It is getting to the point where auctions go out of their way to add a layer of opacity to the results, seemingly in an effort to make it more difficult to analyze their sales… I assume the underlying reason is to make poor results less obvious; I mean let’s be real, the good results are all over the place, including various other media outlets trying to get your clicks with flashy headlines… but for the people that simply want to get a clear picture of the market and what is happening, the supposed public pricing of auctions is becoming less visible. Once in a while, you’d come across a mysteriously missing auction record and wonder if it was intentional, but now merely utilizing the ‘big auction house’ websites are more and more difficult – aside from the Contemporary Curated (New York) sale not having a press release, they also did not offer a results sheet/top 10 (which they always used to offer), nor could you even sort the lots in order of price realized on the sale page… the only options are by lot number or by estimate. Even their high-end Contemporary Evening sale in London didn’t get a press release and the unsold lots were completely removed from the web! Auctions have historically helped set market pricing as well as offered a certain level of transparency into the art world… that is becoming less and less the case. Now that I’ve gotten that out of the way, let’s get to the sale at hand…

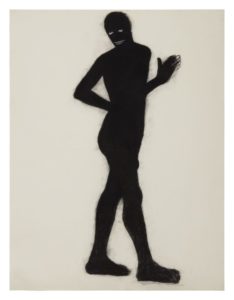

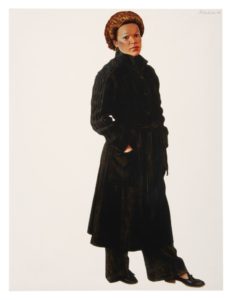

The Contemporary Curated sale at Sotheby’s earlier this month featured nearly 250 lots of mid-level Contemporary works, with estimates ranging from just $4-6K all the way up to $2.2-2.8M (though only 3 lots actually had estimates above $1M). As expected, the top lot was Kenneth Noland’s Ember which came in with that $2.2-2.8M estimate… with the premium, the work achieved $2.56M – the work had been in a private collection since 1977. After that was a work by Kerry James Marshall that vastly outperformed… The Wonderful One, considered to be a seminal work by the artist, utilizes many of the characteristics that would define the artist’s career. It was only expected to bring between $500-700K, but ultimately found a buyer at $1.77M. Rounding out the top three was another overachiever… Barkley Hendricks’ Latin From Manhattan… The Bronx Actually, was expected to bring $700K-1M, but topped that with $1.47M.

There were a handful of other works that greatly outperformed expectations… the biggest surprise came late in the sale as Shepard Fairey’s Obama Hope achieved $600K on a $50-70K estimate; more than 8x the high end! There was also an Alexander Calder that smashed its $40-60K estimate when a bidder pushed it to $440K; more than 7x the estimate. A slew of other works has nice performances too… a Romare Bearden topped $770K on a $150-200K estimate; an Edward Clark achieved $576K on a $100-150K estimate; Calder’s Spotted Butterfly sold for $151K on just a $30-40K estimate; a work by Damien Hirst sold for $1.2M on a $250-350K estimate; a Marca-Relli sold for $428K on an $80-120K estimate; and a work by Cecily Brown found a buyer at $441K on a $90-120K estimate. In fact, 111 total works of the 249 topped their estimate (4 works were withdrawn so there were really only 245 “available” lots).

There were quite a few unsold lots as well… the most significant was Robert Indiana’s Iconic LOVE, which was expected to bring $1-1.5M. There were also no takers on works by Ruth Asawa ($300-400K), De Kooning ($300-400K), Sam Francis ($180-250K), Botero ($200-300K), Haring ($500-700K) and Christopher Wool ($700K-1M). In all, there were 60 works left unsold giving them a 75.5% sell through rate.

The sale as a whole totaled $30.6M which is towards the top end of the $22.9-32.5M range… remember, the sale total includes premiums added on to each sold lot, so those premiums (fees/commissions) really padded the number to make up for all the unsold work. At the end of the day, what is more useful information to gauge the market – seeing a sale total near the top end of the estimate, or knowing that 25% of the material did not sell? These two accuracies tell very different stories on the success of the sale. It is no wonder they are being careful what information they present to their viewers these days.