COMMENTS ON THE ART MARKET

Another reminder - the gallery will be exhibiting at The Newport Antiques Show from July 26th – 28th (Gala Preview - July 25). The show takes place at St. George’s School, 372 Purgatory Road, Middletown, RI. and benefits both the Newport Historical Society and the Boys & Girls Clubs of Newport County.

For more information on the show, please visit the Upcoming Shows page on our web site.

Well, I guess all good things must ‘start’ to come to an end … actually, I am hoping this will just be a pause before another great advance!! June has been a pretty wild month for the market and there have been some pretty big swings … up 138, down 216, up 207, down 116, down 126, up 180, then down 206, down 353... On May 31 the Dow stood at 15116 and by the time I went to press with the newsletter, the Dow was at 15024 … on the 24th (just a few days ago) it was at 14551!

I did listen to a stock report on the morning of June 13 and they were predicting a horrible day since the overseas markets had taken a huge hit (down 6%) … our market ended up 180 points … go figure!

And now for --- where are they now? Among my favorites are Altria ($34.99 Down), JP Morgan ($52.79 Down), Emerson ($54.54 Down), Chevron ($118.34 Down), Exxon ($90.35 Down), GE ($23.19 Down), Berkshire B ($111.92 Down), AT&T ($35.40 Down), VOD ($28.75 Down), Verizon ($50.34 Up), Wal-Mart ($74.49 Down) and Coke ($40.11 Down), DuPont ($52.50 Down) and a new one Lowes ($44.40 Down and in the red – but that is to be expected since we all know what happens when I buy a stock!).

Thanks & Another Gallery Show Is Coming

Alyssa Rehs

Thank you to everyone who replied to my last newsletter article ... especially Mr. E. I really appreciate the time you took to respond to my comments on the contemporary market; as well as the support I received for speaking up against the way art has dramatically changed in its depth and value.

On another note, I trust many of you recall the recent in-gallery show we did with the Ani Art Academies teachers, students, alumni & current apprentices, “The BIG Gamble.” This show not only introduced our clientele to new, upcoming, and mind-blowing artists with amazing talents but allowed these artists to step out into the world of selling artwork. Several of the participants were able to sell their first works – it was not only exciting for them, but us as well. This was the first in-gallery show at Rehs Contemporary Galleries and it was great. The journey was wonderful and definitely a learning experience that we couldn’t be more pleased with. Now that the works are off the walls and sent to their new homes we are already planning our next Ani show with even more artists! 2014 will bring in a new theme as well; we are trading in our poker chips and aces for something “marvel-ous” ... HEROES & VILLAINS / MYTHS & LEGENDS. The show will open Saturday March 15, 2014 -- I’ll be sure to include some teasers in the upcoming month’s newsletters.

Really?

Amy Rehs

Auction rooms this month were filled with buyers fiercely competing for rare items, resulting in remarkable auction records. To begin, a first edition of Harry Potter and the Philosopher’s Stone by J.K. Rowling (published in some countries as Harry Potter and the Sorcerer's Stone…which I am sure is more familiar to most of us) sold for £150,000 at a charity auction. As two untiring bidders faced off, a new record for a printed book by Rowling was set. The book contains personal remarks and illustrations by the author. You should know that a record set at an auction for charity is in no way indicative of the market…Really!

A beautiful cameo glass plaque by Thomas and George Woodall titled The Attack sold soundly above the £70,000 – 100,000 estimate for a record breaking £140,000 (£169,250 – about $265K – with the buyer’s premium). The 17 inch cameo glass plaque features a delicately dressed maiden surprised by two putti. It is similar to one titled The Intruders and the two plaques will now be reunited and displayed at the Chrysler Museum in Virginia.

Oriental art once again, as if it ever stopped, is making headlines and topping estimates. Two tiny Chinese agate carvings estimated at just £200-300 became the star of the show when bidders battled in the room and on the phones eventually selling for £150,000 (£180,000 - $283K – with the buyer’s premium). The carvings depicted two boys, one beating a drum, the other with a cat and were catalogued as 19th/20th century. Due to the huge result, the auction house now believes the pieces are more likely to be from the 18th century. It is really interesting to see what a difference a century makes.

Another record was achieved in Germany for Oriental art when an 18th century Yongzheng Imperial doucai porcelain wine pot and cover sold for €2.8M (€3.73M - $4.85M – with the buyer’s premium). The piece, a mere 5 inches (probably only good for about one glass of wine) is painted in delicate colors featuring the Three Friends of Winter: bamboo, blossoming plum and pine trees; symbols for longevity and perseverance as they flourish even in adverse conditions. The successful bidder deftly showed signs of perseverance as he defeated massive competition in the room and on the phones.

And the big winner this month is the Corcoran Gallery of Art in Washington. The Corcoran put up for auction a 17th century Persian sickle-leaf carpet which had been bequeathed to it by William Clark, an industrialist and U.S. senator in 1925. The piece soared passed the estimate of $5-7M and magically brought $30M at the hammer ($33,765,000 with commission). Apparently Middle Eastern and Asian collectors are buying Persian rugs with the same enthusiasm as they are showing for rare contemporary works of art. Unfortunately, for the financially ailing institution, all the proceeds must go to new acquisitions and not aid their bottom line…Really!

The Art Market

After $1.5 Billion worth of art traded hands last month in New York one might have felt that the art world needed a rest, and you are probably right. However, the salerooms were not going to let that happen and moved the auction action over the pond to Merry Old England. Hey, why not milk the market for as much as you can, as fast as you can. Not a great strategy in my humble opinion; but if you are just in it for some fast money, I guess it works.

By the middle of the month, both main salerooms presented another round of Impressionist / Modern and Contemporary art sales – at least they are waiting until July for their Old Master sales – oh wait, that is only next week (we will cover those results next month). Once again the press was abuzz with the thought that another billion dollars worth of art might sell. In addition, I found it very interesting to read that other dealers and even the press are now voicing concerns that there may be too many sales since there appears to be a ‘shortage’ of quality material coming to the auction block. The big question on everyone’s mind is - where have all the good works of art gone? The simple answer is: they are hanging on people’s walls.

Now, for what I feel is a more all-encompassing answer. Over the past decade the major market players have been really pushing the idea that art is a great investment. While I agree that over a long period of time most works of art, by well established artists, will do well, I am still a firm believer that one needs to buy art because they love it and want to own it … not just to make money. Remember, nobody can guarantee that each work you buy will go up in value. In addition, there are now a number of art funds who will be happy to take your money and invest it in works they feel will bring you (more likely them) great rewards. So, with all the talk about investing in art and many of the major money people buying into it, you have to assume that at some point most of the really good works will be in private collections (and do not forget that some will be in those art funds). On top of that, the banks are paying almost nothing in interest (at times I feel like I am paying them to hold on to it) and the stock market, while it has made great strides over the past few years, is still one big roll of the dice – come on 7 – and let’s not forget the wild swings it takes which can really take a toll on your mental health. So, if your money is doing nothing in the bank, and you are not ready for a game of craps or the volatility of the markets, the art market seems to be a nice calm place to park some of your greenbacks. There are no daily ups and downs (at least that you can see or read about), you can dream about the big score when you decide to sell and you get the added bonus of enjoying the works that you own (unless they are part of an art fund). So why should people sell? If they do not need the money they are not and that is part of the reason why less stellar works are coming to the market.

Of course, bigger issues will surface if all of the great private collections are donated to public or private museums with the caveat that they cannot be sold; but the odds of that happening are pretty slim. Many of the large players in today’s market are young and it will be a long time until they (or their estates) want or need to sell. That is not to say these buyers will not tweak their collections as time goes on, but it also does not mean that those works will appear on the auction block --- yes, us dealers do sell a lot of work that never goes through the auction houses … there are many 5, 6, 7, 8 or even 9 figure transactions that take place in the private sector of the market. On top of that, the auction rooms now offer ‘private’ sales, so they are adding to the public’s perception that the great works are drying up. We all know it is hard to have your cake and eat it too.

The real interesting part is that as the supply has dwindled the number of people coming to the market has increased. Some of these new buyers are beginning to pay strong prices for average works of art … in the grand scheme I guess that is a double-edged sword. The sellers of these ‘average’ works are very happy; but at some point the market for the ‘average’ will get so high that people who own the better pieces will want to sell just to cash in … and that is when the crap may hit the fan. I say ‘may’ because it all depends on how much good art comes on the market at any one time. If the works flow into the market in an orderly fashion they should be easily absorbed, at very strong prices, and only help support the middle level works; but if too much comes out at one time, hold on to your hats … it will make that initial drop on Six Flags’ Kingda Ka feel like a ride through Disney’s It’s A Small World!!

Anyway, now it is time to get on with the auction action in London. Our first report, courtesy of Lance, is on the Impressionist and Modern sales:

The Impressionist and Modern sales which took place in London illustrate the problems the market seems to be having. Now let me start off by saying the results in both sales were not terrible but the greater concern is the works being offered. Simply put, there are very few really great paintings available for sale and this is a big problem! Maintaining a market is crucial for any artist or period and this becomes difficult when too few pictures are offered, especially when those pieces are far inferior to the artist’s best work.

Let’s first look at Christie’s Evening sale which offered a skimpy 44 lots (slim and trim is the idea … not just slim) and sold 37 (about 84%). That sounds pretty good, no? Well, let me quote the New York Times’ description of the top lot in the sale… Wassily Kandinsky’s ‘Studie zu Improvisation 3, 1909,’ was not exactly a masterpiece… the rearing horse in the painting evoked a rider trying to tame a kangaroo. Now, laughable descriptions aside, the work sold for £13.5 million ($21.1M – est. £12-£16M – it was purchased by the Nahmad family in 2008 for $16.88M); a nice chunk of change, but I bet Christie’s was somewhat disappointed. Coming in second was a Modigliani, also owned by the Nahmad family (purchased in 2006 for $4.8M), that sold for £6.7 million ($10.6M – est. £5-£7M) and then there was Picasso’s Femme assise dans un fauteuil topping its £4-£6M estimate at £6.1 million ($9.5M). The sale, as a whole, brought in £64 million ($100 million) which landed them almost exactly in the middle of their presale estimate of £52.8-£75.8M ($82.9-$119M).

The following day saw Christie’s day and works on paper sales. The day sale was a bit bulkier, offering 161 lots of which 113 sold (70%). Leading the way was a ceramic vase by Picasso which demolished its estimate £250-£350K estimate when it set a new auction record for a ceramic by the artist at £980K ($1.5M). Next was a Chaïm Soutine which too blew by its estimate (£90-£130K) and sold for £722K ($1.1 million). In third was Chagall’s Le baldaquin selling for £626K ($979K) on an estimate of £500-700K. The day sale totaled £15.9 million ($24.96M) which also fell in the middle of their £12.3-£18.1M ($19.3-$28.4M) presale estimate. As for the works on paper, the top spot saw a tie between Nolde and Picasso, both selling for £302K ($474K - Nolde est. £200-£300K/ Picasso est. £250K-£350K). In third was another work by Picasso selling for £242K ($380K – est. £120-£180K). The works on paper sale sold just 77 of the 115 offered (67%) and was the only one of the series to fall short of the presale estimate (£5.9-£8.5M) when it grossed a measly £4.9 million ($7.69M).

The three Christie’s sales totaled £84.9M ($133.3M) and sold 227 of the 320 offered (70.9%). To put things in perspective, last year’s evening and day sales offered just 223 works and sold 151. With nearly 100 fewer lots offered and almost 80 less works sold, last year’s sale topped £106M ($166.4M), £20M ($31.4M) more than this year’s sale. This direction is a signal that there is a shortage of quality works being brought to the market.

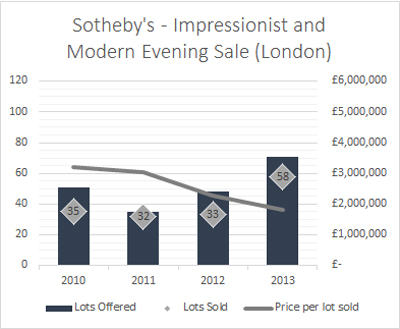

Now let’s talk about the sales at Sotheby’s, who I’ll say, right off the bat, was the clear winner this week. We start with the evening sale and the results seem impressive. Of the top 10 lots, 8 beat their estimate and leading the way was a piece from the Nahmad family, Claude Monet’s Le Palais Contarini, which sold for £19.68M ($30.8M – est. £15-£20M – it was purchased in 1996 for $4.24M). Next, was a work by Mondrian selling for £9.2 million ($14.5M – est. £4.5-£6.5M) and coming in third was Wassily Kandinsky’s Studie fur Herbstlandschaft mit Booten (it might be easier for you to say Study for Autumn Landscape with Boats), which brought £6.2M ($9.95M - est. £3-£5M). The evening sale totaled £105.9M ($165.9M – presale est. £74-£104M) and sold 58 of the 71 works offered (82%) -- really, it doesn’t sound so bad especially since they topped the high end of their presale estimate (with the buyer’s commission added in). Last year the Sotheby’s evening sale offered just 48 works and sold only 33 (68.8%); so this might make you say: what are you talking about when you say quality works are scarce? Let me first point out that the top 10 sold lots this year, while only accounting for 17% of the actual sold works, account for 63.7% of the total take at £67.5M ($105.96M). Furthermore, if we compare the price per lot sold from last year, £2.27M ($3.56M) to this year’s £1.8M ($2.83M), we see that the works in this year’s sale were in fact weaker even though the overall result gives the appearance that they were stronger.

Moving on to Sotheby’s day sale, 196 pieces were offered of which 141 sold (71.9%) with a grand total of £14.5M ($22.8M - est. £11.5-£16.5M). Two pieces tied for the top lot at £1.3 ($2.03M) – a van Gogh (est. £200-£300K) and a complete set of 19 silver plates by Picasso (est. £300K-£500K). The third lot was another van Gogh which sold for a more reasonable £531K (est. £400-£600K). Finally, we have Sotheby’s works on paper sale which offered 145 lots and sold just 97 (66.9%), yielding £7.1M ($10.9M). The top lot here was a Miró which sold for £555K ($857K – est. £350-£550K), then came a van Gogh at £447K ($690K - est. £300K-£400K) and in third was Matisse’s Tête de jeune fille which sold for £327K ($504K – est. £220K-320K).

Sotheby’s three sales totaled over £127.5 million ($196.4M) and sold 71.8%; as I said earlier, the clear winner between the two. To be honest, both of the sales were… ok. I don’t think anyone was blown away by the prices or by the works themselves. The central theme seems to be that there is a lack of great works coming on to the market. While the buyers are there, the product is simply not and only time will tell as to how this impacts the future prices of Impressionist and Modern art.

The following week the Contemporary sales were the center of attraction and what I found very interesting is that both rooms included works by Damien Hirst in their evening offerings --- an artist who was missing from the NY sales … guess being a Brit helped.

Up first was the Christie’s sale and the work with the highest published estimate was Peter Doig’s Jetty at £4- £6M ($6.2-$9.3M), but the Basquiat carried no estimate (est. on request) – so that was the one to watch!

The sale started off pretty strong with the first 11 works all selling at or above their estimate range – these included a Nicolas de Stael at £3.08M ($4.76M – est. £1-£1.5M) and Peter Doig’s Jetty making £7.34M ($11.3M). I am sure they were thinking – this is great! Well, it was not long before a change in the winds really started to slow the action. John Currin’s Daughter & Mother (not one I personally liked) brought 1.5M ($2.34M – est. £1.4-£1.5M so the hammer price was below the estimate) and another Currin, along with works by Dumas and Barcelo, failed to find buyers. In fact, by the end of the sale works by Kruger, Warhol (owned by Steven Cohen), Auerbach, Hirst, Palermo, Marden Wool, Grotjahn and Weischer also found no takers.

Now do not get me wrong, the sale also had some pretty strong numbers … Basquiat’s Untitled brought £18.76M ($28.8M – this work last sold in 2002 for $1.66M … nice increase), Lichtenstein’s Cup of Coffee made £2.8M ($4.3M – est. £1.5-£2M), a Castellani made £1.85M ($2.86M - est. £400-£600K), Fontana’s Concetto Spaziale, Attese made £1.2M ($1.86M – est. £550-£850K) and Wool’s Untitled fetched £1.63M ($2.5M – est. £700-£1M). But the sale lacked spark.

By evening’s end, of the 64 works offered 51 sold (79.7%) and the total take was £70.25M ($108.5M) … the upper end of their presale estimate was £72.6M (so they were close with the buyer’s premium added in). In addition, the top 10 works brought in £47.04M ($72.63M) or 67% of the sale’s total take. Last year’s corresponding sale saw 69 works offered and 60 sold (87%) and the total was £132.8M ($207M) – much stronger.

The following day was the lower end material … you know, those more affordable works by Basquiat, Warhol, Haring, Hirst, Doig, etc. HA HA HA! Taking the top three spots were Auerbach at £506K ($780K - est. £200-£300K), Schutte at £482K ($743K - est. £100-£150K) and Condo at £458K ($706K - est. £180-£250K). When the long day ended, of the 277 offerings, 230 found new homes (83%) and the total take was £17.7M ($27.3M).

Christie’s combined totals were 341 works offered, 281 sold and a gross of £87.9M ($135.7M) … keep in mind that last year’s evening sale brought in £132.8M ($207) on its own! This was another sign that either there is a shortage of quality works coming to the market, or there are just too many sales.

That same evening Sotheby’s presented their offerings and all eyes were waiting for lot 25 - Francis Bacon’s Three Studies of Isabel Rawsthorne (est. £10-£15M – it was bought by Acquavella in 2004 for $4.3M). Once again the sale started off pretty smooth with the first 6 lots finding buyers; but then the first casualty of the evening arose – Mark Grotjahn’s Untitled (est. £200-£300K). Then things picked up again with the next 13 works selling … among them was a Francis Bacon at £10.4M (est. £5-£7M – also owned by Acquavella), a Hockney at £3.44M (est. £2-£3M) and a Soulages at £4.34M (est. £2-£3M). Then another small hiccup when Warhol’s Multicolored Retrospective failed to find a buyer; however, the next 11 lots found buyers -- these included Richter’s Abstraktes Bild at £2.32M (est. £2.5-£3.5M – it last sold in 1994 for $126K – so while it did not reach its estimate, it was a winner for the seller), Bacon’s Three Studies of Isabel Rawsthorne which made the top price of £11.3M (est. £10-£15M) and Gursky’s Chicago Board of Trade III making £2.15M (est. £600-£800K).

After that, things got real rough (and at times, very quiet). Most of the remaining works either did not find buyers (13) or sold within (13) or below (8) their estimates. Some of the big casualties included works by Basquiat, Wesselmann, Kippenberger, Brown, Fontana, Gromley and Manzoni.

By the end of the evening, of the 68 works offered, 53 sold (78%) and the total take was £75.8M ($116.8M – est. range was £66.1-£94.6M – so they only beat the low end with the buyer’s premium added in) -- a real poor showing and more fuel for the - there are just too many sales - fire.

On the 27th Sotheby’s held their day sale and it dragged on all day; by 4 pm they still had another 50 lots to go! Taking the top 3 slots here were Richter’s Abstraktes Bild at £1.65M ($2.54M - est. £800-£1.2M), Doig’s Boiler House at £627K ($965K - est. £350-£450K) and Wesselmann’s Sunset Nude at £591K ($909K - est. £500-£700K).

By the end of the long session (it finished around 5 pm), of the 282 works offered, 207 sold (73.4%) and the total take was £21.1M ($30.7M). When added to the evening sale, Sotheby’s brought in £96.9M ($148M) and when combined with the Christie’s sale, the weeks total hit £184.8M ($283.4M).

So, for the two weeks about £397M ($613M) worth of art sold. That is a long way from the billion dollar mark; but then there are the Old Master sales next week!! Can they bring in almost $400M? I doubt it, but anything is possible.

Final Thoughts

The trend continues … more people are coming to the market, good works are selling for big money and those people who know what they are doing (or have good advice) are buying the works that will hopefully stand the test of time. However, there is still far too much product being offered in the auction arena – keep in mind that most of you only read/hear about the major sales that take place; but there are hundreds of other sales (across the globe) that are also happening all month long.

In order for the art market to remain healthy and strong the auction rooms need to use some self-control … it is time to cut back on the number of sales you are having and the number of works you are offering. In the long run this will benefit everyone.

Where does the market go from here? That will all depend on what, and how much, is offered. As they say on Wall Street – Bulls & Bears make money – Pigs get slaughtered!!! Let’s all hope that the art community does not get too piggish.

Once again, enjoy the journey and if done right it will be a very rewarding experience.

Howard L. Rehs

Gallery Updates: We head to Newport for the art and antiques show at the end of the month. And please remember that the gallery will be open Monday – Thursday.

Web Site Updates: A number of work have made their way through the gallery this month – included are paintings by Dawson, Blanchard, Jahn & Suys. In addition, a number of new pieces have been added to the site.

Next Month: I was thinking we would get a break from the auction action, but there are those pesky Old Master sales!