COMMENTS ON THE ART MARKET

May Flowers Have Arrived, But Our Hours Will Remain The Same

We have decided that for the time being, we will continue with our Tuesday – Friday hours (10 am – 5 pm) – the good news is that no appointments are needed; feel free to stop by when you are in the neighborhood. We are also very happy to come in on Saturday, Sunday, or Monday if that is more convenient.

____________________

Online Exhibitions

Current

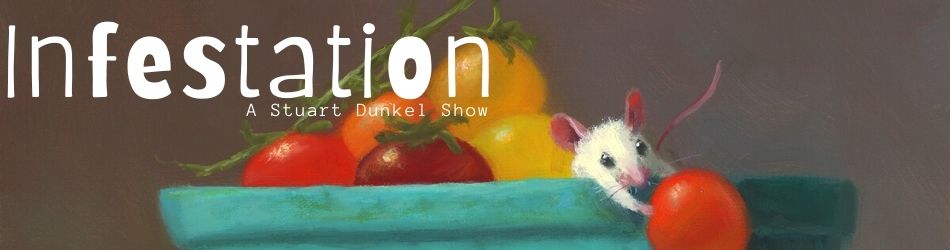

Infestation - our online exhibition featuring the whimsical works of Stuart Dunkel continues through May 15.

Nearly 30 years ago, Dunkel immersed himself in painting, studying a variety of animal subjects. Before long, his infatuation with painting animals took a turn towards infestation… over the years, Dunkel has painted hundreds (if not thousands) of mice. The works, unmistakably, take on an autobiographical feel as if Dunkel is sharing his own experiences through Chuckie – at times seeming to embody the human emotions of delight, fear, or even comical confusion.

These quirky and charming compositions often lead to feeling a personal connection to the artist. In many cases, viewers feel the work was made uniquely for them. And while the paintings are small, they are certain to bring big smiles for years to come!

While more than half of the works have sold, there are still many outstanding examples available, and we invite you to enjoy the show.

Opening Monday, May 3rd

Water Works – On May 3rd, the gallery will present an online exhibit of 40 works focused on one of the most important parts of our planet – WATER! Among the participating artists are John Stobart, William Davis, Ben Bauer, Mark Daly, Mark Lague, Ken Salaz, Katie Swatland, Sally Swatland, and Mitsuru Watanabe.

The exhibit will also include a work by Andrew Orr; a new artist to the gallery's roster. We believe you will be very impressed with the quality of Andrew’s landscape paintings.

____________________

Stocks

By: Lance

April was another fairly choppy for the stock market, but things ended on a relatively high note… for a second straight month, the Dow pushed to new record levels topping out on the 16th at 34,256. The exchange has been trading within about 400 points of that mark since then - as of close on Friday, it’s sitting at 33,875. The S&P 500 saw a nice gain, with a fresh intra-day record set on the 29th at 4,218 and closed out the month at 4,181. The Nasdaq recovered to the highs seen in February and then some, also hitting a fresh high on the 29th at 14,211 but falling off that number to close out at 13,963. All things pointing up!

The Euro strengthened against the dollar, while the Pound fluctuated a bit and closed out the month where it started; they currently sit at $1.202 and $1.38, respectively. Crude gained a bit but was fairly stable considering how things have been the last few months, and gold futures bounced off the lows seen in March, now in the $1,750-1,800 range.

The Crypto arena was like a damn warzone! Bitcoin jumped to a new record just shy of $65,000 before falling off a cliff and hitting $47,000 just ten days later. A slight recovery to close out the month landed us at $56K, which was not far off from where we started ($59K). Ethereum, which is the blockchain utilized by NFT’s, continued a stratospheric ascension as it gained more than 50% on the month – it closed out at $2,764. Litecoin also saw a nice gain but endured a rather volatile month… it nearly doubled through the first two weeks of the month before coming back down to earth and finishing off the month with a 35% gain at $266. My lesser-known cryptos performed nicely as well… Bitcoin Cash popped from about $500 to more than $1,200 but settled back down as it now sits around $1,000 (84% gain), Stellar Lumens topped out at $0.69 and closed out at $0.53 (or a 29% gain), and Civic is just about where we started at $0.52 (4% gain)… but the real story of the month was Dogecoin – I guess I spoke too soon last month when I said I wouldn’t be retiring as early as I hoped. At the end of March, I was giddy over the fact that we saw the coin climb from .01 to .05… well this month, we watched it take off like a rocket and top $0.40 – it now sits at $0.32, which is a bit over 500% on the month and a cool 3,000% since January. TO. THE. MOON!

Finally, my stock picks not for the faint of heart… it was a bloodbath. Airbnb (ABNB – month -8%); American Well Corporation (AMWL – monthly return -11%); Aurora Cannabis Inc. (ACB – month -4%); Beyond Meat, Inc. (BYND – month +1%); Blink Charging Co. (BLNK – month -10%); Churchill Capital Corp IV (CCIV – month -1%); Canopy Growth Corp. (CGC – month -16%); Cronos Group Inc. (CRON – month -14%); FuelCell (FCEL – month -33%); Fisker Inc. (FSR – month -24%); Nikola Corp (NKLA – month -17%); QuantumScape Corp (QS – month -18%); Under Armor, Inc. (UAA – month +10%); and Zomedica Corp. (ZOM –month -33%). Almost all losers, and down bad. Hope you weren’t following my lead.

__________________

Tales from the Dark Side

By: Alyssa

The Salvator Mundi Saga Continues – This Time On The Big Screen

The da Vinci story never seems to end. Is it real or not? I doubt we will ever find out. On April 13, The Savior for Sale, a film about the da Vinci saga, is scheduled to hit the big screen. In the movie, which I have not seen, we learn about the Louvre’s extensive scientific examination and their conclusion that the artist “only contributed” to the work. Really, “contributed”?

The film also gives a great deal of behind-the-scenes information about the financial wheeling and dealing between the Saudi Prince (who paid $450M for the work at Christie’s) and the French government. Of course, the Prince wanted the work included in the Louvre’s exhibition about Leonardo. He even insisted that it be displayed next to the Mona Lisa, presenting it as authentic. In the end, the Louvre (or science) won out and did not include it in their exhibition.

I guess this $450M story will never go away.

Can You Blame Them?

In 2016, the American graffiti artist JonOne painted an extremely large work (7.8 x 22.9 feet) in front of an audience at the Lotte World Mall in Seoul, South Korea. The artist then left cans of paint and brushes in front of the work as part of the display.

According to an article in the Daily Mail, recently, a couple looking at the work thought the brushes and paint were there for people to use, so they added a few large strokes of black paint. My first questions are, how did they use paint and brushes sitting there for five years? Does the paint take a very long time to dry?

After they walked away, the couple was arrested by the mall’s police but subsequently released since their actions appeared to be an ‘honest mistake.’

I bet that their addition to the work only added to its value since it gave the artist and the piece a great deal of publicity. Hmm … was this a publicity stunt?

I did write to JonOne and he was kind enough to reply:

Honestly … At first, I told myself: what is this shit?

But I quickly realized their misunderstanding by watching the video…

I said: OK… “with just three brush strokes on my canvas, they have managed to cause a planetary buzz?!?” There is strength in that.

It made me think about how in today’s world we are all so closely linked and I hope someday to have the opportunity to drink tea with them in Korea…

maybe i’ll tell them… thank you.

JonOne.

Maybe this was not a publicity stunt?

Wow, One da Vinci Mystery Has Been Solved

In 1909, the Berlin Royal Museums, under the direction of Wilhelm Bode, purchased a wax bust of the goddess Flora for 185,000 Goldmark. The artist? Leonardo da Vinci! Well, maybe. The purchase created controversy, and hundreds of articles appeared – some in favor and others against the attribution.

In 1909, the Berlin Royal Museums, under the direction of Wilhelm Bode, purchased a wax bust of the goddess Flora for 185,000 Goldmark. The artist? Leonardo da Vinci! Well, maybe. The purchase created controversy, and hundreds of articles appeared – some in favor and others against the attribution.

Even though there were no other Renaissance wax sculptures, that did not deter Bode’s insistence that this was, in fact, an original Leonardo da Vinci. Gustav Pauli, director of a Hamburg museum, had another artist in mind – Richard Cockle Lucas (1800-1883). Lucas was a 19th-century British sculptor known to have created wax sculptures inspired by the Old Masters. According to the article in The Art Newspaper, Lucas was a real eccentric; he named his son Albert Durer, believed in fairies, and drove around in a Roman chariot. Ah, the good old days!!

A year after the museum purchased the work, Lucas’s son claimed that the bust was actually by his father and described how he helped create the work (using wood and paper to fill the inside of the sculpture), all of which seemed to be true. However, this did not sway Wilhelm Bode’s attribution, claiming that the wood and paper products were part of a 19th-century restoration.

Now, with the use of Carbon-14 dating, the mystery has been solved. The material used was spermaceti wax along with beeswax, seen in other 19th-century sculptures. The analysis determined that sculpture dates between 1704 and 1950 (a wide range), but since da Vinci died in 1519, there was no chance he created it.

At least one da Vinci debt has finally been settled.

____________________

Really?

By: Amy

Real Coin Or Bitcoin?

What is the better investment, a real coin or a Bitcoin? Only time will tell, but I am betting on the real deal for now. Nothing can compete with looking at and holding a real treasure; obviously, you cannot do that with a cryptocurrency or any digital asset.

What is the better investment, a real coin or a Bitcoin? Only time will tell, but I am betting on the real deal for now. Nothing can compete with looking at and holding a real treasure; obviously, you cannot do that with a cryptocurrency or any digital asset.

An 1822 Gold $5 Half Eagle coin just set a record price for any US coinage sold at auction; it is considered a ‘trophy’ coin because of its rarity. While the coin was initially intended for widespread circulation, only 17,796 were minted. In 1834 most of the coins were melted down because a decision was made to decrease the gold content in coins (this coin is 92% gold). Today there are only three known examples; two of them are in National Numismatic Collection at the Smithsonian Institute. The third (this fine specimen) has remained in private collections since 1899.

The coin has a grading of AU50, suggesting it was most likely never circulated. It has an impeccable provenance dating back to 1899 when Virgil Brand purchased it and remained in his collection until his heirs sold it to Louis Eliasberg, Sr. in 1945, becoming part of one of the only complete US Coinage collections. In 1982, Eliasberg’s complete set (which included every coin produced for circulation since the start of the nation’s coinage in 1793) was sold at auction. Collector D. Brent Pogue purchased it at that sale for $687.5K. In 2016, Pogue tried to sell it at auction, but it failed to meet the reserve of $6.4M. Pogue passed away in 2019, and the coin was presented again at the end of March 2021.

This time the bidding started at $3.6M, and the hammer fell at $7M ($8.4M w/p). Wonder if my Bitcoin will reach $8M in 200 years?

Tom Brady Sets Record Off The Field

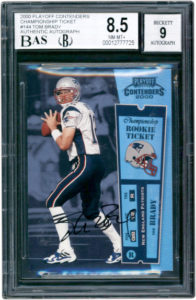

Tom Brady is one of the most distinguished football quarterbacks and a legend in the NFL today; he is often referred to as the GOAT (Greatest of All-time). Brady has set numerous records throughout his 20 plus year career, including a new record off the field when his rookie football trading card sold at auction.

Tom Brady is one of the most distinguished football quarterbacks and a legend in the NFL today; he is often referred to as the GOAT (Greatest of All-time). Brady has set numerous records throughout his 20 plus year career, including a new record off the field when his rookie football trading card sold at auction.

“The 2000 Playoff Contenders Championship Ticket #144 Tom Brady” card has become one of the most sought-after football cards as the Playoff Corporation made only 100. The card presented is numbered 99 and has been in a private collection for over a decade. The auction house submitted the card to Beckett for grading; it received an 8.5 overall score and a 9 for the signature. The bidding opened at $75,000 and quickly ran into the End Zone selling for a recording breaking $2.253M!

Make An NFT & Destroy The Original?

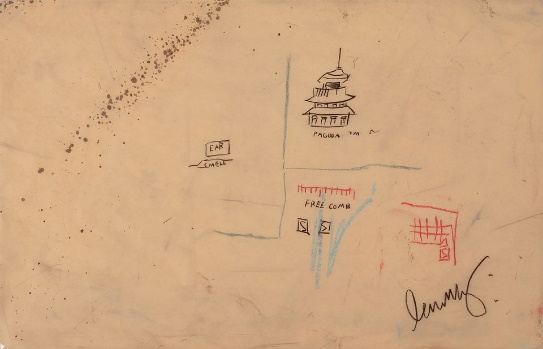

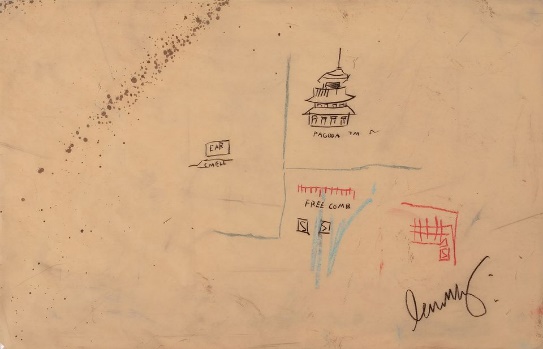

Now I can confirm that some of the players in the NFT market are off their rockers. The owner of Basquiat’s Free Comb with Pagoda will have it made into an NFT and sold at auction. The ‘lucky’ purchaser will then be able to instruct the seller to destroy the original. What? Are you kidding me? Why would anyone want to destroy an original work of art and then be left with just a digital version? Also, as far as I know, you cannot willfully destroy a work of art unless the artist permits you. They are also claiming that the owner will have the copyright in perpetuity. I think that only the artist (and possibly their estate) can actually sell or transfer the copyright.

Now I can confirm that some of the players in the NFT market are off their rockers. The owner of Basquiat’s Free Comb with Pagoda will have it made into an NFT and sold at auction. The ‘lucky’ purchaser will then be able to instruct the seller to destroy the original. What? Are you kidding me? Why would anyone want to destroy an original work of art and then be left with just a digital version? Also, as far as I know, you cannot willfully destroy a work of art unless the artist permits you. They are also claiming that the owner will have the copyright in perpetuity. I think that only the artist (and possibly their estate) can actually sell or transfer the copyright.

There are reports that the drawing is worth $120,000. Really?

That is worth $120,000? Would you pay $120,000 for that drawing? I can think of many other works I would rather own. Back in 2012, the work was put up at auction with an $80-120K estimate and failed to find a buyer… so I say not likely.

Here is the way I see it. The owner bought the piece in 2015 and is unhappy with the purchase. Now they want to get some, or all, of their money back. What better way than try to latch onto the NFT fad, send out press releases, get coverage from the media, and hope for the best?

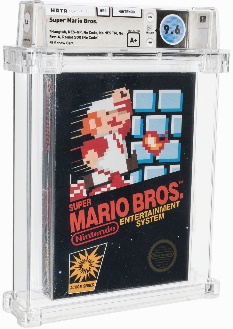

Way To Go, Mario!

Super Mario scores again when one of the oldest known factory-sealed game cartridges sold for a record price. Super Mario began his adventures in 1985 when NES (Nintendo) started producing the iconic video game. The copy just presented at auction was initially given as a Christmas gift in 1986 and was in pristine condition, still in the plastic shrink wrap. The owner recently found it at the bottom of his desk drawer, where it had been for 35 years.

Super Mario scores again when one of the oldest known factory-sealed game cartridges sold for a record price. Super Mario began his adventures in 1985 when NES (Nintendo) started producing the iconic video game. The copy just presented at auction was initially given as a Christmas gift in 1986 and was in pristine condition, still in the plastic shrink wrap. The owner recently found it at the bottom of his desk drawer, where it had been for 35 years.

The cartridge smashed the previous record for a video game; it was just this past July when a copy of Super Marion Bros sold for $114K. Now that seems like a bargain as this copy sold for $660K!! Wazoo…way to go, Mario!

That Did Not Take Long – Thank Goodness!

The other day we reported on the Basquiat NFT and our feelings that creating one is a violation of the artist’s copyright, not to mention the idea of possibly destroying the work would also open up a legal battle. Well, the Basquiat estate has stepped in and halted the sale stating, “The estate of Jean-Michel Basquiat owns the copyright in the artwork referenced. No license or rights were conveyed to the seller and the NFT has subsequently been removed from sale.” Bravo!

____________________

The Art Market

By: Howard & Lance

The auction action slowed down a little in April but will ramp up in May. In fact, it will be out-of-control! This month we covered three sales, one in London, another in Paris, and the last in New York (the last of which we did a deep dive to give you a better understanding of what is happening).

The NFT Market Continued

By: Lance

Last month I briefly discussed NFT’s and left off on the fact that many are concerned about potential issues with the technology… well, one month later and some of those concerns have already been exploited in the real world.

With any new technology, there is going to be a bit of a learning curve – both for users and developers. Users need to understand how to utilize the technology, and developers need to see how that technology is being abused to close loopholes and fix bugs. But given how quickly the NFT market cropped up, and how widespread its usage is, I do not think developers and coders have had a chance at keeping up with the madness.

Some points of worry that have been mentioned surround some obvious issues such as counterfeiting/duplication, fraud, unauthorized distribution and altered provenance… and we are not even getting started on the government regulations and tax implications side of all of this. Overshadowing these very real concerns, is the fact that much of the media coverage is all about how amazing and lucrative the NFT market is… the old adage applies – if it’s too good to be true, it probably is. To be clear, there are quite a few artists who have made a killing by selling NFT’s, and there have been a handful of absurd stories of people selling unimpressive “things” as NFT’s for asinine prices (I don’t even know how to categorize a Jack Dorsey Tweet, or audio recordings of farts… so “things” seem appropriate)… much of what is out there seems to be building a house of cards, better yet a castle of cards – after all, we are talking about billions of dollars of assets.

Legally speaking, it will be interesting to see how nefarious actors in the NFT market are held accountable. In a basic sense, we have already seen hacking of the now world-famous Beeple NFT Everydays: The First 5,000 Days. Earlier this month, an artist (read as: hacker) who goes by Monsieur Personne employed a technique that has become known as “sleepminting.” When an artist creates an NFT, the process is called minting; but sleepminting is a hacker’s way of creating a fraudulent NFT… this hacking method actually mints new NFT’s through another person’s crypto wallet. Long story short, Monsieur Personne minted a second version of Everydays directly through Beeple’s crypto wallet, and then transferred the NFT to someone else. The blockchain infrastructure is being billed as a technology that would disallow exactly this type of behavior, but where there is a will there is a way. That means that this second version’s underlying code makes it seem very authentic – and there is no way to undo that.

This one example alone touches on almost all the major concerns – as if this were a concise study into the shortcomings of the current NFT infrastructure. This circumvented duplication, fraud, unauthorized distribution as well as provenance safeguards… and we have no way to track down the culprit, unless they do interviews in the press like in this case.

All said, there is a genuine utility for NFT’s and I truly believe they will become a commonly collected “thing”… but until the technology catches up, CAUTION: ENTER AT YOUR OWN RISK.

Impressionist & Modern - Paris

By: Howard

On April 14, Christie’s, Paris, presented their Oeuvres modernes sur papier / Art Impressionniste et Moderne sale that included a wide range of work from the 19th and 20th centuries. While there was very little that interested us, it is obvious many others were very interested – the results for several works really surprised me. (w/p = with the buyer’s premium).

On April 14, Christie’s, Paris, presented their Oeuvres modernes sur papier / Art Impressionniste et Moderne sale that included a wide range of work from the 19th and 20th centuries. While there was very little that interested us, it is obvious many others were very interested – the results for several works really surprised me. (w/p = with the buyer’s premium).

The top lot in this sale was a Cubistic work by the Russian born Marie Vassileff’s titled Nu. The painting carried a €250-350K estimate and sold for €550K/$659K (€680K/$814K w/p). In a close second was Robert Delaunay’s Manège de cochons; a work on paper that was estimated at €500-800K and sold for €500K/$599K (€620K/$742K w/p – this same work sold back in 2017 for $450K – so the seller walked away with a little extra money). Pierre Bonnard’s small gouache Femme à sa toilette took the third spot when it sold for €360K/$431K (€450K/$539K w/p – est. €150-250K — it was last on the market in the 1930s, so we can call that one fresh).

Rounding out the top five at €300K/$359K (€375/$449K – actually, the top six) were Degas’s Danseuses en maillot, au repos (est. €300-500K), Dufy’s Nu dans l’atelier de la place Arago à Perpignan (est. €120-180K), and Félix Vallotton’s Chemin de la Croix-Rouge (est. €250-350K).

I mentioned earlier that some of the sold works left me wondering why they generated so much interest. Perhaps the most puzzling was a pastel landscape measuring about 6.5 x 12.5 inches by Degas. The work had, what I thought was, a hefty estimate of €60-80K, and it sold for €140K/$168K (€175K/$210K w/p) — can anyone explain why it made so much (I am always interested in learning)?

The sale also had 38 works that went unsold; these included pieces by Severini (€300-500K), Bonnard (€190-270K), Claus (€180-250K), Miro (€120-180K), Dufy (€80-120K), Renoir (€60-80K), Appel (€60-80K), Luce (€45-65k), Vuillard (€40-60K), and Pascin (€30-50K).

Of the 154 lots offered, 116 found buyers (75.3% sell-through rate), and the total achieved was €8.296M/$9.9M (€10.35M/$12.4M w/p). The low end of their presale estimate range was €8.28M, so they just squeaked past it even without the buyer’s premiums.

Digging deeper, we discover that of the sold works, 18 were below, 56 within, and 42 above their estimate ranges. When we add in the 38 unsold works, their accuracy rate was 36.4% — which is one of the better results.

19th-Century & British Impressionist – Bonhams, London

By: Howard

On March 31, Bonhams presented their 19th-century and British Impressionist sale, which included various works dating from the 1840s through the 1960s.

In the number one position, they had a tie. Alice Boyd’s The Thames from Cheyne Walk (est. £15-20K) and John William G

odward’s Waiting for the Procession (est. £200-300K) each made £190K/$261K (£238K/$327K – w/p). I will assume that the seller of the Boyd was thrilled, while the Godward seller not so much. Moving to the number three spot, we have a bit of a dilemma. Lot 43, The Five Senses, by Henri Schlesinger, brought £160K/$220K (£200K/$275K – w/p, est. £70-100K). The only problem is the lot included five paintings. If we divide the price by five, each work sold for £32K/$44K. If we decide to pass over that one, then the next most expensive work was Grimshaw’s Greenock Shipping at £155K/$213K (£194K/$267K – w/p, est. £150-200K). Rounding out the top five were a landscape by Munnings, Brightworthy Ford, Withypool, Exmoor, that made £88K/$121K (£110/$152K – w/p, est. £15-20K – so that seller was pleased), and another Grimshaw, Scarborough from the seats near The Grand Hotel, at £70K/$96K (£88K/$121K – w/p, est. £80-120K).

There were a few lots that surprised me. The first was a small (7 x 9 inch) oil study by Godward that had an estimate of £12-18K and sold for £55K/$76K (£69K/$95K). Then there was a small (9 x 13 inch) landscape by Louis A. Lapito, Marina Piccola a Capri, that was expected to bring £1-1.5K and sold for £20K/$28K (£25K/$35K – w/p). A small (12 x 14 inch) portrait by Jan van Beers carried a £1.2-1.8K estimate and sold for £29K/$40K (£36.5K/$50K). And finally, Frantisek Kupka’s Le femme et la terre also had a £1.2-1.8K estimate and brought £25K/$34K (£31.5/$43K). Among the unsold lots were paintings by Unterberger (£12-18K), Springer (£15-25K), John Brett (£15-20K), Edward Sego (£35-45K), Harold Harvey (£40-60K), and Ziem (£40-60K).

When the sale ended, of the 83 works offered, 67 sold (80.7% sell-through rate – pretty good). The low end of their presale estimate range was £1.324M and the sale, including the buyer’s premium, totaled £2.05M. Of the 67 sold works, 16 were below, 25 within, and 26 above their estimate ranges. After adding in the 16 unsold works, they were left with an accuracy rate of 30% — which is better than most.

Christie’s 19th-Century – What Did They Expect?

By: Howard

On April 21, Christie’s offered up a selection of 19th-century European works of art. I will start by saying that when the catalog arrived, I felt like many of the works had been offered recently (I will get into that later). I even went to view the actual sale; I wanted an accurate understanding of the quality and condition of each piece.

On April 21, Christie’s offered up a selection of 19th-century European works of art. I will start by saying that when the catalog arrived, I felt like many of the works had been offered recently (I will get into that later). I even went to view the actual sale; I wanted an accurate understanding of the quality and condition of each piece.

The top seller was a painting by Jean-Francois Millet titled Portrait of Madame Martin. This 18 x 15-inch head and shoulder portrait was last on the market in 2011 (it made $230,500 then). The estimate was $200-300K, so the owner was willing to take a loss, but when the bidding was over, it hammered down at $500K ($625K w/p) – I am sure the seller was pleased with their profit. Taking second place was Sir Alfred Munnings’ The Golden State Coach at the Royal Mews. According to the provenance, it was originally purchased from the artist by Wildenstein and sold to a collector in 1966 (so it was pretty fresh). The only issue I saw was the artist added pieces to the canvas (extending its size); those seams were slightly raised and inpainted. Oh, and the painting was not signed.

That did not seem to bother people since the work was estimated to bring $100-150K and sold for $310K ($388K w/p). Another Munnings, from the same collection, captured the number three spot. Willows on the Stour was a pretty impressionistic river landscape that they expected to bring $70-100K and sold for $240K ($300K w/p).

Rounding out the top five were Edwin Lord Weeks’ Lake at Oodeypore, India, estimated at $180-220K and sold for $230K ($288K w/p). This was one of many works that were offered before. Christie’s had it in their October 28, 2019 sale with an estimate of $250-350K, and it did not sell (more on this later). And in fifth was Dedham Mill Pool by Munnings, which made $180K ($225K) on a $50-70K estimate.

All three Munnings came from the same collection and were bought in the 1960s. Their combined estimate range was $220-320K, and they totaled $730K ($913K w/p). Guess that shows what can happen with fresh works.

Many sold works surprised me due to their lack of quality and/or condition issues. Two of the most shocking were paintings by Ziem and Seignac. From the photo in the catalog, Ziem’s Coup de canon à Venise, jour de fête seemed like it would be of interest to us. However, after viewing the painting, I was sure that due to its condition, it would not sell; here is the published condition report:

This work has a glue relining, and some of the original stretcher bars have been replaced. The surface is stable and clean. Examination under UV reveals that the retouches in this picture are concentrated in the sky and to the extreme edges, though there are a few small touches in the figural group at lower left. In the sky, there are retouches around the edge of the building at lower left, and a large cluster of retouches in the sky at upper left, halfway between the extreme left edge and the sails, measuring about 6 inches high. There is another group measuring about 5 inches high directly to the right of the sails of the foremost boat. There are also retouches in the areas between the sails at center.

In other words, this painting is a wreck. Did that stop people? Well, at least two did not seem to care, and the artwork made $75K ($94K w/p – est. $50-70K). I can only imagine what that painting would have made if it were in excellent condition.

Then there was Guillaume Seignac’s Cupid; first offered in their October 2019 sale with an $18-25K estimate, but the condition stopped people (published report below):

The canvas is laid down onto Masonite. There is a network of craquelure throughout. Upon inspection under UV light, there is inpainting to the figure’s mouth and eyes. There is a 2 inch horizontal line of inpainting and a 1 by 1 inch area of inpainting to the figure’s torso. There are two small spots of inpainting to the figure’s knees. There are a few small dots of inpainting to the background at right. What the report failed to mention is that the painting was overcleaned as well.

Then the painting was offered in the June 2020 sale with a $10-15K estimate and supposedly sold for $13,750. I guess the buyer never paid for it, so it was reoffered here with an $8-12K estimate and sold for $15K ($19K w/p).

When the sale ended, of the 88 lots in the catalog, only 85 were offered (they withdrew three due to an ownership dispute). Of the remaining 85, 56 sold (65.9%), and the total take was $3.1M ($3.87M w/p). The low end of their estimate range was $3.23M, so the hammer total fell a bit short. Of the offered works, 26 were below, 12 within, and 18 above their estimate range. When we account for the 29 unsold works, this gave them an accuracy rate of 14.1% – not the best.

Since this sale falls into my area of expertise, I decided to dig a bit deeper. To start, of the 85 lots, 29 (34%) had been up in the last two years (they went unsold in the earlier sales). Of the 29 lots, 11 failed again, and of those that sold, 10 made less, 3 within, and the rest beat their estimate. There was a Courbet portrait (not the prettiest model) that went unsold in June 2020 with a $60-80K estimate. In this sale, it had a $50-70K estimate and sold for $110K ($138K w/p), higher than its 2020 range – go figure!

Also, 12 additional works had sold in the last ten years, three of which appeared to have sold in their 2020 sale, but I guess the buyer reneged. Henryk Siemiradzki’s At the Fountain was one of them, supposedly selling in their June 2020 auction for $300K ($375K w/p – est. $150-250K). That would tell me that there were at least two interested parties. Well, this time, it was offered with the same estimate and did not find a buyer.

I found it interesting that this sale included 29 lots that were unsold in sales between 2019 and 2020, and when this sale ended, there were 29 unsold lots (not all the same, but still).

This sale illustrates the difficulty auction rooms are having. There is a shortage of great works coming to the market, so many auctions are filled with past rejects. Of course, new people are always coming into the market, so they probably have no idea that is the case. It will be nice to see what happens when a really strong sale, with a majority of fresh-to-the-market works, is presented. I hope that happens while I am still alive!!

The Rehs Family

© Rehs Galleries, Inc., New York –May 2021