COMMENTS ON THE ART MARKET

Happy Fourth of July

The Rehs family wishes everyone a happy and relaxing 4th of July weekend; a day we celebrate passage of the Declaration of Independence by the Continental Congress back in 1776.

We are going to continue our Tuesday – Friday hours of 10 am – 5 pm for the month of July. We are also very happy to come in on Saturday, Sunday, or Monday if that is more convenient.

____________________

Upcoming Shows

Our first live fair is the LA Art Show which opens on July 29th and runs through August 1st. The show began in 1994 with just 14 galleries, and not only are we among the founding dealers, but the only gallery that has exhibited in every show since its inception, and this summer is no exception.

This year, we will focus on our contemporary roster, and have divided our booth into a series of rooms that will either feature a single artists work, or a themed exhibit. Among them will be a curated group of paintings by one of the most important living marine artists -- John Stobart. There will also be about a dozen paintings by David Palumbo from his Marvel Masterpiece series -- if you are a Superhero fan, you will definitely enjoy this one. Other featured artists will include, Hammond, Josh Tiessen, Lucia Heffernan, Stuart Dunkel, Mitsuru Watanabe, Hiroshi Furuyoshi, Ben Bauer, Nigel Cox, and more.

Unlike previous years, complimentary tickets to this year's show are somewhat limited. If you would like to attend the show, please send us an email and we will forward you a PDF ticket, which are being offered on a first come, first served basis. Please note that the tickets we are offering are good for the Opening Night event, and will also allow you access during general admission times - Friday, Saturday, and Sunday.

The following weekend (August 5th - 8th) we will be exhibiting at the Nantucket Show. This year we are pleased to announce that Rehs Galleries and Rehs Contemporary Galleries will have their own booths. Rehs Galleries will present an exhibit of mainly European paintings from the 19th through 20th centuries. Rehs Contemporary will be dividing its booth into two sections. The first will feature a curated exhibition of 6 to 7 important works by John Stobart, the other will display a cross section of works from the gallery's roster.

If you would like complimentary tickets, please send us an EMAIL.

____________________

Stocks

By: Howard

Well, I am back! In case you did not realize, Lance has been covering the stock market for the first part of 2021. We decided that it might be fun for me to give people an idea of how the old, boring stocks have done during the first six months of 2021, so here I go.

When I left off, the Dow was sitting at 30,606, and at the end of June it was a bit higher – 34,450, an increase of almost 4,000 points – pretty good! The Crypto market has seen a real wild ride in 2021, and I am sure some people lost a great deal of money. For those, like me, who have a buy-and-hold mentality and bought some crypto at the end of 2020, you cannot complain. At the end of 2020, Bitcoin was at $29,005.04, and now it is $35,078.82. Litecoin was $123.30 and now $143.81; Ripple was $0.22, and now it is $0.69, and then there is Ethereum which closed out 2020 at $742.38, and today it is worth $2,265.61. The best thing anyone who invested in the Crypto market at the end of 2020 could have done was to have taken a 6 month nap! Then you would have never experienced the wild ride some of our billionaires caused with their Tweets!! Here is my thought on that – if you have billions of dollars, shut the &%$# up!

As for the dollar, the Euro was at $1.22, and now it is $1.19. The Pound was at $1.37, and now it is $1.38; so, we gained against the Euro and lost a tiny bit against the Pound. Again, this will have little impact on many of us since most people are still not heading overseas. Crude Oil crushed it – going from $48.44 to $73.59 – bravo to all who are invested in oil. And for those of you who bought gold, well, there was only a $134 drop – from $1,903.60 to $1,769.60. Drum roll please …. now for my stocks (the first number is the 2020 close, followed by the current stock price, and then the difference):

JP Morgan ($126.97 – $155.54 - up $28.57), AT&T ($28.75 – $28.78 - up $0.03), Verizon ($58.73 – $56.03 - down $2.70), Wal-Mart ($144.14 – $141.02 - down $3.12), Disney ($181.03 – $175.77 - down $5.31), Apple ($132.69 – $136.96 – up $4.27), Microsoft ($222.42 – $270.90 - up $48.48 – wow!), Bristol-Myers ($62.02 – $66.82 – up $4.80), Pepsi ($148.30 – $148.17 – down $0.13), Eaton Corp. ($120.20 – $148.18 – up $27.98), Comcast ($52.40 – $57.02 – up $4.62), American Express ($120.99 – $165.23 – up $44.24 – another wow!), Bank of American ($30.32 – $41.23 – up $10.91), Twitter ($54.14 – $68.81 – up $14.67), Palantir Technologies ($23.54 – $26.36 – up $2.82), and I sold my Merck, but bought Intel, Exxon Mobile, CISCO, and Coca Cola. Of the 15 older stocks listed, 11 of them are UP!

Next month I will hand this back to Lance, and I will see you all again at the end of 2021 with another update from the boring side. Have a very happy 4th of July!

__________________

Tales from the Dark Side

By: Alyssa

Lovis Corinth Still Life Restituted

The heirs of Gustav and Emma Mayer will be receiving one of many items that the Nazis stole during the war. The painting, Blumenstilleben, has been in the collection of the Royal Museum of Fine Arts, Brussels, along with approximately 30 other works thought to have been stolen during World War II.

The heirs of Gustav and Emma Mayer will be receiving one of many items that the Nazis stole during the war. The painting, Blumenstilleben, has been in the collection of the Royal Museum of Fine Arts, Brussels, along with approximately 30 other works thought to have been stolen during World War II.

Last month, the lawyer for the couple’s grandchildren received a letter from Thomas Dermine, Belgian secretary of state, notifying them that the painting will be returned. I was a little troubled by the following — in the 1960s, German authorities compensated the Mayer family for their loss. Now the relatives will be asked to pay 4,100 Euros, which appears to be the ‘estimated’ cost of the painting (still trying to determine if that is the original cost, or the amount they were compensated for in the 1960s). Regardless, don’t you think they, and their family, have gone through enough? Let alone what they must have spent in legal fees.

As with so many other restituted works, I am sure this one will be put up for sale in the not-to-distant future. Gotta cover those legal fees!

Disappointing End for Another Nazi-Looted Artwork

A final update on the work by Camille Pissarro – La Bergere Rentrant des Moutons. Leone-Noelle Meyer, a Holocaust survivor herself, has renounced her rights to the artwork in a decades-long legal struggle.

A final update on the work by Camille Pissarro – La Bergere Rentrant des Moutons. Leone-Noelle Meyer, a Holocaust survivor herself, has renounced her rights to the artwork in a decades-long legal struggle.

Meyer lost multiple family members at Auschwitz, including her mother. At just seven years old, she was adopted before her new family fled Paris. Her adoptive parents, Raoul and Yvonne Meyer, hid their artwork, which included the Pissarro, as well as a Picasso and Renoir. With the Nazi occupation of Paris, the works were seized and ended up in the hands of a Swiss dealer.

Eventually, the work was “purchased in good faith” through a New York gallery before being donated to the University of Oklahoma. Supposedly, Meyer signed an agreement five years ago which would see the work rotate between Paris’ Musee d’Orsay and the Fred Jones Jr. Museum of Art in Oklahoma. Still, she continued fighting for ownership, saying she entered into the agreement under duress.

With French courts ruling that her contract supercedes French law requiring restitution of Nazi-looted art, along with further legal action being threatened by the University of Oklahoma, Meyer has given up her fight. Sure, it’s nice that the University will uphold their end of the agreement and continue rotating the work every three years and displaying a plaque sharing the Meyer family story. But, the University further stated that it was committed to identifying and transferring ownership to a French Public Institution. I assume so they get some financial benefit… seems that they don’t actually care about holding onto the work; they just don’t want to give it up for nothing. Sad to see.

A Long Overdue App For The Artworld

In May, Interpol launched a free app called ID-Art to help law enforcement and the general public identify stolen art. The database has over 52,000 items listed, and you can search with an image or specific criteria (artist’s name, etc.). While this is a good step forward, there are still many stolen or missing works not in this database. When will law enforcement from other countries get on the bandwagon? It is time that all stolen art is in one central database for all to access — FREE! Today, there are many different stolen art databases, most of which are only accessible if you pay for the service.

In May, Interpol launched a free app called ID-Art to help law enforcement and the general public identify stolen art. The database has over 52,000 items listed, and you can search with an image or specific criteria (artist’s name, etc.). While this is a good step forward, there are still many stolen or missing works not in this database. When will law enforcement from other countries get on the bandwagon? It is time that all stolen art is in one central database for all to access — FREE! Today, there are many different stolen art databases, most of which are only accessible if you pay for the service.

If we want to help stop the theft of art, or better yet, the selling of stolen art, we all need access to this data, a need that is often time-sensitive. Wouldn’t it be great to confirm that a work is not listed as stolen before you purchase it? This information will save people a lot of time and money.

Please use the link below to read more about and download the app.

Huge Art Theft Uncovered

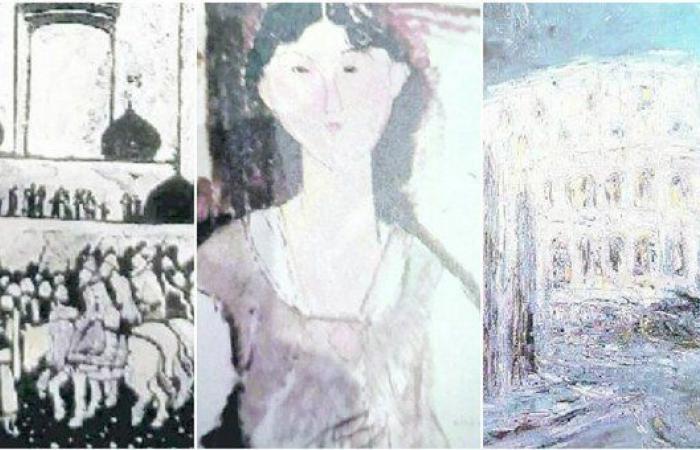

When Architettura, a work by Italian artist Ottone Rosai, fell from the wall of Italian broadcasting company Rai, an art heist hidden in the shadows for decades was brought to light. According to reports, upon inspection, it was determined that the painting was a well-executed copy, sparking an inventory check on the company’s 1,500-piece art collection. By the end, they realized that 120 original artworks were unaccounted for, roughly $30 million worth, including works by notable artists Claude Monet, Amedeo Modigliani, Alfred Sisley, and de Chirico.

When Architettura, a work by Italian artist Ottone Rosai, fell from the wall of Italian broadcasting company Rai, an art heist hidden in the shadows for decades was brought to light. According to reports, upon inspection, it was determined that the painting was a well-executed copy, sparking an inventory check on the company’s 1,500-piece art collection. By the end, they realized that 120 original artworks were unaccounted for, roughly $30 million worth, including works by notable artists Claude Monet, Amedeo Modigliani, Alfred Sisley, and de Chirico.

Authorities concluded that the thefts began in the 1970s but increased in the 1990s after Rai’s collection was exhibited in Puglia, and employees recognized the worth of the office decor. As for Architettura, a former employee admitted to the theft, selling the work for 25 million lira in the 1970s. However, since the statute of limitations for the robbery falls beyond the 10-year limit, no charges can be filed.

Many More Recoveries

In 2017, an investigation was launched when a state archaeology lab in Apulia, Italy made a discovery in a European arts catalogue… they noticed ‘decorative elements’ from a Daunian funerary stele that was in the hands of a “wealthy Belgian collector,” was similar to those found in fragments at a museum in southern Italy. In fact, it turns out that one of the museum fragments perfectly completed a missing piece from the item in the catalogue.

In 2017, an investigation was launched when a state archaeology lab in Apulia, Italy made a discovery in a European arts catalogue… they noticed ‘decorative elements’ from a Daunian funerary stele that was in the hands of a “wealthy Belgian collector,” was similar to those found in fragments at a museum in southern Italy. In fact, it turns out that one of the museum fragments perfectly completed a missing piece from the item in the catalogue.

The European Union Agency for Criminal Justice Cooperation coordinated a joint operation between Belgian and Italian authorities. When they raided the owner’s house, they came upon an amazing collection of 782 illegally excavated Italian artifacts worth an estimated €11M ($13M), which had been illegally exported from Italy.

Interestingly, a CNN article notes that during the past year there has been a sizable increase in the trading of looted artifacts through Facebook groups. According to the Antiques Trafficking and Heritage Anthropology Research Project, in April and May, one of the largest groups that the organization monitors has swelled to more than 300,000 members.

While we can score one for the good guys, there is still a lot of work left to do.

____________________

Really?

By: Amy

And You Think NFTs Are Crazy

News broke that Salvatore Garau, an Italian artist, recently sold one of his sculptures for $18,000. I know, what’s the big deal? Why is a sculpture priced at $18,000 something to even write about? Well, the sculpture does not exist in material form. It is all in his mind! Yes, someone bought a figment of the artist’s imagination, but at least the buyer will get a certificate of authenticity!

News broke that Salvatore Garau, an Italian artist, recently sold one of his sculptures for $18,000. I know, what’s the big deal? Why is a sculpture priced at $18,000 something to even write about? Well, the sculpture does not exist in material form. It is all in his mind! Yes, someone bought a figment of the artist’s imagination, but at least the buyer will get a certificate of authenticity!

To me, this looks like another publicity stunt, and it seems to be working. I wonder who the buyer was – maybe a friend or family member??

Basketball's Record-Breaking Action This Season

Stuart Weitzman (the iconic shoe designer) started collecting stamps and coins in his childhood; as a young boy, he had a dream to one day own the rarest of the rare and saved a blank space in his books for them. He successfully fulfilled his dream when he acquired three extraordinary treasures, the 1933 Double Eagle gold coin, the British Guiana One-Cent Black on Magenta stamp, and the Inverted Jenny Plate Block. Each of them a star in their own right, but to see them all come up at auction in one sale was galactic.

Weitzman purchased the 1933 Double Eagle 20-dollar gold coin in 2002 for a record price of $7.59M. Over 445,000 coins were minted but never circulated, and all but two were ordered to be melted down. However, during the melting process 20 of the coins were stolen, and ‘somehow’ they made their way into collectors’ hands. Over the years, 19 were recovered. Weitzman’s example (which has a long story as to why it could legally be sold) is the only one remaining in a private collection. This time around, the coin was expected to make $10–15M and easily rolled past the estimate selling for $18.9M (w/p). The new owner of the coin requested to stay anonymous.

Weitzman purchased the 1933 Double Eagle 20-dollar gold coin in 2002 for a record price of $7.59M. Over 445,000 coins were minted but never circulated, and all but two were ordered to be melted down. However, during the melting process 20 of the coins were stolen, and ‘somehow’ they made their way into collectors’ hands. Over the years, 19 were recovered. Weitzman’s example (which has a long story as to why it could legally be sold) is the only one remaining in a private collection. This time around, the coin was expected to make $10–15M and easily rolled past the estimate selling for $18.9M (w/p). The new owner of the coin requested to stay anonymous.

The British Guiana One-Cent stamp is the world’s most unique and valuable stamp and is the only copy to have survived since 1856. This lot also carried a $10-15M estimate but unfortunately fell slightly short of the goal. The London stamp Dealer, Stanley Gibbons, bought the stamp for $8.3M, $1.2M less than Weitzman paid for it in 2014.

The British Guiana One-Cent stamp is the world’s most unique and valuable stamp and is the only copy to have survived since 1856. This lot also carried a $10-15M estimate but unfortunately fell slightly short of the goal. The London stamp Dealer, Stanley Gibbons, bought the stamp for $8.3M, $1.2M less than Weitzman paid for it in 2014.

And Weitzman’s last treasure is the infamous Inverted Jenny Plate Block which he purchased in 2014. The Inverted Jenny is considered the most valuable stamp printed in the United States. It was estimated to bring $5-7M and fell short of expectations but did make a respectable $4.9M (w/p), surpassing the price Weitzman paid by $2M. The new owner is David Rubenstein, co-founder of the Carlyle Group.

And Weitzman’s last treasure is the infamous Inverted Jenny Plate Block which he purchased in 2014. The Inverted Jenny is considered the most valuable stamp printed in the United States. It was estimated to bring $5-7M and fell short of expectations but did make a respectable $4.9M (w/p), surpassing the price Weitzman paid by $2M. The new owner is David Rubenstein, co-founder of the Carlyle Group.

All the proceeds from these rare treasures will benefit charitable organizations, including the Weitzman Family Foundation (supporting medical research and higher learning) and a new museum in Madrid devoted to Spanish-Judeo history.

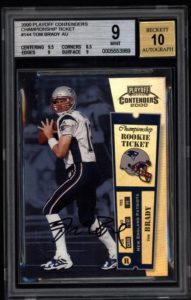

Tom Brady Scores In The Off Season

Well, it was less than two months ago that I wrote about the record-breaking Tom Brady rookie card, and it did not take long for that record of $2.25M to be sacked. A similar card as the one that sold in April just sold; this example of the 2000 Playoff Contenders Championship Rookie Ticket card, with Brady’s autograph, received a Mint 9 grade, with a perfect 10 for the signature grading by BSG. There are only seven cards in this condition to still exist out of the 100 cards released. The card had a starting bid of $750K, and after receiving 32 bids, it sold for $3.1M – another new record for the champ!

Well, it was less than two months ago that I wrote about the record-breaking Tom Brady rookie card, and it did not take long for that record of $2.25M to be sacked. A similar card as the one that sold in April just sold; this example of the 2000 Playoff Contenders Championship Rookie Ticket card, with Brady’s autograph, received a Mint 9 grade, with a perfect 10 for the signature grading by BSG. There are only seven cards in this condition to still exist out of the 100 cards released. The card had a starting bid of $750K, and after receiving 32 bids, it sold for $3.1M – another new record for the champ!

On a side note, the football Brady threw to complete his first career touchdown pass sold at the same auction for $429K. Brady threw the football to Terry Glenn, who then threw it into the stands – the lucky person who caught the ball was the consignor.

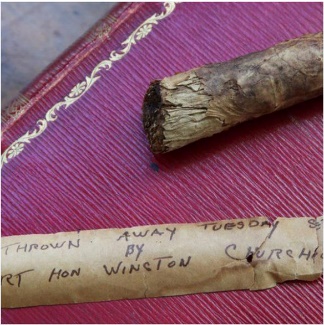

Churchill’s Cigar Butt Smokes Estimate

Sometimes when I look through the auction reports, I come across some extraordinary things that make their way to the auction block. I was surprised to see that a two and three quarter inch cigar butt, a remnant of just one of the ten cigars Winston Churchill supposedly smoked a day, made its way to an auction house in England.

Sometimes when I look through the auction reports, I come across some extraordinary things that make their way to the auction block. I was surprised to see that a two and three quarter inch cigar butt, a remnant of just one of the ten cigars Winston Churchill supposedly smoked a day, made its way to an auction house in England.

A Scotland Yard police officer who escorted Churchill (sometime in the 1940s) picked up the half-smoked cigar butt and preserved it in brown paper, adding a note to record its provenance. The officer passed it onto his grandson, the consignor. The butt smoked the estimate of £800 and sold for £3,500 (£4,370 w/p – $5,654). I am still amazed at what people will buy!

____________________

The Art Market

By: Lance & Howard

Usually, as summer approaches, the auction action wanes so we were surprised to see so many taking place. Between the two main auction houses, there were dozens of sales throughout June… that said, many of them were geared towards goods other than art – Jewels, manuscripts, whisky & wine, watches, cars, and of course NFTs. It’s hard to keep up with them all, so we focused on just a few of the art offerings over in London… that said, there were some impressive results in other markets. A contemporary sale at Sotheby’s Hong Kong topped $100M; both main rooms held a ‘Magnificent Jewels’ sale – Sotheby’s saw 7 stones top the $1M mark, and Christie’s even had one top $5M; a single (large) bottle of Chateau Haut Brion 1959 topped $60K; a complete set of original Air Jordans 1 – 14 also found a buyer for $60K; and of course, the single lot CryptoPunk sale at Sotheby’s which garnered $11.75M! It was an eclectic month to say the least, but let’s get into the auction action we are a bit more familiar with… up first,

Hekking’s Mona Lisa Sells – Stupidity At Its Finest

By: Howard

I think many will agree that this week’s result from Christie’s sale of a 17th-century copy of the Mona Lisa, called the Hekking Mona Lisa, illustrates how crazy the art world has become — not to mention that some people have far too much money.

I think many will agree that this week’s result from Christie’s sale of a 17th-century copy of the Mona Lisa, called the Hekking Mona Lisa, illustrates how crazy the art world has become — not to mention that some people have far too much money.

Back in the 1950s, Raymond Hekking claimed he purchased THE REAL ‘Mona Lisa’ for £3 and went on a crusade to prove that his painting was, in fact, the original. He even produced a video — you can see it HERE.

Of course, his claims fell short, and the work was determined to be a 17th-century copy. Just look at the figure’s hands; is that the work of a master? This week, the painting appeared in an online auction with an estimate of €200-300,000 and sold for €2.9M ($3.4M).

Total stupidity!

The Big Gamble

By: Howard

While the general NFT market has been heading south, the upper end still seems to be heading north. On Thursday, Sotheby’s London auctioned off “Covid Alien,” CryptoPunk 7523 for an astounding $11.8M. The buyer definitely knows something about gambling, it was Shalom Meckenzie, the largest shareholder of DraftKings. I guess when you are a gambler and worth an estimated $1.6B, why not roll the dice on an NFT. By the way, this was an auction record for a single CryptoPunk. And in case you are wondering, this same NFT sold in 2017 for $1,646.

While the general NFT market has been heading south, the upper end still seems to be heading north. On Thursday, Sotheby’s London auctioned off “Covid Alien,” CryptoPunk 7523 for an astounding $11.8M. The buyer definitely knows something about gambling, it was Shalom Meckenzie, the largest shareholder of DraftKings. I guess when you are a gambler and worth an estimated $1.6B, why not roll the dice on an NFT. By the way, this was an auction record for a single CryptoPunk. And in case you are wondering, this same NFT sold in 2017 for $1,646.

Early Evening Sale At Sotheby’s London – British Modern & Contemporary

By: Lance

Sotheby’s hosted a British Art evening sale to close out June, though it curiously took place in the afternoon. The sale featured Modern and Contemporary works; just 38 lots, though 4 seem to have been withdrawn before the start, so we’ll call it 34.

Sotheby’s hosted a British Art evening sale to close out June, though it curiously took place in the afternoon. The sale featured Modern and Contemporary works; just 38 lots, though 4 seem to have been withdrawn before the start, so we’ll call it 34.

Taking the top spot of the “evening” was Lucian Freud’s David Hockney, a portrait of the acclaimed artist also his longtime friend. They met back in 1962, though this work was completed in 2002 – Hockney sat for more than 100 hours for the painting, and it was included in Freud’s retrospective at the National Portrait Gallery in 2012. Expected to bring £8-12M ($11.04-16.56M), the work hammered for £13.1M ($18.08M, or £14.9M/$20.56 with premium). That figure ranks it as the sixth most expensive work by the artist at auction; and the only work to break 8 figures in the sale.

The top three was completed with two works by Peter Doig. Blue Mountain happened to be one of the few that hammered below estimate in the sale; £4.8M ($6.62M) on a £5-7M ($6.9-9.6M) estimate, though once you add in the premium that bumps the price to £5.3 ($7.3M). And Bomb Island hammered at £3.9M ($5.38M and £4.3M/$5.9M with premium), on a £3-5M ($4.14-6.9M estimate). Both works have been in private collections since the 90s, meaning this is the first time either has appeared at auction.

A few lots saw nice performances relative to the expectations… those results included works by Hockney (£410K hammer on a £150-200K estimate), Hurvin Anderson (£200K hammer on a £40-60K estimate), and Dame Magdalene Odundo (£300K hammer on a £60-90K estimate). Conversely, there were 6 lots that went below their estimate along with 4 that failed to find buyers. Works by Sir John Lavery and Euan Uglow were the most significant underperformers, hammering 20% below estimate; failed lots included works by Ben Nicholson, Bridget Riley, Henry Moore, and Peter Lanyon – none of which I’d consider major lots in the sale.

When the session closed, the total take was £41.3M hammer or £47.9M with premiums. As I mentioned earlier, 4 works were withdrawn and another 4 went unsold; that left a sell through rate of 88.2% (30/34) – a respectable figure. They also saw 11 works go above estimate, and 13 within their expected range, yielding an estimate accuracy rate of 41%!

Sotheby’s – Modern & Contemporary Art Evening Sale

By: Howard

A great deal has changed over the past 16 months. In the old days, an evening sale took place in the evening – usually starting between 6 and 7 pm. Today, an ‘evening sale’ happens whenever they want – this one began about 3 pm London time (or 10 am New York time), right after the British Art Evening sale (that one started at 2 pm London time).

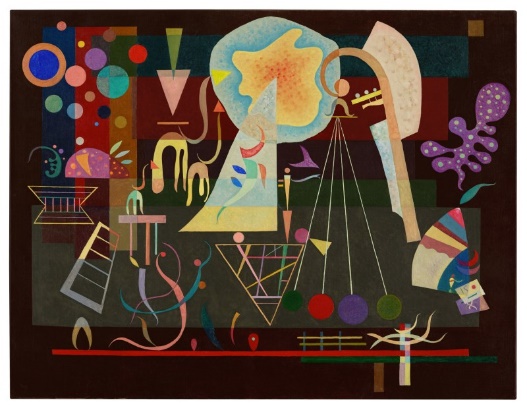

Taking the top spot in this sale was Kandinsky’s Tensions calmées that was last on the market in 1964, when it was part of a sale that featured 50 paintings by the artist from the Guggenheim Foundation; the combined total for the 50 works was $1.5M. Now, this single painting was expected to bring far more than the entire 1964 sale – £18-25M – and it hammered for £18.3M/$25.35M (£21.22M/$29.4M w/p). I’m sure that family was thrilled! Coming in second was Picasso’s Homme et femme au bouquet. This late example, from 1970, carried an £8-12M estimate and sold for £8.3M/$11.5M (£9.4M/$13M w/p). Cy Twombly’s Untitled (I love the creative titles), hammered down at £6.6M/$9.14M (£7.8M/$10.7M w/p – est. £5-7M). This same work sold in 2014 for $7.5M, so there was a bit of a profit.

Taking the top spot in this sale was Kandinsky’s Tensions calmées that was last on the market in 1964, when it was part of a sale that featured 50 paintings by the artist from the Guggenheim Foundation; the combined total for the 50 works was $1.5M. Now, this single painting was expected to bring far more than the entire 1964 sale – £18-25M – and it hammered for £18.3M/$25.35M (£21.22M/$29.4M w/p). I’m sure that family was thrilled! Coming in second was Picasso’s Homme et femme au bouquet. This late example, from 1970, carried an £8-12M estimate and sold for £8.3M/$11.5M (£9.4M/$13M w/p). Cy Twombly’s Untitled (I love the creative titles), hammered down at £6.6M/$9.14M (£7.8M/$10.7M w/p – est. £5-7M). This same work sold in 2014 for $7.5M, so there was a bit of a profit.

Rounding out the top five were two Andy Warhols. Front and Back Dollar Bills made £5.75M/$8M (£6.8M/$9.4M – the work had an estimate of £6-8M, so it needed the buyer’s premium to make it); while 9 Gold Marilyns hammered at £5.5M/$7.6M (£6.5M/$9M) on a £5.5-8M estimate. This same work last sold in 2013 for $9.1M … so the seller was not a happy camper.

While there were no serious fireworks in the sale, a few pieces did pretty well. Among the better performers were Jadé Fadojutimi’s I’m pirouetting the night away. The painting, created in 2019 by an artist I never heard of, carried an £80-120K estimate and sold for £320K/$443K (£402K/$557K – w/p). Salman Toor’s Untitled, painted in 2017, was expected to bring £100-150K, and brought £250K/$346K (£315K/$436K – w/p). And Odilon Redon’s small pastel, Profil bleu, hammered at £1.15M/$1.59M (£1.4M/$1.95M) on a £600-800K estimate.

There were several underperforming works and a few that failed to find buyers; these included works by Mutu, Dubuffet, Oehlen, Bonnard, and Schutz.

By the end of their “evening” session (well before lunchtime in New York), of the 57 works that were finally offered (a few, about 8, seemed to disappear before the sale started), 53 sold. This gave them a sell-through rate of 93%, and the total take was £90.8M/$126M (£108M/$150M – w/p). The presale estimate range was £95.3-125M, so they were a few million pounds short without the buyer’s premium.

Of the 53 sold works, 15 were below, 24 within, and 14 above their estimate range, giving them an accuracy rate of 45.3% — a respectable number.

20th/21st Century: Christie’s London Evening Sale

By: Howard

Following Sotheby’s lead, Christie’s presented their evening sale (which started at 2 pm London time, breakfast time in New York) on the 30th. As with Sotheby’s, this was a mixed sale of works ranging from 19th-century Impressionist to living artists.

Following Sotheby’s lead, Christie’s presented their evening sale (which started at 2 pm London time, breakfast time in New York) on the 30th. As with Sotheby’s, this was a mixed sale of works ranging from 19th-century Impressionist to living artists.

The top lot happened early in the sale when Picasso’s L’Étreinte (from 1969), hammered down at £12.6M/$17.4M (£14.7M/$20.3M w/p – est. £11-16M). Coming in a close second was Alberto Giacometti’s bronze Homme qui chavire at £12.4M/$17.1M (£13.7M/$19M w/p – est. £12-18M). This exact piece last appeared on the market back in 1998 and sold for $2.65M – so I am sure the seller was pleased. Now you may have noticed that the difference in the hammer prices between the first two lots was only £200K, while the difference in price with the premium added in is about £1M. Wonder why? Well, the Giacometti was a guaranteed lot, so the guarantor received a nice discount! Kandinsky took the third spot when Noir bigarré (1935) found a buyer at £7.8M/$10.7M (£8.85M/$12.2M w/p – est. £8-12M). Rounding out the top five were Ernst Kirchner’s Pantomime Reimann: Die Rache der Tänzerin at £6M/$8.3M (£7.14M/$9.9M – w/p – est. £6-9M), and Basquiat’s Untitled at £5M/$6.9M (£6M/$8.3M w/p – est. £4-6M).

There really wasn’t much in the way of fireworks in this sale, as at least half of the works sold within their estimate. In fact, 50% of those sold on the bottom end – most likely the reserve. Do you think the market needs a breather? I do, but sadly, I doubt that will happen as many more sales are scheduled for July.

By the end of the session, of the 52 works offered (a Banksy was withdrawn before the sale), 46 sold, generating an 88.5% sell-through rate, and the total take was a strong £101M/$139.6M (119.3M/$16.5M w/p). The presale estimate range was £94.7-138.4M, so they fell within the range, even without the buyer’s premium. Of the 46 sold lots, 10 were below, 24 within, and 12 above their presale estimate range; this gave them an accuracy rate of 46.2% — another respectable number.

The Rehs Family

© Rehs Galleries, Inc., New York –July 2021