COMMENTS ON THE ART MARKET

Limited Gallery Hours For August

For most of August, the gallery will be open Tuesday through Thursday, with the following exceptions:

Since we are participating in the LA Art Show and the Nantucket Show, the gallery will be closed on Tuesday, August 3rd. Then, at the end of the month, Alyssa is scheduled to have her wedding ‘party’ (something she and Adam missed last summer since they were married in our backyard with just 9 people in attendance), so we have decided that the gallery will be closed from August 27th through September 6th. Time for a little break!

____________________

Upcoming Shows

John Stobart - Navara on the Clyde (detail)

This year we are pleased to announce that Rehs Galleries and Rehs Contemporary Galleries will have their own booths. Rehs Galleries will present an exhibit of mainly European paintings from the 19th through 20th centuries. Rehs Contemporary will be dividing its booth (which has now been expanded) into two sections. The first will feature a curated exhibition of 9 important works by John Stobart, the other will display a cross section of works from the gallery's roster.

If you would like complimentary tickets, please send us an EMAIL.

____________________

In The News

Journey Through The Golden Age Of Sail With An Intimate Look At The Studious Paintings Of Contemporary Master John Stobart (by Natasha Gural-Maiello, Forbes.com) – Born in Britain in 1929, Stobart is celebrated as the leading maritime master of the 20th and 21st centuries, best known for his prolific creation of American harbor scenes during the Golden Age of Sail, loosely spanning the mid-19th century to the early 20th century... Read More

Journey Through The Golden Age Of Sail With An Intimate Look At The Studious Paintings Of Contemporary Master John Stobart (by Natasha Gural-Maiello, Forbes.com) – Born in Britain in 1929, Stobart is celebrated as the leading maritime master of the 20th and 21st centuries, best known for his prolific creation of American harbor scenes during the Golden Age of Sail, loosely spanning the mid-19th century to the early 20th century... Read More

The gallery will be exhibiting a selection of paintings by John Stobart at this year’s Nantucket Show - August 5th - 9th.

Feel free to email us if you would like a complimentary ticket to the show.

____________________

Stocks

By: Lance

Another month in the books for 2021, and another month of gains; six straight for the S&P! Both the Dow and Nasdaq were trading roughly 1% higher from where they started July, with the S&P up more than 2%... in fact, the S&P is up roughly 17% this year. Much of the positive sentiment is attributed to stronger than expected quarterly earnings being reported. Further, with second quarter GDP below expectations, the consensus is that the fed will maintain their policies to help bolster economic growth. That said, there are obviously continued concerns over inflation and potential supply chain disruptions as we head into the second half of the year. Additionally, many expect the surge in consumer demand to begin a cool down period so this hot streak may come to an end sooner rather than later – let’s hope for the best though.

The Pound and Euro followed similar patterns through the month, weakening a bit relative to the dollar before reversing course for the past week – the Pound ultimately settled at $1.39 whereas the Euro ended the month at $1.18. Gold saw a modest increase of 3%, while crude hovered in the $73 range. When it comes to crypto, it’s anyone’s guess what is going on… Bitcoin bottomed out, falling below $30K for the first time this year, then recovered into the $40-42k range to close the month. Ethereum and Litecoin followed suit seeing low points on the 19th and 20th – ETH got as low as $1,718 and LTC was down to just $103.88! Then there’s good ol Dogecoin… still trending downward but holding strong - BUY. THE. DIP! (but seriously, don’t listen to me, I have no idea what I’m doing).

As always, we’ll wrap this up with a few personal holdings… I took a page out of my father’s book this month and didn’t keep an eye on them daily, just at the end of the month so let’s see where we are at. Airbnb (ABNB – month -7.4%); American Well Corporation (AMWL – month -5.9%); Aurora Cannabis Inc. (ACB – month -22.7%); Beyond Meat, Inc. (BYND – month -22.2%); Blink Charging Co. (BLNK – month -14%); Churchill Capital Corp IV (CCIV is now trading as Lucid Group LCID -16.5%); Canopy Growth Corp. (CGC – month -21.5%); Cronos Group Inc. (CRON – month -14.3%); FuelCell (FCEL – month -27.3%); Fisker Inc. (FSR – month -14.9%); Nikola Corp (NKLA – month -32.9%); QuantumScape Corp (QS – month -20.2%); Under Armor, Inc. (UAA – month -5.2%); and Zomedica Corp. (ZOM –month -26.2%). I don’t know if I should be impressed or sad – all down; what are the odds?

__________________

Tales from the Dark Side

By: Alyssa

Picasso & Mondrian Recovered

The city of Athens is celebrating the recovery of two important stolen paintings. On January 9, 2012, it was believed that a gang broke into the National Gallery in Athens, stealing Head of a Woman by Pablo Picasso, Stammer Windmill by Piet Mondrian, and a sketch by Guglielmo Caccia. Another work by Mondrian was among the targets but it was dropped as the thieves fled. The heist took only seven minutes, leaving police puzzled for almost a decade.

The city of Athens is celebrating the recovery of two important stolen paintings. On January 9, 2012, it was believed that a gang broke into the National Gallery in Athens, stealing Head of a Woman by Pablo Picasso, Stammer Windmill by Piet Mondrian, and a sketch by Guglielmo Caccia. Another work by Mondrian was among the targets but it was dropped as the thieves fled. The heist took only seven minutes, leaving police puzzled for almost a decade.

The Guglielmo Caccia was discovered in a toilet shortly after the heist, most likely ditched due to damages. But the whereabouts of the Picasso and Mondrian remained unknown until now. With help from tips, the police narrowed in on a single individual believed to be part of a larger group of thieves responsible for the heist. Upon questioning, authorities were astonished to find out that not only did the man admit to the crime, but took sole responsibility for it; even explaining how he prepared for and conducted the crime.

The 49-year-old had enjoyed the works in his own home before first stashing them in a warehouse, then a dry gorge outside the city, once he knew the police were onto him.

Fortunately, the works were securely wrapped and protected from the elements. Now they are back home with added security measures!

Museums & Galleries In British Columbia Duped

Recent news reports revealed that British Columbian art dealer Steve Hoffman, based in Langley, has been supplying fake indigenous art to Canadian museums and art galleries. The works, supposedly by artist Harvey John, have been on the market for years. It is anybody's guess how much money was generated from the scam.

Upon learning of the fraud, museums selling the fake works contacted the buyers offering a full refund and removed the pieces from their stores. In a telephone interview with CBC News, Hoffman admitted to his deception and claimed that the works were by one carver based in British Columbia. He also refused to identify the artist, explaining that, "I don't want to be ratting out anybody."

You might be wondering how the deception was uncovered? Well, Erin Brillon, a Haida/Cree fashion designer, saw a listing that described John's work as original Haida carvings, not Nuu-Chah-Nulth as noted in the artist's official biography. It was apparent to her that the works were not Haida designed. She then posted the listing on a Facebook group page devoted to uncovering fake Indigenous art. After that, it did not take long for the whole scheme to unravel.

Chalk one up for people who care!

Remember - the art world is a jungle, so find the right guide before you become someone's next meal!

____________________

Really?

By: Amy

Harrison Ford’s Fine Fedora

Do you fantasize about living the life of a movie star? Maybe go back in time or take a leap into the future; or perhaps be as fearless as some of the great action heroes in your favorite movie? Well, you may not be a movie star, but you can certainly own a piece of memorabilia that can make your dream come true…sort of.

Recently at an auction in Los Angeles, Harrison Ford’s fedora from Indiana Jones and the Temple of Doom (1984) was the featured item in a sale. Another version of the hat also made an appearance in Raiders of the Lost Ark (one of my personal favorites!); both were created by Herbert Johnson. Although the hat showed its age with some light wear, it was considered to be in excellent condition and was estimated to make $150 – 250K. Hang on to your less expensive hats folks because this one sold for $300K, and now someone can pretend to be Indiana Jones in their new/old Fedora.

Size Does Not Always Matter

Christie’s London celebrated the classics this week as they auctioned antiquities through 20th-century works of art and an assortment of other objects. A highlight of Classic Week was included in their Exceptional Sale, which focused on European decorative arts as well as ‘masterpieces’ from various antiques categories. A drawing by Leonardo Da Vinci led the sale; it is thought to have been executed around 1480 and is one of only eight known drawings in private hands. The small study of a bear’s head is slightly smaller than a Post-it Note, a mere 2 ¾ x 2 ¾ inches, but packed a powerful punch with an estimate of £8-12M ($11.2 -16.9M).

Christie’s London celebrated the classics this week as they auctioned antiquities through 20th-century works of art and an assortment of other objects. A highlight of Classic Week was included in their Exceptional Sale, which focused on European decorative arts as well as ‘masterpieces’ from various antiques categories. A drawing by Leonardo Da Vinci led the sale; it is thought to have been executed around 1480 and is one of only eight known drawings in private hands. The small study of a bear’s head is slightly smaller than a Post-it Note, a mere 2 ¾ x 2 ¾ inches, but packed a powerful punch with an estimate of £8-12M ($11.2 -16.9M).

While it fell shy of the estimate, it hammered down at £7.5M ($10.3M -£8.85M/$12.2M w/p) to a single bidder in the saleroom, that is still a far cry from when the drawing sold at Christie’s in 1860 for £2.50. And if you are one of those people who try to value a work based on size, that works out to $1,586,776.86 per square inch!

____________________

The Art Market

By: Lance & Howard

July was another busy month for the art market, and there were many sales that took place in Europe. I do hope that they will take a much-needed break in August ... we are!

20th/21st Century: Christie’s London Evening Sale

By: Howard

Following Sotheby’s lead, Christie’s presented their evening sale (which started at 2 pm London time, breakfast time in New York) on the 30th. As with Sotheby’s, this was a mixed sale of works ranging from 19th-century Impressionist to living artists.

The top lot happened early in the sale when Picasso’s L’Étreinte (from 1969), hammered down at £12.6M/$17.4M (£14.7M/$20.3M w/p – est. £11-16M). Coming in a close second was Alberto Giacometti’s bronze Homme qui chavire at £12.4M/$17.1M (£13.7M/$19M w/p – est. £12-18M). This exact piece last appeared on the market back in 1998 and sold for $2.65M – so I am sure the seller was pleased. Now you may have noticed that the difference in the hammer prices between the first two lots was only £200K, while the difference in price with the premium added in is about £1M. Wonder why? Well, the Giacometti was a guaranteed lot, so the guarantor received a nice discount! Kandinsky took the third spot when Noir bigarré (1935) found a buyer at £7.8M/$10.7M (£8.85M/$12.2M w/p – est. £8-12M). Rounding out the top five were Ernst Kirchner’s Pantomime Reimann: Die Rache der Tänzerin at £6M/$8.3M (£7.14M/$9.9M – w/p – est. £6-9M), and Basquiat’s Untitled at £5M/$6.9M (£6M/$8.3M w/p – est. £4-6M).

There really wasn’t much in the way of fireworks in this sale, as at least half of the works sold within their estimate. In fact, 50% of those sold on the bottom end – most likely the reserve. Do you think the market needs a breather? I do, but sadly, I doubt that will happen as many more sales are scheduled for July.

By the end of the session, of the 52 works offered (a Banksy was withdrawn before the sale), 46 sold, generating an 88.5% sell-through rate, and the total take was a strong £101M/$139.6M (119.3M/$16.5M w/p). The presale estimate range was £94.7-138.4M, so they fell within the range, even without the buyer’s premium. Of the 46 sold lots, 10 were below, 24 within, and 12 above their presale estimate range; this gave them an accuracy rate of 46.2% — another respectable number

Old Masters – Sotheby’s, London

By: Howard

It is Old Master week in London, and the action started at Sotheby’s with their evening sale, which began at 6 pm, so it was an actual evening sale.

The sale consisted of 50 lots, and the top work was the last one — Joseph Mallord William Turner’s 1808 Purfleet and the Essex Shore as seen from Long Reach. The painting was last on the market in 1945 and has remained in the same family’s collection ever since. The work was estimated to bring between £4 – 6M and hammered at £4.0M/$5.5M (£4.8M/$6.6M – w/p). Taking second place was Sir Anthony van Dyck’s Family portrait of the painter Cornelis de Vos and his wife Suzanna Cock and their two eldest children, Magdalena and Jan-Baptist (now that is a title!). This painting was one of many recovered by the Monuments Men in the 1940s and restituted to the family in 1948. Since then, it has changed hands a few times and appears to have been in the same collection since the 1970s. The work was expected to bring £1-1.5M and hammed at £2M/$2.76M (£2.44M/$3.36M – w/p). In the third position was Willem Kalf’s Still life with a Chinese ginger jar, silver, objects of vertu, a cut melon, bread, a paper packet in a porcelain bowl, and a pink rose, all on a table draped with a Persian carpet, that carried an £800-1.2M estimate and sold for £1.2M/$1.66M (£1.47M/$2M – w/p). Rounding out the top five were Gerrit Adriaensz. Berckheyde’s The Oudezijds Heerenlogement, on the confluence of the Grimburgwal and the Oudezijds Voorburgwal, Amsterdam at £550K/$760K (£681K/$939K – w/p); and then there was a tie for 5th. Jan Brueghel the Elder’s A wooded estuary with a ferry and fishermen selling their catch, just 8.5 inches in diameter, which was purchased by the seller back in 1978 for £68K (est. £300-500K), and Adriaen Isenbrant’s The Crucifixion (est. £200-300K) each made £520K/$717K (£644K/$889K – w/p).

From the results of the top five lots, you would assume that this was an extremely successful sale; well, as we all know, there is more to an auction story than just the top sellers.

Of the 50 works listed in their online catalog, only 49 were offered (lot 26 went missing), and of those, 21 were unsold (about 43% of the sale). Among their biggest failures were Jan Brueghel the Elder’s A lavish still life of many flowers in a terracotta vase resting on a wooden ledge, flanked by a clump of cyclamen and scattered diamonds and sapphires (est. £2.5-3.5M), Ambrosius Bosschaert the Elder’s Floral still life including tulips and roses, in a glass beaker upon a stone ledge (est. £700-1M), and Balthasar van der Ast’s Flowers in a vase on a stone ledge, with redcurrants and shells (est. £600-800K).

It is important to note that we do not deal in Old Master paintings, so the exact reason why so many works did not sell is hard for us to determine. What I can say is that after reading several condition reports (which seemed rather vague and brief), I would not be surprised if some of the failures were due to condition issues and the fact that most people could not view the works in person. Remember, for most people, when you buy at auction, the item is yours… regardless of what it looks like once you receive it.

Of the 28 sold lots, 2 were below, 13 within, and 13 above their range, leaving them with an accuracy rate of 26.5%. The total take was £14.0M/$19.3M (£17.2M/$23.7M – w/p), but the presale estimate range was £16.9-24.8M; they only made it when we add in the buyer’s premiums – and it was still close!

For me, this is another sign that there is too much product being offered on the market. Sadly, those sellers with less than stellar material are paying the price.

B.J. Eastwood Collection – Christie’s

By: Howard

This month, Christie’s presented a small sale (30 works) featuring sporting and Irish art from the collection of B.J. Eastwood. Eastwood, who passes away last year, acquired most of the works decades ago. This was a perfect storm; a collection of great quality works, in good condition, that were were fresh-to-the-market… something I have always said is essential for a successful event. (All prices include the buyer’s premium)

Taking the top spot was Sir Alfred Munning’s The Vagabonds. This large work (50 x 80 inches) carried a £700k-1M estimate and sold for £1.94M/$2.68M. Eastwood acquired the painting in 1990 for £187K/$307K, so I am sure his estate was pleased – but that is just the beginning. Sir Munnings also captured the second and third spots when The Coming Storm (est. £600-800K) and John J. Moubray, Master of Foxhounds, dismounted with his wife and two mounted figures with the Bedale hounds in a landscape (est. £400-600K) each made £1.2M/$1.6M. He purchased The Coming Storm in 1989 for £352K/$558K, and the other was bought in 1986 (I am still trying to determine the purchase price). Rounding out the top five were two Irish works; Jack Butler Yeats’ A Summer Day (est. £500-800K), and a beautiful works by Sir John Lavery, The Terrace, Cap d’Ail (est. £400-600K); each brought £1.16M/$1.6M.

There were other strong results, among them were John Fergus O’Hea’s Punchestown Races, 1868 at £695K/$960K (est. £100-150K), Paul Henry’s Mountains and Lake, Connemara at £623K/$860K (est. £120-180K – it was purchased in 1990 for £64K/$103K), Munnings’ Point-to-Point – £413K/$570K (est. £30-50K), William Orpen’s Portrait of Lady Evelyn Herbert – £313K/$432K (est. £80-120K), and James Pollard’s The London-Edinburgh Royal Mail coach setting a brisk pace on a summer day – £106K/$147K (est. £25-35K).

By the end of the sale, 28 of the 30 works found buyers, giving them a sell-through rate of over 93% (excellent). Their presale estimate range was £6.55-9.84M, and the total take was £14.2M – this result shows you what a sale of excellent quality, fresh-to-the-market works can do!

A Better Day For The Old Masters – Christie’s

By: Howard

On July 8th, Christie’s presented their Old Master evening sale, and this one did just a little better than their main competitor’s. My only question for the saleroom is: why did you put a Burne-Jones in this sale? Burne-Jones was born in 1833 (so he would not be classified as an Old Master artist), and he was part of the British Pre-Raphaelite movement. His paintings belong in a British Victorian or 19th-century European sale. Anyway, let us move on. (Unless otherwise noted, all prices are hammer)

On July 8th, Christie’s presented their Old Master evening sale, and this one did just a little better than their main competitor’s. My only question for the saleroom is: why did you put a Burne-Jones in this sale? Burne-Jones was born in 1833 (so he would not be classified as an Old Master artist), and he was part of the British Pre-Raphaelite movement. His paintings belong in a British Victorian or 19th-century European sale. Anyway, let us move on. (Unless otherwise noted, all prices are hammer)

The most expensive work of the evening was a large painting (52 x 92 inches) by Bernardo Bellotto titled View of Verona with the Ponte delle Navi. The work carried a hefty estimate of £12-18M and hammered down at only £9M/$12.47M (£10.6M/$14.7M with premium). It was interesting to read that the painting was last sold publicly back in 1971 and brought £300K (a pretty big number at the time and yielded a good return on investment). Next up was Georges de la Tour’s Saint Andrew that was estimated to bring £4-6M and only achieved £3.7M/$5.1M (£4.3M/$5.9M w/p). In third was a lovely interior scene by Frans van Mieris, the Elder, titled The Music Lesson. The painting was last on the public market back in 1928 (it sold for 36,000 florins) and has been in the same family’s collection since. The painting was estimated to bring £700k-1M, and after some fierce competition, it sold for £2.9M/$4M (£3.5M/$4.8M w/p). When those little gems appear, they create a lot of action.

Rounding out the top five were Jan de Heem’s A Banquet Still Life at £2.6M/$3.6M (£3.1M/$4.3M w/p – est. £3-5M). This large work (55 x 45 inches) was one of several restituted works being offered. And then there was the outlier – Sir Edward Coley Burne-Jones’s The Prince Entering the Briar Wood. As I mentioned earlier, this really belonged in their 19th-century sale since it is NOT an Old Master work. The painting carried a £2-3M estimate and sold for £2M/$2.7M (2.4M/$3.3M w/p – it was last on the market in 2001 and sold for £1.16M/$1.6M; not a bad return).

Rounding out the top five were Jan de Heem’s A Banquet Still Life at £2.6M/$3.6M (£3.1M/$4.3M w/p – est. £3-5M). This large work (55 x 45 inches) was one of several restituted works being offered. And then there was the outlier – Sir Edward Coley Burne-Jones’s The Prince Entering the Briar Wood. As I mentioned earlier, this really belonged in their 19th-century sale since it is NOT an Old Master work. The painting carried a £2-3M estimate and sold for £2M/$2.7M (2.4M/$3.3M w/p – it was last on the market in 2001 and sold for £1.16M/$1.6M; not a bad return).

Overall, the sale did ok, and several lots performed rather well; among them were a pair of paintings by Francesco Tironi at £420K (est. £120-180K), a Ferdinand Bol at £980K (est. £400-600K), Gentileschi’s Venus and Cupid at £2M (est. £600-1.2M), and Michaelina Wautier’s Head of a Boy at £320K (est. £60-80K). There were also a few that failed to generate any interest; these included paintings by Vivarini (est. £500-700K), Hobbema (£500-800K), and van Hemessen (£300-500K). And one expensive lot was withdrawn – van Dyck’s Portrait of Thomas Wentworth (est. £3-5M).

By the end of the session, 46 of the 60 lots found buyers (76.6%) – a much stronger sell-through rate than Sotheby’s – and the total take was £37.3M/$51.7M (£45M/$62.4M w/p). The low end of their estimate range was £40.6M, so they were a bit shy. What I did find interesting is that the first ten lots in this sale made more than Sotheby’s entire sale — £16.7M vs. £14M.

Of the 46 sold works, 20 were below, 9 within, and 17 above their presale estimate range, leaving them with an accuracy rate of just 15%, much less than the competition; however, overall, we must give Christie’s the win.

Sotheby’s Attempt At A European & British Sale

By: Howard

Auction rooms need to start paying attention to what works and what does not. Putting together a large sale of ‘nothing too great’ is just not going to cut it today. On July 14th, Sotheby’s presented one of these sales.

Auction rooms need to start paying attention to what works and what does not. Putting together a large sale of ‘nothing too great’ is just not going to cut it today. On July 14th, Sotheby’s presented one of these sales.

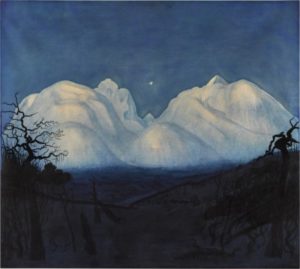

As with any sale, there are always a few works that do well. Here, Harald Sohlberg’s Winter Night in the Mountains (a watercolor) took the top spot at £1.1M/$1.5M (£1.35M/$1.86M w/p – est. £800-1.2M). This painting was a very nice example and had descended in the artist’s family – so it was fresh! Another fresh work grabbed the second spot – Eugen von Blaas’ No Love Without Envy. This painting has been in the same family’s collection since 1952; it carried a £150-250K estimate and sold for £350K/$484K (£439K/$606K w/p). And the third-place finisher was Dawson’s The ‘Shun Lee’ in Pacific Seas, which was last on the market in 1962 (oh look, another fresh one that did well), and brought £170K/$235K (£214K/$296K w/p – est. £80-120K). Rounding out the top five were Monsted’s A Woodland Stream on a Summer Day at £120K/$166K (£151K/$209K – est. £60-80K), and Frederic, Lord Leighton’s Head of a Girl at £110K/$152K (£139K/$191K w/p – est. £60-80K).

While I could go on about other works that did ok and those that did not (of the top ten lots with the highest estimates, only three sold), I believe that the numbers speak for themselves. The sale consisted of 115 lots. Of those, 60 found buyers, and 55 are going back to their owners, giving them a sell-through rate of just 52%. The total take was £3.05M/$4.2M (£3.8M/$5.25M w/p), while the presale estimate range was £5-7.4M, so even with the buyer’s premium, they fell far short. Of the 60 sold works, 6 were below, 33 within, and 21 above their estimates, this generated an accuracy rate of 28.7% (which is not all that bad), but on the flip side, when almost half the sale is bought-in, that is not very good.

While studying the 33 works that sold within their estimate range, an interesting statistic emerged. Twenty-three of them sold at the bottom of their range, meaning that most likely, those paintings sold on the reserve to just one bidder.

Next up … Christie’s British and European sale…

British & European Art: Christie’s London

By: Howard

On July 15th, Christie’s presented a big sale of British and European art, which faired a little better than their competition’s. While things opening up in the UK helped bring in more material, the problem still seems to be sourcing excellent quality works to sell.

The session began at 1 pm UK time (8 am NY time), and the top sellers all happened within the first 22 lots (of a 181 lot sale). In first was lot 22, Sir John Everett Millais’ Nina, daughter of Frederick Lehmann, Esq. which carried a £200-300K estimate and sold for £400K/$554K (£500K/$693K w/p). This same painting was offered at Sotheby’s, New York, in 2017 at $400-600K and failed to sell .. the seller bought it back in 1984 for £230K/$317K . The second and third place finishers, which came from the Hartmuth Jung collection, were tied. Lot 7, Dante Gabriel Rossetti’s pastel Study of Alexa Wilding, her head turned three-quarters to the right (bought in 2004 for £128/$235K) and lot 9, John Roddam Spencer Stanhope’s Patience on a monument smiling at Grief (last on the public market in 2001 and sold for £158K/$224K), were each expected to sell in the £300-500K range and fell a little short at £280K/$388K (£350K/$485K w/p). Even though they did not hit the low end of their range, the seller was still in the black. It was nice to see some strength in the Victorian market.

Rounding out the top five were Gustave Moreau’s watercolor and gouache Le lion amoureux (The Lion in Love) at £260K/$360K (£325K/$450K w/p – est. £300-500K). The seller bought the work back in 1991 for $550K, so they took a big loss. And then there was Fernand Khnopff’s Les Caresses, a pencil and crayon work from the Jung collection, that made £180K/$250K (£225K/$312K w/p – est. £80-120K). It appears that Jung acquired the work in 2005 from a collector who purchased it back in 2000 for £92K/$130K.

Rounding out the top five were Gustave Moreau’s watercolor and gouache Le lion amoureux (The Lion in Love) at £260K/$360K (£325K/$450K w/p – est. £300-500K). The seller bought the work back in 1991 for $550K, so they took a big loss. And then there was Fernand Khnopff’s Les Caresses, a pencil and crayon work from the Jung collection, that made £180K/$250K (£225K/$312K w/p – est. £80-120K). It appears that Jung acquired the work in 2005 from a collector who purchased it back in 2000 for £92K/$130K.

Other strong performers included Carlos Schwabe’s La Porte d’or at £180K/$250K (225K/$312K w/p – est. £100-150K), which was also from the Jung collection and was purchased back in 2005 for £42K/$73K; Schwabe’s L’Idéal made £75K/$104K (94K/$130K w/p – on a £20-30K estimate); Edmund Dulac’s small watercolor Venise: The Carnival, St Mark’s, Venice made £20K/$28K (£25K/$35K w/p – est. £7-10K); and Albert Goodwin’s Fireflies, Trinidad (also a small watercolor) hammered at £5.5K/$7.6K (£6.9K/$9.5K w/p – est. £1-1.5K).

Among the more expensive works that failed to sell were Robertson’s The Carpet Bazaar, Cairo (£250-350K), Ernst’s Two Warriors in the Alhambra Palace (£250-350K), Bossoli’s Veduta de Golfo di Napoli (£60-80K), Atkinson Grimshaw’s Late Autumn on the Esk (£100-150K), Sandy’s Portrait of Julia Smith Caldwell (£40-60K), and de Dreux’s A Lady Riding in a Landscape, with Her Dogs (£60-80K).

By the sale’s end, of the 181 works offered, 133 sold (73.5%), which is reasonable for this type of sale. The presale estimate range was £5.4-8.3M, and the hammer total was £4.2M (£5.26M/$7.3M w/p), so they fell short of expectations. Of the 133 sold works, 56 were below, 46 within, and 31 above their estimate range, leaving them with an accuracy rate of 25.4%.

The Rehs Family

© Rehs Galleries, Inc., New York –August 2021