COMMENTS ON THE ART MARKET

Gallery News

June Gallery Exhibition

Rehs Contemporary, in partnership with Art Renewal Center, is pleased to announce our current exhibition INSIGHT which runs through June 24th. INSIGHT features artwork by 5 international artists of various nationalities – Jesús Inglés and Arantza Sestayo (Spanish), Alexandra Klimas (Dutch), Roman Pankov (Ukrainian), and Anne-Marie Zanetti (Australian).

____________________

Stocks & Crypto

By: Lance

All things considered, I was pleased with where the markets closed out May. Early in the month, there was substantial worry that we were officially entering a bear market as losses continued to mount… but the downward trend turned volatile, with large swings in both directions; in fact, this month the Dow saw multiple days with 1,000+ point fluctuations. Fortunately, the final week leading up to Memorial Day provided some relief… all three major indices closed out the month roughly where they started. The Dow saw a gain of just .03%, the S&P 500 was up .03%, and the NASDAQ was down 2%. Again, with the way things were going, I’ll call this a win.

Turning to currencies and commodities, both the Pound and Euro fell alongside the equities markets through the first two weeks before recovering… the Pound closed out at $1.26, up 1.1%, while the Euro closed at $1.07, up 2.1%. Keeping an eye on Japan, the Yen bounced a bit from its steep decline in the past 2 months, up 2% in May. Gold and crude took diverging paths… the solid was down more than 3.5% for the month, whereas the liquid was up more than 10%! With continued uncertainty surrounding Russia and escalating sanctions, it’s not surprising to see oil prices rising, but it is anyone’s guess how this plays out in the long run.

The crypto plunge continued, hitting some of its lowest levels since the market took off in 2020… Bitcoin bottomed out just north of $25K; a significant decline from the first week of May when it topped $40K. It is currently at $31.6K, but that $30K threshold has long been seen as the bottom end of the trading range… falling below that number is fairly worrying, especially with the way things are trending. Ethereum also saw a seismic drop, falling from the $3K ballpark to about $1,700 – a loss of roughly 40%... it closed out May just under $2K, equivalent to a 30% loss for the month. Litecoin saw the most sizable drop, shedding nearly 47% of its value before recovering to the $70 range – a decline of 30%.

At the end of it all, there are still several concerns on the table… from Russia, to inflation, to interest rate hikes. Analysts are not in agreement as to whether a bottom has been established, and given the continued uncertainty, I’d bet the volatility will continue.

____________________

The Dark Side

By: Nathan

Oleg Kulik: A Criminal for Joking?

Andy Warhol is known for many things, soup cans and flowers among them. But his portraits are often cited as some of the pop art icon’s most recognizable works. From Marilyn Monroe to Mao Zedong to Mick Jagger, Andy Warhol seems to have immortalized every great cultural figure of the twentieth century in neon-colored silkscreen. Among Warhol’s portrait subjects, the musician and 1980s icon Prince is just one of many. But it’s a Warhol portrait of Prince that’s the subject of an upcoming US Supreme Court case.

Andy Warhol is known for many things, soup cans and flowers among them. But his portraits are often cited as some of the pop art icon’s most recognizable works. From Marilyn Monroe to Mao Zedong to Mick Jagger, Andy Warhol seems to have immortalized every great cultural figure of the twentieth century in neon-colored silkscreen. Among Warhol’s portrait subjects, the musician and 1980s icon Prince is just one of many. But it’s a Warhol portrait of Prince that’s the subject of an upcoming US Supreme Court case.

It all started in 2016 following Prince’s death, when Vanity Fair published an article on the late musician. Accompanying the article was a number of colorful portraits of Prince done by Andy Warhol in the years leading up to the artist’s 1987 death. That’s when Lynn Goldsmith noticed something out of place. Warhol’s portraits bore a striking resemblance to a photo she had taken of Prince in 1981. Lynn Goldsmith is a musician and a photographer known for having taken photos of many celebrities and public figures. While she may occasionally snap a picture of Hillary Clinton or the Dalai Lama, she’s always been a musical photographer at heart. Singers and musicians are her most common subjects, including Bob Dylan, Keith Richards, Michael Jackson, and Bruce Springsteen. She’s also taken pictures for a number of recognizable album covers, most iconically Frank Zappa’s Sheik Yerbouti. But the center of this legal battle has to do with Goldsmith’s 1981 black-and-white portrait of Prince.

Goldsmith originally licensed the photo to Vanity Fair in 1984 for use in an article about Prince entitled “Purple Fame”. The magazine then reached out to Warhol to create a portrait based on Goldsmith’s photograph. The Warhol portrait accompanied the article, but Vanity Fair credited Goldsmith for the original work. However, Warhol went on to create an additional fifteen portraits of Prince based on the original photograph without Goldsmith’s permission. After discovering this, Goldsmith reached out to the Andy Warhol Foundation for the Visual Arts (AWF), the organization that holds the copyright to all Warhol works. It seems her efforts to remedy the situation failed, because she then registered the original photo with the US Copyright Office. The AWF sued, while Goldsmith countersued, starting the legal battle that has continued to the present day.

In New York federal court, Judge John Koeltl ruled that although photographs are copyrightable, “the subject itself – and general features of that subject – are not.” Furthermore, Judge Koeltl wrote that Goldsmith doesn’t really have a case against the AWF because of Warhol’s transformation of the original photograph. The changes that Warhol made “result[ed] in an aesthetic and character different from the original. The Prince Series works can reasonably be perceived to have transformed Prince from a vulnerable, uncomfortable person to an iconic, larger-than-life figure.” This decision, however, was overturned on appeal. The panel of appellate judges ruled that a secondary work being transformative cannot be determined just by the artist’s intent or the perceptions of the work. “[W]hether a work is transformative cannot turn merely on the stated or perceived intent of the artist or the meaning or impression that a critic – or for that matter, a judge – draws from the work. Were it otherwise, the law may well ‘recogniz[e] any alteration as transformative.’” Faced with this new ruling, the AWF has appealed to the Supreme Court, who agreed to hear the case this past Monday.

A group of professors of both copyright and art law, as well as lawyers representing the Robert Rauschenberg Foundation, the Roy Lichtenstein Foundation, and the Brooklyn Museum, have already submitted briefs to the Supreme Court supporting the AWF’s case against Goldsmith. While the AWF wants to portray the situation as artistic free expression under siege by some random photographer and the US legal system, what this case really deals with is simple: fair use within the context of copyright. These cases are context-based, and even if the justices side with Goldsmith, by no means will it create a new case law precedent for future free use copyright disputes. In law, there are certain circumstances where the free use justification is applicable, like commentary or journalism. No author is going to sue a literary critic because they used a quote from one of their books in a review. But taking someone else’s photograph, making an exact copy via screenprint, and then just changing the color is, by most people’s definition, not a wholly original work and is a clear and blatant infringement of copyright. The AWF is just making a fuss over a mistake their namesake made, and now they don’t want to look bad in front of everyone.

Left Hanging: Dictator’s Wife Caught with a Stolen Picasso

Ferdinand Marcos was president of the Philippines between 1965 and 1986 and was known as one of the most prominent dictators of the Cold War. He kept a hold on power through electoral fraud, corruption, and violent repression, aided by maintaining martial law for nine years straight. While that doesn’t make him stand out among the cast of colorful characters that the Cold War had to offer, his wealth made him unique. Marcos and his wife Imelda used their political power to enrich themselves and their family, mainly by skimming money from foreign aid and receiving kickbacks from government contracts. Experts estimate that the Marcos family plundered $5 billion at a minimum, with some economists predicting that the family could have stolen as much as $30 billion. Since Marcos typically only declared his presidential salary on government documents, he hid his ill-gotten gains by investing in real estate, buying jewelry, and, the focus of this story, curating a 200-piece art collection.

Ferdinand Marcos was president of the Philippines between 1965 and 1986 and was known as one of the most prominent dictators of the Cold War. He kept a hold on power through electoral fraud, corruption, and violent repression, aided by maintaining martial law for nine years straight. While that doesn’t make him stand out among the cast of colorful characters that the Cold War had to offer, his wealth made him unique. Marcos and his wife Imelda used their political power to enrich themselves and their family, mainly by skimming money from foreign aid and receiving kickbacks from government contracts. Experts estimate that the Marcos family plundered $5 billion at a minimum, with some economists predicting that the family could have stolen as much as $30 billion. Since Marcos typically only declared his presidential salary on government documents, he hid his ill-gotten gains by investing in real estate, buying jewelry, and, the focus of this story, curating a 200-piece art collection.

The Marcos family is back in the news again because Ferdinand and Imelda’s son Ferdinand Jr., also known as “Bongbong”, was elected president and is set to take office this June. Many have noted how his campaign was rooted in attempting to sanitize or whitewash his father’s dictatorship by trivializing or straight-up ignoring the human rights abuses and the outright theft that went on for twenty years. But this may be difficult to do when the Marcos family makes such lackadaisical efforts to hide all of it. A photo of Imelda celebrating her son’s electoral victory had some people looking not at the celebration but the wall behind the couch. One of the paintings hanging on the wall has since been identified as Femme Couchée VI, a 1932 work by Pablo Picasso almost certainly bought using the family’s plundered billions.

Many have been aware that this particular Picasso has been in Imelda Marcos’s possession for years. In 2014, the Philippine government seized a cache of artworks from the Marcos family, the Femme Couchée among them. Yet, in 2019, a documentary film looking into the life of Imelda Marcos featured several interviews with the former first lady. In these interviews, the Picasso in question is hanging on the wall behind her. Soon after the documentary’s release, authorities raided Imelda Marcos’s house in Makati City, only to find that the Picasso had been moved elsewhere. Philippine officials have since claimed that they probably seized a forgery back in 2014 and that the real Picasso is likely still in the Marcoses’ possession, worth over $150 million.

With Bongbong Marcos about to become president, there is a very real possibility that he will effectively crush any governmental efforts to recover his family’s plunder. Maybe the lack of oversight in hiding the Picasso is just a sign of the family’s growing comfort in showing off their wealth again. Who knows? But I think we all know that regardless, it’s not looking good for the Philippines.

Experts Disagree Over Stolen Titian Portrait

Italy’s Cultural Heritage Protection Unit has successfully recovered a stolen portrait by a Renaissance master. In 2004, a work by Titian entitled Portrait of a Gentleman with a Black Beret went missing. Created when the master was around 24-years-old, the work was said to have been stolen and trafficked to Switzerland. However, after a decade and a half, authorities in Italy received an anonymous tip in 2020 that someone had spotted the work at a restorer’s studio in Asti, in northwestern Italy. Two Swiss citizens have since been under investigation concerning the work’s theft. The Carabinieri, a branch of Italy’s national police, announced these details while presenting the portrait to the press at the Palazzo Chiablese in Turin.

Italy’s Cultural Heritage Protection Unit has successfully recovered a stolen portrait by a Renaissance master. In 2004, a work by Titian entitled Portrait of a Gentleman with a Black Beret went missing. Created when the master was around 24-years-old, the work was said to have been stolen and trafficked to Switzerland. However, after a decade and a half, authorities in Italy received an anonymous tip in 2020 that someone had spotted the work at a restorer’s studio in Asti, in northwestern Italy. Two Swiss citizens have since been under investigation concerning the work’s theft. The Carabinieri, a branch of Italy’s national police, announced these details while presenting the portrait to the press at the Palazzo Chiablese in Turin.

Upon inspection, specialists gave the recovered Titian a value of around €7 million, making it one of the more valuable works by the Venetian master. His auction record was achieved in 2011 when his Madonna and Child sold at Sotheby’s New York for $16.9 million. However, the experts are not all in complete agreement. Some, like Andrea Donati and Vittorio Sgarbi, dispute that Titian even created the work. Donati, a prominent art historian, wrote that the style is inconsistent with the Venetian master’s work. Donati claims that the portrait seems more like a German or Flemish imitation of Italian-style portraiture. “I do not even see the shadow of Titian in this portrait,” he wrote. Sgarbi, a politician and art critic, later stated, “If that’s a Titian, I’m Napoleon!” Quite the authoritative statement. But yet, these are the assessments of two people, not the consensus. Accordingly, the Italian government has not given any indication that these objections will be addressed through further research. The Cultural Heritage Protection Unit’s Turin office has 280 agents alone. Surely one of them would have caught on that the portrait might not be a true Titian. But who knows?

Not Looking Good for Danieli

In December, there was quite a bit of commotion when FBI and IRS agents led a raid on the Palm Beach locations of Danieli Fine Art and Galerie Danieli. The agents covered the windows with brown paper and began removing things from the gallery in cardboard boxes. Some of these boxes were broad and thin, poor for holding documents, but great for storing paintings. While I hypothesized that Danieli had something in their possession that they shouldn’t have, this week’s reports confirmed those suspicions.

In December, there was quite a bit of commotion when FBI and IRS agents led a raid on the Palm Beach locations of Danieli Fine Art and Galerie Danieli. The agents covered the windows with brown paper and began removing things from the gallery in cardboard boxes. Some of these boxes were broad and thin, poor for holding documents, but great for storing paintings. While I hypothesized that Danieli had something in their possession that they shouldn’t have, this week’s reports confirmed those suspicions.

Daniel Elie Bouaziz, the owner of both galleries, was arrested on charges of mail fraud, wire fraud, and money laundering in connection with selling forged works of art. He was released on bail for the hefty sum of $500,000, which is surprising because Bouaziz is a French citizen and therefore a flight risk. These forgeries were, according to the Associated Press, “cheap reproductions” of original works by modern and contemporary masters that Danieli was known for. Documents show that Bouaziz had dealt in reproductions that he claimed were originals by Roy Lichtenstein, Andy Warhol, Jean-Michel Basquiat, and Bansky. Bouaziz bought these fakes from online auction websites and sold them for insane markups claiming them as originals. In one instance, Bouaziz purchased a $100 replica of a Warhol print and sold it later for $85,000 as an original print. After six clients discovered that their coveted works were fakes, federal authorities opened an investigation into both galleries in 2021. During the investigation, Bouaziz offered undercover agents several deals on his reproductions. Most egregiously, he had a “Basquiat” on sale for $12 million that he bought online for €495 (or $530). But this goes beyond the works themselves. Bouaziz also allegedly forged documents relating to the works’ provenance and authenticity.

One of the hints that something may not have been entirely legitimate was the prices. While the Galerie Danieli sold these reproductions at very high markups, the price tags were at times not as high as they should have been if they were original works. One work purported to be an original Warhol, which would have been worth millions of dollars, was sold for a mere $25,000 at the Palm Beach location. Investigators claim that Bouaziz used the profits from the replicas to buy himself a Lamborghini, Rolex watches, and jewelry from Cartier.

Bouaziz has his plea hearing on June 15th. If found guilty, he faces up to twenty years in prison and hundreds of thousands of dollars in fines.

____________________

Really?

By: Amy

The Jersey of the Century

Would you give someone the shirt off your back? Two soccer players did just that after the 1986 World Cup semifinal game in Mexico – and one of them just scored again when the ‘Jersey of the Century’ sold at auction.

Would you give someone the shirt off your back? Two soccer players did just that after the 1986 World Cup semifinal game in Mexico – and one of them just scored again when the ‘Jersey of the Century’ sold at auction.

Diego Maradona was an Argentinian football (soccer) player in the 1980s and is considered by many to be one of the greatest players of all time. Maradona made two of his most famous goals during the 1986 World Cup quarterfinal game against England. The first has become known as the ‘Hand of God‘ goal; Maradona illegally punched the ball past the goalkeeper, and the referees mistakenly thought he used his head. After the game, Maradona stated that the goal was ‘a bit with his head and a bit with the Hand of God.’

Just four minutes later, Maradona scored his second goal in the game. He gained possession of the ball at midfield, dribbled through the English defenders, and right passed the goalkeeper, solidly kicking the ball into the goal. In 2002 this goal was voted by fans as the ‘Goal of the Century.’ Argentina went on to win the game 2-1. The team went on to win the World Cup that year, defeating West Germany 3-2.

After the game, Steve Hodge, England’s midfielder, asked Maradona if he would swap jerseys. Maradona was happy to make the exchange as Hodge was the player who accidentally flicked the ball to Maradona for his famous Hand of God goal. In 2002, Hodge loaned the jersey to the National Football Museum in Manchester, where it has been on display. Recently, Hodge decided it was time to sell the jersey. When word got out that he planned to auction it, delegates of the Argentine Football Associate traveled to England to try and convince him to return the jersey to Maradona’s family; he decided to proceed with the auction.

The presale estimate was £4- 6M ($5 – 7.5M), and while the jersey didn’t skyrocket passed the estimate, it did surpass it when it sold for a record price of £7.1M ($9.3 M w/p). This jersey now holds the record for the most expensive game-worn jersey, beating the record set in 2019 for a Babe Ruth jersey that sold for $5.6M. In addition, it holds the record for any sports memorabilia sold at auction after topping the Olympic Manifesto from 1892, which sold in 2019 for $8.8M.

Presidential Rocking Chair Soars

With summer just around the corner, maybe it’s time to sit back, relax and enjoy the warmer weather in a new rocking chair. Perhaps a slightly used presidential rocking chair. One lucky person might be able to do that, as one of President John F. Kennedy’s treasured rocking chairs recently sold at auction.

With summer just around the corner, maybe it’s time to sit back, relax and enjoy the warmer weather in a new rocking chair. Perhaps a slightly used presidential rocking chair. One lucky person might be able to do that, as one of President John F. Kennedy’s treasured rocking chairs recently sold at auction.

JFK was known to have issues with his back and underwent surgery before becoming a senator in 1955. Upon a follow-up visit to his doctor, Janet Travell, he sat in a rocking chair in her office and found it so comfortable that he bought one for his senate office.

When JFK became President and moved into the White House, the rocker came with him. Unfortunately, his back pain worsened and he decided to purchase additional rocking chairs for the White House, as well as Camp David, his family homes in Hyannis Port and Palm Beach, and of course, for Air Force One. In total, JFK had 12 chairs made.

The rocking chairs became Kennedy’s favorite pieces of furniture. To share his enjoyment of the rocker, he gifted several of them to friends and supporters. Kennedy gave one of the chairs to former New York governor Averell Harriman (1891 – 1986). Upon Harriman’s death, the bulk of his estate went to his third wife, Pamela Harriman (1920–1997).

After Pamela died in 1997, the treasures left in the Harriman’s three homes were auctioned. More than one thousand items were sold over six sessions, many exceeding their estimates. Melvin “Pete” Mark, a Portland businessman and philanthropist, purchased the Harriman’s rocker, as he had a passion for collecting presidential memorabilia.

Melvin Mark passed away in 2017, and, to respect his wishes, his family consigned most of his collection for auction, with the proceeds going to a foundation for the arts. The bidding for the chair started at just $57.5K and rocked the room when the hammer finally fell at $480K ($591K w/p). This sale made the Harriman rocker the highest-valued of the Kennedy rocking chairs, beating out two similar chairs from the Jackie Kennedy auction in 1996 that sold for $442K and $453K, respectively.

Kurt Cobain’s “Smells Like Teen Spirit” Guitar Sells at Auction

Rock and roll memorabilia is a big business, and guitars used by the biggest rock stars command big prices. According to Rolling Stone, the most expensive guitar ever auctioned was Kurt Cobain’s guitar from his 1993 MTV Unplugged performance. The 1959 Marin D-18E acoustic guitar sold in 2020 for just over $6M. Until this past week, coming in second was a guitar that belonged to David Gilmour of Pink Floyd, which sold in 2019 for $3.98M. Well, now that guitar has slipped to third place. Another one of Cobain’s guitars strums into second.

Rock and roll memorabilia is a big business, and guitars used by the biggest rock stars command big prices. According to Rolling Stone, the most expensive guitar ever auctioned was Kurt Cobain’s guitar from his 1993 MTV Unplugged performance. The 1959 Marin D-18E acoustic guitar sold in 2020 for just over $6M. Until this past week, coming in second was a guitar that belonged to David Gilmour of Pink Floyd, which sold in 2019 for $3.98M. Well, now that guitar has slipped to third place. Another one of Cobain’s guitars strums into second.

The Lake Placid blue guitar, consigned by the Cobain family, enticed a very spirited bidding battle. Collectors from all over the world vied for the late singer’s iconic guitar, and in the end, Jim Irsay, the owner of the Indianapolis Colts, was victorious. It was estimated to make $600K – 800K and led the sale when it hammered down at $3.75M ($4.55M w/p).

Irsay’s passion for rock and roll and pop culture has driven him to amass an amazing collection. A few of the famous guitars he owns include David Gilmour’s guitar (mentioned above), Jerry Garcia’s Tiger guitar ($1M), and Bob Dylan’s Stratocaster ($965K). Irsay plans to open a museum to showcase his collection.

When the family found out that Irsay purchased the guitar, they decided to donate part of the proceeds to Kicking the Stigma, an Indiana-based non-profit that the Colts and Irsay started to help battle mental illness.

____________________

The Art Market

By: Nathan, Amy & Howard

Bonhams Knightsbridge Marine Sale

By: Nathan

I was initially excited for the Bonhams marine sale on Wednesday, April 27th, mainly because it was truly a mixed bag of different pieces of maritime art. While most of the lots were paintings, the first thirteen were not. Some were pieces of Barbadian folk art made from shells, while others were examples of scrimshaw, some ship models, and a gold ring commemorating the British victory at Trafalgar with a strand of Horatio Nelson’s hair inserted into the enamel. There were some great examples of marine art, but unfortunately, that day’s buyers didn’t seem to think so. While the experts predicted that the entire sale would bring in anywhere between £510.5K and £732.2K, frustratingly, the sale fell short of the minimum estimate by a mere £220. Only forty-six of the one hundred sixty-two available lots (28%) fell within their estimates. Thirty-one lots (19%) surpassed their estimates, while fifty-six lots (35%) went unsold. The biggest victims were those artists with many works featured. If you watch art auctions long enough, you begin to realize something. There’s an inverse correlation between the number of pieces by one artist and the interest that artist garners. This was seen on Wednesday with the nineteenth-century British painter Nicholas Matthew Condy. There were ten paintings by Condy featured in the sale, but only five sold (just too much material for the market to absorb at one time). But at least of the five that sold, three sold within estimate and two slightly above. Condy’s contemporary, the Dutch painter Abraham Hulk, also had ten works featured, but he did far worse. Out of ten, only one sold within estimate, three others sold below, and the other six were unsold. Regardless, the auction wasn’t complete doom and gloom. There were still some highly-valued lots that sold, along with a few surprises.

The Battle of the Saintes was painted by British naval lieutenant William Elliott, showing a 1782 British victory over the French in the American Revolutionary War. The canvas is massive, measuring close to five feet tall by eight-and-a-half feet wide, enabling a viewer to observe some of the details of the French and British warships. If it weren’t for the billowing smoke from the cannons, the work would seem oddly peaceful, with scores of ships lined up against one another in the rippling Caribbean waters. Though estimated to sell for between £25K and £35K, the hammer came down at £48K / $60.2K (or £60.8K / $76.2 w/p). Not far behind was a work by the nineteenth-century British marine painter David James which sold for slightly above its estimate. While about half the size of the Elliott work, Plunging Seas is a very typical work by James, as he tended to focus less on coastlines and ships at sea and preferred to study the ocean itself. The canvas of tumbling waves sold for £46K / $57.7K (or £58.3K / $73.1K w/p), exceeding its original £35K high estimate. Finally, two works tied for third place: the maritime painting entitled Margate by George Chambers shows the eponymous British port town located at the eastern end of Kent in southern England. The other work was Norman Wilkinson’s The Canadian Pacific liner Empress of Canada lying in Hong Kong harbour. The title doesn’t exactly leave much explaining for me to do. Both paintings sold for £28K / $35.1K (or £35.6K / $44.6K w/p), though predicted to go for £10K and £12K maximum, respectively.

The Battle of the Saintes was painted by British naval lieutenant William Elliott, showing a 1782 British victory over the French in the American Revolutionary War. The canvas is massive, measuring close to five feet tall by eight-and-a-half feet wide, enabling a viewer to observe some of the details of the French and British warships. If it weren’t for the billowing smoke from the cannons, the work would seem oddly peaceful, with scores of ships lined up against one another in the rippling Caribbean waters. Though estimated to sell for between £25K and £35K, the hammer came down at £48K / $60.2K (or £60.8K / $76.2 w/p). Not far behind was a work by the nineteenth-century British marine painter David James which sold for slightly above its estimate. While about half the size of the Elliott work, Plunging Seas is a very typical work by James, as he tended to focus less on coastlines and ships at sea and preferred to study the ocean itself. The canvas of tumbling waves sold for £46K / $57.7K (or £58.3K / $73.1K w/p), exceeding its original £35K high estimate. Finally, two works tied for third place: the maritime painting entitled Margate by George Chambers shows the eponymous British port town located at the eastern end of Kent in southern England. The other work was Norman Wilkinson’s The Canadian Pacific liner Empress of Canada lying in Hong Kong harbour. The title doesn’t exactly leave much explaining for me to do. Both paintings sold for £28K / $35.1K (or £35.6K / $44.6K w/p), though predicted to go for £10K and £12K maximum, respectively.

Towards the end of the sale, a pair of works by a contemporary marine artist spiced things up a bit. Martyn Richardson Mackrill’s works, entitled Light airs and a flowing tide and Two yachts in full sail, possibly off Cumbrae, were only valued at £1K and £800, respectively. For a pair of contemporary works, it’s not terrible. But demand for Mackrill’s work may be picking up since both paintings sold for £7K / $8.8K (or £8.9K / $11.2 w/p). While not exponentially exceeding its estimate, a third Mackrill work, 30 linear raters racing on the Solent, reached £2K / $2.5K (or £2.8K / $3.5K w/p). Though Bonhams specialists ever so slightly missed the mark, at least they came close. Despite all the unsold works, the sale highlighted some more modern and contemporary artists like Mackrill and Wilkinson.

Sotheby’s Modern Online Sale

By: Nathan

Sotheby’s modern and impressionist online auction on Wednesday, May 4th, may not have had any multimillion-dollar lots, but it was nonetheless a great sale for Sotheby’s. It garnered a good bit of attention, likely because many of the featured works were once in the collection of Marina Picasso. The modern master’s granddaughter is one of the five members of the Picasso Administration, the organization that oversees the artist’s estate. I’ve previously written about Marina Picasso when she and her son Florian unsuccessfully attempted to mint NFTs based on Picasso ceramics they own.

Sotheby’s modern and impressionist online auction on Wednesday, May 4th, may not have had any multimillion-dollar lots, but it was nonetheless a great sale for Sotheby’s. It garnered a good bit of attention, likely because many of the featured works were once in the collection of Marina Picasso. The modern master’s granddaughter is one of the five members of the Picasso Administration, the organization that oversees the artist’s estate. I’ve previously written about Marina Picasso when she and her son Florian unsuccessfully attempted to mint NFTs based on Picasso ceramics they own.

The modern and impressionist department specialists accurately predicted two of the top three lots: Pierre-Auguste Renoir’s 1898 work Composition, Pommes is just a simple still-life of apples on a countertop. It was estimated to go for anywhere between £150K and £200K, selling for £160K / $199.8K (or £259.7K / $324.3K w/p). The lot directly following the Renoir was Maurice Denis’s oil on canvas work entitled Nausicaa. While some may know the title from the 1984 Hayao Miyazaki film Nausicaä of the Valley of the Wind, it originates in classical mythology. The painting by Denis shows a scene from the Odyssey, where Odysseus washes up on the beaches of Phaeacia after surviving a shipwreck. He wanders through the woods naked until he stumbles upon Nausicaa and her servants washing clothes. Following this scene, Nausicaa gives Odysseus some clothes to wear so he can come with her to her parents and retell the story of his journey home thus far. Denis’s treatment of the scene was estimated to go for £80K to £120K. In the end, I think both the work’s size (41 x 55 inches) and the familiarity of the subject caused it to exceed the specialists’ expectations and reach £160K / $199.8K (or £201.6K / $251.7K w/p).

The third-place lot was a bit of a surprise since it was only thought to fetch £20K to £30K. Albert Marquet’s Environs d’Alger is a landscape from 1920 showing the city of Algiers. While you can only make out a few of the buildings in the distance, the foreground is colored with many shades of green from the hillside vegetation. The line where the city meets a Mediterranean bay is also rather distinct. While not expected to get anywhere near the top three, Marquet’s landscape reached £120K / $149.8K (or £151.2K / $188.8K w/p). The one lot that Sotheby’s specialists misjudged was Odilon Redon’s painting Ophélie, which was set to bring in just as much as the Renoir but was unfortunately passed over and went unsold.

But Sotheby’s may have missed the mark when predicting how much some would spend on the sale’s Picasso ink-on-paper drawings. According to Sotheby’s provenance information, both his Étude de personnages and Étude de tête were created in the 1920s and were “unlawfully removed” from Picasso’s studio. While my first thought was that the drawings had been looted during the Second World War, it’s more likely that a visitor or an assistant stole the pictures. This would have been especially easy for Étude de tête since it only measures 4¼ x 3¾ inches. Though estimated to go for only £800 and £1K, respectively, the name recognition Picasso has decades after his death resulted in several bidding wars over the drawings. Étude de tête sold for seven-and-a-half times its estimate at £15K / $18.7K (or £18.9K / $23.6K w/p). Meanwhile, Étude de personnages did even better when it destroyed the specialists’ predictions and sold for £11K / $13.7K (or £13.86K / $17.3K w/p), close to fourteen times its estimate.

Of the one hundred forty-six available lots, 45% sold above estimate, while an additional 38% sold within estimate. Only seven lots sold below estimate, and eighteen went unsold. Prior to the sale, Sotheby’s experts predicted the whole auction would bring in anywhere between £2.44M and £3.55M. So it’s safe to say that everyone was satisfied after the last lot sold and the total tallied up to £3.42M (or $4.28M). It shows that even the low-to-mid end of the modern and impressionist market is still strong.

Christie’s New York Ammann Collection Sale

By: Nathan

On Monday night, May 9th, Christie’s New York saleroom in Rockefeller Center hosted the auction of one of the world’s premier twentieth-century art collections, belonging to Thomas and Doris Ammann. Thomas Ammann was a Swiss art dealer who operated Thomas Ammann Fine Art in Zürich. From the 1970s until he died in 1993, Ammann became known as one of the top dealers in twentieth-century art, with works by Picasso, Matisse, Bacon, Calder, and Kandinsky frequently decorating the walls of his gallery. Ammann also greatly supported the top contemporary artists, curating a personal collection filled with works by Cy Twombly, Alberto Giacometti, and Jean-Michel Basquiat. But of all the artists he worked with, he was closest to the pop art icon Andy Warhol. Warhol permitted Ammann to compile his official catalogue raisonné, the first volume of which wasn’t released until 2002, after both Warhol and Ammann had died. Doris Ammann was Thomas’s sister and business partner who passed away last year.

Minimalist works may have gotten more attention than expected when one looks at the top lots. Untitled works by Cy Twombly and Robert Ryman took second and third place at the sale, selling for $18M ($21M w/p) and $17.25M ($20.1M w/p), respectively. The Ryman work may be a little underwhelming through a computer screen, but it’s certainly more impressive up close. The linen support is nearly a perfect square, five feet by five feet. Though most of the work is painted completely white, one square section dominating the upper right-hand corner has such thick impasto that it almost seems like paint peeling away and revealing traces of a more colorful work beneath it. While the Twombly and the Ryman were certainly on the specialists’ radar, there was no doubt what the auction’s top lot would be. Andy Warhol’s 40×40-inch portrait Shot Sage Blue Marilyn was featured in the arts sections of most American news sites within an hour of the hammer coming down at $170M (or $195.04M w/p). While it was less than the $200M that experts predicted, the hammer price is nothing to complain about.

The auction was a good opportunity to highlight the modern masterworks Ammann had collected during his life. But it seems buyers were just as interested in the contemporary artists included in the collection. Mike Bidlo’s Masterpieces Series is the American artist’s attempt to immerse himself in the work and creative processes of modern masters by recreating or reinventing famous masterworks. He started this project in 1982 by recreating the works of Jackson Pollock. By 1987, he presented Not Picasso (Bather with Beachball, 1932), which was estimated to sell for $60K to $80K by Christie’s experts. It was the first lot up for sale, so everyone was probably taken aback when this contemporary work, a recreation of another work, sold for $1M (or $1.26M w/p), twelve-and-a-half times what it was expected to sell for. Moments later, Francesco Clemente’s Fourteen Stations, No. XI sold as well. The title implies that the subject is the eleventh of the Fourteen Stations of the Cross, showing the death of Christ. But while the eleventh station is Christ nailed to the cross, some viewers may not recognize Clemente’s abstract work as such at first glance. Like the Bidlo work, the Clemente was estimated to sell for anywhere between $80K and $120K, shocking everyone with a hammer price of $1.5M (or $1.86M w/p). But the biggest surprise of the evening came towards the end when Ann Craven’s I Wasn’t Sorry, 2003 came across the block. Though created less than 20 years ago, the four-foot by five-foot oil-on-canvas reached a stunning eighteen times its $30K high estimate at $540K (or $680.4K w/p).

Overall, it was an incredible night for Christie’s. Nineteen of the thirty-six available lots (53%) sold over their estimates, with thirteen selling for more than double their high estimates. Only four lots sold below estimate, and two went unsold. Despite the Marilyn portrait falling short, the sale still brought in a total of $273M, a substantial amount going to fund Ammann’s charitable foundation dedicated to aiding underprivileged children.

Christie’s New York Bass Collection & 20th Century Sales

By: Nathan

Christie’s Rockefeller Center saleroom in New York hosted back-to-back sales last Thursday, May 12th, kicking off a string of very successful auctions between Thursday and Saturday. There were actually a trio of sales that evening, but I won’t be talking about the $11.5M dinosaur skeleton that followed the two art sales. The sale that started everything off was that of a prominent private collection. The twelve pieces featured once belonged to Anne H. Bass, a prominent investor and philanthropist who passed away in 2020. The small but incredibly valuable collection was set up for viewing at Christie’s in one of the ground floor galleries. The collection’s three paintings by Monet hung in a darkened, semicircular alcove with pale purple and blue lights focused on each canvas to highlight their dominant colors. By the end of the night, the Bass Collection brought in more for Christie’s than many of their hundred-lot sales.

Christie’s Rockefeller Center saleroom in New York hosted back-to-back sales last Thursday, May 12th, kicking off a string of very successful auctions between Thursday and Saturday. There were actually a trio of sales that evening, but I won’t be talking about the $11.5M dinosaur skeleton that followed the two art sales. The sale that started everything off was that of a prominent private collection. The twelve pieces featured once belonged to Anne H. Bass, a prominent investor and philanthropist who passed away in 2020. The small but incredibly valuable collection was set up for viewing at Christie’s in one of the ground floor galleries. The collection’s three paintings by Monet hung in a darkened, semicircular alcove with pale purple and blue lights focused on each canvas to highlight their dominant colors. By the end of the night, the Bass Collection brought in more for Christie’s than many of their hundred-lot sales.

Claude Monet was the star of the show with two of the top three lots at the sale. Monet resided in London between 1899 and 1901, where he completed a series focusing on the Palace of Westminster, the seat of the British Parliament. Looking out the window across the Thames, Monet captured the building at different times a day, in different light and different weather, creating 19 paintings. Several of Monet’s Parliament paintings hang in some of the world’s great galleries and museums, including New York’s Metropolitan Museum of Art, the Art Institute of Chicago, Washington’s National Gallery, and Paris’s Musée d’Orsay. Le Parlement, soleil couchant, rich with the oranges and purples of a British sunset, was estimated to sell for between $40M and $60M. It sold slightly above estimate at $66M (or $75.96M w/p), making it the most valuable Monet Parliament work sold at auction. Though Mark Rothko’s Untitled (Shades of Red) was the most highly-valued work in the sale at $60M to $80M, it sadly deferred to the Monet and took second place at $58M (or $66.8M w/p). I think, by law, it cannot be a prominent private collection if there isn’t a Monet water lily painting present. If I’m right, the Bass Collection is certainly up to code. The last lot in the sale, a Nymphéas by Monet, fell nicely within its $35M to $55M estimate, selling for $49M (or $56.5M w/p).

Of the twelve lots, eight sold above estimate. The only work that may have surprised anyone was Vilhelm Hammershøi’s painting Stue (Interior with an Oval Mirror). Though just a simple interior scene, it’s a very typical work for the Danish impressionist. Estimated to bring in just $2.5M maximum, the specialists seemed to have misjudged interest in the painting as it reached $5.2M (or $6.3M w/p) by the time the hammer came down. Within a little less than an hour, the Bass Collection brought in $313.5M and served as a good opening act for the 20th Century sale that followed.

The 20th Century sale did just as well as the Bass Collection, bringing in $401.5M after all was said and done. The most publicized lot in the sale was a small-scale version of Emanuel Leutze’s Washington Crossing the Delaware. Leutze created three versions, two large and one small. The original work was kept at the Kunsthalle in Bremen, Germany but was destroyed by Allied bombing in 1942. The other large version, measuring a monumental 12 by 21 feet, can still be seen at the Metropolitan Museum of Art in New York. The small version sold at Christie’s, a mere 40 x 68 inches, went for $39M (or $45M w/p). Though Washington Crossing the Delaware was the most well-known work at the sale, Pablo Picasso’s bronze bust Tête de femme (Fernande) was the highest-valued lot, valued by Christie’s specialists at $30M to $50M. But despite the experts’ high expectations, it only reached third place at $42M (or $48.5M w/p). The top spot went to Jackson Pollock’s Number 31, which, despite being on the small side for a prominent work by Pollock (31 x 22.5 inches), sold slightly above estimate for $47M (or $54.2M w/p). The sale’s lone Van Gogh followed up close behind at $45M (or $51.9M w/p). Van Gogh created the tree-dotted landscape, entitled Champs près des Alpilles, in 1889 during his stint in Provence. Van Gogh originally gave the work to Joseph Roulin, a railroad postman who became the subject of several Van Gogh’s portraits. The landscape found itself in the hands of several collectors during its life, including the French fashion designer Yves Saint-Laurent.

The 20th Century sale did just as well as the Bass Collection, bringing in $401.5M after all was said and done. The most publicized lot in the sale was a small-scale version of Emanuel Leutze’s Washington Crossing the Delaware. Leutze created three versions, two large and one small. The original work was kept at the Kunsthalle in Bremen, Germany but was destroyed by Allied bombing in 1942. The other large version, measuring a monumental 12 by 21 feet, can still be seen at the Metropolitan Museum of Art in New York. The small version sold at Christie’s, a mere 40 x 68 inches, went for $39M (or $45M w/p). Though Washington Crossing the Delaware was the most well-known work at the sale, Pablo Picasso’s bronze bust Tête de femme (Fernande) was the highest-valued lot, valued by Christie’s specialists at $30M to $50M. But despite the experts’ high expectations, it only reached third place at $42M (or $48.5M w/p). The top spot went to Jackson Pollock’s Number 31, which, despite being on the small side for a prominent work by Pollock (31 x 22.5 inches), sold slightly above estimate for $47M (or $54.2M w/p). The sale’s lone Van Gogh followed up close behind at $45M (or $51.9M w/p). Van Gogh created the tree-dotted landscape, entitled Champs près des Alpilles, in 1889 during his stint in Provence. Van Gogh originally gave the work to Joseph Roulin, a railroad postman who became the subject of several Van Gogh’s portraits. The landscape found itself in the hands of several collectors during its life, including the French fashion designer Yves Saint-Laurent.

But the next day, the only lot that anyone was talking about was The Sugar Shack by Ernie Barnes, an often-overlooked artist who encapsulated the feel and experience of twentieth-century America in his work. While The Sugar Shack is a good size (36 x 48 inches), the 1976 painting was only estimated to sell for $200K maximum. Perhaps Christie’s specialists neglected to factor in the painting’s cultural significance in their valuation. The Sugar Shack appeared on the opening credits of the Norman Lear sitcom Good Times and was featured as the cover art of Marvin Gaye’s 1976 album I Want You. Regardless, I don’t think anyone expected it to reach sixty-five times its high estimate. The hammer came down at $13M (or $15.2M w/p), making it an auction record for Ernie Barnes. The last Barnes work to hold that title sold at Christie’s last November, selling for $440K. In the 20th Century sale, forty-two lots brought in $401.5M, bringing the nightly total to $715M. Only one lot went unsold across the back-to-back sales.

Christie’s American Art Sale

By: Amy

On May 17th, Christie’s presented their American Art sale featuring 20th-century paintings, sculptures, and works on paper. There were some surprising results, both good and bad, but overall, I am sure Christie’s is more than a little disappointed with how the sale went.

On May 17th, Christie’s presented their American Art sale featuring 20th-century paintings, sculptures, and works on paper. There were some surprising results, both good and bad, but overall, I am sure Christie’s is more than a little disappointed with how the sale went.

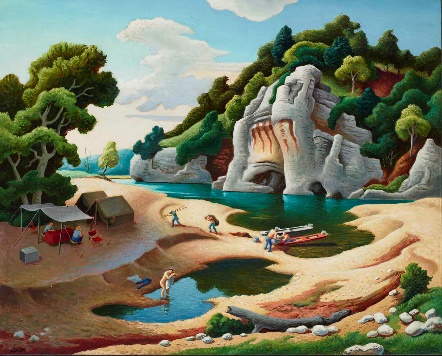

The top spot went to a 1968 work by Thomas Hart Benton titled Fishermen’s Camp, Buffalo River. It was estimated to bring $700K – $1M; bidding opened at just $480K and squeaked past the estimate when it hammered at $1.1M ($1.38Mw/p). Coming in a close second was Georgia O’Keeffe’s Abstraction from 1917. It was estimated to make $1M – $1.5M and fell slightly short when it sold for $900K($1.134M w/p). In a distant third was a sculpture by Elie Nadelman titled Resting Stag, which managed to sell at the low end of the estimate of $500-700K ($630 w/p). Interestingly, the sculpture last sold in 2015 at Christie’s for basically for the same amount – $629K (w/p).

A major disappointment came with the lot in fourth place, another work by Georgia O’Keeffe titled Abiquiu Trees VII. It had an estimate of $700K – $1M, and it fell far below when it sold for just $400K ($504K w/p). A painting by Newell Convers Wyeth titled Christmas Tree – Chadds Ford rounded out the top five. It was estimated to bring $400- 600K and barely missed its mark when the hammer came down at $380K. ($478K w/p).

Four lots did not have reserves, and only one managed to beat the estimate; the others had weak results. A portrait by John Sloan of Gertrude S. Drick “Woe” was estimated to go for $30K – $50K. After the auctioneer dropped the opening bid from $10K to $3.5K, it enticed some bidding, eventually selling for $7K ($8,820 w/p). A portrait by Robert Henri titled Sandy had an aggressive estimate of $80K – $120K and didn’t come close. Again, the auctioneer had to lure bidders by dropping the opening bid from $40K to $10K, sparking a bit of interest, as the work sold for $18K ($22.7K w/p). The Red Robe by Newell Convers Wyeth failed to hit its $30K – $50K estimate but wasn’t a complete failure since it garnered $18K ($22.7K w/p).

And the last unreserved lot did do very well based on the estimate. It also took the longest time to sell. It was a work by Robert Kauffmann titled Arrow Collar Advertisement. The estimate was a mere $2K – $3K, and the bidding began at just $1K. Slow and steady, the bidding climbed and eventually sold for $12K ($15.1K w/p) – four times the high estimate and statistically the best performing lot in the sale.

Christie’s suffered a blow when several of the lots with the highest estimates didn’t sell. Among the unsold lots were works by Arthur Dove, Thomas Hart Benton, Norman Rockwell, Childe Hassam, Frank Weston Benson, and Frederick Carl Frieseke. Had all these lots sold at their low estimate, the sale would have come close to hitting its mark.

When the sale concluded, of the 81 works offered, 63 sold (77.7% sell-through rate), and the total hammer price was $7.51M ($9.45M w/p). The presale estimate range was $15.9 – $22M, so they fell way short, even with the buyer’s premium. Of the sold works, 33 fell below, 10 within, and 20 above their presale estimate range, giving them an accuracy rate of just 12.3 %. Once again, this shows you that an estimate is no more than a guesstimate.

Christie’s New York Post-War & Contemporary Sale

By: Nathan

Day two of Christie’s Thursday through Saturday sale streak involved an enormous post-war and contemporary collection. The entire sale took nearly all day Friday, lasting from 9:30 in the morning to around 7:00 at night. Christie’s broke up the several hundred lots into three sessions, with the second part made up of the remaining pieces from the Ammann Collection. But honestly, having a brief pause between each session didn’t really lessen any of the fatigue viewers may have experienced. I commend the small, merry band of auctioneers for keeping their spirits up over the ten hours the sale went on.

Day two of Christie’s Thursday through Saturday sale streak involved an enormous post-war and contemporary collection. The entire sale took nearly all day Friday, lasting from 9:30 in the morning to around 7:00 at night. Christie’s broke up the several hundred lots into three sessions, with the second part made up of the remaining pieces from the Ammann Collection. But honestly, having a brief pause between each session didn’t really lessen any of the fatigue viewers may have experienced. I commend the small, merry band of auctioneers for keeping their spirits up over the ten hours the sale went on.

The three top lots came and went within the auction’s first session. Two of them were back-to-back lots, both works by Wayne Thiebaud. The American pop painter, who passed away last December, had four pieces featured in the sale, all of them reaching or exceeding their estimates. The painting Three Ice Cream Cones, relatively small for a multimillion dollar work measuring 12 by 15 inches, was predicted to bring in anywhere between $2.5M and $3.5M, with the hammer coming down at $4.1M (or $4.98M w/p). Immediately after that, Thiebaud’s Yo-Yo’s fell within estimate and sold for $2.6M (or $3.18M w/p). But a little later on, Andy Warhol’s Marilyn Monroe (Marilyn) tied Thiebaud for the top lot, also selling for $4.1M (or $4.98M w/p). The Warhol work is a six-foot by fifteen-foot series of ten, brightly-colored Marilyn Monroe portraits, very much keeping with Warhol’s style and choice of subject. This particular series has spent nearly its entire life in a German private collection.

Of course, with a sale this long, there were bound to be some surprises here and there. Ernie Barnes continued to receive buyers’ attention following the impressive $13M sale of his painting The Sugar Shack on Thursday. The following day, his painting Storm Dance, showing a group of men playing basketball against a darkening sky, sold for $1.9M (or $2.34M w/p), over twelve times the specialists’ $150K pre-sale estimate. Equally as impressive was the abstract painter Lynne Drexler’s oil on canvas work Herbert’s Garden. While valued at $100K, it similarly exceeded its estimate twelve times over when the hammer came down at $1.2M (or $1.5M w/p). The nearly three hundred fifty lots brought in $78.8M, a couple million dollars more than Christie’s specialists initially expected. This continued the successful string of auctions that extended into Saturday’s sale of impressionist works on paper.

Sotheby’s Belle Époque Splendor: The Discerning Eye of a Collector

By: Howard

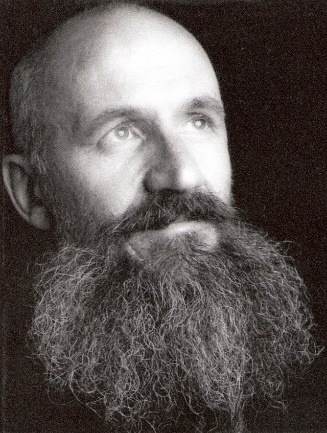

Well, Sotheby’s presented a group of paintings from one collection titled Belle Époque Splendor: The Discerning Eye Of A Collector. I think you will soon agree that “The Discerning Eye” part of the title was very misleading. From the images alone, we felt that this was going to be a tough one, which was confirmed after viewing the actual works. Many had condition issues, were not strong examples, and one or two were unfinished (see image below). Of course, I had to watch the sale to see what happened, and most of the results were what we expected.

The most highly valued lot took the top spot – Giovanni Boldini’s Portrait of Countess Zichy. This very large work (86.5 x 47 inches) carried a $1.5-2.5M estimate and hammered for $1.05M ($1.32M w/p). Not what the auction room was expecting, but the owner bought the painting in 1995 after it went unsold with a $500-700K estimate. So, more than likely, he paid less than $500K. In second place they had Paul César Helleu’s Camara. This large pastel (41.5 x 38.5 inches) had a strong estimate of $100-150K and hammered at $120K ($151.2K w/p). The seller acquired the painting back in 1993 for $51,750 – so not too bad. The third spot was nabbed by Louis Abbéma’s Portrait of Renée Delmas de Pont-Jest. It was estimated to bring $30-50K and was the best performer when it sold for $110K ($138.6K w/p – more than doubling its high estimate). The seller bought this one back in 1993 for $41,400 … another profit.

Coming in fourth was a late period Victor Gabriel Gilbert titled Marche aux fleurs de la Madeleine; L’embarras du choix that had a $50-70K estimate and sold for $70K ($88.2K w/p – it was purchased back in 1995 for $48,875). Then there was a tie for 5th place when Paul César Helleu’s Portrait of Lucette (est. $60-80K – bought for $32K in 1996) and Virgilio Costantini’s The Model’s Repose (est. $80-120K – bought in 1993 for $107K on a $10-15K estimate) each hammered at $50K ($63K w/p). So, of the top works listed, five of the six were in the positive column.

After reading that, you might be wondering – what is Howard talking about? Most of those lots did well. You are correct that most of those did well; what you are missing is the rest of the sale, which did not perform very well. Of the 45 lots offered, 26 sold (a 57.7% sell-through rate – not one of the best). The overall estimate range was $3.43-$5.35M, and the total hammer price was $1.87M ($2.35M w/p), so they fell far short. Of the lots offered, 12 went below, 7 within, and 7 above their estimate range, giving them an accuracy rate of just 15.5%.

This sale was another example of the major saleroom’s inability to source really strong 19th-century works, and it also illustrates that when a good 19th-century work is offered, there is competitive bidding.

____________________

Deeper Thoughts

By: Nathan

New Rules At The Smithsonian

The Smithsonian Institution is the largest museum complex in the world, made up of nineteen museums and twenty-one libraries across the United States. As one of the world’s cultural giants, the Smithsonian is often used as an example of how major museums operate. And recently, I think they may have set a new standard. The Smithsonian has recently announced a new policy regarding the return of looted works. The policy, which took effect on April 30th, states that the individual organizations that make up the Smithsonian do not need the approval of the Institution to repatriate potentially looted or stolen items. Previously, the constituent museums would need to pass a restitution request through a bureaucratic chain until it made its way to the Smithsonian’s Board of Regents. The policy was enacted after extensive conversations with Smithsonian curators and historians over the previous year and will apply to all Smithsonian museums.

The topic of restitution has become more commonplace in recent years. New and difficult conversations are taking place that allows us to reevaluate the role that racism and colonization have played and continue to play in our lives. Within museums, one of the most prominent discussions surrounds the Benin Bronzes. These are several thousand bronze statues, sculptures, and plaques, some dating back to the thirteenth century, that once decorated the royal palace in Benin City in what is now Nigeria. In 1897, the British army embarked on the Benin Expedition, where the British sacked Benin City and forced the Kingdom of Benin into being absorbed by Britain’s Southern Nigeria Protectorate. During the sacking, these bronzes were stolen and distributed across several European and American institutions. Though Nigeria has been requesting these artifacts be repatriated since the country gained independence in 1960, Western art institutions have only been heeding those requests within the past few years. The French and German governments, the Church of England, and Cambridge University have all agreed to return the some or all bronzes in their possession back to Nigeria. This past March, the Smithsonian decided to do the same, with most of their thirty-nine bronzes returning to Nigeria and a few others remaining in the United States as long-term loans. While restitution campaigns have progressed, many museums and collections still hold onto Benin Bronzes and have not stated if they will take action. The Boston Museum of Fine Art has twenty-eight pieces. Though New York’s Metropolitan Museum of Art has repatriated several of their Benin Bronzes, they’re still holding onto a collection of one hundred sixty pieces. It may come as no surprise that the largest collection of bronzes is housed at London’s British Museum, with around seven hundred pieces. But we all know that, based on previous behavior, those looted artifacts aren’t going anywhere anytime soon.

The topic of restitution has become more commonplace in recent years. New and difficult conversations are taking place that allows us to reevaluate the role that racism and colonization have played and continue to play in our lives. Within museums, one of the most prominent discussions surrounds the Benin Bronzes. These are several thousand bronze statues, sculptures, and plaques, some dating back to the thirteenth century, that once decorated the royal palace in Benin City in what is now Nigeria. In 1897, the British army embarked on the Benin Expedition, where the British sacked Benin City and forced the Kingdom of Benin into being absorbed by Britain’s Southern Nigeria Protectorate. During the sacking, these bronzes were stolen and distributed across several European and American institutions. Though Nigeria has been requesting these artifacts be repatriated since the country gained independence in 1960, Western art institutions have only been heeding those requests within the past few years. The French and German governments, the Church of England, and Cambridge University have all agreed to return the some or all bronzes in their possession back to Nigeria. This past March, the Smithsonian decided to do the same, with most of their thirty-nine bronzes returning to Nigeria and a few others remaining in the United States as long-term loans. While restitution campaigns have progressed, many museums and collections still hold onto Benin Bronzes and have not stated if they will take action. The Boston Museum of Fine Art has twenty-eight pieces. Though New York’s Metropolitan Museum of Art has repatriated several of their Benin Bronzes, they’re still holding onto a collection of one hundred sixty pieces. It may come as no surprise that the largest collection of bronzes is housed at London’s British Museum, with around seven hundred pieces. But we all know that, based on previous behavior, those looted artifacts aren’t going anywhere anytime soon.

In a recent interview, Lonnie G. Bunch III, the secretary of the Smithsonian Institution, said that the new policy is just as much about leadership as it is about ethically navigating the arts and antiquities world. It is so that the Smithsonian can become the new model upon which other museums base their restitution policies. “There is a growing understanding at the Smithsonian and in the world of museums generally that our possession of these collections carries with it certain ethical obligations to the places and people where the collections originated.” Bunch has also stated that because the organization’s collections contain over 150 million items, restitution would be considered only when performing research for exhibits or when requested.

This is an incredible step in the right direction. The regents, who previously had the final say over restitution, include the Chief Justice, the Vice President, members of Congress, and some CEOs. While they may know quite a fair bit about business or communications or healthcare, it may be best to take the restitution process out of the hands of appointees. Suppose a constituent museum’s researchers and curators agree that a particular item has a problematic provenance. How is it fair that a senator from Arkansas or an insurance executive might prevent a cultural artifact from returning to where it belongs? Thanks to the Institution’s newly adopted policy, that situation won’t ever have to be considered.

Homeward Bound: The Elgin Marbles’ Continuing Story

I’ve written about the Elgin Marbles multiple times, most recently last August. For those unfamiliar, the Elgin Marbles are a series of sculptures and friezes kept in London’s British Museum that was originally part of the Parthenon in Athens. Lord Elgin, the British ambassador to the Ottoman Empire occupying Greece, removed the sculptures from the site between 1801 and 1812. Though the British Museum is considered one of the largest and most popular museums in the world, its administration seems to interpret the institution’s prestige as a carte blanche to act like an entitled older sibling. On top of their refusal to repatriate the Elgin Marbles to Greece, they have also refused to consider repatriating their large collection of Benin Bronzes pillaged from Nigeria in 1897. They have also continued to keep British Petroleum as a major donor despite the entire British museum community abandoning oil and gas companies. Furthermore, their attempts to hop onto the crypto bandwagon have resulted in hundreds of tons of carbon dioxide being spewed into the atmosphere so they can mint NFTs of their collection highlights. But maybe the museum administration is finally starting to see reason. UNESCO announced last week that the British and Greek governments would enter into formal talks regarding the fate of the Elgin Marbles.

I’ve written about the Elgin Marbles multiple times, most recently last August. For those unfamiliar, the Elgin Marbles are a series of sculptures and friezes kept in London’s British Museum that was originally part of the Parthenon in Athens. Lord Elgin, the British ambassador to the Ottoman Empire occupying Greece, removed the sculptures from the site between 1801 and 1812. Though the British Museum is considered one of the largest and most popular museums in the world, its administration seems to interpret the institution’s prestige as a carte blanche to act like an entitled older sibling. On top of their refusal to repatriate the Elgin Marbles to Greece, they have also refused to consider repatriating their large collection of Benin Bronzes pillaged from Nigeria in 1897. They have also continued to keep British Petroleum as a major donor despite the entire British museum community abandoning oil and gas companies. Furthermore, their attempts to hop onto the crypto bandwagon have resulted in hundreds of tons of carbon dioxide being spewed into the atmosphere so they can mint NFTs of their collection highlights. But maybe the museum administration is finally starting to see reason. UNESCO announced last week that the British and Greek governments would enter into formal talks regarding the fate of the Elgin Marbles.

Last week, UNESCO’s Intergovernmental Committee for Promoting the Return of Cultural Property (ICPRCP) held a session in Paris, where they announced that talks would be arranged. Previously, the British government has consistently stuck with the explanation; that the British Museum legally owns the Parthenon Marbles. Though the British Museum is a public institution, it operates independently from government oversight. Therefore, it is not up to the government but rather the museum’s board of trustees to decide on repatriation. Greece has tried to play nice with the Brits, offering compromises like an exchange program similar to the one they have with Italy. However, until now, the Brits have consistently parroted the same excuses and rejections. But the British public has been turning to favor the return of the Parthenon marbles, including a former British culture minister. Even Prime Minister Boris Johnson, while a classics student at Oxford, wrote a sharply-worded defense of the marbles’ return to Athens. He referred to Britain as a “northern whisky-drinking guilt-culture” unfit to serve as the marbles’ caretaker. Rather, they belong in “a country of bright sunshine and the landscape of Achilles, ‘the shadowy mountains and the echoing sea’.” But I suppose it’s not surprising that, since becoming Prime Minister, Johnson has tamed his Hellenophilia and maintains the legality of the marbles’ ownership by the British Museum. But the British Museum board of trustees may now have to face the music, as stubborn as they tend to be.

The Elgin Marbles have served as a sort of holy grail for art repatriation efforts worldwide. Elgin apologists will often use the slippery slope argument, saying that the return of the Parthenon Marbles will open the floodgates and lead to the British Museum being forced to repatriate its great treasures. This means collection highlights like the Rosetta Stone, the Younger Memnon bust, the Benin Bronzes, and the Double-Headed Serpent would all return to Egypt or Nigeria or Mexico. While that’s unlikely to happen, would it be so bad even if it did? Does Britain have so little culture of its own that it finds itself desperate to fill the galleries of its greatest museum with the works of other peoples? I hope that agreeing to formal talks proves that the British government is perhaps becoming a little more mature in handling similar matters.

The Rehs Family

© Rehs Galleries, Inc., New York – June 2022