COMMENTS ON THE ART MARKET

Memorial Day Weekend - Summer Is Almost Here

First, we wish everyone a happy and relaxing Memorial Day weekend; a time when we can all take a few moments to remember the service men and women who gave their lives to protect and defend the United States.

We are going to continue our Tuesday – Friday hours of 10 am – 5 pm for the month of June. As we mentioned last month, the good news is that no appointments are needed; feel free to stop by when you are in the neighborhood. We are also very happy to come in on Saturday, Sunday, or Monday if that is more convenient.

____________________

Online Exhibitions

Opening June 1

Animal Spirit - A Solo Exhibition Featuring the Artwork of Lucia Heffernan

Heffernan began exploring her artistic side from a very young age, inspired by her mother who was an artist herself. She would study Fine Art at Binghamton University before jumping into the world of digital art and graphic design. In 2000, her focus shifted to oil-painting as she began creating a personal body of work that touched on the “twists and turns that make our life stories a little more interesting.”

The ideas for her compositions are born out of every-day life, whether she is observing others as they go about their day or simply self-reflecting on experiences. By imagining what animals might do if inserted into these situations, she injects a sense of theatrics and whimsy. As Heffernan says of her subjects, “I shine a spotlight on both their innocence and raw instinct.”

The exhibition will run from June 1 – June 30, with both in person and online viewing available.

____________________

Stocks

By: Lance

I have to be honest, I took my father’s approach to the market this month… I tried not to pay attention. The major US indices are still trading at lofty levels, with the Dow and S&P pushing to all-time record highs early in the month before experiencing more volatile trading – the Dow currently sits at 34,608 (about 500 points off the high mark on May 10th) and the S&P at 4,217 (just 20 points off the high on May 7th). The Nasdaq, on the other hand, seems to be struggling to get its footing ever since the Gamestop madness – again this month, we tested the floors seen back in January (though it’s had a nice run the past week)… it closed out the month at 13,820 (just a few hundred points off last month’s high mark).

Both the Pound and Euro strengthened against the dollar, currently exchanging at $1.41 and $1.22 respectively – I’d attribute this primarily to concerns over inflation in the US; that said, the Fed takes such a heavy-handed approach these days, I’d imagine they’d do everything in their power to limit that. On that same line of thinking, it’s no surprise to see gold having a nice run, climbing above $1,900 for the first time this year (silver has also taken off a bit). Crude hovered in the low-to-mid 60 range, but this month could have gone sideways with that Colonial Pipeline hack – gasoline prices rose to their highest national average in over six years as a result. However, the impact was relatively short-lived. Days after the hack, Colonial succumbed to paying a ransom to regain access to their network – they ultimately paid $4.4 million in bitcoin as “it was the right thing to do for the country.” Interestingly, shockingly, I'm not sure what the appropriate word is for this… the cyber hackers released a statement in the aftermath saying, “our goal is to make money and not creating problems for society.” Uhhh… yea ok, explain that one to the judge.

As for the crypto arena… I feel like people have often referred to them as a rollercoaster ride, but it's starting to feel more like the Tower of Terror – down and fast; yikes! Bitcoin saw a precipitous drop following the announcement Tesla would no longer be accepting it as a form of payment… it’s continued the plunge since, now trading at $36K - nearly $30K off its high mark. Ethereum finally peaked by the middle of the month topping $4,300, but the crypto crash took everything down with it… by May 23rd, it had collapsed back under $1,900 – it now sits at $2,500. Litecoin shared a similar fate, topping out at $412 before falling to just $131 on May 23rd – currently trading at $180. And darling Doge… I still am not complaining even after dropping from $0.73 down to $0.31 – I got in at $0.01 so as the kids say, I’m a HODLER.

And now for a few select stocks… Airbnb (ABNB – month -19%); American Well Corporation (AMWL – month -19%); Aurora Cannabis Inc. (ACB – month +8%); Beyond Meat, Inc. (BYND – month +10%); Blink Charging Co. (BLNK – month -8%); Churchill Capital Corp IV (CCIV – month -14%); Canopy Growth Corp. (CGC – month -3%); Cronos Group Inc. (CRON – month +11%); FuelCell (FCEL – month +1%); Fisker Inc. (FSR – month +1%); Nikola Corp (NKLA – month +29%); QuantumScape Corp (QS – month -29%); Under Armor, Inc. (UAA – month -7%); and Zomedica Corp. (ZOM –month -21%). Of the bunch, 8 were up and 7 were down, but the losers certainly outweighed the winners… oh well, good thing I wasn’t paying much attention – who wants to feel like a loser every day anyway?

__________________

Tales from the Dark Side

By: Alyssa

More On The da Vinci Saga

Martin Kemp, one of the leading experts on da Vinci's work, has penned an article for The Art Newspaper about the controversy surrounding the $450 million painting. Will this ever end? I doubt it, but in the end, does it really matter? It is just a painting that may, or may not, be by the artist. What is clear, is the fact that even if it were by the hand of the master, its condition is so bad that many parts are no longer by him. It might now be best described as a collaborative work?

We have no opinion since it is not an area of the market we specialize in. The story just makes for interesting and enjoyable reading, or film making. At least for some of us.

Kardashian Learns A Lesson On Looted Artifacts... Maybe?

Just last week, the U.S. Government filed a suit seeking the forfeiture of an "illegally imported" statue, which is currently being held by U.S. Customs and Border Protection; it has been in their possession since it was imported to the country in 2016. The interesting part of the story is that while Kim Kardashian is listed as the importer on the official paperwork, she completely denies having purchased the work or even knowing about the sculpture - a representative for Kardashian insinuated that "it may have been purchased using her name without authorization."

Either way, the U.S. government had two professors of archeology, as well as an archaeologist from Italy's Ministry of Cultural Heritage examine the work - all concluded that the sculpture fragment (it is only the lower half of a sculpture) dated between 6th Century BCE to 4th Century CE. Further, the Italian archeologist "opined that the defendant statue was looted, smuggled and illegally exported from Italy."

While Kardashian, her trust (who is listed on the import document), and Axel Vervoordt (the gallery that sold the sculpture) are not listed directly in the lawsuit, it does note that "their interests may be 'adversely affected by these proceedings.'" Vervoordt vehemently disputes that the work was looted, claiming they acquired it in good faith, and further that there is no evidence that the piece was illegally imported from Italy.

All that said, it seems fairly certain this artifact will not land in the hands of Kim K, and will be headed back to Italy sooner than later.

While Drawing Protests, Deaccessioning Continues

Throughout the pandemic, we have read stories about museums in financial trouble and how some have resorted to selling works to cover costs. Hopefully, we are getting closer to allowing them to open fully; however, some are still looking to cash in while they can.

Throughout the pandemic, we have read stories about museums in financial trouble and how some have resorted to selling works to cover costs. Hopefully, we are getting closer to allowing them to open fully; however, some are still looking to cash in while they can.

The Newark Museum of Art has jumped in and will attempt to sell a group of 19th & 20th century works at Sotheby's this month. Their decision has sparked outrage and protests from historians, curators, and researchers across the country. The sale takes place on May 19th and will include works by Albert Bierstadt, Mary Cassatt, Burgoyne Diller, Thomas Eakins, Marsden Hartley, Childe Hassam, Thomas Moran, Georgia O'Keeffe, Frederic Remington, and Charles Sheeler. In all, they are offering 11 works with a combined estimate range of $3.95-5.77M.

While looking through the sale, I also discovered that the Palm Springs Art Museum is selling two works, one by Fechin ($120-180K) and the other by Gaspard ($60-80K). The San Diego Museum of Art is also selling a Fechin ($200-300K), and the Brooklyn Museum is selling a Cassatt ($1-1.5M). The entire sale only consists of 61 lots, 15 of which (about 25%) are from museums. Guess it shows you how difficult it is to get material.

Anyway, we will update you once the sale has finished.

Stolen Treasure

The Daily Mail recently reported that thieves broke into Arundel Castle and stole more than £1M worth of gold and silver treasures. Among the items stolen are the gold rosary beads that Mary Queen of Scots had with her when she was beheaded in 1587.

A spokesman for Arundel Castle Trustees said: 'The stolen items have significant monetary value, but as unique artifacts of the Duke of Norfolk's collection [they] have immeasurably greater and priceless historical importance.

A spokesman for Arundel Castle Trustees said: 'The stolen items have significant monetary value, but as unique artifacts of the Duke of Norfolk's collection [they] have immeasurably greater and priceless historical importance.

A follow-up article in the paper has put forth the theory that a crooked collector is behind the theft. There is no specific evidence to show this is true, but the case is now the subject of an international investigation. Hopefully, the items will be found before someone decides to melt them down. Their historical value is far greater than the value of the metal.

____________________

Really?

By: Amy

Kanye West Has A New Record

Kayne West breaks a record, and this one was not vinyl. Kayne West is best known as an American rapper, songwriter, and record producer, but he also has a love of fashion and has had his hand at designing. For years there were rumors that Kanye and Nike were collaborating, and in 2008 there was finally proof; Kayne wore the prototype of the Nike Air Yeezy to the 50th Annual Grammy Awards.

Kayne West breaks a record, and this one was not vinyl. Kayne West is best known as an American rapper, songwriter, and record producer, but he also has a love of fashion and has had his hand at designing. For years there were rumors that Kanye and Nike were collaborating, and in 2008 there was finally proof; Kayne wore the prototype of the Nike Air Yeezy to the 50th Annual Grammy Awards.

Kanye, greatly influenced by early Air Jordan sneakers, added a wide strap over the laces, which would become the signature feature of his Nike Air Yeezy design. In 2009, Nike released the initial limited production of the sneaker to retailers; the prices escalated quickly. The relationship did not last long with Nike, and in 2015, Kanye jumped ship and sailed over to Adidas.

The prototype sneakers were recently offered privately by Sotheby's in New York. The 'investing" platform, RARES, purchased the sneakers and is now offering 'investors' the chance to buy a fractional share of the sneakers – and with the price of these one-of-a-kind sneakers, that's all most can afford. The sneakers sold for $1.8M, breaking the record for the most expensive public sale of sneakers; the previous record was $615K for a pair of 1985 Air Jordan 1s sold in 2020.

Basketball's Record-Breaking Action This Season

As the 2021 Basketball Playoffs have begun, many will be eagerly watching the record-breaking action on the court, but there was also record-breaking action in the auction room. Two fan favorites, Kobe Bryant and Michael Jordan, just scored new records.

As the 2021 Basketball Playoffs have begun, many will be eagerly watching the record-breaking action on the court, but there was also record-breaking action in the auction room. Two fan favorites, Kobe Bryant and Michael Jordan, just scored new records.

Kobe Bryant entered the NBA in the 1996-97 season as the 13th overall pick by the Charlotte Hornets and was traded that very night to the LA Lakers – boy, I bet the Hornets have always regretted that trade! Kobe and Shaquille O'Neal became the powerhouse of the Lakers and led them to five NBA titles. One of Kobe's jerseys from his rookie season, and quite possibly the first Laker's jersey worn by the superstar, just sold at auction. Bidding started at $100K, and the action quickly heated up as 50 bids were placed on the lot. In the end, billionaire Bob Duggan came away with the win, adding an incredible piece of sports memorabilia to his collection. He paid a record-breaking price of $3.6M - making it the most expensive basketball jersey ever sold!

Michael Jordan dominated basketball for 15 seasons playing for the Chicago Bulls; he was the 3rd overall draft pick and is considered the greatest basketball player of all time…which most of you already know. An autographed 1997-98 UD "Game Jersey" NBA All-Star Game Used Patch Card, graded by PSA as Near Mint/Mint condition, crossed the auction block. As Upper Deck only produced 23 of these cards, bidding started at $250K, and as bidders vied for the prized card, a record was set for any Michael Jordan collectible when it sold for $2.1M. On a side note...Jordan is now the principal owner and Chairman of the Charlotte Hornets - I bet he wouldn't have let Kobe go!

____________________

The Art Market

By: Howard, Lance & Amy

There was so much auction action during May that it was out of control at times. There were sales taking place across the globe and sometimes one on top of another. There even a few which lasted into the wee hours of the morning. This month we covered nine of the sale (three were in the American field) … enjoy!

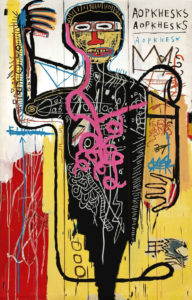

Contemporary Art... Wait No, 21st Century Art At Christie's... Uhh, Except The Basquiats (And Others)

By: Lance

The spring auction season is upon us, with the big houses holding their Impressionist & Modern and Post-War & Contemporary sales. Christie’s being the annoying entity they are, decided to change the structure of their sales; now they feature a 20th Century Sale and a 21st Century Sale, so Contemporary is on its own, and Post-War works are now lumped in with Impressionist & Modern… I guess we will not be evaluating their sales based on prior years as they are no longer comparable – can always count on auctions to bring clarity to the market (if there was a way to notate sarcasm, I would do it here). Also, last I checked 21st Century means post-2000 so why are we sliding in works by Basquiat and others?? Just call it Contemporary Art and let’s move on!

The spring auction season is upon us, with the big houses holding their Impressionist & Modern and Post-War & Contemporary sales. Christie’s being the annoying entity they are, decided to change the structure of their sales; now they feature a 20th Century Sale and a 21st Century Sale, so Contemporary is on its own, and Post-War works are now lumped in with Impressionist & Modern… I guess we will not be evaluating their sales based on prior years as they are no longer comparable – can always count on auctions to bring clarity to the market (if there was a way to notate sarcasm, I would do it here). Also, last I checked 21st Century means post-2000 so why are we sliding in works by Basquiat and others?? Just call it Contemporary Art and let’s move on!

So, up first was Christie’s 21st Century Evening sale and it saw very mixed results… a few select works made really nice prices (compared to their estimates), and the cover-piece absolutely demolished its estimate, which more than made up for the poor performers. The aforementioned cover-piece, Basquiat’s In This Case, was expected to bring “in the region of $40M.” With several interested parties, the bidding quickly climbed to more than double their expectations – the winning bid was $81M, or $93.1M with premiums. This work last sold at auction in 2002 to the Gagosian Gallery for just under $1M ($999.5K)! Jumping into second was the evening’s lone NFT… Larva Labs’ Cryptopunks have been a hot item in the NFT game for the past couple of months, and this lot featured 9 of them. To be perfectly clear, these are not unique or special Cryptopunks – just 9 random ones being sold together as a single lot, though they were minted back in 2017; well before NFT mania. This grouping saw some spirited competition, which pushed the price up to $14.5M, or $16.9M with premium… they had only expected the bunch to sell for $7-9M. Rounding out the top three was another work by Basquiat – Untitled (Soap). This one found a buyer at $11.2M ($13.1M with premium) on a $10-15M estimate.

The next highest lots were underwhelming… the 4th highest price was paid for a sculpture by Martin Kippenberger expected to bring $10-15M. The full size sculpture of a man, clothed, and facing the corner of the room, saw bidding sputter out at $8M ($9.5M w/p). Following that was a guaranteed work by Kerry James Marshall, and I assume it went to the guarantor as it hammered at the low end of the $6.5-8.5M estimate; add in the premium and that brings the work to $7.5M.

As mentioned, there were a few other noteworthy performances… a work by Rashid Johnson hammered at $1.6M on a $200-300K estimate (433% above estimate); Dana Schutz’s The Fishermen hammered at $2.45M on a $400-600K estimate (308% above estimate); and a work by Joel Mesler titled New York, New York (painted in 2021) found a buyer at $220K on a $40-60K estimate – why is this even in the evening sale??

A handful of works had rather poor showings… an Abstraktes Bild work by Richter could not find any bidders after it topped out at $5.8M ($6.9M w/p), which was 36% below estimate. I am surprised it actually sold as the estimate was $9-12M – I’ll bet the seller was not too pleased. A lesser lot also saw a winning bid well below estimate – Cindy Sherman’s Untitled #150 was expected to bring between $600-800K but hammered at just $420K ($525K w/p). There were an additional 8 works that went below estimate, along with one outright failure – a George Condo with a $1.5-2M estimate topped out at $1.3 and went unsold.

When the dust settled, the sale generated a combined hammer price of $186.8M, and $211.2M once you factor in the buyer’s premiums. They were expecting between $131.1-175.3M so they easily topped their target… but as is often the case, it is a tale of one lot; in this case the Basquiat (ay, that rhymed). With a hammer price exceeding the estimate by more than $40M, it pads the overall number quite a bit. Without that one lot, we would be looking at a sale of $105M ($120M w.p) on a $91M-135M estimate… that is a much more accurate representation – mixed results, in the middle of the estimate with 14 works above estimate, 14 within estimate and 10 below estimate as well as one unsold. As I stated earlier, it is hard to compare to previous years – the last true Spring evening sale was back in pre-pandemic 2019 and that included pricey post-war works, which totaled more than $538M. Certainly was better than last year though, which was cancelled; glass half full.

Sotheby's Marathon – Part 1 – The Collection Of Mrs. John L. Marion

By: Howard

Sotheby's began their May 12th marathon with a group of paintings from the collection of Mrs. John Marion (Anne Windfohr Marion). After looking at the works up for sale (most of which were very large), I wondered about the size of the home she lived in, so I did a little research. I discovered that Anne was the heiress to a vast fortune – her parents (and she has several of them since her mom was married four times) were stockbrokers, ranchers, horse breeders, and one was the founder of the Tandy Corporation. According to Wikipedia, in 2006, her net worth was estimated at $1.3 billion; she lived in a 19,000 square foot home in Fort Worth, Texas, and had additional residences in New Mexico, California, Wyoming, and New York City. It was interesting to note that she too was married four times (the last was to John L. Marion, who served as Chairman of Sotheby's from 1975 to 1994), and founded the Georgia O'Keeffe Museum in Santa Fe, New Mexico. She died in 2020. (I was unable to watch this part, so all prices include the buyer's premium)

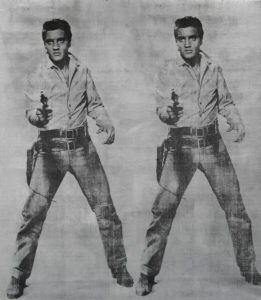

The sale offered 18 works by significant artists of the 20th century – most of which were impressive. The top lot was Andy Warhol's Elvis 2 Times. This 1963 silkscreen ink and silver paint on canvas measured 81 x 71 inches and was purchased in 1999 from a gallery in New York. It carried a $20-30M estimate and sold for $37M. Clyfford Still's PH-125 (1948-No.1), measuring 74 x 68 inches and purchased from a New York dealer, was expected to make $25-35M and came in at a close second when it sold for $30.7M. Taking the number three spot was Richard Diebenkorn's Ocean Park #40. This 93 x 80 inch oil and charcoal on canvas dates from 1971, was purchased at Sotheby's in 1990 for $1.76M and was estimated at $20-30M. There was a bit of action, and the work sold for $27.3M.

The sale offered 18 works by significant artists of the 20th century – most of which were impressive. The top lot was Andy Warhol's Elvis 2 Times. This 1963 silkscreen ink and silver paint on canvas measured 81 x 71 inches and was purchased in 1999 from a gallery in New York. It carried a $20-30M estimate and sold for $37M. Clyfford Still's PH-125 (1948-No.1), measuring 74 x 68 inches and purchased from a New York dealer, was expected to make $25-35M and came in at a close second when it sold for $30.7M. Taking the number three spot was Richard Diebenkorn's Ocean Park #40. This 93 x 80 inch oil and charcoal on canvas dates from 1971, was purchased at Sotheby's in 1990 for $1.76M and was estimated at $20-30M. There was a bit of action, and the work sold for $27.3M.

Other artists in the sale included Gerhard Richter ($23M – estimate $14-18M and purchased at Sotheby's in 2012 for $16.8M), Roy Lichtenstein ($14M – est. $12-18M), Kenneth Noland ($4.3M – est. $2-3M), and Robert Motherwell ($5.1M – est. $4-6M). Sadly, several lots found no takers; these included a bronze by Marino Marini (est. $2-3M), along with large paintings by Franz Kline (est. $15-20M), Hans Hofmann (est. $4-6M), and Sam Francis (est. $5-7M).

When the session ended, of the 18 works offered, 14 sold (78%), and the total achieved was $157.2M (nothing to cry over). The estimated range was 132.8 – 190M, so they only made it with the buyer's premium.

Again, this was just the first part of a very long evening (more than 4 ½ hours).

Part 2 Of The Sotheby's Marathon - Contemporary

By: Howard

When the Marion sale ended, they moved on to the Contemporary Evening Sale, which started at about 7 pm and went on until 9 pm, with only 32 lots. This one just dragged on with the bidders from across the globe and the auctioneer doing everything he could to pump up the prices. I did feel a bit sorry for the employees in London since 7 pm New York time is 12 am in the UK. (unless otherwise noted, all prices are hammer. W/p = with the buyer's premium).

When the Marion sale ended, they moved on to the Contemporary Evening Sale, which started at about 7 pm and went on until 9 pm, with only 32 lots. This one just dragged on with the bidders from across the globe and the auctioneer doing everything he could to pump up the prices. I did feel a bit sorry for the employees in London since 7 pm New York time is 12 am in the UK. (unless otherwise noted, all prices are hammer. W/p = with the buyer's premium).

Coming in at number one was Basquiat's Versus Medici that carried a $35-50M estimate (the highest in the sale) and sold for $44M ($50.8M w/p) – comfortably inside the estimate range. Next came Cy Twombly's Untitled (Rome) at $36M ($41.6M w/p – est. $35-45M) – this was a guaranteed lot, and it appeared only to receive one bid. Robert Colescott's George Washington Carver Crossing the Delaware… saw intense action and took third place when it sold for $13.1M ($15.3M w/p – est. $9-13M) to the Lucas Museum of Narrative Art. Rounding out the top five: Banksy's Love is in the Air, which created a bidding war, and when the battle was over, the new owner paid $11M ($12.9M w/p – est. $3-5M) – they were even accepting cryptocurrency for this lot. And finally, there was Calder's Untitled at $9.6M ($11.3M – est. $4.5-$6.5M).

There were several additional artists whose works performed well; among them were a Bruce Nauman - $7.6M ($9M w/p), Jeff Koons - $8M ($9.5M w/p), and Rudolf Stingel - $3.1M ($3.8M w/p). Also, a small (14 x 11 inches) Elizabeth Peyton's portrait of David Bowie sparked a lot of interest and sold for $1.7M ($2.1M w/p – est. $500-700K), and an 18 x 13 inch oil on panel, painted in 2019, by Salman Toor (who was born in Pakistan), flew past its $60-80K estimate and sold for $700K ($867K w/p).

At the end of the sale, the auction proclaimed a 100% sell-through rate. The only problem I had with the claim is that two lots were withdrawn (Hockney and Morris Louis). Usually, this indicates a lack of interest and the likelihood that the works will not sell. But, since they only put up 32 pieces, I guess we have to give it to them.

Of the 32 lots offered, 32 sold, and the total take was $185.3M ($218.3M w/p). The presale estimate range was $140-194.3M, so they came in close to the high end – which I am sure they were happy about given the fact that some of the bidding dragged on for more than 10 minutes. Of the 32 works offered, 7 were below, 10 within, and 15 above their presale estimate ranges giving them with an accuracy rate of 31.3%. What was even better for some sellers is that almost 50% of the works sold for more than expected. An interesting statistic is that six of the seven works that sold below their estimate ranges were at the end of the sale. Could it be that buyers in Europe were getting tired and went to sleep?

Well, this wasn't the end of the evening's action. Next up were the Impressionist works – talk about a long evening!

The Marathon's Final Leg - Impressionist & Modern

By: Howard

There was a short break after the Contemporary sale, and by about 9:20 pm, the final leg of their marathon event started – those UK staff members must have been drinking a lot of coffee! The auctioneer began by announcing that 11 of 30 works in the sale had irrevocable bids (basically, they were already sold).

The top lot in the sale was Claude Monet’s Le Bassin aux nymphéas, a large work with an added signature that carried an Estimate on Request notation (whisper number was $40M). The bidding opened at $38M and by the time the action stopped, the work sold for $61M ($70.3M), making it the most expensive piece of the three sessions (it was one of the guaranteed lots). On a side note, the painting last sold in 2004 for $16.8M -- a nice return. Paul Cézanne’s Nature morte: pommes et poires carried a hefty estimate of $25-35M, and I guess others felt the same way, as it hammered at $17.15M ($19.9M w/p – the work last sold in 2003 for $8.75M) – making it the second most expensive work in the sale. Amedeo Modigliani’s Jeune fille assise, les cheveux dénoués (Jeune fille en bleu) was expected to bring between $15-20M, but only managed to achieve $14M ($16.4M – this was a guaranteed lot with an irrevocable bid, so it is likely that the guarantor is now the owner). Rounding out the top five were Picasso’s Femme assise en costume vert at $18M ($21M w/p – est. $14-18M – the seller acquired the painting back in 1983 for $568K), and Joan Miró’s Peinture at $10.8M ($12.7M – est. $12-18M – it last sold in 2015 for $12.2M – so the seller took a bit of a loss).

For some reason, they decided to include Childe Hassam’s Flags on 57th Street, Winter 1918 (this one belonged in their American sale, which takes place next week). The work was the property of The New-York Historical Society and estimated at $12-18M. There was very little action, but it managed to find a buyer at $10.5M ($12.3M w/p – also a guaranteed lot, so maybe they now own it). While this was an auction record for the artist, I believe that by offering it in next week’s sale, there would have been much more buzz and possibly a higher price – but we will never know.

Among the other lots that did well were Monet’s Fleurs dans un pot (Roses et brouillard) at $8.8M ($10.4M w/p – est. $4-6M – it last sold in 2002 for $3M), Diego Rivera’s Retrato de Columba Domínguez de Fernández - $6.25M ($7.45M w/p – est. $2-3M), a small Renoir nude, Femme nue couchée, at $3.5M ($4.3M w/p – est. $1-1.5M – last sold in December of 2008 for $1M ), and Leonor Fini’s Autoportrait au scorpion, which sparked a battle and sold for $1.9M ($2.3M w/p – est. $600-800K).

By the end of the sale (around 10:30 pm New York time), of the 33 lots, 31 sold (94% sell-through rate), and the sale totaled $188.6M ($221.3M w/p). Their presale estimate range was $167-$219M, so even without the buyer’s premium, they made it. Of the 31 sold works, 13 were below, 12 within, and 6 above their presale ranges, leaving them with an accuracy rate of 38.7% -- a reasonable number.

My takeaway from this group of sales is that the salerooms need to spread out the material. While we are not buyers at these levels, I cannot imagine that people in Europe were happy having to stay up all night to place a bid. They should go back to the days when the Impressionist and Contemporary sales were spread out over a two week period. There is just too much material offered in such a short period -- it has to impact the prices achieved.

Saved The Best For Last - Christie's 20th Century Evening

By: Lance

Finishing off the week of big Spring sales was Christie’s 20th Century, which featured an impressive lineup; offerings included works by Monet, Rothko, Giacometti, Warhol, Picasso, Mondrian, and a slew of other big names. As you can see 20th Century blends Post-War works with Impressionist & Modern, which in previous years were split. (w.p = with the buyer's premium)

The top spot went to an unsigned painting by Picasso that was inherited from the artist's estate by his granddaughter, Marina Picasso. The work has bounced around a bit, selling in 1997 for just $6.8M, and most recently again in 2013 for $44.7M. This time around, they were expecting somewhere around $55M… but this lot touched off a bidding war that lasted more than 20 minutes! When the action settled, the hammer fell at $90M ($103.4M w.p) – the first auction piece to hit 9 figures since the pre-pandemic days. Taking second was another lot with an unpublished estimate – Monet's Waterloo Bridge, effet de brouillard, which was supposedly expected to bring $35M. They were not far off as it hammered at $42M, but when you add in the premium, it bumps this one up to $48.5M. The last time this one was up for sale, it also topped the estimate, but that was back in 1999 - at that time, the work brought $9.3M on a $4-6M estimate. Rounding out the top 3 was a work by Vincent van Gogh – Le Pont de Trinquetaille. Painted in 1888, this canvas has changed hands more than a dozen times and includes provenance dating back to the artist… it was first acquired by his brother Theo the year it was painted. Most unfortunately, his brother passed away just a few years later; by 1906, the work was in the hands of a private collection. Last time it was up for auction in 2004, it sold for $11.2M on a $12-18M estimate… interestingly however, it had sold just a few years before that for $15.4M on an undisclosed $20M estimate – all three times the work was sold at Christie's New York, so I guess they're the real winners here.

The top spot went to an unsigned painting by Picasso that was inherited from the artist's estate by his granddaughter, Marina Picasso. The work has bounced around a bit, selling in 1997 for just $6.8M, and most recently again in 2013 for $44.7M. This time around, they were expecting somewhere around $55M… but this lot touched off a bidding war that lasted more than 20 minutes! When the action settled, the hammer fell at $90M ($103.4M w.p) – the first auction piece to hit 9 figures since the pre-pandemic days. Taking second was another lot with an unpublished estimate – Monet's Waterloo Bridge, effet de brouillard, which was supposedly expected to bring $35M. They were not far off as it hammered at $42M, but when you add in the premium, it bumps this one up to $48.5M. The last time this one was up for sale, it also topped the estimate, but that was back in 1999 - at that time, the work brought $9.3M on a $4-6M estimate. Rounding out the top 3 was a work by Vincent van Gogh – Le Pont de Trinquetaille. Painted in 1888, this canvas has changed hands more than a dozen times and includes provenance dating back to the artist… it was first acquired by his brother Theo the year it was painted. Most unfortunately, his brother passed away just a few years later; by 1906, the work was in the hands of a private collection. Last time it was up for auction in 2004, it sold for $11.2M on a $12-18M estimate… interestingly however, it had sold just a few years before that for $15.4M on an undisclosed $20M estimate – all three times the work was sold at Christie's New York, so I guess they're the real winners here.

Rounding out the top 5 were works by Rothko and Mondrian… both had an estimate on request. Rothko's Untitled was said to be $40M range, whereas the Mondrian was expected to be close to $25M. Both hammered below expectations, with the Rothko hammering at $33M ($38.1M w.p) and the Mondrian hammering at $24M ($27.8M w.p). All that said, the sellers probably had very different views of the evening… the Rothko was acquired in 2013 for $39.9M (Sotheby's NY on a $15-20M estimate), but the Mondrian was purchased for just $882K back in 1993!

There were a couple of surprising results on the evening – Wayne Thiebaud's Toweling Off came in with a $1.2-1.8M estimate but saw spirited bidding push the price to $8.49M (w.p) or 372% above estimate! A work by Alice Neil, which was interestingly slotted into the sale at the last minute, also far surpassed its estimate of $600-800K; it sold for $3M or 279% above estimate. On the other hand, there were a few that went way lower than expected… the most catastrophic of the few was a sculpture by Joan Miro with a $7-10M estimate. It was a posthumous cast from 1994 – bidding topped out at $3.4M ($4.1M w.p), which is 51% below estimate. A large canvas by Jean Dubuffet shared a similar fate as it went 31% below estimate - $2.75M ($3.3M w.p) on a $4-6M estimate. There was also one left unsold; a Toulouse-Lautrec lithograph with a $500-700K estimate… bidding sputtered at $420K.

At the end of the evening, 50 of the 51 works offered found buyers (one was withdrawn as well). They had 15 works fetch prices above estimate (29%), and 15 works find buyers below estimate (29%), with 19 lots falling within their range – a solid 37% accuracy rate. The total hammer for the sale was $415.9M, but when you add the premiums, that bumps the sale to $481.1M. Given they were expecting between $346.7-428.7, I'm thinking most were pretty happy with how the evening played out.

A Real Difficult One - Sotheby's 19th Century European Sale

By: Howard

I will begin by saying that when I first saw the offerings for this sale, other than a handful of works, I was not very impressed. Supply seems very limited, and what is coming to the market are either not great examples or have condition issues. After we went to view the actual sale, my suspicions were confirmed. We were in and out in under 30 minutes. I assume Sotheby's also felt that the sale was not the best since it was an online-only sale, no live/phone bidding.

I will begin by saying that when I first saw the offerings for this sale, other than a handful of works, I was not very impressed. Supply seems very limited, and what is coming to the market are either not great examples or have condition issues. After we went to view the actual sale, my suspicions were confirmed. We were in and out in under 30 minutes. I assume Sotheby's also felt that the sale was not the best since it was an online-only sale, no live/phone bidding.

The auction began at 2 pm, and was over pretty quickly. The number one lot was James Tissot's The Proposal, which hammered at $850K (1.05M w/p – est. $900-$1M). Since there was only one bid, we can assume that the buyer paid the reserve price. Coming in second was one of the few lots I thought looked promising - William Bouguereau's Yvonne. They expected the work to bring $400-600K, and it sold for $800K ($988K w/p – the seller purchased it in 1991 for $110K, so that was an excellent return). The number three spot saw Henri Gervex's Yachting in the Archipelago, selling for $320K ($403.2K w/p – est. $300-400K). The seller bought the painting in 2017 for $264K, so they probably broke even.

Rounding out the top five were William Bouguereau's Le travail interrompu (this last sold in 1991 for $88,000) and Sorolla's Jardín de los Adarves, Alhambra, Granada (last sold in 2001 for $316K). Both paintings were estimated at $300-500K and sold for $280K ($353K w/p). At least the seller of the Bouguereau was happy!

There were a couple of interesting results. The first was Owen Dalziel's Fish Auction at Yarmouth; a large canvas (32 x 48 inches) that was exhibited at the Royal Academy in 1883. The painting had a very reasonable estimate of $4-6K, which seemed to have sparked a bidding war (65 bids in all). When all was said and done, the work sold for $220K ($277K w/p). I should add that the artist's previous highest auction price was around $13K. You know those sellers were jumping for joy!

The other is one that someone needs to explain to me. There was a del Campo that was a total wreck (overcleaning, lots of inpainting, etc.), and I would have bet it would never sell. The painting brought $32K ($40.3K w/p – est. $40-60K). Obviously, the seller wanted out of it and put a low reserve; but still, from my perspective, $40K for that painting is ridiculous.

As I am sure you can guess, there were a lot of paintings that did not find buyers... among them were Bouguereau’s Les enfants endormis (est. $200-300K), Bouguereau’s Avant le bain (est. $600-800K), Bouguereau’s La sérieuse (est. $300-500K – a very late and loose example), an atypical Gérôme, Promenade de la Cour dans les jardins de Versailles (est. $500-700K), Bartoletti’s Bacchante (est. $150-250K), and Béroud Les joies de l'inondation (est. $300-500K).

When the sale ended, of the 53 works offered, 35 sold (63% sell-through rate), and the total take was just $3.77M ($4.7M w/p). The presale estimate was $5.97-8.85M, so they fell very short. In addition, it appears that before the sale, eight lots were withdrawn. Of the sold works, 12 were below, 14 within, and 9 above their expected range. When we add in the 18 unsold works, this gave them an accuracy rate of 26.4% -- which was better than some of the previous 19th-century sales.

Sadly, it is a lack of good quality material that is causing these results. What seems to be coming up at the New York salerooms are many mediocre works, which have condition issues and estimates that just do not reflect their true value.

The American Art Auctions - And The Winner Was?

By: Amy

This week both Christie's and Sotheby's held their American Art auctions in New York, and you will have to decide who was the overall winner of the American market this season. All sale prices mentioned below include the buyer's premium.

Kicking off the week, Christie's held a live sale titled Fields of Vision: The Private Collection of Artists Wolf Kahn and Emily Mason. Kahn and Mason were married for 62 years, and both recently passed away; Kahn in 2020 and Mason in 2019. The proceeds of their collection went to the Wolf Kahn/Emily Mason Foundation and the Emily Mason/Alice Trumbull Mason Foundation, both supporting artistic visions through exhibitions, research, and philanthropy.

The sale totaled slightly over $8.1M, and both Kahn and Mason achieved new auction records. Down East Sunset I by Kahn was estimated to make $50 -70K and sold for $206K. Mason's Aquifer sold for more than six times its estimate of $10-15K, garnering $93.7K. Top lots in the sale went to more renowned artists – Georgia O'Keeffe took the top spot with a work titled Autumn Leaf with White Flower, estimated at $3-5M, sold for $4.95M. In second place was a painting by Richard Diebenkorn titled Cups II, estimated to bring $500-700K; it sold for $1.47M. In a distant third was a work by Milton Avery, titled Interior with Yellow Lamp; estimated at $120-180K, it brought $362.5K. Of the 28 lots offered, only one lot did not sell. In addition, there was an online-only sale with the rest of the collection (92 lots) that totaled $589K, and again, only one lot did not sell, making the overall sale rate 98.8%.

Later that day, Christie's offered their traditional American sale, featuring 78 lots. The top lot and highlight of the auction was Norman Rockwell's Jeff Raleigh's Piano Solo which was estimated to bring $1.2-1.8M and sold for $2.9M. Coming in second was Newell Convers Wyeth's The Guardians, estimated at $600-800K and selling for $750K. Rounding out the top three was Sanford Robinson Gifford's painting Lake Sunapee, New Hampshire; estimated at $300-500K, it sold for $662.5K. There were no significant upsets here except for a watercolor by Winslow Homer, estimated at $600-800K, that did not sell. The auction totaled just over $9M with the premium, falling right in the middle of the $7.26-11.8M presale estimate, with a sell-through rate of 80.8%.

The next day was Sotheby's turn; they offered just 61 lots and the sale began with a bang! The first two lots blew away their estimates - Gertrude Abercrombie's Giraffe was estimated at $10-15k and sold for $365K! WOW! Next was Orville Bulman's Les Voila Paris, estimated at $25-35K - it sold for $126K. But then things came back to reality; the top lot in the sale was a work by Mary Cassatt, Baby Charles Looking over His  Mother's Shoulder (No. 3), which was guaranteed to sell; estimated at $1-1.5M, it just cleared the top end when it made $1.59M. Childe Hassam's Piazza di Spagna, Rome came in second, beating its estimate of $500 -700K, selling for $1.23M. Taking the third spot was Georgia O'Keeffe's Green Oak Leaves which also sold beyond the $500-800K estimate, garnering $1.17M.

Mother's Shoulder (No. 3), which was guaranteed to sell; estimated at $1-1.5M, it just cleared the top end when it made $1.59M. Childe Hassam's Piazza di Spagna, Rome came in second, beating its estimate of $500 -700K, selling for $1.23M. Taking the third spot was Georgia O'Keeffe's Green Oak Leaves which also sold beyond the $500-800K estimate, garnering $1.17M.

The big disappointment of the sale was a work by Thomas Moran. Estimated at $2-3M, it actually should have been the highlight of the sale, but it failed to find a buyer. Here's an interesting note - a work by Charles Sheeler, estimated at $500-700K, could not find a buyer the first time around during this auction. Sotheby's reoffered the lot later in the sale, and it sold for an underwhelming $315K? Guess the Newark Museum really did not want it back!! The auction's presale estimate was $13.5-19.9M and when all was said and done, the overall take was just shy of $15M.

So in the end, I guess Sotheby's won the American market this year… Christie's may have garnered a bigger total, selling over $17.7M, but it took three sales and 198 lots… Sotheby's came close to $15M with just 61 lots offered, although that was a far cry from their high expectations. To make the comparison clearer, Christie's average price per lot was close to $90K and Sotheby's was more than 2.5 times that with an average price of $245K!!

The Rehs Family

© Rehs Galleries, Inc., New York –June 2021