COMMENTS ON THE ART MARKET

Gallery News

The Process is Moving Along

We visited the new location a couple of weeks ago, and very little progress had been made. There were some lines on the floor to mark out the location of the offices, galleries, storage area, etc. On the 25th, we attended a meeting at the space with the architect and the contractor … we are all pleasantly surprised to see that they had a whole crew there putting up the studs and we were able to finally get a real feel for the new space. We should have a timeline by the middle of November and will keep everyone updated.

We are really looking forward to moving into our new location, which will most likely happen during the first quarter of 2023.

____________________

Upcoming Shows

The Winnetka show will open to the public on Friday, November 4th. If you would like tickets to attend, please email us as know as soon as possible.

Winnetka

Community House

620 Lincoln Ave

Winnetka, IL 60093

November 4: 10am – 6pm

November 5: 10am – 5pm

November 6: 11am – 4pm

Online

As the holiday season approaches, we’re getting ready to present our annual Small Works Show. The online-only exhibit will consist of twenty artists and more than sixty available artworks. The eclectic mix offers an array of styles and subjects and ensures there will be a little something for everyone. Regardless of your aesthetic inclinations, these small and affordable works are a great way to continue building your art collection or get started altogether! And always remember that the gift of art is one of the few that will truly last a lifetime.

____________________

Stocks & Crypto

By: Lance

My father can be a bit impatient, so here we are, talking about the stock market’s performance in October before the month is even over. With just one trading session left, I think it is safe to say the major indices all rebounded nicely over the past few weeks; a welcomed reprieve after a tumultuous September. I honestly don’t know what to make of it… it’s not like we’re getting particularly good news about anything these days to warrant the turnaround. Perhaps the impact of inflation hasn’t creeped its way into balance sheets as quickly as analysts expected – nearly three quarters of the S&P 500 have exceeded EPS (earnings per share) estimates this quarter. I’m certainly not complaining about positive movements in the market, but it does make you wonder what’s driving it all…

As of the close on Friday, the Dow was up nearly 14% for the month, pushing the $33K region. The NASDAQ experienced a more modest 4.5% uptick through October, while the S&P landed between the two with a nearly 9% gain. It wasn’t all sunshine and rainbows though… just ask Jim Cramer, who apologized through tears on CNBC after Meta (Facebook) shares plummeted under $100/share on Thursday – he proclaimed back in June that the stock had “nowhere else to go but up!” It’s down nearly 50% since then and nearly 75% from its high in 2021 – oops!

As for the commodities and currencies… Gold now sits around $1,650 (down about 3%), while crude is in the 90$ range (up about 5%). The Euro regained some ground in relation to the US Dollar – they now sit in near parity. The Pound strengthened as well, now at more than $1.16, up about 4% for the month.

Turning to crypto… Bitcoin had some troubling dips, but ultimately rallied to close things out; it’s now up more than 6% and sitting on the right side of $20K. Similarly, Ethereum had a scary day, but it reversed quickly and yielded a gain of more than 20% through October. Litecoin saw the least volatility and ended up climbing about 3.5% in the same period.

At the very least, I think we can all breathe a sigh of relief that October didn’t cash in another stock market crash – the calendar month has been historically unlucky in that respect. Now we just have to make it through Halloween without getting spooked!

____________________

The Dark Side

By: Nathan & Howard

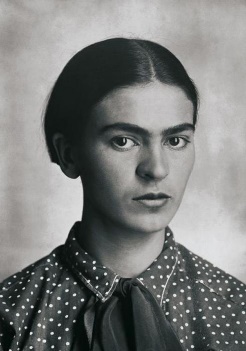

Burn, Frida, Burn

The destruction of art is never something to celebrate or look forward to. Whether it’s a militant organization destroying cultural heritage or some kid at a museum accidentally tripping and putting his hand through a Picasso canvas, it always makes my heart sink. However, woe transforms into annoyance when someone does something intentionally for a ridiculous reason. That is exactly what happened back in January, when the tech group Spice DAO blew $3 million on a rare book of concept art for Alejandro Jodorowsky’s unmade Dune adaptation. They wanted to mint NFTs based on the book’s contents and then destroy it. However, public outcry against destroying the book and the group’s inability to mint their NFTs because of simple copyright issues resulted in the organization’s dissolution in July 2022. Maybe some people should have learned from Spice DAO’s mistakes, namely the Mexican tech entrepreneur Martín Mobarak. He’s now in hot water after publishing content of him destroying a Frida Kahlo drawing allegedly worth $10 million.

Mobarak is mainly known as the creator of the cryptocurrency AGCoin, which, as of October 2nd, is worth about $25 per token. At a private event at his mansion in Miami, Mobarak filmed his destruction of what appears to be Frida Kahlo’s Fantasmones siniestros, an ink-and-watercolor drawing from the artist’s journal created in 1944. He set it alight while the audience cheered and a mariachi band began playing in the background, with Mobarak saying that the work has now “permanently transitioned into the metaverse”. Mobarak’s plan was to mint 10,000 digital versions of the drawing in a project known as Frida.NFT, which seeks to support the great artist’s memory and legacy. While this event occurred on July 30th, coincidentally two days after Spice DAO’s dissolution, Mobarak is coming back in the news again because his little stunt has caught the attention of Mexico’s highest cultural authority: the National Institute of Fine Arts & Literature. The Institute recently announced that it would launch an investigation into the destruction. This is because the Institute considers Kahlo’s work ‘national treasures’, making their deliberate destruction a criminal act. But Mobarak may face another obstacle to his plans similar to the one Spice DAO encountered. In many countries, including the United States, an artist’s work only comes into the public domain seventy-five years after their death. Because Kahlo passed away in 1954, Mobarak does not have the right to digitally reproduce the drawing lest Kahlo’s estate sue for copyright infringement. He would have to wait at least until 2029 to pursue this project.

There is doubt whether the destroyed work was Frida Kahlo’s original drawing since the provenance is a little fuzzy. The work was previously in possession of Mary-Anne Martin Fine Art, a New York gallery specializing in works by Kahlo, her husband Diego Rivera, and other twentieth-century Mexican masters like Tamayo, Orozco, and Siqueiros. Martin sold the drawing to the Vergel Foundation in 2004, which then sold it to a private collector in 2013. However, Mobarak has claimed that he purchased the Kahlo drawing directly from Martin in 2015, despite Martin claiming she had never heard of Mobarak before his stunt in Miami. While the Frida.NFT project claims that the work’s authenticity was verified on the day of the event, I doubt that the destroyed work was the real thing. I think it’s unlikely that a supposed admirer of Kahlo’s work would do such a thing, if not because of legal and financial ramifications, then just based on principle. But I guess we’ll soon find out.

Destruction When Request Is Denied

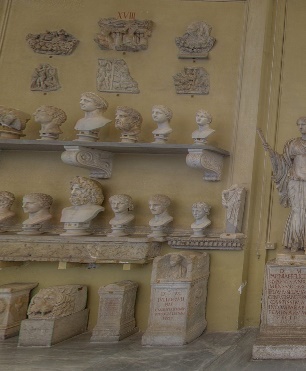

On October 5th, an American tourist requested a visit with the Pope while visiting the Vatican’s Chiaramonti Museum. Of course, it was denied, which sent him off the edge. His response was to knock over two of the approximately 1000 ancient marble sculptures in the collection, causing them to crash to the floor and sustaining damage. The culprit tried to flee but was quickly apprehended by the Vatican gendarmerie, who, in turn, handed him over to Italian authorities.

On October 5th, an American tourist requested a visit with the Pope while visiting the Vatican’s Chiaramonti Museum. Of course, it was denied, which sent him off the edge. His response was to knock over two of the approximately 1000 ancient marble sculptures in the collection, causing them to crash to the floor and sustaining damage. The culprit tried to flee but was quickly apprehended by the Vatican gendarmerie, who, in turn, handed him over to Italian authorities.

According to museum officials, the two damaged sculptures (one of an old and the other of a young man) were not considered important works but need restoration. The estimated cost is about €15,000 (or $15K – the currencies are almost at parity) and will take about two months.

Reports noted that the perpetrator is a 65-year-old man born in Egypt but now an American citizen. He had been in Rome for about three days and appeared to have mental issues. The man has been charged with aggravated property damaged and released. I wonder how quickly he will be on a plane heading back to the US.

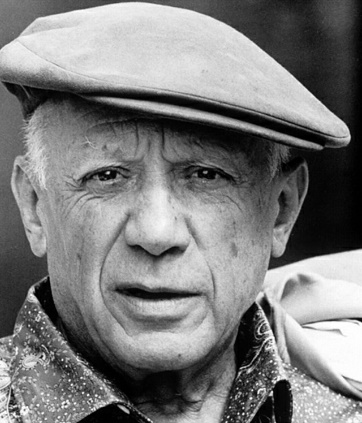

The Handyman And The Stolen Picassos

Gallery owners in Paris are now on trial for trying to cover up their purchase of over 500 drawings by Pablo Picasso that a handyman stole.

Gallery owners in Paris are now on trial for trying to cover up their purchase of over 500 drawings by Pablo Picasso that a handyman stole.

This trial has been over a decade in the making. Originally, a criminal complaint was filed in 2011 by Catherine Hutin, Pablo Picasso’s stepdaughter, and Sylvie Baltazart-Eon, daughter of art dealer Aimé Maeght. In late 2011, the Boulakia Gallery in Paris submitted several drawings to the Picasso Administration for authentication. Then, the estate realized that some of the drawings belonged to Picasso’s wife Jacqueline, who then passed them on to her daughter Catherine. When notified, Catherine took stock of her collection and realized that around three hundred fifty drawings were missing, valued at about €12 million. Around this time, Sylvie Baltazart-Eon discovered over one hundred etchings and lithographs by twentieth-century masters like Francis Bacon, Alexander Calder, Wassily Kandinsky, Joan Miró, and Alberto Giacometti were missing from her own home. Authorities soon learned that the same person likely stole these works.

Hutin and Baltazart-Eon were neighbors in the south of Paris and had employed the same handyman to work on their houses, a man named Frédéric Munchenbach. After his arrest in January 2013, Munchenbach confessed that he used the house keys given to him to steal the drawings to pay off gambling debts. He also admitted that he mainly sold the works to an Italian named Antonio Celano for about €150,000. When arrested, Celano confessed to police that he sold these drawings to the Belle et Belle Gallery in Paris, owned by Anne Pfeffer.

Many of the works described as stolen were found by police in Pfeffer’s gallery and home, most of which were not properly registered. Some of the inscriptions or edition numbers on the prints were altered, while other drawings that were once part of a single piece of paper were found cut and divided to make several works. The seven-year investigation revealed some shady dealings at the Belle et Belle Gallery, including transactions made in cash, if they were included in the ledger at all. The gallery even has ties to an offshore company with an anonymous Swiss bank account, leading some to question whether Pfeffer was involved with money laundering.

Finally, in 2020, Pfeffer, her husband, her daughter, and Antonio Celano were charged with concealment. All have denied that they were aware of the works’ provenance. Celano even claimed he was unaware that the pieces were by Picasso, which is difficult to believe given every one of them bears Picasso’s signature. Additionally, Pfeffer’s husband, a physician, attempted to bribe one of his own patients with a Valium prescription in exchange for testifying in his favor; you know, the type of thing innocent people do. Munchenbach has not been charged mainly because of the statute of limitations. The brief trial lasted from October 5th to October 7th, with a final verdict expected next month. Confusingly, despite investigators’ comments on the Pfeffers’ “particular treachery” both in their crimes and during the trial, prosecutors asked for a suspended sentence for both of them.

So far, authorities recovered only fifty-six works from the Belle et Belle Gallery and at the Pfeffers’ home. Others have been returned from collectors, but hundreds remain missing.

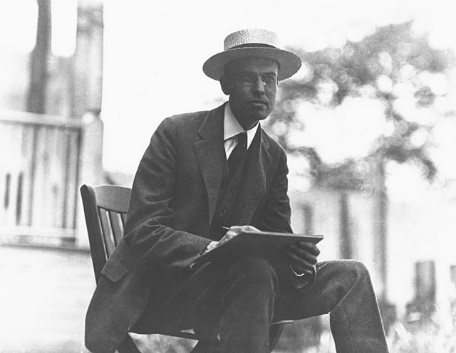

Theft or Misunderstanding? How One Man Got His Edward Hopper Collection

Although his most famous work, Nighthawks, sits in the Art Institute of Chicago, Edward Hopper was a distinctly New York artist. He spent much of his life on the Hudson, having been born and raised in Nyack, before living most of his artistic career in Greenwich Village. Last Wednesday, the Whitney Museum of American Art in Lower Manhattan opened a new exhibition called “Edward Hopper’s New York”. The Whitney is especially qualified to put on such a show. When Hopper’s widow Josephine passed away in 1968, she bequeathed her collection of her husband’s art, some three thousand pieces, to the museum. However, some of the show’s items appear to have a rather suspicious provenance.

Reverend Arthayer Sanborn was a Baptist minister in Nyack, NY, who lived just down the road from where Hopper grew up. It seems that Sanborn was close to Josephine Hopper and Hopper’s sister Marion, being one of their caretakers in their later life. So while it makes sense that he would have some Hopper-related documents like photos and letters, it may be a little strange that the minister also had hundreds of his works. At one point, the minister owned more than three hundred works by Hopper, including paintings, drawings, and sketches now housed in major museums. This includes the 1932 painting City Roofs, which Sanborn sold to New York’s Kennedy Gallery and now sits in the Whitney. Sanborn claimed that much of his collection had been personally gifted to him by the Hoppers. He also claimed to have received other works and documents when he bought the contents of Hopper’s Manhattan apartment and his house in Nyack. But some have disputed these claims for decades.

Gail Levin is one of the world’s foremost experts on Edward Hopper. She is one of his biographers, the compiler of his catalogue raisonné, and formerly the curator of his works at the Whitney Museum. Levin has also spent years challenging Reverend Sanborn’s account. She claims that Sanborn took advantage of Edward and Josephine Hopper in their later life, essentially looting works from their properties while they were under his care and immediately after their deaths. She cites inconsistencies in Sanborn’s claims, as well as the fact that the Hoppers recorded when they gifted works to others, records that are lacking regarding Sanborn’s collection. Levin is essentially alleging elder abuse. While Sanborn passed away in 2007, his family continued denying these accusations. Levin also accused the Whitney Museum of failing to take action or say anything regarding the suspicious circumstances of Sanborn’s acquisition of Hopper’s work. According to the Whitney, “The Museum is aware of claims made by a former curator… Those claims were considered when first made and were again researched more recently. The Museum has found no basis to pursue the matter, and is satisfied with what it received.”

If these allegations are to be believed, then the paintings and drawings Sanborn took were not his to profit from; they were meant to be donated to the Whitney. It is unknown how much money Sanborn made by selling his Hopper collection, but paintings like City Roofs are worth millions today. Even some of the drawings are worth hundreds of thousands of dollars, like the charcoal drawing South of Washington Square, which made $437K w/p at Christie’s New York in May 2015.

Along with the exhibition, the Whitney Museum also opened their Hopper Archive to scholars last Wednesday. Much of the archive is made up of documents donated by the Sanborn family. It’s unknown whether access to the archive may shed some light on the ongoing cycle of allegations, but the best we can do is hope.

____________________

Really?

By: Amy

Levi’s – Old School And Cool

Are you in the market for a new pair of jeans? Well, I have just the pair for you if your style is old school and cool. A pair of Levi Strauss jeans were found in an abandoned mine shaft about five years ago and made their way to the auction block at the beginning of the month in New Mexico. They are considered in fairly good condition and even wearable if you like that worn-in look -LOL.

Experts dated the jeans to the late 19th century; the label inside them was still legible and read “The only kind made by white labor, “a reference to the Chinese Exclusion Act of 1882. According to the Wall Street Journal, Levi’s dropped that statement from the label in the 1890s.

Experts dated the jeans to the late 19th century; the label inside them was still legible and read “The only kind made by white labor, “a reference to the Chinese Exclusion Act of 1882. According to the Wall Street Journal, Levi’s dropped that statement from the label in the 1890s.

A vintage clothing dealer from San Diego purchased the jeans with a little help from a Los Angeles vintage denim expert who paid 10% of the purchase price. The jeans were estimated to make $40-100K, received 11 bids, and strolled off the auction block selling for $76K ($87.6K w/p). They set a record for the most expensive jeans sold at auction. The new owners believe the jeans are worth about $150K, but they plan to put them on display for all to see.

____________________

Architecture In Art

By: Lance

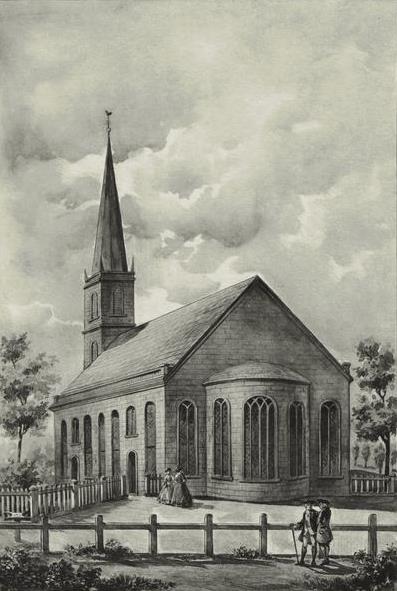

Mark Lague’s Trinity Church Light

Today we’re going to learn about one of the oldest and most historically important churches in America – Trinity Church. It’s been featured in countless artworks, and is prominently the subject of Mark Lague’s Trinity Church Light. While the current structure was completed in 1846, Trinity Church was founded in 1697, well before the founding of our country.

In 1696, the governor approved the purchase of land in Lower Manhattan by the Church of England; the parish received its charter the following year from King William III… the annual rent – 60 bushels of wheat. The first church built was a modest structure on Wall Street… among those who used the church were members of the first and second Continental Congress, as well as the NY Provincial Congress which was key in the American Revolution. Sadly, the Great NYC Fire of 1776 destroyed more than 25% of the city, including the original Trinity Church.

The second church was completed in 1790, but was damaged after severe snowstorms in 1838. While it stood for less than 50 years, the church became increasingly significant as it was used by President Washington and members of his government (NYC was briefly the US Capital), as well as John Jay (first Chief Justice of the US) and Alexander Hamilton.

The current third building used by the church is the one featured in Mark’s painting… it is regarded as one of the first and finest examples of Gothic Revival Architecture in the US. At the time of completion in 1846, it was the tallest structure in the country – it held the title until 1869 with the completion of St. Michael’s Church in Chicago. In addition to the church, the land surrounding the structure is used as burial grounds; several notable individuals are laid to rest, including Alexander Hamilton and his family, Francis Lewis (founding father), Albert Gallatin (politician and founder of NYU) and many others.

The current third building used by the church is the one featured in Mark’s painting… it is regarded as one of the first and finest examples of Gothic Revival Architecture in the US. At the time of completion in 1846, it was the tallest structure in the country – it held the title until 1869 with the completion of St. Michael’s Church in Chicago. In addition to the church, the land surrounding the structure is used as burial grounds; several notable individuals are laid to rest, including Alexander Hamilton and his family, Francis Lewis (founding father), Albert Gallatin (politician and founder of NYU) and many others.

In the 300 plus year history of the church, the Trinity Parish has included eleven chapels, and their 14 acres of Manhattan real estate make them one of the largest landowners in the city… not to mention an investment portfolio worth more than $6 billion, ranking them among the wealthiest individual parishes in the world.

Johann Berthelsen’s 42nd Street Looking East Past Grand Central Station

This week’s Architecture in Art features a National Landmark and one of the most visited spaces in the world – Grand Central Station. It also happened to be a favorite of Johann Berthelsen, as he repeatedly painted the structure throughout his career.

Grand Central Station, or Grand Central Terminal, covers 44 acres of midtown Manhattan at 42nd street and Park Avenue. While it’s the 3rd busiest station in North America, it boasts 44 platforms – more than any station in the world – and they’re all underground!

Grand Central Station, or Grand Central Terminal, covers 44 acres of midtown Manhattan at 42nd street and Park Avenue. While it’s the 3rd busiest station in North America, it boasts 44 platforms – more than any station in the world – and they’re all underground!

The location was originally developed as Grand Central Depot which opened in 1871. By the end of the 1800s, even after an expansion, the depot was at capacity carrying 11.5 million riders annually… and it was still using steam engines. The buildup of soot was a contributing factor in a catastrophic crash in 1902, when 15 died and 30 were injured. After that, plans were made to tear the entire structure down and electrify tracks within tunnels – from 1903 to 1913, the station was demolished and rebuilt without disrupting train service… all while excavating 3.2 million cubic yards of ground at depths of up to ten stories!

Another more subtle feature of the artwork is the Park Avenue Viaduct – an elevated roadway that was added in 1919. Prior to its construction, Grand Central split Park Avenue into two sections – North and South. The viaduct allowed traffic to flow up and around the station (north and south), and unobstructed underneath along 42nd Street (east and west). It’s one of the few places in the city where the road itself is a landmark.

Another more subtle feature of the artwork is the Park Avenue Viaduct – an elevated roadway that was added in 1919. Prior to its construction, Grand Central split Park Avenue into two sections – North and South. The viaduct allowed traffic to flow up and around the station (north and south), and unobstructed underneath along 42nd Street (east and west). It’s one of the few places in the city where the road itself is a landmark.

The new terminal, along with easier access to the north, allowed the area to flourish. The surrounding neighborhood became known as “Terminal City,” the most desirable commercial location in New York… that included new developments like The Chrysler Building (which can be seen in the distance) and The Waldorf Astoria. It’s safe to say Grand Central Terminal had an immeasurable impact on making New York into the city it is today.

Mark Daly’s Flags Along The Avenue At 52nd Street

This one might not be so obvious at first, but Mark Daly’s Flags Along the Avenue at 52nd Street prominently depicts the iconic flags outside Cartier on Fifth Avenue. While it is now known as The Cartier Building, which serves as their flagship, that wasn’t why it was originally built.

This one might not be so obvious at first, but Mark Daly’s Flags Along the Avenue at 52nd Street prominently depicts the iconic flags outside Cartier on Fifth Avenue. While it is now known as The Cartier Building, which serves as their flagship, that wasn’t why it was originally built.

Back in late 1800s, this part of Fifth Ave was relatively undeveloped. Around that time, the Vanderbilts started aggressively acquiring property in the area to control and preserve the neighborhood’s character. They even purchased a hotel and demolished it to get rid of commercial properties in their “pocket of exclusivity” – there were several extravagant homes nearby.

The Vanderbilts acquired this plot and sold it to Morton Plant, who they deemed worthy and had a bit in common with… they both inherited millions from their fathers who made their fortunes developing railroads – Vanderbilt with NY railroads and Plant in the south, across Georgia, South Carolina, and Florida. But there was one condition… Plant had to promise to keep it a residential property for at least 25 years.

Plant agreed and quickly got to work on his mansion… it was completed in 1905, and the Plants became intertwined with high society in NYC. Tragically, his wife fell ill with typhoid in 1913 and died – half of her obituary was dedicated to Morton’s yacht that had just won the Astor Cup… if that gives you an idea of this guy. Nine months later, the New York Times announced he would be remarried… the bride-to-be was granted a divorce by her husband the month prior – it is rumored Plant paid him $8m to agree to the divorce.

Plant agreed and quickly got to work on his mansion… it was completed in 1905, and the Plants became intertwined with high society in NYC. Tragically, his wife fell ill with typhoid in 1913 and died – half of her obituary was dedicated to Morton’s yacht that had just won the Astor Cup… if that gives you an idea of this guy. Nine months later, the New York Times announced he would be remarried… the bride-to-be was granted a divorce by her husband the month prior – it is rumored Plant paid him $8m to agree to the divorce.

By the time his new wife moved in, shops had begun opening in the area, so they decided they’d head uptown. But in the meantime, she became a regular at Cartier and would admire a particular $1m pearl necklace. Legend has it, one night she struck up a conversation with Pierre Cartier, and he mentioned they were on the hunt for a worthy location for their business headquarters… although there is no official reporting, it appears Cartier paid the Plants just $100 plus two pearl necklaces in exchange for the building.

Morton died a couple years later, but when his wife passed in 1956, their 86th street home was emptied and demolished with the contents auctioned – among the items, a pair of remarkable pearl necklaces by Cartier. At the 1957 auction, the pair of necklaces made just $165K… I guess Cartier got the better end of the deal, as the property is now worth more than $120 million! The necklaces have not resurfaced since the auction more than 60 years ago.

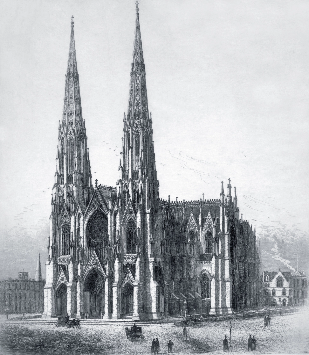

Johann Berthelsen’s St. Patrick’s Cathedral, 5th Avenue

This week’s Architecture in Art features a National Landmark and one of the most visited spaces in the world – Grand Central Station. It also happened to be a favorite of Johann Berthelsen, as he repeatedly painted the structure throughout his career.

This week’s Architecture in Art features a National Landmark and one of the most visited spaces in the world – Grand Central Station. It also happened to be a favorite of Johann Berthelsen, as he repeatedly painted the structure throughout his career.

Grand Central Station, or Grand Central Terminal, covers 44 acres of midtown Manhattan at 42nd street and Park Avenue. While it’s the 3rd busiest station in North America, it boasts 44 platforms – more than any station in the world – and they’re all underground!

The location was originally developed as Grand Central Depot which opened in 1871. By the end of the 1800s, even after an expansion, the depot was at capacity carrying 11.5 million riders annually… and it was still using steam engines. The buildup of soot was a contributing factor in a catastrophic crash in 1902, when 15 died and 30 were injured. After that, plans were made to tear the entire structure down and electrify tracks within tunnels – from 1903 to 1913, the station was demolished and rebuilt without disrupting train service… all while excavating 3.2 million cubic yards of ground at depths of up to ten stories!

Another more subtle feature of the artwork is the Park Avenue Viaduct – an elevated roadway that was added in 1919. Prior to its construction, Grand Central split Park Avenue into two sections – North and South. The viaduct allowed traffic to flow up and around the station (north and south), and unobstructed underneath along 42nd Street (east and west). It’s one of the few places in the city where the road itself is a landmark.

Another more subtle feature of the artwork is the Park Avenue Viaduct – an elevated roadway that was added in 1919. Prior to its construction, Grand Central split Park Avenue into two sections – North and South. The viaduct allowed traffic to flow up and around the station (north and south), and unobstructed underneath along 42nd Street (east and west). It’s one of the few places in the city where the road itself is a landmark.

The new terminal, along with easier access to the north, allowed the area to flourish. The surrounding neighborhood became known as “Terminal City,” the most desirable commercial location in New York… that included new developments like The Chrysler Building (which can be seen in the distance) and The Waldorf Astoria. It’s safe to say Grand Central Terminal had an immeasurable impact on making New York into the city it is today.

____________________

The Art Market

By: Nathan & Howard

Bonhams New Bond Street Modern & Impressionist Sale

By: Nathan

On Wednesday, October 12th, Bonhams’ London location at New Bond Street held its Modern and Impressionist sale. The sixty-six available lots did about as well as the house specialists hoped for, with a few surprises thrown in for good measure. The Bonhams’ experts were nearly spot on in terms of the top lots. Coming in first, exceeding its £1.2M high estimate, was Léonard Tsuguharu Foujita’s 1929 oil-on-canvas Nu assis. The painting has been in the same family since its purchase from the Galerie Mantelet in 1929. As far as we know, it has only been exhibited once. The subject is likely Jacqueline Barsotti Goddard, a French model mainly known for her work and relationship with the American artist Man Ray. Nu assis ended up bringing in £1.3M / $1.44M (or £1.6M / $1.77 w/p).

On Wednesday, October 12th, Bonhams’ London location at New Bond Street held its Modern and Impressionist sale. The sixty-six available lots did about as well as the house specialists hoped for, with a few surprises thrown in for good measure. The Bonhams’ experts were nearly spot on in terms of the top lots. Coming in first, exceeding its £1.2M high estimate, was Léonard Tsuguharu Foujita’s 1929 oil-on-canvas Nu assis. The painting has been in the same family since its purchase from the Galerie Mantelet in 1929. As far as we know, it has only been exhibited once. The subject is likely Jacqueline Barsotti Goddard, a French model mainly known for her work and relationship with the American artist Man Ray. Nu assis ended up bringing in £1.3M / $1.44M (or £1.6M / $1.77 w/p).

Following not far behind the Foujita was a work by Maurice de Vlaminck. Created around 1908, Vlaminck’s arboreal painting La forêt is a decently-sized canvas, measuring approximately 31.8 x 39.4 inches, and features a grove of trees with a sort of dynamism that to me was reminiscent of those found in Van Gogh paintings. Like the Foujita painting, the same family has owned it since the 1920s, and it has not been exhibited since then. However, that will change sooner rather than later since it will appear at a Vlaminck exhibition at the Museum Barberini in Potsdam, Germany starting in September 2024. Bonhams’ house specialists gave the forest scene a reasonable estimate of £700K to £1M, with the hammer coming down at £900K / $996.4K (or £1.12M / $1.24 w/p). And finally, rounding out the top lots was one of Edgar Degas’s iconic ballerina works. The one featured on Wednesday, entitled Danseuse, was a relatively modest drawing done with pastel, wash, and charcoal on paper created around 1908. Danseuse was actually a small surprise since it was only expected to reach £180K, but ended up bringing in £250K.

Among the sale’s surprises was the nude painting Desnudo acostado by the Spanish artist Celso Lagar. It was one of the sale’s earlier lots, only expected to sell for £8K at most. Bid after bid came in; it went on for nearly 7-mintues before the hammer came down at £37K / $40.9K (or £46.92 / $51.9K w/p), or more than four times what specialists were expecting. The sale also finished very strongly, with two of the last three lots greatly exceeding their estimates. A round of applause broke out at the third-to-last lot when André Derain’s Le coq, made from watercolor, brush, and ink on paper, sold for more than six times its estimate at £9.5K / $10.5K (or £12.1K / $13.4 w/p).

Bonhams did incredibly well Wednesday, with experts originally predicting everything would bring in at least £3.19M. All sixty-six lots brought in a total of £3.98M (or $4.4M), with twenty-five lots (or 38%) falling within estimate. Only eleven lots (17%) went unsold that day.

Bonhams New Bond Street Modern & Impressionist Sale

By: Nathan

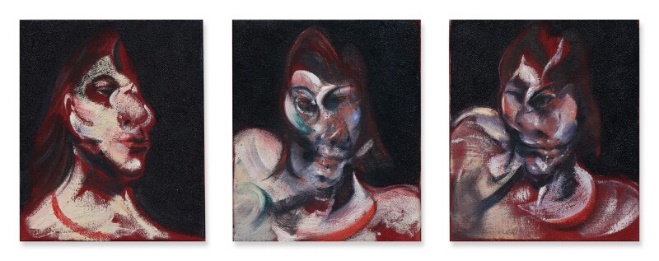

On Friday, October 14th, Sotheby’s London held their much-anticipated Contemporary Evening sale, anticipated because it featured the first of several works from the collection of former CBS President William Paley, which I discussed earlier last month. Three Studies for Portrait of Henrietta Moraes by Francis Bacon was the only lot of the Paley collection up for grabs that day and was expected to be the sale’s big star. Sotheby’s specialists estimated it would go for £30M. Even though it fell short at £23M / $25.7M (or £24.3 / $27.2M w/p), it was still the sale’s most expensive lot. The house experts were also pretty spot-on with the second place lot, Gerhard Richter’s 1966 oil on canvas 192 Farben. It’s a large painting of differently colored squares arranged in a grid. It fell nicely within its pre-sale estimate, expected to make at least £13M, eventually reaching £15.7M / $17.5 (or £18.3M / $20.4M w/p).

On Friday, October 14th, Sotheby’s London held their much-anticipated Contemporary Evening sale, anticipated because it featured the first of several works from the collection of former CBS President William Paley, which I discussed earlier last month. Three Studies for Portrait of Henrietta Moraes by Francis Bacon was the only lot of the Paley collection up for grabs that day and was expected to be the sale’s big star. Sotheby’s specialists estimated it would go for £30M. Even though it fell short at £23M / $25.7M (or £24.3 / $27.2M w/p), it was still the sale’s most expensive lot. The house experts were also pretty spot-on with the second place lot, Gerhard Richter’s 1966 oil on canvas 192 Farben. It’s a large painting of differently colored squares arranged in a grid. It fell nicely within its pre-sale estimate, expected to make at least £13M, eventually reaching £15.7M / $17.5 (or £18.3M / $20.4M w/p).

Other than those two, Sotheby’s dropped the ball a bit when it came to some of the other highly valued lots. The Andy Warhol screenprint Nine Multicolored Marilyns was expected to reach at least £6M, but a lack of interest resulted in the hammer coming down at £4.3M. A little later on, the Thomas Schütte sculpture Bronzefrau Nr. 11 was set to sell for at least £2M but ended up the only lot that day that went unsold. Consequently, Head of J.Y.M. by Frank Auerbach became the sale’s third-place lot. The person in the painting, Juliet Yardley Mills, is probably one of Auerbach’s best-known subjects, with Auerbach having created multiple abstract portraits of her throughout the 1970s and 1980s. Appropriately, the Sotheby’s house experts predicted the portrait would go for anywhere between £3M and £4M. However, it exceeded those estimates, with that day’s bidders bringing the final hammer price to £4.7M / $5.3M (or £5.6M / $6.3M w/p), an all-time auction record for Frank Auerbach. His previous record was set not even four months ago, when Head of Gerda Bohm sold at Sotheby’s London on June 29th for £3.4M.

In total, there were thirty-four lots available at the evening sale. Even though sixteen of them, or 47%, sold over their estimates, Sotheby’s just barely snuck past the sale’s total £73.1M minimum estimate, reaching £73.9M (or $82.6M). As previously noted, I attribute this to some of the higher-valued lots selling for under their estimates. But I think the only thing that saved the sale from bringing in less than expected was that eight initially listed lots were suddenly withdrawn the day of the sale. But I suppose with a 97% sold rate, as well as a 23% accuracy rate for the experts’ predictions, the sale didn’t do that bad.

Christie’s London Modern British & Irish Sale

By: Nathan

On Wednesday, October 19th, Christie’s London hosted their Modern British and Irish evening sale. It was a relatively short affair, with only twenty-nine available lots in about an hour. The house specialists were more or less in the right area regarding estimates and the top lots. They accurately predicted that the top spot would go to Going to the Match by Laurence Stephen Lowry. This moderately sized oil on canvas painting created in 1957 last sold at auction at Sotheby’s London on December 1, 1999 for £1.9M / $3.1M w/p (or £3.3M / $5.5M in 2022 – if adjusting for inflation). Since 2000, it has been on a long-term loan to the galleries at The Lowry in Salford, a small city within Greater Manchester. Christie’s originally gave it a £5M to £8M estimate range, in which it fell at £6.6M / $7.4M (or £7.8M / $8.8M w/p).

Christie’s experts also had high hopes for the two Henry Moore sculptures featured on Wednesday. However, Working Model for Seated Woman, a bronze sculpture created in 1980 and estimated to sell for at least £1.2M, was one of only two lots that went unsold that day. On the other hand, the other Moore sculpture did very well. Working Model for Two Pieces Reclining Figure: Points is another bronze; the eighth casting of a series of ten created between 1969 and 1972. It eventually hit its low estimate at £1.2M.

Because the other Moore sculpture went unsold, third place was a tie between three paintings, each selling for £1M / $1.1M (or £1.2M / $1.4M w/p). The first was Frank Auerbach’s abstract portrait J.Y.M. Seated, which slightly exceeded its original £900K high estimate. Those who follow the market will recognize that another one of Frank Auerbach’s portraits of the same subject sold at Sotheby’s London last Friday, setting the artist’s all-time auction record at £4.7M. The second, which met its £1M low estimate, was another oil on canvas painting by Laurence Stephen Lowry; this one a 1937 full-length portrait of an unknown man simply entitled Unemployed. And finally, something from this century… Bridget Riley’s Painting with Two Verticals 3, is an oil on linen painting from 2005. This enormous work, measuring 26.25 x 104 inches, fell just short of its £1.2M low estimate but did better than its last time across the block. It last sold at Christie’s London on October 7, 2017 for £560.75K / $732.7 w/p (or £668.1K / $887.2K in 2022).

While over a third of the sale’s lots sold above their presale estimates, a small handful exponentially exceeded them. The back-to-back lots Crocuses and Daffodils in Pots by Christopher Wood and The Bridge, Romney Marsh by Paul Nash are rather simple, inoffensive oil paintings estimated to only go for £100K and £120K, respectively. Both works more than doubled their high estimates, selling for £230K / $257.7K (or £289.8K / $324.7K w/p) and £280K / $313.7K (or £352.8K / $395.3K w/p), respectively.

Overall, the sale did relatively well. Out of twenty-nine lots total, eight of them (28%) sold within their presale estimates, with another eight selling below and eleven (38%) selling above. Only two lots failed to sell, giving Christie’s a 93% sold rate. The sale brought in a total of £16.76M or $18.78M, about £2M more than Christie’s minimum expectations.

Sotheby’s “Get Rid Of The Stuff” Sale

By: Howard

On October 16th, we decided to take a trip to Manhattan to view Sotheby's 19th-Century Works of Art sale. Looking at the online photos, it appeared the works would be disappointing, but I needed to be sure. Well, it did not take long to confirm our suspicions. Most of the paintings were, at best, average examples, and many had condition issues. What was also a little odd is that of 172 works offered, 108 came from just three different collections. One of those collectors was Paul Yeou Chichong – all of his lots were guaranteed. At first, it seemed strange that Sotheby's would guarantee all that 'stuff,' but then I remembered several of the collector's works appeared at their Modern Evening auction last May. Among the artists were Monet, Magritte, Miro, Picasso, etc., and the total take for those lots was over $30M. So, guaranteeing the 'stuff' probably meant little to the auction room. It also became obvious that this sale would have been better titled – The "Getting Rid Of Stuff" Sale.

I did a little further research into one of the collections offered and discovered that most were acquired through auctions. It is always troubling that people do not question the quality and condition of the art they might buy, as they are two of the most important things to consider. It was also interesting to note that by the time the sale began, 34 lots were withdrawn – all from the Seymour Stein collection (he, too, had at least one work in Sotheby's May 2022 evening sale). Anyway, let's get on to the action – or lack thereof (w/p – with the Buyer's Premium; and a big thank you to Nathan for watching the sale).

Franz von Stuck's Danae and the Golden Shower took the top spot in the sale. The painting was part of the Seymour Stein collection and carried a $10-$15K estimate. When the bidding ended, it hammered at $130K ($163.8K w/p) - almost nine times its expected range. I was very surprised by this since the condition was rough. According to the condition report, the paint is "stable but soiled", with "[m]inor scratches and scuffs in places". There was also some extensive retouching across the canvas, especially the central figure's "right calf, a C-shaped line approximately 2 inches square in length to her right thigh, to her left thigh, an L-shaped line to her left bicep, beneath her right elbow, to her lower back, and in places across her stomach, chest, neck, face, and hair." Maybe, one day I will understand how certain lots make high prices even though they have many condition issues.

In second place was Gustav A. Mossa's La Légende de Judith (this was part of the Chichong collection). The painting was estimated to bring $30-50K and hammered at $95K ($119.7K w/p). The condition report for this one was much better, with the paint surface described as in "good condition but slightly soiled." There is also craquelure, frame abrasion, and a bit of retouching, but not as extensive as the Mossa. And in third place was Edouard Joseph Dantan's My Father's Studio, estimated at $30-50K and sold for $75K ($94.5K w/p). This one had a little restoration, but nothing too serious. Sotheby's reported that there were only "minor areas of craquelure in places", as well as some retouching to cover up some frame abrasions.

There were a few good surprises. The last lot of the sale was cataloged as Marble Figure of Shakespeare Leaning on a Pedestal, probably English, after Peter Scheemakers, late 19th century, and had a $2-3K estimate. The work hammered at $28K ($35.3K w/p) – more than nine times the estimate. Another piece cataloged as French School, 19th Century Ressemblance Garantie was expected at $6-8K and sold for $24K ($30.2K w/p) – three times its estimate; and Václav Brožík's Two Artists was estimated to bring $12-18K and sold for $42K ($52.9K w/p) – almost four times its high estimate. Of course, there are those surprises one would never expect. Lot 214 was one of several works by Joseph Bail from the Chichong collection. This small work (20 x 11 1/2 inches), titled Taking a Break (detail image shown here), was estimated to sell between $8K and $12K (it last sold in 2012 for $25K) . The biggest issue in my mind was its condition (a wreck), and their condition report confirmed that. There were "patterns of craquelure throughout, especially to the upper half of the composition" and extensive inpainting, many areas of which were "noticeable to the naked eye." After reading the full report, one would assume that any intelligent person would stay away, but the painting sold for $5K ($6.3K w/p). I know that was far less than expected, but still. And as for the unsold lots, there were so many, including a Eugen von Blaas (est. $100-150K), Emile Vernet-Lecomte (est. $55-65K), Pierre Narcisse Guérin (est. $40-60K), and Charles-Auguste van den Berghe (est. $40-60K).

There were a few good surprises. The last lot of the sale was cataloged as Marble Figure of Shakespeare Leaning on a Pedestal, probably English, after Peter Scheemakers, late 19th century, and had a $2-3K estimate. The work hammered at $28K ($35.3K w/p) – more than nine times the estimate. Another piece cataloged as French School, 19th Century Ressemblance Garantie was expected at $6-8K and sold for $24K ($30.2K w/p) – three times its estimate; and Václav Brožík's Two Artists was estimated to bring $12-18K and sold for $42K ($52.9K w/p) – almost four times its high estimate. Of course, there are those surprises one would never expect. Lot 214 was one of several works by Joseph Bail from the Chichong collection. This small work (20 x 11 1/2 inches), titled Taking a Break (detail image shown here), was estimated to sell between $8K and $12K (it last sold in 2012 for $25K) . The biggest issue in my mind was its condition (a wreck), and their condition report confirmed that. There were "patterns of craquelure throughout, especially to the upper half of the composition" and extensive inpainting, many areas of which were "noticeable to the naked eye." After reading the full report, one would assume that any intelligent person would stay away, but the painting sold for $5K ($6.3K w/p). I know that was far less than expected, but still. And as for the unsold lots, there were so many, including a Eugen von Blaas (est. $100-150K), Emile Vernet-Lecomte (est. $55-65K), Pierre Narcisse Guérin (est. $40-60K), and Charles-Auguste van den Berghe (est. $40-60K).

When the sale ended, of the 138 works offered, 56 were bought in (giving Sotheby's a sell-through rate of 59.4%). They were expecting $1.79-$2.65M but only achieved a total of $1.067M – way short. Of the works sold, 50 were below, 19 within, and 13 above their presale estimate range – a 13.7% accuracy rate.

This sale was another excellent example of why people must be careful when purchasing artwork. It is very important to work with individuals in the art world who not only know about the artists they offer for sale (in terms of quality, period, subject matter, etc.) but are also very concerned with the condition of those works. Many firms/people in the art world will sell anything they can get; all they are after is money. Then there are those professionals who pick and choose only works they know are in excellent condition and among the finest examples from a particular artist.

____________________

Deeper Thoughts

By: Nathan

Ukraine: An Arts Update

It’s been a while since I’ve written about Ukraine. The last time I mentioned the conflict was in my coverage of a Christie sale in London back in July featuring a large Jeff Koons sculpture. The sculpture’s seller, the Ukrainian billionaire Victor Pinchuk, announced his intentions to give all proceeds towards medical supplies for those affected by the war, which amounted to £8.6M / $10.5M (or £10.14M / $12.39M w/p). Previously, I’ve written about western art institutions reevaluating their relationships with Russia, as well as the destruction of Ukrainian museums by invading Russian soldiers. But now it seems the tide is turning slightly with a Ukrainian counteroffensive reclaiming occupied territories in the country’s east. So, I think an update is due, especially with all the stuff going on in the past few months.

It’s been a while since I’ve written about Ukraine. The last time I mentioned the conflict was in my coverage of a Christie sale in London back in July featuring a large Jeff Koons sculpture. The sculpture’s seller, the Ukrainian billionaire Victor Pinchuk, announced his intentions to give all proceeds towards medical supplies for those affected by the war, which amounted to £8.6M / $10.5M (or £10.14M / $12.39M w/p). Previously, I’ve written about western art institutions reevaluating their relationships with Russia, as well as the destruction of Ukrainian museums by invading Russian soldiers. But now it seems the tide is turning slightly with a Ukrainian counteroffensive reclaiming occupied territories in the country’s east. So, I think an update is due, especially with all the stuff going on in the past few months.

On September 30th, Vladimir Putin signed several decrees through which Russia annexed four Ukrainian provinces. Combined, these lands comprise 15% of Ukrainian territory and contain nearly a quarter of the country’s population. These annexations have gone completely unrecognized by the international community, but that will not stop Russian forces from doing as they please in the region. These regions are home to dozens of museums and cultural centers, whose collections are now in danger of being looted or destroyed since the Ukrainian culture ministry deems there is insufficient time to evacuate the collections elsewhere. At some of these museums, Russian security forces have already installed new directors and staff, likely to make theft, appropriation, and destruction easier. Because of this and many other reasons, one of Russia’s most important arts figures has resigned in protest. For twenty-two years, Dimitri Ozerkov served as head of contemporary art at the Hermitage Museum in St. Petersburg, one of the largest, most-visited museums in the world. His last straw was seeing the museum’s director openly praise and support Putin. He tendered his resignation and quickly left the country.

The war has already destroyed much of the art in those regions. The siege of Mariupol, one of Ukraine’s largest cities, lasted nearly three months before falling to Russian forces. Entire museums, some dedicated to the memory of single artists, were completely destroyed in the process. The occupied regions, like the province of Luhansk, are home to sacred statues known as stone babas, created by a nomadic Turkic people called the Polovtsians. Many date as far back as the ninth century CE and have been compared to the Moai statues of Easter Island. After Ukrainian forces liberated the city of Izyum, they found many of the area’s stone babas had been destroyed. Appropriately, the International Council of Museums (ICOM) set up an Emergency Red List for artworks and cultural artifacts at risk of being looted or destroyed. This is so authorities can act in case they appear on the market elsewhere. Some art historians have likened these cultural crimes to the Taliban’s destruction of Buddha statues in Afghanistan, or the Islamic State’s destruction of Roman ruins in Syria. It’s the same motivation behind the cultural loot and destruction perpetrated by the Nazis during the Second World War. This is summed up pretty well by Taras Voznyak, the director of the Lviv National Gallery: “Putin knows that without art, without our history, Ukraine will have a weaker identity.”

Debate Or Destruction: A New Show About Problematic Artists

Jimmy Carr is a British comedian who has become incredibly well-known outside the UK over the past few years ( Many people know him from his comedy specials, but I think much of his work nowadays involves hosting television shows. He’s been the host of comedy panels and game shows like 8 Out of 10 Cats and The Big Fat Quiz of the Year. But recently, Britain’s Channel 4 announced that he would be hosting a show that touches upon an incredibly serious topic: how can we admire art created by people we know are horrible human beings?

Jimmy Carr is a British comedian who has become incredibly well-known outside the UK over the past few years ( Many people know him from his comedy specials, but I think much of his work nowadays involves hosting television shows. He’s been the host of comedy panels and game shows like 8 Out of 10 Cats and The Big Fat Quiz of the Year. But recently, Britain’s Channel 4 announced that he would be hosting a show that touches upon an incredibly serious topic: how can we admire art created by people we know are horrible human beings?

Years ago, on a different website, I wrote about how many world leaders, particularly the more infamous ones, were also amateur painters. People often point to Spain’s Francisco Franco and Germany’s Adolf Hitler as the most notable examples of painter-dictators. Clearly, it’s difficult to separate the art from the artist regarding paintings by dictators. But what about people primarily known and admired as great artists who also had troubling personal lives? The show, creatively titled Jimmy Carr Destroys Art, has already announced its acquisition of a ceramic work by Pablo Picasso. The Spanish master has always been a problematic figure. Of course, he was one of the twentieth century’s greatest, most influential artists. Still, he frequently abused and manipulated his family and close friends, referring to women as “machines for suffering.” This was chillingly accurate in Picasso’s experience. He was significantly involved with seven women during his life. He drove two of them to suicide and two more to have nervous breakdowns. Picasso’s granddaughter Marina once said of him, “He needed the blood of those who loved him.” The production team stated that Carr would host a debate on whether we, as viewers and consumers, can separate the art from the artist and whether or not the work is worth destroying. Yes, that is the gimmick of the show. If the audience decides, Carr will destroy the work of the artist in question. So if the audience says so, he will smash the Picasso ceramic to pieces. Channel 4 also announced that they had purchased one of Adolf Hitler’s paintings for use on the show, which they said Carr would incinerate with a flamethrower.

The show’s very concept has been attacked since Channel 4’s announcement, especially when they bought their Hitler painting. And that’s what most of the criticism has been aimed at. When Channel 4 announced the acquisition of the Hitler painting, the Holocaust Memorial Day Trust criticized the move as “making Hitler a topic of light entertainment”, as well as “a stunt for shock value” that “triviali[zes] the horrors of Nazism”. However, the show hasn’t even been made yet, so I wouldn’t jump to conclusions. Works of comedy featuring Nazism are nothing new, and they have almost always been described by some as tasteless. But Stephen Merchant, when commenting on his work in the film Jojo Rabbit from 2018, stated that comedy is a powerful tool to expose “the nonsense of Hitler’s ideology and the kind of absurdity of those beliefs”. Obviously, when handling these subjects in a humorous or satirical way, one must take great care. But rejecting it at face value might be jumping the gun a bit.

While the mere inclusion of a Hitler painting does not really bother me, the destructive element of the show certainly does. Of course, it’s important to discuss if it’s possible to reconcile an artist’s great work with their problematic lives. To do so live on television on a popular channel is even better since it takes the debate out of academic circles and thrusts it into the public forum. But even if we decide that an artist’s life is too problematic for us to enjoy their work, destroying the work itself is not the answer. Of course, it’s easy to say we can’t separate Hitler as a person from his bland cityscapes or Francisco Franco from his horrifyingly violent hunting scenes. It becomes increasingly difficult, however, to decide whether we can still admire Picasso’s paintings given his past. Or if we can appreciate the works of Paul Gauguin in light of what we know about his time in Tahiti. Or if we can still publicly display Eric Gill’s work since we now know about his abusive relationship with his children. But no work of art is ever worth destroying. Destroying a piece of art completely erases the artist and what we can learn from their lives, whether to emulate them or avoid their shortcomings. Art is a teaching tool, and destroying it also destroys its potential for people to learn.

The Rehs Family

© Rehs Galleries, Inc., New York – November 2022