COMMENTS ON THE ART MARKET

January Hours

The gallery will continue its Tuesday through Friday from 10 am – 5 pm hours. If you would like to stop by, please call to schedule an appointment. We are also available, by appointment, on Saturdays, Sundays, and Mondays.

____________________

Lance, Alyssa, Amy, and Howard wish all our friends and readers a happy New Year. 2020 has been a difficult one for many, and we greatly appreciate the support and kind words we have received. We hope that 2021 will bring forth a more peaceful and unified country, not to mention an end to the pandemic. Stay safe!

____________________

New Biographies

Professor Janet Whitmore just finished her biography on Jean Dufy … if you are a fan of his work, you will enjoy reading more about him:

____________________

Stocks

By: Howard & Lance

Years from now, people will look at the Dow’s beginning and ending numbers for 2020 and think very little about it. The year started off at 28,639 and closed at 30,606 … less than a 2000-point gain for the 12 months (nothing very impressive); however, as we all know, it is the crazy ride we took over those 12 months that had many of us shaking our heads in disbelief. On February 12, the Dow hit 29,568, and about a month later, March 23, it was sitting at 19,121 (with an intraday low of 18,213), a 10,000-point drop. I know that many of us wish we had plowed all our extra dollars into a handful of stocks on March 24. Do not worry, I am still working on my time travel machine, and once I get it perfected, we will all have some fun – but I am going first!

At the end of November, the Dow was sitting at 29,638, and as mentioned earlier, we closed out December at 30,606; so, we saw a gain of about 1,000 points. It is still hard for me to understand the numbers given everything that is going on. I guess we are still traveling through the Twilight Zone, and it looks like many of the cryptocurrencies have joined the ride - Bitcoin closed at $29,005.04 (up $11,248.49 – that is an $18,000 gain in three months); Litecoin finished at $124.30 (up $51.03); Ripple was crushed and ended at $0.22 (down 0.33); and Ethereum closed at $742.38 (up $199.46) … Amy was happy!

The Dollar lost ground against the Euro and Pound - $1.22 (down $0.02) and $1.37 (down - $0.04), respectively. I guess that will have little impact on most of us, since we will not be heading overseas anytime soon. And for those readers who live overseas, you will get more bang for your buck over here! Crude Oil improved, closing at $48.44 (up $2.91), and Gold jumped to $1,903.60 (up $115.50). And now for my stocks:

JP Morgan ($126.97 – up $5.75), AT&T ($28.75– down $0.28), Verizon ($58.73 – down $1.85), Wal-Mart ($144.14 – down $7.46), Disney ($181.03 – up $33.95 - crazy), Apple ($132.69 – up $16.10), Microsoft ($222.42 – up $7.19), Bristol-Myers ($62.02 – down $1.03), Pepsi ($148.30 – up $3.70), Eaton Corp. ($120.20 – down $1.70), Comcast ($52.40 – up $0.65), American Express ($120.99 – up $0.40), Bank of American ($30.32 – up $1.33), Twitter ($54.14 – up $7.55), Palantir Technologies ($23.54 – down $3.57), and I bought Merck at $80.39 and it closed at $81.77 – up $1.38. Of the 16 stocks listed, 10 of them were UP! You may have noticed that Intel and eBay are missing, I sold them.

____________________

Tales from the Dark Side

By: Alyssa

Update: Dark Side’s Top 3 of 2020

3. Kenny Schachter Duped By Inigo Philbrick

Original Post

Inigo Philbrick (an art world scammer) hit a lot of people, including his art dealer friend Kenny Schachter who was duped out of $1.67M! The work of art they purchased seems to have vanished ... along with Mr. Philbrick.

According to an article in the Daily Mail, Mr. Schachter has posted a Wanted Ad which includes photos and a $10,000 reward for information on Philbrick's whereabouts.

Update

Inigo Philbrick has been found! The disgraced art dealer fled the US after the US Government and the FBI gathered claims amounting to over $20 million in fraud. He was found on the Pacific Island of Vanuatu, located between Australia and Fiji (noting this one down for post-COVID-19 vacation destinations.) Un-fugitive-like, Philbrick did little to conceal his identity, using his real name on the Island, boasting about his experience in the art world, and according to reports, making “a name” for himself in the community. He was taken into custody, brought back to Manhattan, indicted on charges of wire fraud and aggravated identity theft, and forced to forfeit any property “that constitutes or is derived from proceeds traceable to the commission of said offense.” Philbrick pled not guilty.

2. Another Art Theft? This Time A Van Gogh

Original Post

News just broke that early Monday morning, thieves smashed the front door of the Singer Laren Museum, Laren, The Netherlands, and stole Vincent van Gogh's The Parsonage Garden at Nuenen in Spring, (1884). The painting was on loan from the Groninger Museum, Groningen, Netherlands.

What makes this even more disturbing is that today (March 30) is van Gogh's birthday. When will this madness stop?

Update

The whereabouts of Vincent van Gogh’s The Parsonage Garden at Nuenen in Spring 1884 is still unknown. However, the Singer Laren Museum released video footage of a man breaking into the museum around 3:15 AM on Monday, March 30th, the morning of the vandalizing theft. The museum, which was closed at the time to help stop the spread of the novel Coronavirus, had the glass of its front door smashed with a sledgehammer before the thief made a quick entrance and exit, deliberately targeting the single van Gogh amongst the collection. While over 56 tips have been reported to the authorities, no arrests have been made.

1. More Looted Artifacts At Hobby Lobby

Original Post

Back in 2017, Hobby Lobby agreed to return thousands of smuggled clay artifacts they bought in 2010 and paid a fine of $3 million. Well, now it has come to light that another piece in their collection - Gilgamesh Dream Tablet - was illegally smuggled out of Iraq.

According to several articles, Hobby Lobby paid $1.6 million to an unnamed auction room (finding the name was pretty easy - here is a link to a PDF from Christie's featuring the item) for the 6 1/4 x 4 3/4 inch tablet. It has also been revealed that the provenance listed was fictitious; it seems the work was stolen in 1991 and not sold by a California auction room in 1981.

Oh, what a tangled web we weave...

Update

Hobby Lobby, in fact, returned the looted tablet to Iraq. According to an article written a few months after our post, Hobby Lobby filed a suit against Christie’s for fraud and breach of warranty for selling the antiquity.

In a statement announcing the government’s move to return a piece of Iraq’s cultural history, Richard P. Donoghue, the US Attorney for the Eastern District of New York, notes that “in this case, a major auction house failed to meet its obligations by minimizing its concerns that the provenance of an important Iraqi artifact was fabricated, and withheld from the buyer information that undermined the provenance’s reliability.”

Christie’s stated that they had done their due diligence that the work had been sold through Butterfield and Butterfield in 1981 before all US imports of Iraqi artifacts were banned. However, the seller of the tablet admitted to fabricating the history of ownership. Hobby Lobby is seeking the return of $1.67 million-plus interest and legal fees.

____________________

Really?

By: Amy

Adidas And Meissen Pair Up

Are you in the market for a new pair of running shoes? Then these are probably not for you, but they are the coolest sneakers I have ever seen! Sotheby’s held an online auction with just one lot; a collaborative effort that showcased a single pair of Adidas leather sneakers that were enhanced by the porcelain designs of Meissen.

I am sure everyone is familiar with Adidas, which was founded in 1949 in Germany… but if you are not familiar with Meissen, it was the first European (German) company to make hard-paste (true) porcelain; Meissen has been producing porcelain since 1709. Both Adidas and Meissen continue to be leading manufacturers and innovators in their fields – these sneakers are proof that Meissen’s designs are not just for tableware.

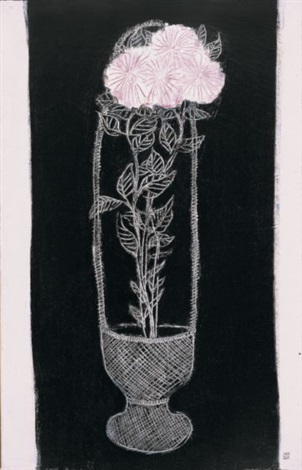

The sneakers are from Adidas’ A-ZX collection, which ranges in price from $100-160. Meissen’s contribution includes hand-painted leather and porcelain overlays on the tongue and heel. Inspired by the Meissen Krater Vase, which was designed by Ernst August Leuteritz in 1856, the sneakers feature fifteen of the vase’s one hundred and thirty different patterns. It took six months to create the pair that weigh just over 2 pounds…if you could wear them you would not need ankle weights to exercise.

The sneakers are from Adidas’ A-ZX collection, which ranges in price from $100-160. Meissen’s contribution includes hand-painted leather and porcelain overlays on the tongue and heel. Inspired by the Meissen Krater Vase, which was designed by Ernst August Leuteritz in 1856, the sneakers feature fifteen of the vase’s one hundred and thirty different patterns. It took six months to create the pair that weigh just over 2 pounds…if you could wear them you would not need ankle weights to exercise.

The one-of-a-kind pair had a very broad estimate of $1 – 1,000,000…yes, you read that right, I guess no one really knew what they were worth. Well, when the online bidding finally closed the sneakers sold for $132,000… I am surprised that they didn’t sell for more!

What is really great about this sale is that 100% of the hammer price is going to the Brooklyn Museum to support arts education in New York.

And Adidas recently did sell a limited edition of the sneakers available through their Creator’s Club – I did register, but sadly did not get a pair…they were priced at $160. If you are still interested in buying a pair, I saw that there are a few pairs available on eBay, ranging in price from $200 – 418; I am just not sure if they are legit.

Highlights From A Holiday Auction

A record-setting Holiday auction was just held and demonstrated the strength in demand for cards and memorabilia. There were over 2100 items up for sale and many of the items had remarkable results; only 78 items failed to sell, so the sell-though rate was an astonishing 96.3%!

The top lot was a 2013-14 Prizm Black Mosaic Basketball card of Giannis Antetokounmpo; it was a unique card, as there is only one, and bidding started at $100,000. The card set a record for the highest price of an unsigned trading card when is sold for $950K ($1.17M w/p). (A signed Antetokounmpo card sold for $1.812 M this past September.)

The top lot was a 2013-14 Prizm Black Mosaic Basketball card of Giannis Antetokounmpo; it was a unique card, as there is only one, and bidding started at $100,000. The card set a record for the highest price of an unsigned trading card when is sold for $950K ($1.17M w/p). (A signed Antetokounmpo card sold for $1.812 M this past September.)

The item that caught my attention brought the second-highest price in the sale - it was a signed album by John Lennon, titled Double Fantasy, which was released in November 1980. On the evening of December 8, 1980, a "fan" waited outside the Dakota apartment building for Lennon and had him sign his copy of the album... that fan would later be identified as Mark David Chapman. Chapman then stashed the album in a flower planter at the entrance of the Dakota and waited for more than 5 hours for Lennon and Ono to return... at which point he shot and killed John Lennon.

The building superintendent found the album, turned it over to the police as evidence, and about a year later, the police were kind enough to return it to the super. The album has been sold several times, first by the super in 1999 to a private buyer for $150K, then again in 2010 for $850K. This time around the bidding started at $400K and when the lot closed, the consignor took a small loss as the album sold for $750K ($922.5K w/p).

Coming in a respectable third place was a 2009/10 Stephen Curry signed Patch Rookie Card (#10/25); the starting bid was just $10K and received 50 bids before it ended up selling for $501K ($616.2K w/p).

Additional items that deserve an honorable mention are a 1999 Pokémon Charizard 1st edition card that sold for $300K ($369K w/p); a 1948 Jackie Robinson Rookie card that sold for $326K ($401 w/p); and a 1986 Fleer Michael Jordan Rookie card that made $176K ($212 w/p).

Additional items that deserve an honorable mention are a 1999 Pokémon Charizard 1st edition card that sold for $300K ($369K w/p); a 1948 Jackie Robinson Rookie card that sold for $326K ($401 w/p); and a 1986 Fleer Michael Jordan Rookie card that made $176K ($212 w/p).

Also of note is that Howard bought a card at this sale to fund our retirement (we should only be so lucky); a 2005/06 Topps “Refractor” LeBron James card, starting bid was $200 and with just 2 bids he got it for $225 ($277 w/p). We now own 2 basketball cards … what a collection!

And one more note - all the w/p prices include a 23% premium, which means that the purchases were made using a credit card - if you pay with a check, money order or wire, the premium is 20%...hope those buyers plan on doing something really fun with their credit card points!

____________________

The Art Market

By: Howard, Lance, Amy & Alyssa

The past 12 months have been a real eye-opener for those who dabble in the art world. By the middle of March, all the in-person fairs and exhibitions were closing, with most of the action going online. I will say that most of the online attempts were not very successful -- take that from someone who participated in several of them. While I am not happy about the reason for show closings, having a break from traveling across the country to participate in over a dozen, which we have done for more than 12 years, is very nice. These past months reminded me of the old days when our gallery participated in one or two shows a year. At the peak, we were doing 2 or 3 shows in a row (one year, we had 4 shows in 6 weeks), and moving 100+ works (packing, unpacking, hanging, lighting, dismantling, repacking, shipping, flying, etc.) is tough on the body. Do not get me wrong; we enjoy participating in most of the shows and being able to see and socialize with our friends and clients; something we are looking forward to again.

Many show promoters have had a challenging year, and sadly some of them will not survive. I also believe that once the pandemic is under control and people are comfortable attending large scale indoor events, the shows/fairs will come roaring back. If you are adventurous, you might want to think about getting into the show business!

Over the past 10 months, we have seen the ridiculous rise in online auction sales and watched as the main salerooms have started to resemble large department stores … selling all sorts of stuff (shoes, handbags, clothing, inexpensive nick-nacks, etc.). I do hope that things will begin to return to normal in this arena as well.

So, here we are – the end of December, and another crazy month in the auction arena is behind us. The number of sales that took place was more than we could handle – dozens of them across the globe, some overlapping one another. There was no way for us to cover them all, so we decided, in no particular order, to focus on 7 of them.

This month we also added two general posts about the art market. One discusses condition and salability, while the other explains how the provenance you see at an auction might not always be complete.

Two General Stories

Condition & Salability

By: Howard

We are always talking about the factors that need to be considered before buying a work of art. One of the most important, at least to us, is a work’s condition. In a recent article in The Art Newspaper, Anna Brady discusses Bill Middendorf’s gift of a Han Memling (1430-1494) painting to the Memling Museum in Bruges.

We are always talking about the factors that need to be considered before buying a work of art. One of the most important, at least to us, is a work’s condition. In a recent article in The Art Newspaper, Anna Brady discusses Bill Middendorf’s gift of a Han Memling (1430-1494) painting to the Memling Museum in Bruges.

In 2002, Hans Memling’s Portrait of a male donor, (Francisco de Rojas?) was offered for sale at Sotheby’s with an estimate of £700-£900,000 … it did not sell. After the sale, Middendorf bought the work for an undisclosed amount. In July of 2019, Middendorf offered the work at a Christie’s auction with a £1.5-2.5M estimate (this time titled: Portrait of a member of the De Rojas family, kneeling, full-length), again, it failed to sell. According to Brady’s article, The trade’s theory was that the panel’s poor condition and extensive restoration likely deterred buyers. It appears that the painting’s condition was an important factor in the work’s salability, or what made it unsalable.

So, what is a collector to do when this happens? Donate! Yes, the Memling Museum was happy to have the work in their collection. According to Till-Holger Borchert, the chief curator of the Groeningemuseum and the director of the Bruges Museums since 2014, the painting is one of the very few examples that we will have to remind us of the Spanish presence in Bruges during the Middle Ages. The city was an important trading hub at that time. While we have a lot of archives documenting the presence of Spanish merchants, we don’t have many images showing them. So having a depiction of a prominent Spanish family makes it very interesting, especially as it is by Memling, another prominent citizen of Bruges, and an extremely important artist.

Even though the painting is now part of an important museum collection, this story beautifully illustrates the need to be concerned with a work’s condition. Now do not get me wrong, many works of art have some level of restoration or conservation; however, those with extensive restoration can be difficult, if not impossible, to sell in the future.

A Story About Altering Provenance

By: Howard

As we have always said, every work has a provenance, but the full provenance of every work is not always known. Now, you should expect that when one of the major auction rooms offers a work, they will do their best to have as complete a provenance as possible. Well, as you will soon see, that is not always the case.

In November of 2019, our gallery acquired a beautiful still life by the Vietnamese artist Le Pho. In July, a collector of Vietnamese art purchased the painting and was very happy with it. In October, while looking through all the auction sites, we noticed that a Modern & Contemporary sale was taking place in Hong Kong and decided to see what was included. Lo and behold, the Le Pho we sold was in the sale with an estimate of HK$150-260K ($19,335-33,514) … which was much less than we sold it for. It seemed odd, but what do I know?

Anyway, while looking at the catalog entry, I noticed the following provenance:

Wally Findlay Galleries, USA

Acquired from the above gallery by the previous owner

Private Collection, USA

I found it strange that they were inferring that our gallery bought it from Wally Findlay, when, in fact, we bought it from a collector who acquired it years ago. Also, our name ‘Rehs’ and the inventory number are visible on the stretcher. On October 12th, I decided to write an email to Christie’s and let them know that their cataloging was incorrect.

I noticed that you are offering a painting by Le Pho – lot 19. Your provenance is not complete. We sold that painting this year (I assume to the seller):

https://rehs.com/Le_Pho_Les_Tulipes_Tulips_Viburnum_and_Anemones.html

You will also note in the image you feature on your site that the name REHS (along with our inventory number) is written at the bottom of the stretcher.

On the 15th I received a reply from Winnie Wan:

Dear Mr Rehs,

Thank you very much for highlighting the provenance of lot 19.

We generally do not include past auction records from auction houses apart from Christie’s and Sotheby’s. Hence, for us this auction record is considered complete. However, for any enquiries we can mention it.

Should you have further concerns, please feel free to contact us.

My reply to Ms. Wan:

We are not an auction house … we have an art gallery in New York City. We bought that painting and then sold it to the individual who is now selling it. [W]e owned the painting outright (had clear title), so your provenance is not complete as stated in the catalog. Of course, you can sell it as you see fit, but do note that I have now told you your provenance is incomplete.

I never received a reply. Now I am sure you are thinking, what did the painting make? HK$625,000 ($80,634) … yes, that was more than we sold it for.

The word ‘provenance’, according to the dictionary, is a record of ownership of a work of art or an antique, used as a guide to authenticity or quality. The key word here is ‘ownership.’ As a previous owner, the gallery’s name should have been included. Also, an auction room should almost never be included in the provenance since they never (or rarely) own the work being sold. They are a middleman, and as they have always stated, title passes from the seller to the buyer when the hammer falls.

We see this time and again, auction rooms leaving out parts of the provenance that might make the sale more difficult. The salerooms are always trying to make people believe they are being as transparent as possible … obviously, that is a bunch of …

Auction Results

Christie’s Hong Kong: Modern & Contemporary Art Evening Sale Shines

By: Howard

Starting in the wee hours in New York (so I was asleep when it took place), Christie’s Hong Kong offered up a selection of works that surely opened people’s eyes. When I initially went to their website, I noticed that there was an option to open a pdf version of the printed catalog (printed catalogs are becoming rare these days). I click the button and it started to download a 372-page catalog. What?! It takes close to 400 pages to market 58 works? (HK$ = Hong Kong Dollars, and unless otherwise noted, prices include the buyer’s premium)

The top lot in the sale was Sanyu’s Pink Chrysanthemums in a Basket which carried a HK$68-98M estimate and sold for HK$138.1M ($17.9M); the painting last sold in 2005 for HK$3.26M ($420K) – that was a very nice return. Zhang Xiaogang’s Bloodline Series The Big Family No. 2, was expected to make HK$38-48M and brought HK$98M ($12.6M). This same painting sold in 2008 for HK$26.4M ($3.4M), so the owner did pretty well. In a close third they had Zao Wou-Ki’s 15.01.82 Triptyque at HK$94.6M ($12.2M – est. HK$70-120M). The seller of this one did not do as well – they bought it in 2013 for HK$85M ($11M). Rounding out the top five were Zao Wou-Ki’s 09.03.65 at HK$75.7M ($9.8M – est. HK$60-80M), and Chu Teh-Chun’s The White Forest I brought $HK42.3M ($5.5M – est. HK$35-55M) – this one last sold in 2006 for HK$10.6M ($1.35M) … another happy seller.

There were several other lots that performed extremely well; these included Mathew Wong’s The Journey Home (est. HK$700K-1.5M – sold HK$11M/$1.43M), Huang Yuxing’s Gyatso’s Palace (est. HK$800K-1.2M – sold HK$4.3M/$548K), Pan Jiun’s The World Best Scenery – Jiang Nan (est. HK$900K-1.5M – sold HK$5M/$645K), and Leonard Foujita’s Reclining Nude with a Small Dog (est. HK$10-15M – sold $HK37.5M/$4.8M).

By the end of the session, of the 58 lots offered, 55 sold (94.8% sell-through rate), and the total take was HK$885M ($114M) on a HK$587.4-$882.7M ($76-$113.8M) estimate range. So, with the buyer’s premium, they squeaked past the upper end. With lots of action, and some strong prices, I am sure that many sellers were happy with the results.

How Much Is Too Much – Christie’s Post-Wat & Contemporary Day Sale

By: Lance

On Thursday, Christie’s hosted a marathon day sale of Post-War & Contemporary works, which featured nearly 300 lots… as we have been saying, the auction houses are throwing anything and everything that they can on the block with little regard for how it is being absorbed. Think basic supply and demand – if there is too much material being put out, it is not simply that an individual auction sees a poor sell-through rate; the greater issue is it creates downward pressure on prices, which hurts the market as a whole. There will always be nice prices paid for the top works being offered, but it is the rest of the field that suffers.

Taking the top spot on the day was Wayne Thiebaud’s Nine Cupcakes as expected – it carried the highest estimate in the sale. The work, which was only painted in 2009, hammered at $2.4M ($2.9M w/p) on a $1.5-2.5M estimate. A few lots earlier in the sale, two lots sold in quick succession which turned out to be good enough for the second and third highest prices of the day… two different color variations of Warhol’s Marilyn, each sporting a $1.2-1.8M estimate. The first, which was arguably nicer in my humble opinion, utilized a bit more color and contrast with splashes of bright blue, pink, yellow, and green – it found a buyer at $1.49M hammer ($1.81M w/p). The latter, which incorporated swaths of red, purple, and green, only reached $1.39M hammer ($1.7M w/p).

Rounding out the top 5, we saw the “digital cover” piece – Matthew Wong’s Coming of Age Landscape, which found a buyer at $1.3M hammer ($1.59M w/p) on a $500-700K estimate. The work was painted in 2018, just a year before the artist’s death. Not far behind were two works that tied – each carrying a $1.2-1.8M estimate and both hammering at $1.2M ($1.47M w/p); Jackson Pollock’s Untitled and Roy Lichtenstein’s Woman Contemplating a Yellow Cup.

There were a few other bright spots among the glut… a work by Salman Toor saw a result of more than 4x its estimate as it hammered at $660K ($822K w/p) on a $100-150K estimate; a Calder hammered at $220K ($275K w/p) on a $60-80K estimate; a Banksy found a buyer at $550K ($687K w/p) on a $150-200K estimate; and two lesser lots – Joel Mesler’s Untitled hammered at $70K ($87K w/p) on a $20-30K estimate and a Robert Mangold hammered at $48K ($60K w/p) on a $15-20K estimate.

Conversely, there was a slew of underperformers and failures… two lots, a work by Saul Steinberg and Hans Hoffman, went for half their low estimate. A Picasso went for just $120K ($150K w/p) on a $200-300K estimate – 40% below the low end. These works were joined by another 75 works that went below estimate – that is 27% of the sale! There were another 71 works that failed to find buyers – that means more than half the sale went below estimate or unsold.

Of the 282 works that were offered (8 were withdrawn), there were 211 sold… that yielded a 76% sell-through rate and a combined hammer of $39M. When we add in the premiums, that bumps the total up to $48.9M, and the sale was expected to bring between $46.4-69.8M, so they just eked it out. That said, these overall results are moderate at best and were likely below most people’s expectations.

Christie’s Impressionist & Modern Day Sale

By: Amy

At the end of last week, Christie’s New York presented an Impressionist and Modern Art Day Sale, and I don’t think it went as well as they had hoped it would. First of all, it was their 14th sale of the month and it was only December 4th; secondly, it was their second Impressionist and Modern-Day Sale in just two months…you think it’s just a little too much for potential buyers??

The top lot was a painting by Pierre-Auguste Renoir title Le petit peintre (Claude Renoir); it was estimated at $600 -900K and it just squeaked by the estimate when it hammered for $960K ($1.182M w/p). Now I am sure the consignor was happy it made a little more than the estimate, but when I did a little further research, I saw that the last time it sold was at Sotheby’s in 1988 for $3.2M, so maybe the consignor wasn’t so happy after all. Next was a work by Pablo Picasso titled Buste d’homme a la cigarette; a work on paper that sold for $820K ($1.014M w/p) on a $1 -1.5M estimate, so it needed the commission to just make the low end of the estimate. And rounding out the top three, was a work by Alfred Kubin titled Der letzte König that was estimated to make $400-600K and just beat the low estimate when it hammered at $420K ($525K w/p).

Unfortunately, there were some major failures which led to the overall poor performance of the sale. First was a painting by Pierre Bonnard titled Raisins noirs et peches ou Panier de fruits that was estimated at $400-600K; it last sold in May 2001 for $885,750. Also estimated at $400-600K was a work by Randolf Bauer titled Andante 3 – it failed to find a new home and was last sold in 2013 for $382K. Another miss was a group of 68 miniature replicas and color reproductions in a leather case by Marcel Duchamps; it was also estimated at $400-600K and found no buyer. A work by Marc Chagall titled Couple au Bouquet didn’t make it across the finish line with an estimate of $350 -550K. And lastly, two works by Salvador Dali didn’t make the cut either – Narcisse jeune endormi was estimated at $300-500K (sold in 2013 for $148.3K) and Projets de rideaux de scène et études préliminaires dit aussi “Grand dessin” which was estimated to bring $350-450K (last sold in 2007 for $360K).

Of the 132 works offered, 51 works were unsold, so just 61.4 % found new homes. Of the works that found buyers… 18 were above the estimate, 29 were below and 34 were within. The sale was estimated to make $14 – 19.9M and when all was done it only totaled $9.5M ($10.23M w/p), so it did not come close to the low estimate.

Sotheby’s, London – European & British Art

By: Howard

On December 9th, Sotheby’s offered up a selection of European & British works of art … the results will speak for themselves. (w/p = with the buyer’s premium)

On December 9th, Sotheby’s offered up a selection of European & British works of art … the results will speak for themselves. (w/p = with the buyer’s premium)

The top lot of the sale was a large oil painting by Eduard Gaertner titled The Royal Opera, Unter den Linden, Berlin, which hammered at £750K/$992K (£923K/$1.22M w/p – est. £800-1.2M). In fact, the sale included 30 other works by the artist, though the rest were works on paper … all of those that sold made between £2,000 and £10,000, and each carried a £2-3K estimate.

The second most expensive work was Sorolla’s massive (99 x 146 inch) painting Before the Bullfight at £650K/$860K (£802K/$1.06M – est. £650-850K) – guess someone has a giant wall to fill! In a distant third was Akseli Gallen-Kallela’s Skaters on Lake Ruovesi at £320K/$423K (£402K/$532K w/p – est. £300-500K); this one last appeared on the auction block in 2011 and made $158K, so the seller was happy about the result. Rounding out the top five, we had a tie; Anders Zorn’s Girl from Mora Skiing (est. £300-500K) and Franz von Stuck’s Medea (est. £100-150K) each made £300K/$397K (£378K/$500K w/p).

Some of the better performers included Cornelis Springer’s The Zuiderspui with the Drommedaris, Enkhuizen at £190K/$251K (est. £100-150K), Olga W. Florian’s Summer Flowers of the Field £150K/$198K (est. £50-70K), and Henriette Browne’s Man Sewing which crushed its £7-10K estimate when it hammered down at £70K/$93K. On the other side, there were a lot of works that just did not generate any interest. Among the more expensive were three by Carl Larsson (£240-340K and two at £150-200K), Munnings (£260-360K), Leighton (£260-360K), and a Gérôme (£200-300K).

By the end of the sale, of the 176 lots finally offered (6 seemed to have vanished), 97 sold (55.6% sell-through rate), and the total take was £4.18M/$5.5M (£5.22M/$6.9M w/p). The low end of their presale estimate range was £6.46M, so they were way short. Of the 97 sold lots, 16 were below, 55 within, and 26 below their expected ranges. When we consider the 79 unsold works, this gave them an accuracy rate of 31.25% — which is better than most.

So from the numbers, we can see that their accuracy rate improved, but the overall sale did not perform as hoped. Sadly, for the sellers, with all the works coming to the market (too many sales for even us to keep track of) many lots are just not finding buyers.

American Art – Sotheby’s

By: Alyssa

The best way I can describe Sotheby’s New York American Art sale is – better luck next time. (unless otherwise noted, all dollar amounts are the hammer price)

Prior to the sale opening on December 11th, two lots were withdrawn, leaving just 54 works to be auctioned off over the course of a boring hour and a half. Withdrawn from the sale were Columbus’ First Landing in America by Emanuel Gottlieb Leutze, which held an estimate of $600,000 – $800,000 (a work that seemed to be an important highlight in the sale as it claimed four catalog pages), and a piece by Thomas Hart Benton, Navajo Sand, estimated between $400K – $600K.

The result of the sale fell considerably shy of their $13,610,000 – $19,180,000 pre-sale estimate, bringing in just $7,232,500 – that is, until one lot was reopened moments before the sale was to close. The mic cut off, and a young lady approached the auctioneer. Once she stepped out of view, lot 16, Two Girls on the Beach, Tynemouth by Winslow Homer (which BI’ed earlier at $1.2M on a $2.5M – $3.5M estimate) reopened at $1.8M, selling just a moment later for $2M… the watercolor last sold in 1997 for $1.65M. That brought the final tally up to $9,232,500 ($11.4M with the buyer’s premium), still well short of the low-end estimate.

Overall, 15 sold under, 11 fell within, and just 9 above their estimates, with another 19 failing altogether (a 20.4% accuracy rate). Winslow Homer’s Two Girls on the Beach, Tynemouth, snagged the gold medal at $2M after it was reoffered (under the low-end of its estimate). The silver medal was awarded to Mary Cassatt’s Children Playing with a Cat, which garnered $1.8M (also falling under its $2-3M estimate) – this same painting sold back in 2006 for $3.38M… ouch! Taking the bronze medal at $700K, was Edward Hopper’s Gloucester Factory and House (this too went below estimate – $800K-$1.2M).

Among the works that did not sell were Homer’s In the Rapids (est. $1-1.5M), Avery’s Mender (est. $800K-1.2M), Frieseke’s The Apple Tree (est. $400-600K), Avery’s Pink Cock (est. $350-550K), Predergast’s Gray Day, Venice ($300-500K), and Henry Koerner’s The Rosebush (est. $300-500k).

There was only one work in the sale to blow its estimate out of the water, lot 26, Attack by John F. Clymer (a chaotic scene of Native American Indians attacking the caravans of frontiersmen; a popular scene amongst the artist’s Western works). With an estimate of $100k – $150K, the hammer came down at $710K… making this the fourth most expensive lot in the sale.

…and that is all she wrote.

Christie’s, London – British & European Art

By: Howard

On December 10th, Christie’s 15-day online sale featuring 105 lots of British and European art ended … I know, not another sale! Sorry, but the hits, or better yet, failures, just keep on coming. Hopefully, once this medical mess is behind us, the salerooms will go back to the way it was. Wishful thinking on our part. (unless otherwise noted, all prices include the Buyer’s Premium)

On December 10th, Christie’s 15-day online sale featuring 105 lots of British and European art ended … I know, not another sale! Sorry, but the hits, or better yet, failures, just keep on coming. Hopefully, once this medical mess is behind us, the salerooms will go back to the way it was. Wishful thinking on our part. (unless otherwise noted, all prices include the Buyer’s Premium)

Taking the top slot was Grimshaw’s Under the Silvery Moonbeams, which brought £237.5K/$316K on a £100-150K estimate (the work was last on the market in 1995 with an estimate of £20-30K and did not sell). Coming in second was Godward’s His Birthday Gift at £137.5K/$183K (est. £50-80K); this same work last sold in 2013 for £56.3K/$92K on a £50-70K estimate. Third place was taken by artist Jessica Hayllar when her Fresh from the Greenhouse crushed its £20-30K estimate, selling for £81.3K/$108K. Picou’s The Birth of Venus (est. £20-30K) and Ziem’s Fête de l’Assomption devant la Douane, Venise (est. £60-80K) tied for 4th and 5th place as they each sold for £69K/$91K (I was surprised the Ziem sold since the top of the cupola on Basilica di Santa Maria della Salute, in the background, is tilted). I think we can all agree that the sellers of the top four works were happy.

A few of other work that performed well were Blanche’s Tamara Karsavina, ballet dancer of the Ballets Russes at £60K/$80K (est. £20-30K), Edward Seago’s Street Corner, Hong Kong making £52.5K/$70K (est. £15-25K), and Abraham Solomon’s Academy for instruction in the discipline of the fan, 1711 garnering £47.5K/$63K (est. £8-12K). Then there were some of the more expensive works that found no takers; among them were Courbet’s Vue de Franche-Comté (est. £150-200K), Boldini’s La Spagnola (est. £100-150K), Grimshaw’s Woodland near Leeds (est. £50-80K), and about 6 works that carried £50-70K estimates.

Once the sale ended, of the 105 works offered, 66 sold, and 39 went back to the sellers; this gave them a sell-through rate of 62.9%. The 66 lots brought £1.83M/$2.43M and the low end of the estimate range was £2.16M – so they were a bit short considering the total includes the buyer’s premium and the estimate does not. Of the sold works, 24 were below, 21 within, and 21 above their presale estimate ranges. Adding in the 39 unsold works, this resulted in an accuracy rate of 20%.

We believe that until the main auction rooms get back to creating curated sales (like they did years ago), they will continue to have some sales that do well and others that do not. The people who pay the biggest price are those whose works go unsold.

When Will The Madness Stop?

By: Howard

Over the past few months, we have talked about the ridiculous amount of material the auction rooms are throwing into the market. They are even having sales that, to me, do not seem to make financial sense … here is a case in point. (w/p = with the buyer’s premium)

On December 7th, Sotheby’s presented The World Around Us: Still Lifes by Robert Kulicke, all of which were the property of A Distinguished Private Collector. I never heard of the artist, but when I saw the listing, I figured he might be one of those high-priced contemporary artists. So, I clicked through, and boy was I surprised.

The online sale contained 32 lots, almost all of which did not impress me. Most of the works carried estimates in the $400 – $3,500 range. Lot 211 had the highest estimate of $6-8,000. My initial thought was, why are they presenting a standalone sale of this ‘stuff’? I can only assume that the ‘Distinguished Private Collector’ is important to them. Of course, I had to watch the sale to see what would happen. Would these works fly through the roof or fall to the floor? I will let you be the judge.

The online sale contained 32 lots, almost all of which did not impress me. Most of the works carried estimates in the $400 – $3,500 range. Lot 211 had the highest estimate of $6-8,000. My initial thought was, why are they presenting a standalone sale of this ‘stuff’? I can only assume that the ‘Distinguished Private Collector’ is important to them. Of course, I had to watch the sale to see what would happen. Would these works fly through the roof or fall to the floor? I will let you be the judge.

The top work in the sale was Carnations in a Jar that brought $9,000 ($11,340 w/p – est. $6-8,000). In second was Pears at $4,000 ($5,040 w/p – est. $2-3,000); and in third was Table top Floral Still Life at $3,500 ($4,410 w/p – est. $4-6,000). Rounding out the top five were New Paltz, New York at $1,900 ($2,304 w/p – est. $1-1,500) and Flowers, which made $1,600 ($2,016 w/p – est. $2-3,000).

By the end of the small sale, of the 32 works offered, 24 sold (75% sell-through rate), and the total take was $37,800 ($47,628 w/p). The low end of their presale estimate range was $49,600, so they really missed the mark, even when you add in the buyer’s premium – just so you know, when you add in their 26% buyer’s premium to the estimate range, it bumps that number up to $62,496.

Of the 24 sold works, 17 were below, 4 within, and 3 above their estimate range, leaving them with an accuracy rate of just 12.5%! I guess the seller really wanted to get rid of these works since a majority of them sold well below their estimate range — some, at less than half.

Putting 32 works, by a little-known artist, into one sale is not a recipe for success. Do not get me wrong, I see nothing wrong with offering inexpensive works of art; however, over a period of time, these works should have been filtered into their general American sales. I bet you that the results for each work would have been a lot stronger. When will this madness (or better yet, stupidity) stop?

The Rehs Family

© Rehs Galleries, Inc., New York – January 2021