On October 28, Sotheby’s presented two sales, a Contemporary one followed by the Impressionist & Modern (which we will cover here). By the time the sale began, four works had disappeared, so the featured 36 lots. This review will also illustrate how inaccurate some of these online art valuation companies can be.

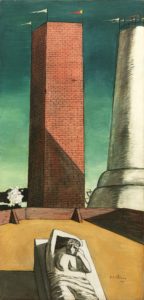

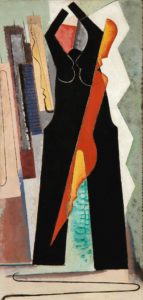

Giacometti took the lead here when his Femme Leoni (est. $20-30M) hammered at $22.6M ($25.92M w/p – the piece also had an irrevocable bid, so it was guaranteed to sell). Van Gogh’s Fleurs dan un Verre squeezed into second when it hammered down at $13.9M ($16.24M w/p – est. $14-18M … this painting last sold in 2000 for $4.63M, and in 1998 it made $4.07M … so a nice return for the seller, but just below the estimate range). In a close third was de Chirico’s Il Pomeriggio de Arianna at $13.6M ($15.9M w/p – est. $10-15M). Rounding out the top five were Magritte’s L’Ovation at $12M ($14.05M w/p – est. $12-18M), and Man Ray’s Black Widow that brought $4.8M ($5.78M w/p – est. $5-7M).

The day before the sale, we received an email from one of these all-knowing art valuation companies discussing the Man Ray work and what they believed was the accurate valuation … and I quote: Given this work’s uniquely desirable characteristics and the ARTBnk Values of the works from this series, the ARTBnk Value for Black Widow (Nativity) is in the range of $12m. If we feel that the pandemic has reduced the overall Man Ray market and we use the ARTBnk Values produced from the median of the bottom 80% of returns we get an ARTBnk Value of $10.3m. Considering the work only sold for $5.78M, I would have to say that they were way off!… or as ArtBnk goes on to say A result below $10.3m, which appears to be the expectation from Sotheby’s, would indicate either a significant drop in the market value of the entire series of paintings or an ineffective sales strategy on the part of the auction house… I guess Sotheby’s needs to step their game up.

Unlike many other sales, this one had no unsold lots (they called it a white glove sale). When you consider the following, you will see why they (on the surface) had a 100% sell-through rate. First, three lots were withdrawn from the sale before it started (preventing them from going unsold). Then, of the 36 lots offered, 21 sold below their estimate range; some were way below, like a Botero for $900K (est. $1.5-2M), a Miro from the Brooklyn Museum at $950K (est. $1.2-1.8M), and a Braque at $420K (est. $800K-1.2M). And finally, seventeen of the pieces had guarantees on them – so there was no chance they would not sell.

By the end of the session (which took a pretty long time as the bidding on some of the top works went in $100K increments and bidders took a long time to place their bids), of the 36 sold works, 21 went below, 9 within, and 6 above their expected ranges. The sale’s total was $119.1M hammer ($141.1M w/p), and the low end of their range was $111M … so they did make it.