The first part of the October 28th evening sales at Sotheby’s featured their Contemporary offerings, plus a piece of furniture and three Alfa Romeos! Now you, like me, might think this makes no sense, but for the auction rooms, it gives them a way to generate better results for these higher-end sales. As we all know, a year from now, most people will never remember that the millions generated from a particular sale included items that were not classic works of art – you know, cars, tables, dinosaur bones, etc. And when the press raves about the final results, most people do not realize that ‘other’ things were among the works being sold.

I started watching this sale at lot 29 (a Tansey that went unsold). So for all of the later lots, I had the hammer prices; but for the early ones, it is tough to figure out what the works hammered for (you know, before the buyer’s premium). First, there are the various rates charged at different price levels (25%, 20%, 13.9%), plus the additional 1% B.S. charge (wonder when the buying public will say ENOUGH?). Then, any works purchased by guarantors (who get a piece of the action, so they receive a discounted price if they buy a work), it takes a math wiz to figure it out … way too much time for me. So, we will be using hammer and/or selling price with the buyer’s premium (w/p) for this review.

Driving slowly, but taking the checkered flag, were the set of three Alfa Romeo’s B.A.T. 5, 7, and 9d, which date from the early 1950s (so, if they were not going to offer them in an automobile sale, the least they could have done was sell them in the Modern section). The lot carried a $14-20M estimate (the second highest in the sale) and sold for a hammer price of $13.25M ($14.84M w/p). It was interesting to note that the buyer’s premium for automobiles is just 12%. Why do they only charge a 12% commission for cars and more complex/ higher premiums for other items? They did not even charge the additional 1% on this lot.

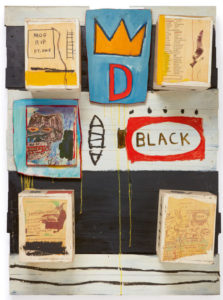

Coming in a distant second was Calder’s mobile Sumac 17 at $8.3M w/p (est. $6-8M), this same work last sold in 2016 for $5.77M, so I am guessing that the seller was happy. In a close third was Basquiat’s Black at $8.1M w/p (est. $4-6M). Rounding out the top 5 were Frank Stella’s Untitled (I always love these creative titles) that was supposed to bring $5-7M and sold for $8.08M w/p, and Basquiat’s Jazz at $6.93 w/p (est. $4-6M).

There were a couple of failures in the sale, lot 29 (which I mentioned above), and the ‘star’ lot of the sale, Mark Rothko’s Untitled (Black on Maroon). This painting carried a $25-35M estimate and failed to garner a single bid. The work last sold in 2013 for $27M, and it appeared (from the triangular-shaped symbol next to the description) that Sotheby’s now owns this lot … so that seller was not happy!

Along with the unsold lots, the Baltimore Museum, at the last minute, decided to pull two of the lots they were going to offer – a Brice Marden ($10-15M) and Clifford Still ($12-18M). It was reported that along with the general outcry from the public, two former members of the museum’s board were very upset and rescinded their planned gifts to the museum – the stated value was $50M! Guess the money talked! There was also a large Warhol (Last Supper) from the museum that was being offered privately … that was put on hold.

By the end of the 41-lot sale (which took a couple of hours to complete), 39 lots found buyers, for a total take of $119.7M hammer ($142.9M w/p). The presale estimate range was $128.2-142.8M, so they fell short until you add in the buyer’s premium.