer any questions you may have … be safe and enjoy the final days of summer.

____________________

New York of Bust: A solo exhibition of works by Hammond

Rehs Contemporary presents New York Or Bust, an online-only exhibition of works by abstract artist Hammond. On digital display are more than 30, spanning from 2015 through today, demonstrating the array of styles and color palates he utilizes. More notably, the collective of works embody the life experiences and thoughts of the artist, chronicling everything from love to politics to religion… as Hammond sees it, "I believe it is one of my responsibilities to use my talents as a tool to communicate my opinions, ideas and concerns."

Hailing from the historic Hudson Valley of New York, Hammond was introduced to the arts from a young age. It was not until he was in his mid-30s when he shifted to this current abstract expressionist genre, working more from his subconscious. Ultimately for Hammond, the artwork serves two purposes… it is a conduit for the unexplainable, allowing him to examine his feelings in a deep and sincere way. At the same time, it helps manage the turbulence of life through the process of creation; a process fully within his control, when surrounded by a world of seeming chaos, which is very much out of his control.

Works like Fluffy Bunnies and Toxic, for example, take on this role of resolve in uncertainty… Fluffy Bunnies explores political concerns regarding authoritarian rule, with hidden symbols and gestures throughout the canvas. The title itself serves as part of the artwork, in the sense of distracting. It forces the viewer to look for what they are being told they are looking at, rather than seeing what is right in front of their face. Toxic delves into mental health and self-worth; the artist investigates his physical and emotional surroundings, using linework to mimic geographic markers and invoke the idea of certain objects. Hammond sees it as a reactionary piece recounting the effects of those surrounding him, particularly ones that have not always been positive. As he states, "titles are an important aspect of my work. They alone dictate if I try to control what is seen through suggestion or allow a piece to be open to interpretation."

The creative process for Hammond is not always direct. Oftentimes, works will sit incomplete in the studio for months or even years – but it allows for an evolution… in a sense, he feels his personal growth is reflected in the progression of the work. Take for instance Deep Blue, which began in 2015 and evolved over more than two years… the development coinciding with various life events. The work emerged in 2017 as a cautionary tale – one focused on relationships with both friends and lovers, and the blurring of lines between the two.

While the final result of each canvas may not tell a happy story, there is something about the journey and the completed work that is fulfilling. For Hammond, "the connection to the piece, and the experience of making it, becomes the underlying fuel to do more."

View the exhibit HERE

____________________

In The News

Hammond's Colorful, Gestural, Symbolic Abstractions Convey Profound Emotion And Experience - Natasha Gural-Maiello, spoke with Hammond about his work and our current exhibition – New York or Bust. This Forbes.com article will give you a little insight into the mind of the artist. What inspires him and the meaning behind several of his abstract works. Even if you are not a fan of abstraction, I believe you will enjoy it. Click HERE

____________________

Stocks

By: Howard & Lance

At the end of August, the stock market was still traveling in the 4th dimension; I am wondering when it will either move into the 5th dimension or head back to reality? Strange times. On the last day of the month, Apple's stock split (4 for 1), and Tesla had a 5 for 1 split. I wondered how many other stocks split during the month, so I checked … almost 50! Now I need to add that 40 of those were reverse splits – these included Reservoir Capital Corp (1 for 100), Actinium Pharmaceuticals (1 for 30), Canadian Energy Partners (1 for 25), and Top Ships (1 for 25). I know nothing about these stocks, but I did look up Top Ship. Its 52-week high was $242.75 and is now trading at $1.29. The price chart also showed its Price Performance: -99.22%. Funny how the media never reports on these stocks.

As with last month, the market continued its upward momentum. We closed out July at 26,428 and finished August at 28,430.05 -- that is a 2,002-point gain. The cryptocurrencies also did well - Bitcoin closed at $11,688.46 (up $329.99); Litecoin finished at $60.95 (up $2.79); Ripple ended at $0.2802 (up $0.0255); and Ethereum closed at $432.82 (up $88.19). Nice!

The Euro and Pound continued to strengthen against the Dollar - $1.19 (up $.02) and $1.3367(up $0.0291), respectively. Crude Oil is continuing its uphill climb, closing at 42.78 (up $2.41), and Gold lost $14.30 to close at $1,975.40. And now for my stocks:

JP Morgan ($100.19 – up $3.59), AT&T ($29.81 – up $0.22), Verizon ($59.17 – up $1.79), Wal-Mart ($138.85 – up $9.45), Disney ($131.87 – up $14.89 – who needs amusement parks!), Intel ($50.95 – up $3.22), Apple ($129.04 – up $22.78 – price adjusted), Microsoft ($225.53 – up $8.97), Bristol-Myers ($62.20 – up $3.54), Pepsi ($140.06 – up $2.40), Eaton Corp. ($102.10 – up $5.57), Comcast ($44.81 – up $2.01), and American Express ($101.59 – up $8.27), Bank of American ($25.74 – up $0.85). I also added two stocks to the portfolio Twitter (bought at $37.93 – closed at $40.58 – up $2.65), and eBay (bought at $56.66 – closed at $54.78 – down $1.88). So, of the 16 stocks listed, 15 were up. Pretty good!

____________________

Tales from the Dark Side

By: Alyssa

Seized Business Records Uncover Looted Indian Antiquities

$1.15 million worth of looted antiques from India are to be returned after they were recovery by the antiques trafficking unit in New York City. In total, the objects include ten antiquities that were recovered during a series of raids between 2015 and 2016 at three Manhattan locations: Christie's Auction house, Nancy Weiner Gallery, and Maitreya Gallery.

$1.15 million worth of looted antiques from India are to be returned after they were recovery by the antiques trafficking unit in New York City. In total, the objects include ten antiquities that were recovered during a series of raids between 2015 and 2016 at three Manhattan locations: Christie's Auction house, Nancy Weiner Gallery, and Maitreya Gallery.

According to Eileen Kinsella's article on Artnet, the recovered antiques include…

a marble apsara ceiling panel dating to the 10th century and valued at $500,000 from Weiner Gallery, and, from Maitreya, a red sandstone figure of Parvati holding a fly whisk aside a male attendant, from Rajasthan or Madhya Pradesh, dating to the 11th century and valued at $54,000.

The highest-value items were those seized from Christie's: a buff sandstone stele of Rishabhanata flanked by a pair of standing attendants, from Rajasthan or Madhya Pradesh, dating to the 10th century and valued at approximately $150,000, and a buff sandstone panel depicting Revanta and his entourage—a rare representation of the equestrian deity, a figure of great importance in Hinduism—dated to the 8th century, valued at approximately $300,000.

It is widely known that in 2012 Subhash Kapoor, an American antiques dealer, had his business records seized along with more than $100 million in looted antiques… according to the article, Kapoor is connected to these objects, so hopefully investigators can continue using the information they found to recover and return more missing artifacts and antiques.

Of Little Value – Easy To Return

It was recently reported that Peter Forner, the son of a German soldier who, during WWII, was ordered to take a painting by Nicolas Rousseau, has returned it to France. The painting is now on display at the World Centre for Peace, Liberty and Human Rights, Verdun, in the hopes of finding its true owner.

It was recently reported that Peter Forner, the son of a German soldier who, during WWII, was ordered to take a painting by Nicolas Rousseau, has returned it to France. The painting is now on display at the World Centre for Peace, Liberty and Human Rights, Verdun, in the hopes of finding its true owner.

Typically, we read reports of legal battles that go on for years, over valuable works of art that were stolen by the Nazis. Since this painting has a value of about $5,000, I guess it was an easy one for Mr. Forner (who passed away in May) to return.

Please check the links below for full images of the work. Should it look familiar, please contact the center.

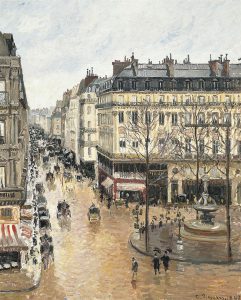

Well, this case was finally settled. Back in 2000, the heirs of Lilly Cassirer sued Madrid's Thyssen-Bornemisza Collection, over Pissarro's Rue Saint-Honoré, dans l'après-midi. Effet de pluie (1897). The painting was taken by the Nazi's in 1939, and in 1976 Baron Hans-Heinrich Thyssen-Bornemisza purchased it from the Hahn Gallery in New York City.

Well, this case was finally settled. Back in 2000, the heirs of Lilly Cassirer sued Madrid's Thyssen-Bornemisza Collection, over Pissarro's Rue Saint-Honoré, dans l'après-midi. Effet de pluie (1897). The painting was taken by the Nazi's in 1939, and in 1976 Baron Hans-Heinrich Thyssen-Bornemisza purchased it from the Hahn Gallery in New York City.

After a 20 year battle, a California appeals court ruled that while the work was stolen … Spain did not know about the pre-WWII origins of the painting when they purchased the work from Thyssen-Bornemisza, and that he did not know about its origins when he bought the work in 1976. Because the museum did its due-dilligence prior to the purchase, the painting will remain with the Thyssen-Bornemisza, where it has been on display since the museum opened in 1992.

Bouvier/Rybolovlev – A Never Ending Saga

According to an article written by Anna Brady and Vincent Noce, for The Art Newspaper, it appears that the Swiss government's investigation into Yves Bouvier for unpaid taxes, which began in 2017, is still ongoing. The government is alleging that Bouvier owes taxes on over £276m in profits he made from sales to Dimitry Rybolovlev.

According to an article written by Anna Brady and Vincent Noce, for The Art Newspaper, it appears that the Swiss government's investigation into Yves Bouvier for unpaid taxes, which began in 2017, is still ongoing. The government is alleging that Bouvier owes taxes on over £276m in profits he made from sales to Dimitry Rybolovlev.

One of the bones of contention is whether Bouvier made the sales in Switzerland or Singapore … even though said sales seem to have been made through two offshore companies he owns.

I must say, if I made over $350M in profits from the sale of a few expensive works of art, I would have paid my taxes and then moved to some tropical island!

We will continue to bring you updates on this never-ending saga as they surface.

Video surveillance (click the source link below) shows a 50-year-old Austrian tourist sitting on the original plaster cast model of Antonio Canova's Pauline Bonaparte as Venus Victrix, and breaking off three of the figure's toes. You might wonder why? Well, he had to get a photo of himself with the work!

Video surveillance (click the source link below) shows a 50-year-old Austrian tourist sitting on the original plaster cast model of Antonio Canova's Pauline Bonaparte as Venus Victrix, and breaking off three of the figure's toes. You might wonder why? Well, he had to get a photo of himself with the work!

There have been several similar situations in recent times (people damaging a work of art while taking selfies). When will the stupidity end? I know, when we hold people financially responsible for their actions!

____________________

Really?

By: Amy

Betting Big Pays Off

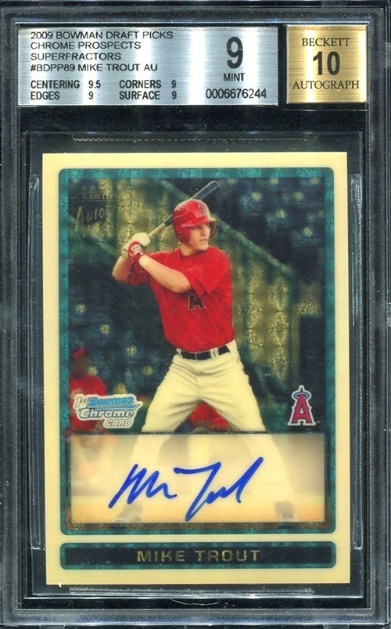

So, here is the follow-up I promised regarding the Mile Trout rookie card that came up for auction this month. After the LeBron James card set a record last month when it sold for $1.8M, it really didn't take long for a new record to be set in the world of modern trading cards. But wait, the Trout card didn't just set a record for a modern card, it set a record for THE most expensive baseball card as it passed the record held by the 1909-11 T206 Honus Wagner card that sold in 2016 for $3.12M.

A great marketing gimmick for the trading card companies is that in addition to printing base cards each year for players, they create sets that have limited production with slight variations to the base card; these card sets are known as parallels. Each parallel set (produced in editions from 499 to just one unique piece) have different border colors. They are sold in sets that can cost a few hundred dollars to many thousands of dollars.

In the last newsletter, I did mention that the Trout card would have an opening bid of $1M, which I thought might be a bit aggressive as one just sold a few months ago for $922K (that was a rare parallel card known as a red refractor card, and just five copies were printed). What I failed to realize when I heard about the card coming up was that it was a really rare and unique parallel card, limited to just one copy.

The card was Trout's 2009 Bowman Chrome Draft Prospects Superfractor card (a rare trading card with a reflective coating) with the serial number 1/1. The photo on the card is from Trout's 2009 season when he played for one of the Angels' minor league teams and includes his signature. It was graded by BGS as MINT 9, as there is some wear to the edges, but the signature was graded a perfect 10.

As I followed the auction online, the bidding held steady at $1.45M, but in the last few hours, the action finally started, and the card sold for an astounding $3.2M ($3.936 w/p). And if you are wondering what the seller paid for the card, in an Instagram post, the consignor boasts that he originally purchased the card for $400K just 2 years ago! An amazing return, but apparently the consignor is a betting man, better known as "Vegas Dave," who obviously bets big in the world of sports…this bet certainly paid off!

Location, Location, Location

What is the difference between Thing 1 and Thing 2? I honestly believe there is only one really big difference, but I will get to that shortly. First, let's go over what I think are the similarities. Both were produced by the Grueby Faience Company, an American ceramics company founded in 1894, that produced pottery during the American Arts and Crafts period. As described in the auction catalogs, both vases are glazed earthenware created in the early 20th century (c. 1900), and they both measure 6 ¾ inches in height. Thing 1's description clearly states that the vase has the firm's name "Grueby Pottery Boston U.S.A" impressed on it, Thing 2's description merely states 'with the firm's impressed mark.' And although there is a slight variation to an incised marking that identifies the artist, Thing 1 is marked CH #y39-1, and Thing 2's mark is stated as CH-139. Neither auction had photos of the bottom of the pieces, so I cannot tell where the discrepancy lies, but I would venture to say it is with the cataloging. And the last thing I noticed was that both pieces had a similar listing in the Provenance "Private Collection, Northern California" – coincidence? I think not!

I can only say from the evidence presented before you that both Thing 1 and Thing 2 are one and the same….but I could be wrong. I did call one of the auction houses to confirm my suspicion, but of course, they were not at liberty to say anything. So this is what I see as the big difference…$426,175!

When Thing 1 came up for auction in Los Angeles in April 2019, it sold for $5,075, seems unremarkable and I am sure no one really noticed the sale. Jump forward a little over a year to July 2020, and now the same or a REALLY similar Thing comes up for sale in New York, and this little inconspicuous vase becomes the focus of a bidding war. Estimated to make $7-9K this time around (reasonable based on the last sale), it sparked a 45-minute battle, and when the hammer came down it sold for an astonishing $345K ($431.2K w/p), an auction record for pottery from the Arts and Crafts period. If someone has an explanation for the price difference or can show me that they are indeed two different Things, I would love to hear it. Maybe it just proves once again how unreliable, and volatile the auction market is or, does it really show that location makes all the difference…like they always say…LOCATION, LOCATION, LOCATION!

____________________

The Art Market

By: Howard & Lance

Thankfully, the rash of online sales slowed down during August. We are only covering one that ended in August and its sister sale that ended in June. Lance has also given his perspective on the summer rush … trust you will enjoy it!

Charging More – Give Me A Break!

Not sure how I missed this one. In May, Sotheby's announced the following:

As of August 1, 2020, Sotheby's will be implementing a new fee – an Overhead Premium – payable by all auction buyers in our global salesrooms and online sales.

As of August 1, 2020, Sotheby's will be implementing a new fee – an Overhead Premium – payable by all auction buyers in our global salesrooms and online sales.

The fee, which will be 1% of the hammer price plus any applicable local taxes, is an allocation of the overhead costs relating to our facilities, property handling and other administrative expenses, and reflects the increasing costs associated with delivering great service and experiences in a highly competitive marketplace.

This fee and our Buyer's Premium rates exclude local taxes and any applicable artist's resale right.

The Overhead Premium will be applicable to all live auctions that take place on or after August 1st and any online auction that close after that date.

SO …

Many of their salerooms are basically closed, they have laid off staff, they are not producing those expensive catalogs, sales are taking place online, all of which must be saving them millions of dollars. With their cost's way down, they now feel another 1% fee is appropriate … give me a break!

In a highly competitive marketplace, one would expect a business to lower their fees a little to get new clients. I have an idea … why not charge the sellers 1% more? Those are the people you are representing! Why do the auction rooms constantly reduce the seller's costs and make it up by charging the buyer more?

The American Market – Sotheby's

At the end of June, Sotheby's offered a selection of American paintings from the 19th and 20th centuries. As you will soon see, the sale performed reasonably well. (w/p = with buyer's premium) Taking the top spot was Augustus Saint-Gaudens's Abraham Lincoln: The Man (Standing Lincoln), which carried a $600-900K estimate and sold for $1.3M ($1.58M w/p). What I did find interesting is that the work is a posthumous cast (done after the artist died). In a press release about the sale, Sotheby's notes: Beginning in 1910, the artist's widow, Augusta, authorized the casting of commercial-sized reductions of the original monument. The reductions of Lincoln: The Man, of which the present work is one, stand at 40 ½ inches high and were cast in an edition of approximately 17. I always find it interesting that people will

Taking the top spot was Augustus Saint-Gaudens's Abraham Lincoln: The Man (Standing Lincoln), which carried a $600-900K estimate and sold for $1.3M ($1.58M w/p). What I did find interesting is that the work is a posthumous cast (done after the artist died). In a press release about the sale, Sotheby's notes: Beginning in 1910, the artist's widow, Augusta, authorized the casting of commercial-sized reductions of the original monument. The reductions of Lincoln: The Man, of which the present work is one, stand at 40 ½ inches high and were cast in an edition of approximately 17. I always find it interesting that people will  pay high prices for works an artist never put their hands on.

pay high prices for works an artist never put their hands on.

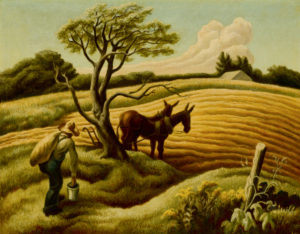

The second-highest price - $850K ($1.04M w/p) - was achieved by Thomas Hart Benton's Noon -- it carried an estimate of $700-1M. So this one hammered within the range. In third, they had Milton Avery's Mandolin with Pears, which was estimated to bring $500-700K and hammered for $600K ($740K w/p). Rounding out the top five were Mary Cassatt's Mother in Purple Holding Her Child that brought $450K ($560K w/p - est. $400-600K) and an early (before abstraction) Jackson Pollock – Landscape with White Horse – that made $380K ($475 w/p – est. $150-250K). I thought some of you would enjoy seeing what an early Pollock looks like, so we included an image.

There were a few works that failed to find buyers... among them were Jamie Wyeth's The Thief (est. $400-600K) and his Surf Watchers ($250-350K), N.C. Wyeth's Ayrton's Fight with the Pirates ($200-300K), Childe Hassam's Promenade – Winter in New York (est. $400-600K), and the most expensive, Dennis Miller Bunker's A Winter's Tale of Sprites and Goblins (est. $700-1M).

There were a few works that failed to find buyers... among them were Jamie Wyeth's The Thief (est. $400-600K) and his Surf Watchers ($250-350K), N.C. Wyeth's Ayrton's Fight with the Pirates ($200-300K), Childe Hassam's Promenade – Winter in New York (est. $400-600K), and the most expensive, Dennis Miller Bunker's A Winter's Tale of Sprites and Goblins (est. $700-1M).

Initially, the sale consisted of 51 works, but it seems that 3 were withdrawn before they came up. Of the 48 works offered, 36 sold, giving them a sell-through rate of 75% - not too bad – and the total take was $9.1M w/p … the presale estimate range was $7.998 - $12M; so they fell into the range with the buyer's premium.

American Art – Christie's

More than a month later (August 7th), Christie's presented their American painting sale … and overall, this one was far less successful.

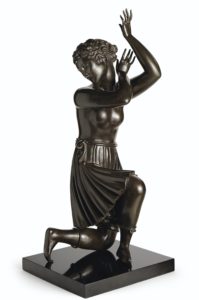

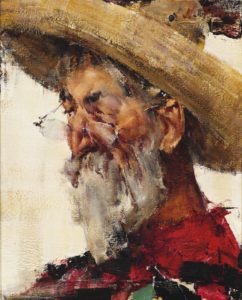

The most expensive lot in the sale was Mary Cassatt's Two Little Sisters that brought $420K ($519 w/p – est. $400-600K) – it was also the lot with the highest estimate. Taking the number two position were two lots: Elie Nadelman's Kneeling Dancer (est $350-550K) and Nicolai Fechin's Abuelo (est$120-180K) each bringing $200K ($250K w/p). As you will note, the Nadelman came in well below its estimate while the Fechin went over). Third place was captured by Willard Metcalf's Green Idleness at $190K ($237.5K w/p – est. $200-300K).

Rounding out the top five were Elie Nadleman's Head of a Woman at $175K ($212.5K w/p – est. $20-300K), and there was a tie for 5th with Nicolai Fechin's Amoset (est. $150-250K) and James McNeill Whistler's St. Ives: The Beach (est. $80-120K) each bringing $140K ($175K w/p).

Among the works that did not find buyers were Farny's Mountain Pass (est. $300-500K), Prendergast's Ponte Gianbattista-Gallucioli (est. $200-300K), and Milton Avery's Lavender Beach (est. $100-150K).

By the end, of the 87 works offered, 65 found buyers (74.7% - pretty close to the Sotheby's sale), and the total take was $3.97M w/p (far less than the competition). The low end of the presale estimate range was $4.45M, so they fell well short of expectations.

One of the biggest difference between the two sales were the level of art offered.

Christie's and Sotheby's Race Through the Summer - Online Auction Recap

As the summer of social distancing comes to a close, I thought we could take a look at the auction arena as a whole and what has been going on… it seems the two big houses finally caught up on their Spring schedule and used the month of August as an abbreviated annual summer lull… but aside from the past few weeks, the auction houses have been humming along if not overheating the engine… things really started ramping up at the end of May and into June as Sotheby's and Christie's were working out the kinks prior to offering anything too major.

Christie's hosted 39 online sales globally that closed in June with totals ranging from just $200K to more than $15 million… by the time they got into July, they were closing an average of 2 auctions every day! And yes, many of them were smaller auctions, with the lower sales totaling around $200K, but they also held a number of major sales – the most significant being their ONE sale, featuring important 20th Century art, which topped $400 million! How can anyone keep up with all those sales… 63 in one month?!? As I mentioned, things cooled off in August which saw just 14 auctions close and significantly lower totals – they ranged from a $15K Christie's Staff Art Show (no comment) to a $3.9M American Art sale.

And if you thought that was a lot, Sotheby's was full on redlining as they closed out 76 sales in June and another 75 in July… again, there were quite a few that were on the lower end of the spectrum – small watch sales, wine sales or other items, totaled as low as $30K in June and $60K in July. But the high end was very present… they hosted their rescheduled New York Contemporary Evening sale (online) in June, which topped $230M, and then their Rembrandt to Richter totaling £150M. Similarly, things tapered off substantially as we got into August with just 26 auctions closing… but that is still almost an average of an auction closing every day, and for the last two months its been averaging nearly 3 a day! Who is buying all this stuff?!?

Now, perhaps I am being a bit hyperbolic… after all, it is not like all of these auctions that are occurring are seeing blockbuster results… we've regularly covered sales this summer with moderate to poor sell through rates – Christie's 19th Century Sale sold just 35%! So, what gives?

I think there may be a few things at play here… first and most obviously being making up for lost time from the shutdown. The sales that were scheduled to take place needed to be rescheduled, which overlapped with a preexisting schedule – that makes sense. On top of that, while auctions are usually hosted in-person in various cities, now they are all piled on top of each other in an online calendar (to clarify, the various auction house locations still host the sales, but they are presented together on their websites). Finally, and perhaps most speculatively, is that they are hedging their risk if things take a turn for the worse by unloading as much as they can as quickly as possible. I'm hopeful given things have recently been trending in the right direction, but if we were to experience a second wave as we reopen heading into the winter, I think the next set of major auctions will be in jeopardy of seeing less than decent results and a high amount of material withdrawn. Either way, it's nice to see they've taken their foot off the gas, even if it is just for a moment. Expect things to pick up again soon!

The Rehs Family

© Rehs Galleries, Inc., New York – September 2020