Last week Sotheby’s hosted a 2-part Contemporary Day Sale, one in-person and one online, with more than 230 works in total on the block… it seems they kicked over the lesser lots into the online session, while keeping more mid-level works for the in-person offering. Either way, it did not work out so well…

The top spot from the in-person bidding was to Barkley L. Hendricks’ Jackie Sha-La-La (Jackie Cameron) at $2.2M hammer ($2.8M w/p) on a $2-3M estimate. The same work was sold at Swann Galleries’ African American Fine Art Sale back in 2010, where it also sold within its estimate range… at that time though, it was only estimated at $40-60K and found a buyer at $48K including the premium – that’s an annual rate of return of more than 50%! Behind that were two works that tied. The first being Helen Frankenthaler’s Giant Step, which topped its $1.2-1.8M estimate as it hammered at $2M ($2.4M w/p). This one also yielded a more modest 17% annual return… it was purchased by the seller back in 2003 at Christie’s New York (Post-War and Contemporary Morning Session) for $153K on an $80-120K estimate. The other lot hammering at $2M ($2.4M w/p) was Fernando Botero’s Leda and the Swan, which was also expected to sell for $1.2-1.8M.

There were a few other lots that saw nice prices… the most significant overachiever was a Calder which found a buyer at $504K on a $120-180K estimate (180% above estimate). A work by Alex Katz sold for $645K on a $200-300K estimate (115% above estimate); a Calder necklace sold for $612K on a $200-300K estimate (104% above estimate); and a Keith Haring found a buyer at $1.9M on a $900k-1.2M estimate (58% above estimate).

As always, there were a few poor performances and outright failures in the session… Somehow a Keith Haring sold for just $155K on a $300-400K estimate and a Sturtevant went for just $302K on a $400-600K estimate. Works by Albert Oehlen ($800K-1.2M), Rondinone ($800K-1.2M), Sam Francis ($900K-1.2M) and a slew of others failed to find a buyer… and an additional 9 works were withdrawn, the most significant being a KAWS estimated at $800K-1.2M.

At the end of the session, just 60 of the original 81 lots were sold…. The 9 withdrawn works, and 12 unsold. Without factoring in the withdrawn lots, the sale achieved an 83% sell through rate and totaled just over $39.1M with premium ($31.8-45.2M estimate)… of the sold works, 28 were within the estimate range, and 26 were above estimate, but that is only when you factor in the premiums… if you look at the hammer prices, just 18 were within the estimate and 15 above, meaning 27 lots hammered below estimate. All in all, not too bad but certainly not too great either.

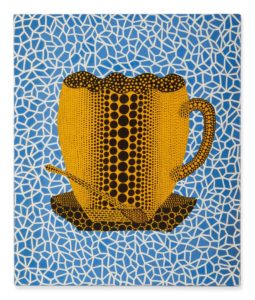

As for the online session, there was not much to write home about… there were a few nice results, but the amount of unsold work really weighed this one down. The top three lots were among the first 20 lots, and the rest dragged on. The top spot was Yayoi Kusama’s Coffee Cup, which doubled up its $200-300K estimate at $600K. Behind that was a work by Botero at $403K on a $350-450K estimate and then a Haring at $378K on a $150-200K estimate.

A few select lots saw unexpected results, such as works by Warhol ($201K on a $40-60K est.), Calder ($151K on a $35-45K est.), and Olga de Amaral ($239K on a $60-80K). That said, 47 works failed to sell, including a Basquiat estimated at $350-550K and a Frank Stella at $350-450K; and 7 works were pulled from the sale, the most significant being Danh Vo’s Red Bull expected to bring $260-350K.

The 97 sold works (67%) resulted in a total of $8.9M (including the premium), but the presale estimate was $10.9-16M, so even with the premiums, they still fell short – not good. As has been stressed, time and time again, the amount of material being thrown into the market is more than can be absorbed… it is simply a recipe for poor results.