COMMENTS ON THE ART MARKET

March Hours

Spring is almost here ... and I know that many of us cannot wait for calmer and warmer weather. Having said that, it was kind of nice to be in New York during the winter. This was the first February, in more than a decade, that Amy & I were in New York. Our show schedule usually took us from LA to Palm Beach to Naples to Charleston; however, the pandemic put a halt on most shows.

The gallery's hours for March will be Tuesday through Friday from 10 am – 5 pm. If you would like to stop by, please call in advance. We are also available, by appointment, on Saturdays, Sundays, and Mondays.

____________________

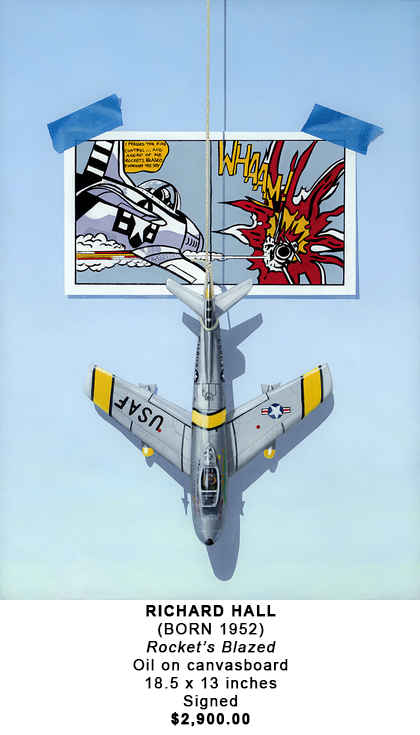

Richard Hall

We are pleased to offer two exceptional trompe l'oeil works by the extremely talented Richard Hall, who was named an ARC Living Master in 2019.

____________________

Stocks

By: Lance

All aboard the crazy train! Welp, another month has passed, and the madness continues… the Dow opened the month at 30,054 and rode up to record levels, seeing an intraday high of 32,009 on the 24th. That was followed by an abrupt sell-off to close out the month at 30,932, which coincided with a spike in Treasury yields (US Government-issued bond rates) – a moderately concerning development.

When the economy took a hit at the beginning of the pandemic, the Federal Reserve used policies to help strengthen the markets – they promised to keep interest rates low and increased asset purchases, also known as quantitative easing. To make sure I am not going over anyone’s head - when you buy something, you pay money for it… so when the Federal Reserve buys a lot of assets, it puts a lot of money into circulation, which can help provide stability in uncertain times.

Last week, the Fed announced they are maintaining their current policy of keeping interest rates low and continuing to purchase assets. But suppose the economy were to overheat, say from something like another round of stimulus checks alongside effective vaccines. In that case, it is plausible we see inflation and the Fed pull back on their purchasing and possibly move interest rates higher. The surge in Treasury yields signals that some investors are concerned about just that – an overheating economy… and with the market already feeling a bit bubble-ish, it is a reasonable concern even if it is unlikely.

And I haven’t even had a chance to mention the GameStop/Robinhood clown show on Capitol Hill last week! I’m not going to get into a whole long thing about it, but I’ll say this – if we are going to have congressional oversight via financial regulation, it would help if the members of the House Financial Committee actually understood the complexities of what they are talking about because at times these congressmen and women just seemed confused. Don’t get me wrong, there were a few members that asked meaningful and insightful questions, but the vast majority of it was an absolute joke – and yes, I watched the full five-plus hours!

And now, onto the personal holdings…

The crypto revolution is in full swing! Holy wow! Bitcoin started the month off hot even before Elon Musk got involved… on February 8th, Musk announced Tesla bought $1.5 billion in bitcoin; at the time, it was priced at roughly $38,000 per coin. Following that announcement, bitcoin went stratospheric as it climbed to nearly $60,000 per coin over the next two weeks – as of Friday, it has dipped back down to $47,000; isn’t volatility fun! Ethereum followed in suit, jumping from roughly $1,300 per coin to more than $2,000 before reversing course and closing the month under $1,500. Same goes for Litecoin, which started the month off around $130, peaked at $247, and is currently in the $175 range… All three still saw nice gains for the month. I’ll also mention a few lesser known cryptocurrencies I am holding – I purchased Bitcoin Cash, Stellar Lumens and Civic at the end of November; they have seen gains of 63%, 100%, and 296%, respectively since then… and I cannot forget about Dogecoin! I am still holding strong while sitting on a 383% return.

The Euro held stable at $1.21, while the Pound strengthened to $1.39 (up $.02). Crude oil is up to $61.63 (up $9.49) and gold is sitting at $1,727.30 (down $122.50).

I’m going to switch things up this month and tell you about some of the stocks I have bought over the last few months and how they are doing – my father’s stocks under the guidance of our financial advisor at Morgan Stanley just feels a little boring. Warning: I AM NOT ENDORSING AN INVESTMENT IN ANY OF THE FOLLOWING!

American Well Corporation (AMWL – total return -6%/monthly return -31%); Aurora Cannabis Inc. (ACB – total -4%/month -5%); Beyond Meat, Inc. (BYND – total +23%/month -18%); Blink Charging Co. (BLNK – total +67%/month -23%); Canopy Growth Corp. (CGC – total +13%/month -18%); Cronos Group Inc. (CRON – total +21%/month +1%); Fisker Inc. (FSR – total +76%/month +90%); Nikola Corp (NKLA – total -54%/month -22%); QuantumScape Corp (QS – total -1%/month +26%); Under Armor, Inc. (UAA – total +177%/month +25%); and Zomedica Corp. (ZOM – total +721%/month +102%). I also added a few last minute on the 25th (the day prior to writing this), so I’ll give you my single day return… Airbnb (ABNB – total +13%); Churchill Capital Corp IV (CCIV – total +5%); and FuelCell (FCEL – total -3%). With a couple of big winners on the month, it more than made up for the losers!

____________________

Tales from the Dark Side

By: Alyssa

Austrian Priest with Alleged Sticky Fingers

Last May, during a routine inventory check, the custodian of a collection belonging to a Benedictine abbey in Kremsmünster, Austria, discovered that fifty objects, with a total value of approximately €300,000 ($360,780), were missing. The abbey, which dates back to 777 AD, amassed a collection of 2,200 paintings, 70 icons, 2,000 copper engravings, and early medieval antiques. Since the finding, 20 of the objects have been returned through dealers and private collectors; however, many remain unaccounted. On January 26, the case gained greater recognition when authorities turned to the public for help, publishing images of 21 pieces still missing, including paintings by Philipp Peter Roos (illustrated here) and Johann Wilhelm Bauer.

The primary suspect is a former priest who cared for the collection from 1997 to 2017. While he had no authority to sell or lend these works, it is alleged that he sold the pieces to cover the cost of restoring others.

According to reports, This is not the first known theft at the medieval abbey. Its oldest painting, The Last Supper, by the artist Meister von Raigern and dated to around 1415, went missing in 2006. That same year, a book of astronomical drawings worth about €30,000 that was on loan to the abbey went missing during an exhibition there. The Kronen Zeitung reported at the time that the security cameras were defective—and the book had been replaced by a fake during the show’s run.

Hopefully, the missing items will find their way back to the abbey.

Sculptor Charged with Fraud years After Public Ridicule

Charges of fraud have been brought against Ioan Bolborea, a 65-year-old sculptor from Romania nearly ten years after his work was unveiled; and this is not the first time the work has made the news. Bolborea was commissioned to complete a series of sculptures from 2005-2016, and back in 2012, the Bucharest municipality installed one of them in front of their National History Museum – the work was publicly ridiculed, with even the museum’s curator stating it was of “doubtful artistic quality.”

Charges of fraud have been brought against Ioan Bolborea, a 65-year-old sculptor from Romania nearly ten years after his work was unveiled; and this is not the first time the work has made the news. Bolborea was commissioned to complete a series of sculptures from 2005-2016, and back in 2012, the Bucharest municipality installed one of them in front of their National History Museum – the work was publicly ridiculed, with even the museum’s curator stating it was of “doubtful artistic quality.”

Now to make matters worse, in 2017, the sculpture suffered damage, at which point it was determined that the materials used were brass, not bronze, as agreed. As a result, the artist has been charged with defrauding the Bucharest municipality of €3.7M ($4.5M).

Interestingly, the artist is defending himself by stating that “brass gives a beautiful patina… the costs are the same, sometimes brass is even more expensive [than bronze].” He goes on to claim that the Romanian authorities are “trying to pin all sorts of crap on me” due to legal disputes…

I wonder what his defense is for the poorly executed statue at the center of the controversy?

Since the discovery, three additional monuments by the artist are being investigated by authorities.

A Crazy Art World Conspiracy Theory

Jay Rappoport is not happy with his family’s actions and has brought a lawsuit against more than 20 individuals.

In 2015, a member of the Rappoport family put an Old Master painting up at Nye & Co (a small auction room in New Jersey). The work, estimated to bring as much as $800, ended up selling for over $1 million to Talabardon & Gautier, Paris. Well, it turns out that the work is an early Rembrandt titled Unconscious Patient (Allegory of Smell), painted around 1624-25.

The gallery sold the piece to Thomas Kaplan for a reported $4 million (excellent return). Kaplan collects work by the Rembrandt and has reunited it with two others in his collection from the same series — a set inspired by the human senses.

According to The Art Newspaper article: in the court complaint, Jay Rappoport, the grandson of Philip Rappoport, a silk manufacturer who purchased Unconscious Patient before the Great Depression, says his aunt “pilfered” the work from his ailing grandmother before she died and that his cousins consigned it to auction without his knowledge or permission as an heir. He maintains that bidders at the auction were working together as part of a conspiracy. Rappoport is also suing Thomas Kaplan and the Leiden Collection, demanding the return of the work or $5m, plus legal fees and court costs.

Guess conspiracy theories are the norm today! We will let you know what happens with this family dispute.

Schiele Restitution

Recently, there was some good news for the heirs of Heinrich Rieger (a Jewish Viennese dentist who was killed at the Theresienstadt concentration camp located in the Czech Republic). According to an article in The Art Newspaper, [t]he German government’s advisory panel on Nazi-looted art has called on the city of Cologne to return Egon Schiele Crouching Female Nude to Rieger’s heirs. In 2019, The Art Newspaper reported on another Schiele from the Rieger collection that ended up in a legal battle – Who really owns this Schiele watercolour Portrait of the Artist’s Wife?

Recently, there was some good news for the heirs of Heinrich Rieger (a Jewish Viennese dentist who was killed at the Theresienstadt concentration camp located in the Czech Republic). According to an article in The Art Newspaper, [t]he German government’s advisory panel on Nazi-looted art has called on the city of Cologne to return Egon Schiele Crouching Female Nude to Rieger’s heirs. In 2019, The Art Newspaper reported on another Schiele from the Rieger collection that ended up in a legal battle – Who really owns this Schiele watercolour Portrait of the Artist’s Wife?

Over three decades, Rieger allowed artists to use works of art to pay for dental procedures. In the end, he amassed a collection of over 800 works, which included many by Kokoschka, Klimt, and Schiele. In fact, he owned so many pieces by Schiele that he dedicated an entire room in his home to the artist’s work.

Art Expert, The Key Witness

Italian art dealer, Gabriele Seno, is appealing a suspended sentence of one year and eight months plus $4,800 in fines after being found guilty of attempting to peddle a forged work by Josef Albers for $387,000. The painting, Study for Homage to the Square, may have seemed to be an easy work to replicate and pass off as authentic, but expert Nicholas Fox Weber (executive director of the Josef and Anni Albers Foundation) and Jeannette Redensek (art historian and director of Josef Albers’s catalogue raisonné), called the artworks bluff immediately.

The tell-tale sign? The signature. While to the average eye, the signature may have looked just like that of an authentic Albers, the experts undoubtedly knew it was off. Furthermore, Seno claimed his father purchased the work in 1986 but has since lost the certificate of authenticity. Redensek believes that the painting is part of a large group of forgeries that appeared on the market in the 1980s.

For almost a decade now, I have been working at our family’s gallery. My father is working on three catalogue raisonnés (Julien Dupré, Daniel Ridgway Knight, and Emile Munier), while my mother is working on the Antoine Blanchard catalogue. What was once shocking to me, that my mother and father could tell a painting was fake before it was completely unwrapped, is no longer a shock. I’ve come to learn that time, experience, and analyzing an artist’s work, sure does allow an “expert” to determine the authenticity or lack thereof by a simple brushstroke (you can check out these articles about expertise: How To Safely Navigate The Art Market – Expertise, How To Safely Navigate The Art Market – Authenticity, How to Safely Navigate The Art Market: Catalogue Raisonnés).

____________________

Really?

By: Amy

Bowmore Islay and Aston Martin – A Winning Combo

The small Scottish Isle of Islay (pronounced eye-la), often referred to as the Queen of the Hebrides, is the Inner Hebrides’ southernmost island. With a friendly population of just over 3,000 people, stunning scenery, mild weather, and most notably the nine distilleries on the island, it attracts tens of thousands of visitors each year. The whiskey distilled here is known for its smoky aroma; some brand names are Laphroaig, Lagavulin, and Ardbeg.

Bowmore Islay, the island’s oldest licensed distillery (founded in 1779), announced this past August that it was teaming up with Aston Martin to present a limited edition “DB5” bottle of 1964 Single Malt Scotch Whisky. The whiskey was initially bottled in 1995 and rebottled in 2020 for the limited release of just 27 bottles. Of these, 25 were offered for sale, and Bowmore kept 2 for their whiskey archives.

The year 1964 was significant for both Aston Martin and Bowmore. For Aston Martin, it was the year of the James Bond Goldfinger movie; this was the first time Bond drove the Aston Martin DB5, and it has turned into a long-term relationship. As for Bowmore, it was the year that the distillery received a new boiler and entered the modern age of distillery, producing a whiskey that became iconic, Black Bowmore, which is one of the rarest and most sought-after single malts.

Bowmore offered the limited edition whiskey in a special presentation box made from string-grain calfskin, brass latches, and nickel-plated hinges. Glasstorm, a contemporary glass studio in Scotland, created the handcrafted bottle, which incorporated a genuine Aston Marin DB5 piston onto the bottle. The original price from the distillery for the 1964 Single Malt whiskey was £50K ($65K)- really expensive!

Well, one of the bottles was just offered and sold in a single lot online auction where you had only 48 hours to bid on the rare whiskey. There was no provenance listed on the lot description, so I can’t say whether the distillery put it up for auction or a secondary market sale. Still, the estimate did seem slightly aggressive for a short turnaround -estimated to make $100-200k, it just missed the mark when it sold for $95K ($118,750 w/p). I trust the new owner will enjoy their purchase – Cheers!

A Big Payday for a Little Work

A small oil painting that had been in a collection for years, most likely from the early 1950s, possibly even longer, just had a big payday for the owners.

A small oil painting that had been in a collection for years, most likely from the early 1950s, possibly even longer, just had a big payday for the owners.

The painting, just 12 ¼ x 9 ½ inches, was cataloged as ’18th Century Italian School’, oil on canvas in a gilt and carved Florentine frame; it carried a modest estimate of £400 – 600. Further, it was notated that “it has been suggested that this portrait depicts Batholomew Beale, the son of Mary Beale, ” and that was all it took to spark enormous interest in the work.

Mary Beale (1633 – 1699) was an English portrait painter, one of just a small group of 17th-century female artists working in London; she became the primary financial provider for her family as she built a reputation for being a talented artist.

As it turned out, it was a work by Mary Beale, and although it had some condition issues, interested buyers were not deterred – early online bidding ran the item up to £20K. When the painting finally came up for sale, eight telephone bidders and several online bidders competed in a four-minute battle. A new auction record was achieved when the hammer struck, closing the deal at £100,000.

The Booming Card Market

I was hoping to find something different to write about, but I could not resist covering the two Michael Jordan 1986 Fleer Rookie Cards that just sold; both had a PSA grading of Mint Gem 10.

I was hoping to find something different to write about, but I could not resist covering the two Michael Jordan 1986 Fleer Rookie Cards that just sold; both had a PSA grading of Mint Gem 10.

Jordan’s 1986 Fleer Rookie Card has multiplied in price more than 15 times since the start of the Covid-19 pandemic. For many years the value of the card lingered between $18 – 30K. In March 2020, the escalation began when a card sold for $48K. Since then, the record has been broken seven times.

I would venture to say that the Michael Jordan documentary The Last Dance, which aired last April, set fuel to the fire. Shortly after, another copy sold for $51K followed by at least five additional cards.

This past January, a new record was set for the card when one brought $217K. Now, less than a month later, two prime examples were auctioned and set a new record when they each sold for $738K! And they were not even the top lots in the sale…these were:

A 1952 Topps Mickey Mantle Rookie Card took the top spot selling for $1.6M. A 2012-13 National Treasures Anthony Davis signed Patch Rookie card came in second, selling for $1.04M. Then there was a 2009-10 Panini National Treasures “Century Platinum” Stephen Curry signed Patch Rookie Card that made $984K. Taking fourth was a Patrick Mahomes Panini National Treasures signed Patch Rookie card; it made $861k! The Michael Jordan cards tied for 7th place in the sale.

Overall the sale took in $33M!

The collectible card market is booming…which is great for everyone jumping into the game.

Overall the sale took in $33M!

The collectible card market is booming…which is great for everyone jumping into the game.

____________________

The Art Market

By: Howard

Last month I mentioned that even February was going to be a slow one in the auction arena. While there were sales that took place, the only one that seemed to have something exciting was the Freeman's sale (which we covered below).

Have no fear, the auction action will heat up in March ... so stay tuned for more.

Freeman’s Master Paintings – One Painting Makes All the Difference

By: Howard

While February has been a rather quiet one in the art market, there was a sale that took place at one of the peripheral salerooms that caught our eye. Included in the sale was an impressive painting by Carl Moll which carried an estimate of $300-500K, and when we first discussed it in the gallery my opinion was that the work would sell in excess of $1M. (w/p = with the Buyer’s Premium)

Taking the top spot was Moll’s Weisses Interieur which sold for $4M ($4.76M w/p), crushing its $300-500K estimate … it was a beautiful work of art. Coming in a very distant second, was Jakob Schikaneder’s The Calm Sea, Nocturne which was expected to bring between $100-150K and sold for $275K ($347K w/p); and in third was a rather unimpressive Renoir of Roses that hammered at $240K ($302.4K w/p – est. $60-100K). Rounding out the top five were Yuri Ivanovich’s The Lemonade Stand at $72K ($91.7K w/p – est. $10-15K), and Gustave Klimt’s Dame Wittgenstein at $70K ($88K w/p – est. $50-80). So, four of the top five smashed their estimates.

Taking the top spot was Moll’s Weisses Interieur which sold for $4M ($4.76M w/p), crushing its $300-500K estimate … it was a beautiful work of art. Coming in a very distant second, was Jakob Schikaneder’s The Calm Sea, Nocturne which was expected to bring between $100-150K and sold for $275K ($347K w/p); and in third was a rather unimpressive Renoir of Roses that hammered at $240K ($302.4K w/p – est. $60-100K). Rounding out the top five were Yuri Ivanovich’s The Lemonade Stand at $72K ($91.7K w/p – est. $10-15K), and Gustave Klimt’s Dame Wittgenstein at $70K ($88K w/p – est. $50-80). So, four of the top five smashed their estimates.

There were a few additional works that performed well, among them were Neapolitan School (17th C.) Venus at the Forge of Vulcan that hammered at $37.5K ($47.3K w/p – est. $5-8K), Martin-Ferrières’ Place du Tertre sous la neige at $18K ($22.7K w/p – est. $4-6K), and Valentin de Boulogne’s Étude pour Le Martyre de Saint Procès et Saint Martinien at $62.5K ($78.8K w/p – est. $20-30K).

On the other side, there were a few works that did not generate interest, these included works by Circle of Frans Francken the Younger (est. $10-15K), Lionello Spada (est. $25-40K), and an Aristide Maillol bronze (est. $30-50K).

On the other side, there were a few works that did not generate interest, these included works by Circle of Frans Francken the Younger (est. $10-15K), Lionello Spada (est. $25-40K), and an Aristide Maillol bronze (est. $30-50K).

By the end of the 67-lot session, 60 works sold (89.6% sell-through rate), and the total take was $5.34M. On the surface, that was a very impressive total given the fact that the low end of their estimate range was $1.09M. What one needs to remember is that the Moll accounted for $4M (75%) of the sale’s total. Without that lot, they would have fallen just above the low end.

Of the 67 works, 22 were below, 17 within and 21 above their estimate ranges; this left them with an accuracy rate of 25.8% — which is not too bad.

The Rehs Family

© Rehs Galleries, Inc., New York – March 2021