COMMENTS ON THE ART MARKET

Gallery News

Gallery Hours

We are pleased to inform you that the gallery will now be open Monday - Friday from 10am - 5 pm, and all other times by appointment.

March Gallery Exhibition

Rehs Contemporary, in partnership with Artefex, is pleased to announce their upcoming exhibit, Beneath the Surface. Opening on Friday, March 25th, 2022, Beneath the Surface features 17 premier contemporary artists… and while most art exhibits are solely focused on the artwork aesthetics, Beneath the Surface highlights the fact that artworks are more than just a layer of paint.

Upcoming Fairs

Inspired by the rich historical, architectural, and cultural heritage of Charleston, the Charleston Spring Antiques Show builds on the history of the former Charleston Antiques Show as a premier destination for collectors and enthusiasts who enjoy seeing and learning about incorporating antiques into modern-day décor. The Antiques Show will be returning to the Charleston Gaillard Event Center (95 Calhoun Street, Charleston SC 29401).

CHARLESTON SPRING ANTIQUES SHOW PREVIEW PARTY

Benefitting Drayton Hall Preservation Trust

Thursday, March 31, 2022

6:00 pm VIP access, 7:00 pm to 9:30 pm Preview Party

Regular Show Hours

Friday and Saturday: 10 am - 6 pm

Sunday: 11 am - 5 pm

Note that we have a limited quantity of complimentary tickets.

____________________

Stocks & Crypto

By: Lance

As I alluded to last month, there were several concerning developments in play with relation to the stock market… the most unpredictable being Russia’s actions with respect to Ukraine. As everyone is well aware by now, that “development” escalated into an unprovoked invasion. While inflation concerns still loom and Covid is still a thing, most of the attention has shifted to the conflict in Eastern Europe and the sprawling ripple effect it will have.

Before I say anything else, I think it is essential to address the fact that the people of Ukraine are the ones most impacted by these recent events. While we may be affected in the form of stock price fluctuations in our portfolios, or higher gas prices at the pump, our day-to-day life has not been unscrupulously uprooted. Here we still wake up each day, have a cup of coffee, kiss our loved ones, and head to work… the same cannot be said for the people of Ukraine, many of whom have been forced to flee, while others bravely stay and help protect their country. Either way, the hardship faced isn’t a fraction of anything I can imagine, so when discussing how these events impact something like our stock market, I think it is important to be mindful of the bigger picture.

That said, February was volatile… the first couple of weeks were a bit choppy. Then, all the major indices saw significant drops in the final week, coinciding with escalating tensions in Ukraine. The first day of invasions curiously saw a large gain in the US markets – I don’t have much of an explanation for that one, though I read somewhere that it was essentially a “relief rally,” where short-sellers cover their positions. Even still, for the month, the Dow was down more than 5.5%, the NASDAQ down more than 8%, and the S&P down about 6.5%.

The Pound and Euro weakened slightly to the Dollar, 0.7% and 0.4%, respectively, but finished the month in the same ballpark they started. Gold futures have steadily climbed through February, currently topping $1,900. Similarly, crude futures elevated into the $90 arena and spiked the day of the Russian invasion, briefly topping $100… remember, a chunk of the world’s oil supply comes from Russia. International sanctions against Russia could prevent certain countries from buying Russian oil, which would effectively reduce supply… the basics of economics apply; when supply goes down, prices go up – it’s pretty simple.

Over on the blockchain, we saw gains across the board for February though it was a nauseating ride… Bitcoin jumped from roughly $35K to $45K in the first ten days of the month before reversing course and bottoming out on the day of the Russian invasion. It briefly went negative for the month but recovered in the past week and now sits above $43K – a gain of almost 14%. Ethereum followed a similar pattern of choppiness, along with a roughly 14% upswing for February; Litecoin was the outlier, which only gained about 2.5%.

As far as my stocks go, I mentioned last month I sold off most of my longshot stock picks and moved the money into a fund; it was down a bit more than 3% for February… not too bad.

With the continued uncertainty of a military conflict and how it will play out, some believe the Fed will adjust their plans on raising rates. But the Fed may be forced to act differently than it normally would during a war... that being to fight inflationary forces harder, rather than loosening policy, to ensure inflation experienced during covid is not compounded.

____________________

The Dark Side

By: Alyssa & Nathan

A Million Dollar Mistake

We all do stupid things at work from time to time. Sometimes it’s something harmless like online shopping or listening to podcasts, only serving to relieve some boredom. But in other instances, the way you kill time can be inconceivably costly. And one security guard at a Russian museum discovered this the hard way when he doodled on a painting worth $1 million.

We all do stupid things at work from time to time. Sometimes it’s something harmless like online shopping or listening to podcasts, only serving to relieve some boredom. But in other instances, the way you kill time can be inconceivably costly. And one security guard at a Russian museum discovered this the hard way when he doodled on a painting worth $1 million.

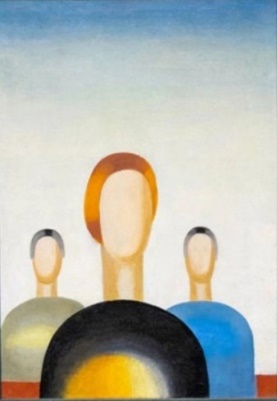

The Yeltsin Center, a museum in the Russian city of Yekaterinburg, announced that a painting loaned to them by a state gallery had been vandalized in early December. The painting, Three Figures by the Soviet avant-garde artist Anna Leporskaya, shows three people with featureless faces looking eyelessly back at the viewer. But one security guard, on his first day on the job, I guess decided to improve upon it by adding eyes with a ballpoint pen. The painting was part of an exhibit called The World as Non-Objectivity, and the eyes were only noticed after a pair of visitors brought them to the staff’s attention. One of the museum’s curators described the security guard's vandalism as “some kind of a lapse in sanity”. The Russian culture ministry sought to have the guard charged with damage to cultural heritage objects, but prosecutors later only charged him with mere vandalism. If convicted, he would have to serve a short prison sentence and pay a fine.

It’s always tragically interesting news when a museum piece gets damaged in an accident. But the situation becomes even more fascinating when the damage is intentional. Even though the pen broke through the topmost layer of paint, representatives of the Yeltsin Center say that specialists at the Tretyakov State Gallery can restore the painting. While the work is insured for about $1 million, specialists estimate that the restoration would only cost $3,300. If it wasn’t clear already, the security guard has been fired.

A Deal Too Good To Be True

News broke about a German collector who thought he was getting the deal of a lifetime in early February. It appears that Gallery T293, based in Rome and offering works by several in-demand artists, had been hacked. Cybercriminals accessed their emails and set up another email account ending in t292 (one digit off) and a bogus phone number. Then the scam began, contacting the galleries' buyers and offering them works of art at very attractive prices.

News broke about a German collector who thought he was getting the deal of a lifetime in early February. It appears that Gallery T293, based in Rome and offering works by several in-demand artists, had been hacked. Cybercriminals accessed their emails and set up another email account ending in t292 (one digit off) and a bogus phone number. Then the scam began, contacting the galleries' buyers and offering them works of art at very attractive prices.

The German collector was offered two paintings by Anna Park and wired the funds ($33,000) to a bank account set up by the Cybercriminals. It seems that the fraudsters contacted 19 individuals, including an art advisor in the US (who almost fell for the scam). Once the fraud came to light, authorities deactivated the scammer's bank account and returned the German collector's money.

As more and more sales are taking place online, buyers need to confirm that the emails are coming from the 'real' gallery account and their banking information is accurate. If you have any doubt, do an online search for the gallery, and then pick up the phone and call them. Better safe than sorry.

Over the past couple of years, we have received several emails from accounts we know that seemed a little strange. Upon closer inspection, we found that a letter or number in the address was changed. We even played along with a couple, just to see what would happen. Every time, they were looking for money.

____________________

Really?

By: Amy & Nathan

Ruth Bader Ginsburg's Personal Library Smashes Estimates

Ruth Bader Ginsburg may have been petite, but she was a powerhouse. Ginsburg confronted many obstacles in both her personal and professional life yet worked to overcome them. She passed away in September 2020, and recently many items from her personal library were auctioned off and smashed the auction estimates. The results demonstrated the power of her legacy, how influential she was, and how influential she still is.

The auction, held by Bonhams, New York, was a huge success, with every item sold. It certainly gave any Ruth Bader Ginsburg fan a chance to snatch a piece of history. The estimates were rather modest, and bidding was fierce. According to the auction house, more online bidders vied for the Supreme Court Justice’s belongings than any other online sale they've ever held before.

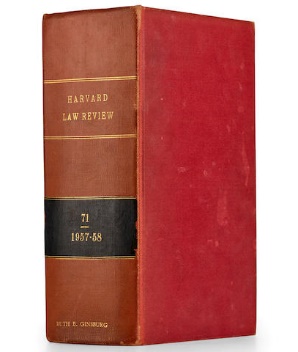

The white glove sale featured over a thousand books, photographs, and even a few honorary degrees. Many items had annotations from Ginsburg herself, as well as inscriptions from colleagues and other remarkable women. The top lot was her copy of the Harvard Law Review from 1957-58, which she heavily annotated. It was estimated at $2,500-3,500 and sold for an astounding $80K ($100.3K w/p).

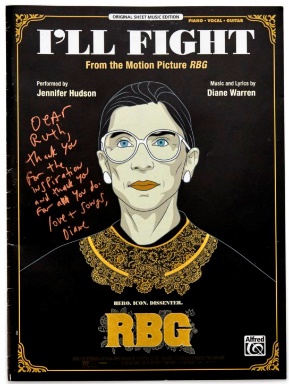

Additional highlights from the sale included Ruth Bader Ginsburg’s copy of her book My Own Words. It is a collection of her writings and speeches ranging from elementary school essays to Supreme Court documents. The book sold for $65K ($81.5K w/p) against a $1-2,000 estimate. A copy of Gloria Steinem’s memoir entitled My Life on the Road was also featured, including an inscription: “To Dearest Ruth – who paved the road for us all with a lifetime of gratitude -Gloria”. It had an extremely low estimate of $300-500 and sold for $42K ($52.8K w/p). My Beloved World, written by Sonia Sotomayor, was inscribed to Ginsburg, and sold to $32K ($40.3K w/p); the estimate was, again, just $300-500. But the last item that I think deserves an honorable mention is sheet music for the song “I’ll Fight”, written by Diane Warren for the 2018 movie RBG. Warren inscribed the sheet music with, “Dear Ruth, Thank you for the inspiration and thank you for all you do. Love & songs, Diane.” Both the movie and the song were nominated for Academy Awards in 2019. The sheet music smashed its $100-200 estimate when it sold for $28K ($35.3K w/p).

Additional highlights from the sale included Ruth Bader Ginsburg’s copy of her book My Own Words. It is a collection of her writings and speeches ranging from elementary school essays to Supreme Court documents. The book sold for $65K ($81.5K w/p) against a $1-2,000 estimate. A copy of Gloria Steinem’s memoir entitled My Life on the Road was also featured, including an inscription: “To Dearest Ruth – who paved the road for us all with a lifetime of gratitude -Gloria”. It had an extremely low estimate of $300-500 and sold for $42K ($52.8K w/p). My Beloved World, written by Sonia Sotomayor, was inscribed to Ginsburg, and sold to $32K ($40.3K w/p); the estimate was, again, just $300-500. But the last item that I think deserves an honorable mention is sheet music for the song “I’ll Fight”, written by Diane Warren for the 2018 movie RBG. Warren inscribed the sheet music with, “Dear Ruth, Thank you for the inspiration and thank you for all you do. Love & songs, Diane.” Both the movie and the song were nominated for Academy Awards in 2019. The sheet music smashed its $100-200 estimate when it sold for $28K ($35.3K w/p).

In the end, the results surprised everyone. Every lot sold above its presale estimate. While Bonhams had hoped to bring in $60K for the entire sale, all expectations were blown away as the overall sale totaled close to $2.4M with the premium added. I would have to say Ruth Bader Ginsburg is still an influential force.

Nike ‘Air Force 1’ Sneakers Fly By Estimate

Virgil Abloh was an American fashion designer, and in 2018 he became the artistic director for Louis Vuitton's menswear collection. He was a rising star, and Time Magazine named him one of the most influential people in 2018. Tragically, in 2019 Abloh was diagnosed with cardia angiosarcoma, a type of cancer, and passed away at the young age of 41 in 2021. This week, an online auction at Sotheby's came to a close; it featured 200 pairs of Nike's 'Air Force 1' sneakers designed by Abloh, created in a collaboration between Louis Vuitton and Nike.

The Nike 'Air Force 1' was designed in 1982 by Bruce Kilgore and was the first basketball shoe to feature Nike's Air Technology, which brought a soft, springy bounce to the game. Since that time, Nike has collaborated with many designers, one of whom was Abloh. His first partnership with Nike was in 2017 when he redesigned several sneakers; he maintained the original structure but updated them with his style.

The Nike 'Air Force 1' was designed in 1982 by Bruce Kilgore and was the first basketball shoe to feature Nike's Air Technology, which brought a soft, springy bounce to the game. Since that time, Nike has collaborated with many designers, one of whom was Abloh. His first partnership with Nike was in 2017 when he redesigned several sneakers; he maintained the original structure but updated them with his style.

Before Abloh passed away, he collaborated with Nike, once again, to create the Nike x Louis Vuitton "Air Force 1" for the Spring-Summer 2022 Men's Collection. The sneakers are easily recognizable as they were constructed in Louis Vuitton's signature monogram canvas and Azur pattern. Each pair was presented with an exclusive Louis Vuitton pilot case made from orange taurillon monogrammed leather. The sneakers varied in size from 5 – 18, with each lot carrying an identical $5 – 15K estimate, but the final bids had a far greater range. The LEAST expensive pair, a size 6.5, sold for just $60K ($75.6K w/p)…WOW! And the most expensive lot, which happened to be the first lot and a size 5, sold for a phenomenal $280K ($352.8K w/p). While this impressive winning bid is not a record price for a pair of Nike's (that honor belongs to Kanye West's Nike Air Yeezy Grammy prototypes from 2008 which sold in April of 2021 for $1.8M), the auction total did set a record. The overall sale was estimated to make between $1 – 3M, and when the timer hit zeroes, the collection made $25.3M (w/p).

Also of note is that the proceeds from the sale will go to the Virgil Abloh "Post-Modern" Scholarship Fund, a charity established by Abloh in 2020 to provide scholarships within the fashion industry for the next generation of Black fashion industry leaders.

Man Ray's Record-Setting Violin

I took an art history elective in high school, and that’s where I saw Man Ray’s work for the first time. It was his 1921 readymade sculpture The Gift, consisting of thumbtacks glued to the bottom of a flatiron. I chuckled when I saw it. He took an ordinary, everyday object and made it completely useless. It’s not unlike Méret Oppenheim’s Déjeuner en fourrure, a fur-covered teacup, saucer, and spoon. Ray has always been one of the most recognizable names in Dada or Surrealism, and now one of his works is predicted to become the most valuable photograph in the world.

I took an art history elective in high school, and that’s where I saw Man Ray’s work for the first time. It was his 1921 readymade sculpture The Gift, consisting of thumbtacks glued to the bottom of a flatiron. I chuckled when I saw it. He took an ordinary, everyday object and made it completely useless. It’s not unlike Méret Oppenheim’s Déjeuner en fourrure, a fur-covered teacup, saucer, and spoon. Ray has always been one of the most recognizable names in Dada or Surrealism, and now one of his works is predicted to become the most valuable photograph in the world.

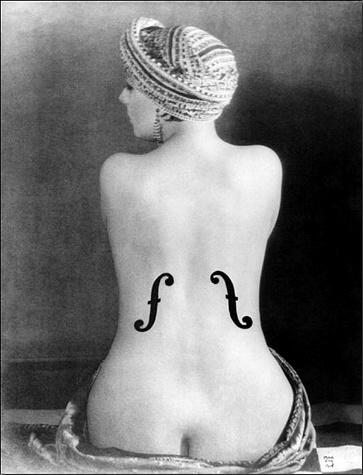

This May, Christie’s will auction The Rosalind Gersten Jacobs & Melvin Jacobs Collection, held in high regard as one of the world’s most well-known private collections of Surrealist and Abstract works. The Man Ray photograph Le violon d’Ingres has grabbed the most attention after Christie’s specialists estimated it to fetch as much as $7 million. Le violon d’Ingres will set an auction record for a photograph if the photo reaches the specialists' estimate. Currently, the most valuable photograph ever sold at auction is Rhein II by the German photographer Andreas Gursky, which brought in $3.8 million (or $4.3 million w/p) at a 2011 Christie’s sale.

The photo shows the nude back of Ray’s lover Kiki de Montparnasse made to look like the body of a violin with f-holes inserted using then-revolutionary darkroom techniques. Ray kept the original print until 1962 until he sold it to the Jacobs family. Based on the title, Ray took inspiration from the nineteenth-century French painter Jean-Auguste-Dominique Ingres, particularly his use of the nude female form. Ingres most famously used the female nude in his Grande Odalisque, but Man took his inspiration from La Grande Baigneuse, also known as The Valpinçon Bather. But the photo has another meaning known only to those who speak French. The title is also a take on the French phrase violon d’Ingres, or Ingres’s violin, a euphemism for a hobby or pastime, named after the painter’s love of the instrument.

Even if the Man Ray photo underperforms, there’s no doubt that the sale will do well. While Christie’s has not released the complete sale catalog, press releases indicate that works by René Magritte, Marcel Duchamp, and Vija Celmins are also part of the Jacobs collection.

____________________

The Art Market

By: Howard & Nathan

19th-Century European Art Sale - Sotheby's, New York

By: Howard

On January 29th, Sotheby's held The European Art Sale, Part II. Yet again, there were many works with condition issues, and surprisingly, several of them sold. I wonder if people buy works from simply viewing the images and not traveling to examine them in person. If so, when the paintings arrive, some of the buyers will probably wish they were not successful.

On January 29th, Sotheby's held The European Art Sale, Part II. Yet again, there were many works with condition issues, and surprisingly, several of them sold. I wonder if people buy works from simply viewing the images and not traveling to examine them in person. If so, when the paintings arrive, some of the buyers will probably wish they were not successful.

The top lot in this sale was one of the lower estimated works. Elizabeth R. Coffin's The Old Falconer of Ben Gana, Sheik of the Ziban sparked the most interest in the sale. It was expected to bring $10-15K and finally hammered at $80K ($100.8K w/p – almost seven times the high end of the estimate). What I found interesting is that the work had paint loss on the face of the figure, but here is what the condition report stated: The canvas is not lined. The paint surface is in good condition but under a soiled varnish. Under UV light, no apparent inpainting. I am not implying that this is a serious issue, but paint loss should be noted.

The Marquis de Montgomery's Chestnut Filly, "La Toucques" at Chantilly by the British Victorian sporting artist Harry Hall, was the second most expensive work. The painting came from the Gaston collection, carried a $20-30K estimate, and sold for $40K ($50.4K w/p). This one had a good deal of restoration, and it was noted in their condition report: Lined canvas. The paint surface is in good condition and under a fairly clean varnish. Under UV light: scattered areas of inpainting throughout the sky and the ground; some inpainting to the jacket of the figure at left. The third spot saw Camille Joseph Etienne Roqueplan's 1836 Paris Salon painting Portrait of a Lady with Pink Sash. The work was estimated at $5-7K and hammered at $35K (44.1K w/p – more than six times the high estimate).

The Marquis de Montgomery's Chestnut Filly, "La Toucques" at Chantilly by the British Victorian sporting artist Harry Hall, was the second most expensive work. The painting came from the Gaston collection, carried a $20-30K estimate, and sold for $40K ($50.4K w/p). This one had a good deal of restoration, and it was noted in their condition report: Lined canvas. The paint surface is in good condition and under a fairly clean varnish. Under UV light: scattered areas of inpainting throughout the sky and the ground; some inpainting to the jacket of the figure at left. The third spot saw Camille Joseph Etienne Roqueplan's 1836 Paris Salon painting Portrait of a Lady with Pink Sash. The work was estimated at $5-7K and hammered at $35K (44.1K w/p – more than six times the high estimate).

Rounding out the top five... Salvatore Frangiamore's Ladies of the Harem at $30K ($37.8K w/p – est. $20-30K), and then there was a tie when Hans Buchner's The Ace of Hearts (est. $8-12K) and Lancelot-Théodore Turpin de Crissé's Monks in a Church Interior (est. $30-50K) each made $24K ($30K w/p). I guess one seller was happy, and the other not so much.

Other than those works mentioned above, only one additional work performed fairly well, Landini's La pâté en croute at $14K ($17.6K w/p – est. $3-5K). Several works did not leave the starting block – Ferneley, Sr's A Chestnut Hunter with Robert Day up (est. $70-90K), Ferneley, Jr's Outside Allington Hall ($30-40K), Cabanel's Portrait d'enfant aux jouets ($20-30K), and Adolphe Joseph Thomas Monticelli's Les Orientales ($20-30K).

The sale consisted of 51 lots, of which 38 sold (74.5% sell-through rate), and the total take was $512.7K ($646K w/p). The presale estimate range was $613-895K, so it took the addition of the buyer's premium to hit the mark. Of the 38 sold works, 19 were below, 11 within, and 8 above their presale estimate range. When we added in the 13 unsold works, this gave them an accuracy rate of 21.5%.

It is becoming more and more evident that the main auction rooms are not the market makers for 19th-century works.

Old Masters Getting Old?

By: Nathan

There was a bit of excitement about the Thursday morning January 27th Old Masters sale at Sotheby’s. This was mainly because of Sandro Botticelli’s Christ portrait known as the Man of Sorrows. Previously, I had written about the painting, namely its rarity and how scans showed another work underneath the paint. But the actual auction proved less exciting than expected.

The auctioneer came across as unnecessarily slow and cautious right off the bat. He seemed hesitant to bang the gavel on most lots, causing me to scream “Go!” at my computer screen more than once. Giovanni Bellini’s Madonna and Child at a Ledge with an Apple passed with a final bid of $2.9 million. Yet it seemed like the auctioneer lingered at that bid for a solid two or three minutes, saying “Fair warning” twice in the process (maybe because of stress or maybe ineptitude). I felt like I could’ve walked the twenty blocks to Sotheby’s and banged the gavel myself quicker than he did most of the time.

But when the big-ticket item finally came up, it sadly fell just a little short. The Botticelli brought in $39.3 million (or $45,190,700 w/p), just shy of the $40 million estimate. Not an insignificant price, but not what many were expecting. Confusingly, the rap of the gavel was met with a round of applause, perhaps a little undeserved. It’s not like it went for an exponentially higher dollar amount or anything.

Old Masters sales can sometimes serve as a moment to teach everyone an important lesson. The title of Old Master doesn’t always mean you’re going to like the painting. I first became aware of this reality during the sale when Fra Diamante’s Madonna and Child with Three Angels came up. Two of the five figures have faces too small for their heads, while the Christ Child was given a set of legs more appropriate for the Michelin Man.  Furthermore, I was baffled to see a $4.5 million estimate on a painting by Correggio, mainly because of the appearance and the size. Saint Mary Magdalen Reading is strange since the subject saint is confusingly dressed in a dark robe against a dark background, making it difficult to see what you’re even looking at. Also, the painting without the frame is barely even 9 inches by 11 inches. Now, the multimillion-dollar estimate could be excused by the painting’s recent rediscovery. Before coming to auction, experts only knew about the Correggio Magdalen because of copies by other artists. Otherwise, it was considered a lost masterwork.

Furthermore, I was baffled to see a $4.5 million estimate on a painting by Correggio, mainly because of the appearance and the size. Saint Mary Magdalen Reading is strange since the subject saint is confusingly dressed in a dark robe against a dark background, making it difficult to see what you’re even looking at. Also, the painting without the frame is barely even 9 inches by 11 inches. Now, the multimillion-dollar estimate could be excused by the painting’s recent rediscovery. Before coming to auction, experts only knew about the Correggio Magdalen because of copies by other artists. Otherwise, it was considered a lost masterwork.

But the sale wasn’t entirely without highlights. Francisco de Goya’s Portrait of the Marquis de Caballero is very typical of the Spanish master’s portraits in playing with light and texture and creating displays of power. It reached triple its high estimate with a hammer price of $1.8 million (or $2,198,000 w/p). Furthermore, the Dutch painter Quiringh van Brekelenkam did very well with another one of his looks into Dutch domestic life with The Lacemaker’s School. It brought in more than double its $150,000 estimate. Finally, the most unexpected of the highlights came in the form of a seemingly out-of-place ancient Egyptian statue. The 4,000-year-old limestone figure was fascinating to find in this sale specifically. I mean, I know it's an Old Master sale, but this is undoubtedly a little too old. But the statue did very well, far exceeding its estimate and reaching $8.4 million (or $9,915,600 w/p). Though not an Old Master work, it ended up reaching the second-highest hammer price of the sale.

While the Sotheby’s saleroom seemed to have a decently-sized crowd in attendance, there was undoubtedly a lack of enthusiasm. Despite a few highlights, the entire sale seemed a bit lackluster given the names attributed to the works. In total, the sale brought in $76 million hammer (or $91 million w/p), which is just barely past the total minimum estimate of $73.1 million. Many analysts have been saying for some time that interest in Old Masters has declined in recent years, especially among the younger buyers that have become such a powerful force in the market. While this Sotheby’s sale might serve as another unfortunate example of that phenomenon, Old Masters works aren’t exactly making nothing at auction. It’s likely this corner of the art world is just undervalued for the time being and will bounce back with the ebbs and flows of the market soon enough.

CryptoPunk NFT Sale – A No Go

By: Howard

Over the past few weeks, there has been much publicity surrounding the single lot CryptoPunk sale at Sotheby's. In a tweet, they stated:

Over the past few weeks, there has been much publicity surrounding the single lot CryptoPunk sale at Sotheby's. In a tweet, they stated:

"CryptoPunks get the Sotheby's treatment. Our next #SothebysMetaverse sale 'Punk It! 104 CryptoPunks. 1 Lot.' will be a landmark LIVE Evening Auction on February 23. A truly historic sale for an undeniably historic NFT project."

The lot, owned by a collector who goes by the Twitter handle 0x650d, was estimated to bring $20-30M. The evening began with a panel discussion about the history and significance of CryptoPunks. The sale was to start at 7 p.m., and according to reports, the room was crowded. Well, about 25 minutes later, Sotheby's announced that the owner decided not to move forward with the sale. You can bet there were a lot of disappointed attendees, not to mention the auction room!

So, you might be wondering why did the owner pull the lot? After hearing about it through a tweet by art critic Katya Kazakina, I replied, "No interest? Stock market falling. Crypto values dropping. Probably did not want to start an NFT market correction."

In an article Katya posted on Artnet that evening, "By 7:38 p.m., any mention of the auction had vanished from Sotheby's website. "Withdrawn lots are routinely removed from the website," a Sotheby's spokesman said, but declined to comment further on what caused the withdrawal of the lot." Guess their policy of only showing sold works makes them look good to the unwitting people who surf their site.

A post-sale party went ahead as scheduled with free drinks and a DJ – wonder what they were celebrating? I also wonder if they are charging the seller a fee for withdrawing the lot?

____________________

Deeper Thoughts

By: Nathan

Hold Your Horses… or Picassos?

Pablo Picasso was in the news (again) last week, this time because of art’s newest hot topic: NFTs. The artist’s granddaughter Marina Picasso and her son Florian announced that they would be hopping on the NFT bandwagon by minting 1,010 digital works based on a Picasso ceramic in their possession. This comes on the coattails of the British Museum’s announcement earlier this month that it would mint NFTs based on twenty of their paintings by the British master J.M.W. Turner.

Pablo Picasso was in the news (again) last week, this time because of art’s newest hot topic: NFTs. The artist’s granddaughter Marina Picasso and her son Florian announced that they would be hopping on the NFT bandwagon by minting 1,010 digital works based on a Picasso ceramic in their possession. This comes on the coattails of the British Museum’s announcement earlier this month that it would mint NFTs based on twenty of their paintings by the British master J.M.W. Turner.

After Picasso died in 1973, one-fifth of his assets went to his granddaughter Marina. Marina has since sold many of her grandfather’s works, telling the Guardian in 2015 that selling her inheritance is often therapeutic given the turbulent relationship between Picasso and his son Paulo, her father. Many forget that while Picasso is primarily known for his paintings, he also produced thousands of ceramic works throughout his life, ranging from bowls to vases to platters, decorating them with various designs, including faces, birds, the heads of goats, and men on horses. A widely-circulated photo of the Picasso mother-son duo shows Florian posing in their Geneva, Switzerland apartment, holding the large bowl in question. Florian holds the bowl in a way where you can only see the bottom as if he's hiding a surprise yet to be revealed. The artist’s great-grandson described their decision as an attempt to introduce Picasso’s works to a younger audience, as well as “build a bridge between the NFT world and the fine art world”. The two generated a good deal of publicity. In his capacity as a music producer, Florian got both John Legend and Nas on board to create music to accompany the sale. According to Marina, her grandfather’s bowl dates to 1958 and has never been seen outside the family collection. Agents working on behalf of both Marina and Florian have indicated that both the bowl and an NFT based on the ceramic work will be featured at a Sotheby’s auction this upcoming March. The two Picassos have also announced that the auction proceeds will be donated to healthcare and environmental NGOs. Sotheby’s, however, has said that they have no intention of auctioning off any Picasso NFTs.

Like Rachael Bunyan of the Daily Mail and Jamey Keaten of the Sydney Morning Herald, some have likened Picasso NFTs to something monumental, similar to the Beatles catalogue becoming available on iTunes back in 2010. But I wouldn’t be too sure about that analogy just yet. Even though Marina owns many of her grandfather’s works, she still needs to gain permission from the Picasso estate, known as the Picasso Administration, to do anything with the works. While Marina is one of the Administration’s five members, the two uncles, one aunt, and one cousin that comprise the other four members have granted no such consent. After the estate clarified that it had not given any permission for a digital auction to take place, Marina and Florian’s agents announced that the sale had merely been “postponed”. But simultaneously, Florian Picasso is going through with an NFT sale, but of his own work rather than that of his great-grandfather. This may be a simple family spat for some, but the outcome will definitely have broader ramifications for how existing works can be sold digitally, if at all.

How To Get Rich? Find A Lost Renaissance Masterpiece

A freshly-discovered masterwork has ended its stay in New York.

Three years ago, Clifford Schorer from Massachusetts bought what he thought was just an old drawing. It’s a nice image of a seated woman holding her baby, done using pen-on-paper with an interesting monogram of the initials AD just below it. Schorer actually admitted to initially planning on giving it away. As he tells it, he bought the drawing in hopes of finding a gift for a retirement party. He heard from a bookseller that someone had bought a nice drawing for $30 at the estate sale of a local architect. But I don’t think anyone could have expected that what he bought for $30 then, is now estimated to be worth millions. That AD monogram just so  happened to be the signature of the German Renaissance master Albrecht Dürer. And so, some old drawing of a woman and her baby has transformed into a priceless Madonna and Child. Schorer, who once served as president of the Worcester Art Museum, stated that he brought it to several different experts to have it authenticated as a genuine Dürer work, only to receive rejections from everyone he took it to. I suppose the story of how he found it along with its good condition may have led some to reject it outright. It wasn’t until the drawing was brought to the London gallery Agnew’s that it was properly authenticated. Christoph Metzger, curator of Vienna’s Albertina Museum, and Giulia Bartrum, head of German prints at the British Museum, have since confirmed the drawing’s authenticity. The confirming evidence came when specialists held the paper up to a light and saw a watermark in the shape of a trident and a small circle. This is known as the Trident and the Ring, and is one of the known watermarks found in Albrecht Dürer’s works.

happened to be the signature of the German Renaissance master Albrecht Dürer. And so, some old drawing of a woman and her baby has transformed into a priceless Madonna and Child. Schorer, who once served as president of the Worcester Art Museum, stated that he brought it to several different experts to have it authenticated as a genuine Dürer work, only to receive rejections from everyone he took it to. I suppose the story of how he found it along with its good condition may have led some to reject it outright. It wasn’t until the drawing was brought to the London gallery Agnew’s that it was properly authenticated. Christoph Metzger, curator of Vienna’s Albertina Museum, and Giulia Bartrum, head of German prints at the British Museum, have since confirmed the drawing’s authenticity. The confirming evidence came when specialists held the paper up to a light and saw a watermark in the shape of a trident and a small circle. This is known as the Trident and the Ring, and is one of the known watermarks found in Albrecht Dürer’s works.

The drawing is estimated to have been created around 1503, and is most likely a study for one of Dürer’s watercolors known as Virgin Among a Multitude of Animals. That painting, perhaps coincidentally, currently hangs in the Albertina Museum. But between January 21st and 29th, the drawing, now commonly known as Virgin and Child with a Flower on a Grassy Bank, enjoyed a stay at the Colnaghi Gallery on East 70th Street for the 2022 Master Drawings New York exhibition. Agnew’s gallery director Anthony Crichton-Stuart stated that the Grassy Bank Virgin is the first Dürer work of comparable quality to be discovered in 45 years. The all-time auction record for a Northern European drawing is Lucas van Leyden’s study of a young man that sold for £11.48 million (or $14.6 million) at Christie’s London in 2018. But some have predicted the newly-discovered Dürer would fetch far more if it were to ever come up at auction - in the $50 million range. Even though the Old Masters market isn’t what it once was, the story behind the Grassy Bank Virgin may add enough to the drawing to lead it to set a new record... one day.

US Treasury Report: Nothing To See Here, Folks

A report compiled by the US Treasury Department highlights some of the art world’s most significant flaws exploited by criminals. Congress initially commissioned the report as part of anti-money laundering legislation from 2020. It states, “the high-dollar values of single transactions, the ease of transportability of works of art, the long-standing culture of privacy in the market […], and the increasing use of art as an investment or financial asset” as the elements of the industry that make financial crimes easier. Furthermore, larger galleries, museums, and auction houses are more prone to facilitating illegal activity. The report also acknowledges the new risks introduced by the growing online art market, which nearly doubled in size over the past year. Namely, the report lists the online market's decentralized and heterogeneous nature as factors that allow money launderers to operate.

A report compiled by the US Treasury Department highlights some of the art world’s most significant flaws exploited by criminals. Congress initially commissioned the report as part of anti-money laundering legislation from 2020. It states, “the high-dollar values of single transactions, the ease of transportability of works of art, the long-standing culture of privacy in the market […], and the increasing use of art as an investment or financial asset” as the elements of the industry that make financial crimes easier. Furthermore, larger galleries, museums, and auction houses are more prone to facilitating illegal activity. The report also acknowledges the new risks introduced by the growing online art market, which nearly doubled in size over the past year. Namely, the report lists the online market's decentralized and heterogeneous nature as factors that allow money launderers to operate.

However, despite the forty-page report detailing all the issues facing the art world, the Treasury recommends that government action is not immediately necessary. According to the ironically named Scott Rembrandt, a senior official in the Treasury’s Office of Terrorist Financing and Financial Crimes, the government would focus instead on some of the underlying problems that allow illegal practices in the art world and beyond. These include the use of shell companies and the protected use of anonymity among buyers. But some have recommended that American laws governing the art world fall in line with those already in place in Britain and Europe. These reforms include a database to be created and used by dealers, auction houses, museums, and galleries to keep tabs on the more sketchy clients. This would, hopefully, encourage transparency without direct government regulation.

In the United States, antiquities dealers must perform background checks on their clients and report suspicious activity to ensure that any money and goods used in a transaction were acquired legally. However, this requirement has not been extended to art dealers and auction houses. In recent years, many galleries and auctioneers have voluntarily enacted their own rules regarding the due diligence that their employees must exercise. But so far, it is not legally required. The Art Dealers Association of America released a response to the report, agreeing with its conclusions: “There is not evidence of sufficient money laundering risk in the art market to justify subjecting art dealers to new regulations”. Not exactly a surprising response. This comes at a time when exposing looted artifacts and paintings bought with dirty money have become a fixture of our news cycle, from Jho Low to Michael Steinhardt.

China’s Dissident Artist Who Built The Beijing Olympic Stadium

I first saw the work of the Chinese artist Ai Weiwei years ago at New York’s Museum of Modern Art (MoMA) when I saw parts of his Study of Perspective series. A few black-and-white photographs of different world landmarks hung on the wall, all with a middle finger emerging behind the camera. The Eiffel Tower, Tiananmen Square, and the Mona Lisa were all being flipped off by whoever was behind the camera. Though Ai stopped contributing to the series in 2003, he couldn’t help but revive the motif in 2017 to give the finger to New York’s Trump Tower. Giving the middle finger has been so associated with Ai Weiwei that a few years ago he created one thousand small sculptures of the gesture, with several of them selling at auction in recent years for as high as $7,000 (or $8,750 w/p).

I first saw the work of the Chinese artist Ai Weiwei years ago at New York’s Museum of Modern Art (MoMA) when I saw parts of his Study of Perspective series. A few black-and-white photographs of different world landmarks hung on the wall, all with a middle finger emerging behind the camera. The Eiffel Tower, Tiananmen Square, and the Mona Lisa were all being flipped off by whoever was behind the camera. Though Ai stopped contributing to the series in 2003, he couldn’t help but revive the motif in 2017 to give the finger to New York’s Trump Tower. Giving the middle finger has been so associated with Ai Weiwei that a few years ago he created one thousand small sculptures of the gesture, with several of them selling at auction in recent years for as high as $7,000 (or $8,750 w/p).

Since seeing the Study of Perspective, I’ve followed Ai’s work, from his sculpture Forever Bicycles made from bike frames, to installing cages around New York to bring attention to the plight of refugees worldwide. Ai Weiwei, whose own father was sent to a prison farm in 1957 after defending persecuted artists, has nearly always been ahead of the curb when it comes to calling attention to humanity’s shortcomings, especially those which go on in his home country. After being arrested and detained for 81 days without charge in 2011, he began his process of self-imposed exile. He now lives in Portugal after being allowed to leave China in 2015.

But Ai has come up again in the news recently because of his commentary on Beijing’s Olympic stadium originally built for the 2008 summer games but is now being used for the current winter games. The stadium, known popularly as the Bird’s Nest because of the design, was built by the Swiss architecture firm Herzog & de Meuron, while Ai was brought on as the principal artistic consultant. Even during the 2008 Olympics, Ai Weiwei denounced his creation as “a big disappointment” being used as propaganda by the central government in Beijing. In his book 1000 Years of Joys and Sorrows, Ai writes that the stadium’s design was directly inspired by traditional Chinese ceramic art, and was meant to symbolize freedom and transparency. While Ai seemed hopeful for a better future for his country, fourteen years later, as Beijing hosts another set of Olympic games, he seems more doubtful than ever. He’s been more critical of Beijing than ever, calling attention to the plight of the Uyghur people in western China, as well as the whereabouts of Chinese Olympian Peng Shuai, who has not been seen since accusing a senior party official of sexual assault. He accused the International Olympic Committee of “standing next to the authoritarians” in failing to comment on China’s human rights record.

No one can know if Ai Weiwei’s pessimism about China’s future is wholly warranted. But no one can deny that this artist will always make sure we all pay attention to what’s actually going on in the world.

Museums Betting Big

This past weekend, Cincinnati and Los Angeles got all the attention as their respective football teams faced off in the Super Bowl. Millions of dollars are lost and gained in betting on the Super Bowl every year, and it seems like everyone gets in on the action... even the cities’ museums! The Cincinnati Museum and Los Angeles’s Huntington Library each wagered a painting from their collections over who would emerge victorious on Sunday.

This past weekend, Cincinnati and Los Angeles got all the attention as their respective football teams faced off in the Super Bowl. Millions of dollars are lost and gained in betting on the Super Bowl every year, and it seems like everyone gets in on the action... even the cities’ museums! The Cincinnati Museum and Los Angeles’s Huntington Library each wagered a painting from their collections over who would emerge victorious on Sunday.

What made this particular wager an interesting one is that the two paintings are both by the same American artist, Robert Henri. Ironically, the Cincinnati painting shows a girl dressed in the blue of the Los Angeles Rams, while the Huntington painting shows a different girl dressed in the red and white of the Cincinnati Bengals. With the Rams triumphing over the Bengals, Robert Henri’s Patience Serious will be on its way as a loan to Los Angeles to be reunited with Irish Girl.

This is not the first time museums have bet on the Super Bowl. The tradition started in 2010 when the journalist Tyler Green suggested the idea. That year, the Indianapolis Museum of Art bet J.M.W. Turner’s Fifth Plague of Egypt against the New Orleans Museum of Art’s Ideal View of Tivoli by Claude Lorraine. Since then, whenever art institutions decide to participate in what many call the Museum Bowl, they’ve tended to choose a work representative of their city. For example, the Broncos’ 2014 loss to the Seahawks resulted in the Denver Art Museum loaning Frederic Remington’s statue The Bronco Buster to Seattle. I can’t lie, I got a little giddy when I saw the wagered artworks. They all had subjects representative of the team or the city itself. And hopefully, in the future, museums will continue this tradition with a little more frequency to show off some pieces from their collections that are often looked over.

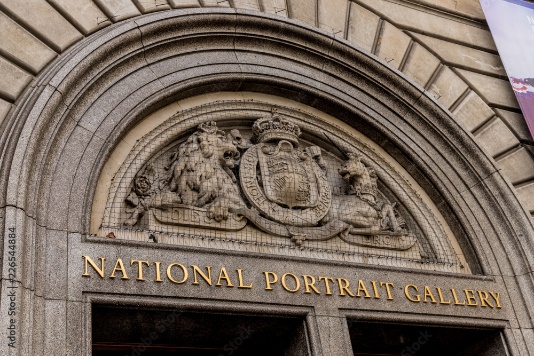

This Month’s Great British Break-Up

British Petroleum (BP) has sponsored an annual portrait competition awarded by London’s National Portrait Gallery (NPG) for the past thirty years. But after December 2022, that partnership will come to an end. While the Turner Prize is often considered the most significant art prize in Britain, the BP Portrait Award is still considered one of the most sought-after awards in the arts. It was first awarded in 1990, replacing the NPG’s John Player Portrait Award, named after and sponsored by the British tobacco giant John Player & Sons. The most recent winning work was awarded in 2020, going to Jiab Prachakul’s Night Talk.

British Petroleum (BP) has sponsored an annual portrait competition awarded by London’s National Portrait Gallery (NPG) for the past thirty years. But after December 2022, that partnership will come to an end. While the Turner Prize is often considered the most significant art prize in Britain, the BP Portrait Award is still considered one of the most sought-after awards in the arts. It was first awarded in 1990, replacing the NPG’s John Player Portrait Award, named after and sponsored by the British tobacco giant John Player & Sons. The most recent winning work was awarded in 2020, going to Jiab Prachakul’s Night Talk.

The NPG is, to date, the most prominent cultural institution to end its business relationship with BP. While the NPG’s director Nicholas Cullinan spoke of how the gallery is “hugely grateful to BP for its long-term support”, this move was eventually going to happen. Opposition to BP’s sponsorship of the award, and in the arts in general, has grown in recent years. In 2019, a petition signed by eighty British artists, including five Turner Prize recipients, called on the NPG to cut ties with BP. The Tate Museums, the National Galleries Scotland, the National Theatre, the Royal Shakespeare Company have all cut their ties with BP and other oil companies. Oftentimes, BP claims that these developments had nothing to do with climate activism. Instead, it was because of “an extremely challenging business environment”, whatever that’s supposed to mean. But climate activist groups like Culture Unstained have heralded the NPG’s decision as a sign that oil and gas companies will no longer be able to use cultural institutions to sanitize and promote their image.

One of the last major British cultural institutions to maintain its business relationship with BP is the British Museum. Like the NPG, many of the British Museum’s programs are sponsored by BP, and set to expire this year unless the museum chairman decides to renew it. Recently, a group of academics and museum employees signed an open letter calling on chairman George Osborne to let the sponsorship expire. While museum higher-ups will insist that corporate donations and financial support are essential to fund exhibits, lectures, and other programs, the British Museum is now becoming increasingly isolated as more cultural institutions break away from money made through environmental destruction.

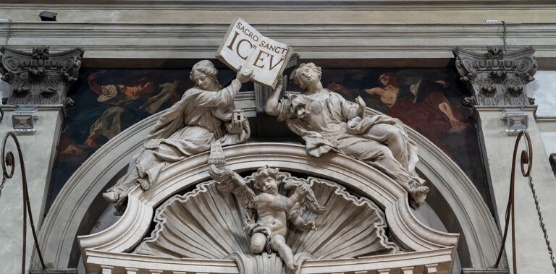

The Colston Four Walk Free

Save Venice is a US-based nonprofit that works to preserve and educate about Venetian cultural patrimony. The organization raises money to fund the restoration of paintings, sculptures, and public monuments in Venice that have deteriorated over the centuries. In one of their many projects, Save Venice restored 19 works by the sixteenth-century Venetian master Jacopo Tintoretto in time for his 500th birthday in 2018. But the organization found itself with another project in the works due to their Tintoretto restorations. The altarpiece Saint Martial in Glory with Saints Peter and Paul was one of the Tintoretto paintings restored. But when conservators returned the painting to the parish church of San Marziale, they noticed two oil paintings on canvas inserted into the spandrels between the arch and the wall above the altarpiece. Save Venice decided to restore the spandrel paintings, showing the evangelists Luke and John, to brighten up the entire altar. The conservators also worked on two similar spandrel paintings at another altar in the church, showing Saints Mark and Matthew. When all the oxidized varnish started to come off the canvas, specialists almost immediately recognized that the saints were created by one of Venice’s greatest female artists, Giulia Lama.

Save Venice is a US-based nonprofit that works to preserve and educate about Venetian cultural patrimony. The organization raises money to fund the restoration of paintings, sculptures, and public monuments in Venice that have deteriorated over the centuries. In one of their many projects, Save Venice restored 19 works by the sixteenth-century Venetian master Jacopo Tintoretto in time for his 500th birthday in 2018. But the organization found itself with another project in the works due to their Tintoretto restorations. The altarpiece Saint Martial in Glory with Saints Peter and Paul was one of the Tintoretto paintings restored. But when conservators returned the painting to the parish church of San Marziale, they noticed two oil paintings on canvas inserted into the spandrels between the arch and the wall above the altarpiece. Save Venice decided to restore the spandrel paintings, showing the evangelists Luke and John, to brighten up the entire altar. The conservators also worked on two similar spandrel paintings at another altar in the church, showing Saints Mark and Matthew. When all the oxidized varnish started to come off the canvas, specialists almost immediately recognized that the saints were created by one of Venice’s greatest female artists, Giulia Lama.

Giulia Lama was never registered with the painters’ guild and was not widely known among scholars until the twentieth century. She was constantly overshadowed by her male contemporaries like Canaletto and Giambattista Tiepolo. According to Save Venice, Lama has since become “one of the most enigmatic and fascinating figures of the early Venetian Settecento.” Experts had previously attributed much of her work to Giovanni Battista Piazzetta. This is understandable since Lama and Piazzetta were close friends who continually influenced each other. Lama’s work is mainly located at some of Venice’s parish churches, like Santa Maria Assunta, Santa Maria Formosa, and San Vidal. Her work also hangs in Venice’s great museums, namely the Gallerie dell’Accademia and the Ca’ Rezzonico.

The rediscovery of Giulia Lama’s works at the church of San Marziale prompted Save Venice to start their newest project, Women Artists of Venice (WAV). Work is beginning on the paintings of a few select artists, but specialists have already drawn up a list of about thirty Venetian women whose work will be studied and eventually restored. The restoration projects currently underway include Lama’s evangelist paintings, her Female Saint in Glory at the church of Santa Maria Assunta, and the pastel portraits by Rosalba Carriera and Mariana Carlevarijs. Hundreds of thousands of euros have already been donated and appropriated for the WAV. While the work of female artists is not nonexistent in Venetian museums and galleries, up until the WAV there has never been an organized effort to study them as a category of their own.

The Rehs Family

© Rehs Galleries, Inc., New York – March 2022