The buying frenzy keeps going and going. On November 15, Sotheby’s presented The Macklowe Collection, a sale of 35 Modern and Contemporary works of art. Before we get started, please note that all the lots in this sale were guaranteed, and 22 had irrevocable bids. In other words, its success was a fait accompli.

The top seller was Mark Rothko’s No. 7 at $77.5M. The lot took about 8 minutes to sell, and once the hammer fell, the auctioneer announced that it was a new auction record for the artist. With the premium, the price was to be $89.3M… but when their website displayed a final price moments later, it was almost $7M less – $82.47M. Now you may wonder how that could happen? Maybe a computer glitch? Well, that lower price would indicate that the buyer was the guarantor. If the guarantor does not buy the work, they receive a percentage of the selling price above their guarantee. However, they receive a credit/discount if they continue bidding and ultimately purchase the piece. To me, this seems a bit unfair to the other bidders. Long story short – it was no longer an auction record with the reduced commission.

Albert Giacometti’s bronze, steel, and iron sculpture Le Nez came in second. The work was estimated to bring $70-90M and hammered at ‘just’ $68M ($78.4M w/p), so there wasn’t much serious action. The buyer was Justin Sun, the 31-year-old founder of the cryptocurrency platform TRON. In case you did not know, a few months ago, Sun was the underbidder on the Beeple NFT that made $69M. Guess those early crypto investors need to convert some of it into hard assets.

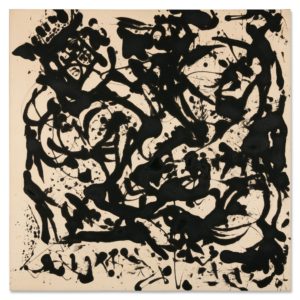

Jackson Pollock’s Number 17, 1951, took third when it sold for an impressive $53M ($61.2M w/p) after an almost 10-minute bidding battle — its estimate was $25-35M. While this is an auction record for the artist, over the years, reports have emerged of other works by the artist selling over $150M privately.

Rounding out the top five from the Macklowe Collection were Cy Twombly’s Untitled (a very large work consisting of 6 parts, measuring 217 inches in length). The painting carried a $40-60M estimate and sold for $51M (58.9M w/p). And then there was Andy Warhol’s Nine Marilyns… when the work appeared on the block (lot 19), it brought just $42M ($48.5M w/p – est. $40-60M). Well, when they got to lot 30, the auctioneer announced that the Warhol would be reoffered. This time it sold for $41M ($47.4M), and it took a mere 30 seconds to close. Of course, they did not explain the reason for the reoffering, but while I was watching the actual sale, I kept up with the Twitter posts people were making. One art critic in the room Tweeted that the agent who originally bought the painting for $42M was now sitting on her hands, so one of two things happened. Either she mistakenly bid on the work… or the individual she was bidding for was also on the phone with one of the auction representatives. If it were the latter, the two were bidding against each other while representing the same buyer. Either scenario is not a good one. When this crap happens, it should be mandatory for the auction room to explain the situation.

Several additional lots performed well. These included Agnes Martin’s Untitled #44 ($15.2M/$17.7M w/p – est. $6-8M), Philip Guston’s Strong Light ($21M/$24.9M w/p – est. $8-12M), and Warhol’s Sixteen Jackies ($29.3M/$33.9M w/p – est. $15-20M).

While a few other lots did not hit their target, in the end, everything sold… but remember, everything was guaranteed, so we expected this result. The presale estimate was $440-619M, and the total achieved was $588M ($676M w/p). Of the 35 works, 4 sold below, 14 within, and 17 above their estimate ranges, giving them an accuracy rate of 40%, one of the highest we have seen. I am sure that the Macklowes, now divorced and in attendance for the sale, were pleased with the results.

If you are interested in reading a bit more about the Macklowe mess, check out this article in Curbed – Everything We Know About the Immense, Messy Macklowe Art Auction.