Christie’s Post-War and Contemporary Day Sale was a full-day event for me as I began watching it at 10:00 AM, and there were still six lots to go when I left the gallery at 5:35 PM. Unfortunately, there was really nothing exciting about the sale, and when all was said and done, one painting and one shiny sculpture stole the show.

Christie’s Post-War and Contemporary Day Sale was a full-day event for me as I began watching it at 10:00 AM, and there were still six lots to go when I left the gallery at 5:35 PM. Unfortunately, there was really nothing exciting about the sale, and when all was said and done, one painting and one shiny sculpture stole the show.

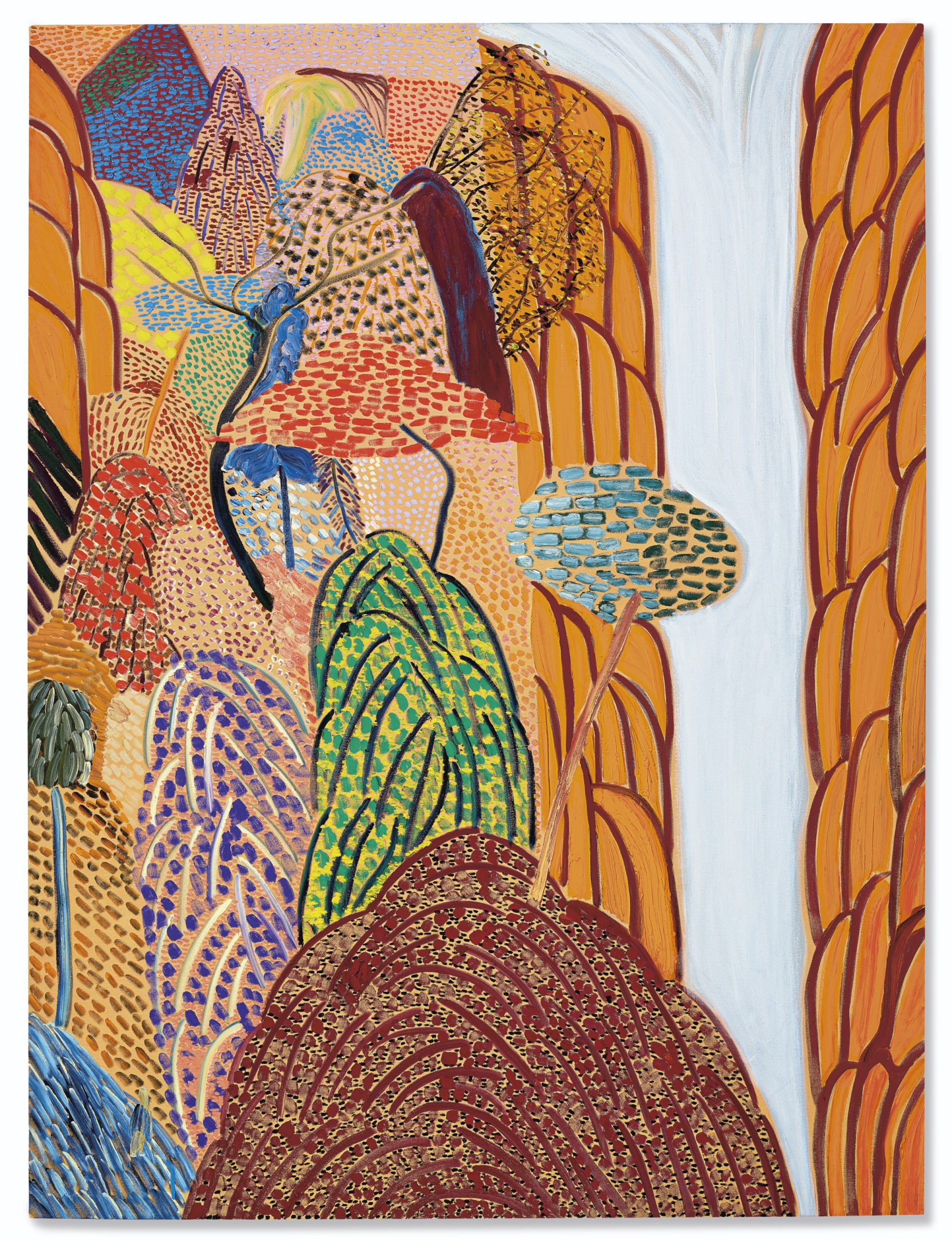

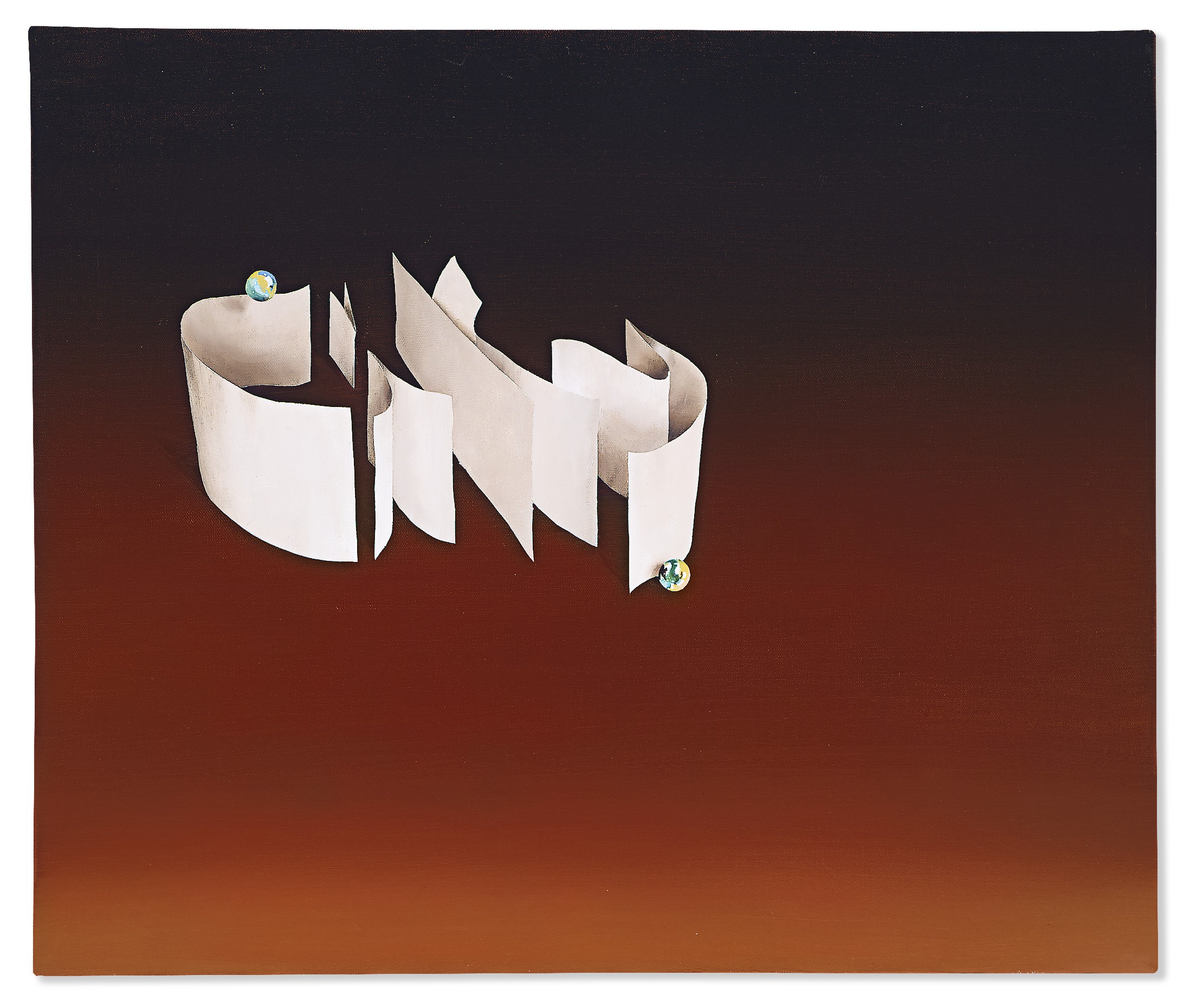

The top lot, and first show stealer, was Matthew Wong’s (1984 – 2019) Shangri-La (2017), which far surpassed the estimate of $500-700K when it hammered down at $3.7M (4.47M w/p) … setting an auction record for the artist. Wong was a Canadian artist dealing with Tourette’s syndrome and depression, and took his own life just last year in October 2019. In second place was Ed Ruscha’s (b. 1937) City, With Marbles estimated at $2.5 – 3.5M and hammered a little below, at $2.2M ($2.67M w/p).

Coming in third was that shiny sculpture I mentioned earlier; a sterling silver work by Takashi Murakami (b. 1962) titled Oval Buddha Silver (a cartoonish and new interpretation of the religious leader). The work is number one from an edition of 10 that was executed in 2008; it measures 53 ¾ x 31 ¾ x 30 ¾ inches and lived up to its stature when it sold for $1.5M ($1.83 w/p), well past the estimate of $400-600K.

Coming in third was that shiny sculpture I mentioned earlier; a sterling silver work by Takashi Murakami (b. 1962) titled Oval Buddha Silver (a cartoonish and new interpretation of the religious leader). The work is number one from an edition of 10 that was executed in 2008; it measures 53 ¾ x 31 ¾ x 30 ¾ inches and lived up to its stature when it sold for $1.5M ($1.83 w/p), well past the estimate of $400-600K.

I do want to mention one piece, mostly because I found it intriguing. The piece was created by the artist Ben Gentilli; however, it was cataloged as ‘by Robert Alice’ (the name of the artistic project Gentilli created to promote visual works based on blockchain).

I do want to mention one piece, mostly because I found it intriguing. The piece was created by the artist Ben Gentilli; however, it was cataloged as ‘by Robert Alice’ (the name of the artistic project Gentilli created to promote visual works based on blockchain).

The series will include 40 hand-painted pieces, 20 of which have already been sold by the artist to private collectors. Gentilli decided that the remaining 20 works would be sold publicly; the first one presented in this sale. This is the first time a work by the artist has been up at auction, and the first time Christie’s has sold a work related to cryptocurrency and blockchain. Titled Block 21 (42.36433 ° E) (From Portraits of a Mind), it was created  from 24-carat gold leaf, suspended pigment and acrylic on canvas laid down on a panel, and Non-Fungible Token (NFT). In case you are wondering what an NFT is, here is what I found on Wikipedia – A non-fungible token (NFT) is a special type of cryptographic token which represents something unique; non-fungible tokens are thus not mutually interchangeable. This is in contrast to cryptocurrencies like bitcoin, and many network or utility tokens that are fungible in nature. Understanding this, is way beyond my pay grade!

from 24-carat gold leaf, suspended pigment and acrylic on canvas laid down on a panel, and Non-Fungible Token (NFT). In case you are wondering what an NFT is, here is what I found on Wikipedia – A non-fungible token (NFT) is a special type of cryptographic token which represents something unique; non-fungible tokens are thus not mutually interchangeable. This is in contrast to cryptocurrencies like bitcoin, and many network or utility tokens that are fungible in nature. Understanding this, is way beyond my pay grade!

The artist used special machinery to engrave the 40 paintings, each with over 300,000 digits of the intricate 12.3 million digit code that launched Bitcoin; he then went on to paint each digit by hand. Gentilli explained that by creating each work with just a portion of the code, no one collector will have the entire code. In addition, the work includes an OpenDime hardware key (a device that allows you to store and spend your Bitcoins – if you have any). While I was unable to find any information about what the private collectors paid for their pieces, I am sure they are all thrilled when the piece bolted past the estimate of $12-18K and sold for $105K ($131K w/p).

There were a number of pricier works that could not find a new home; among them were works by Motherwell (Black Open with Ochre – est. $600-800K and Untitled – est. $400-600K), Alex Katz (Kristen – est. $400-600K), Keith Haring (Untitled – est. $350-450K), Damien Hirst (Naja Nivea – est. $350-550K), Franz Kline (Untitled – est. $480-680K), and Gottlieb (Green Halo – est. $250-350K).

When the sale ended, of the 254 works offered (there were 4 withdrawn), 190 sold, leaving them a sell-through rate of 74.8%. The final result of $29.4M hammer was towards the lower end of the estimate range, but when we add in the buyer’s premium, the total came to $36.5M – falling just in the middle of the pre-sale estimate of $28.8M – $42.3M.